A Guide to Scanning Invoice Software

At its core, scanning invoice software is a tool that takes your paper or PDF invoices, reads them, and automatically pulls out all the important information—like vendor names, dates, and line items—and plugs it directly into your accounting system. This process relies on a clever combination of Optical Character Recognition (OCR), which turns images of text into machine-readable text, and Artificial Intelligence (AI) to make sense of it all.

Essentially, it gets rid of the soul-crushing task of manual data entry.

Moving Beyond Manual Data Entry

Picture your accounts payable team. Are they swamped, buried under stacks of paper invoices? Each one needs to be manually keyed into your accounting software, a slow and painstaking process that creates a major bottleneck in your operations. It’s not just inefficient; it’s a recipe for costly mistakes and a massive drain on your team's time.

This is exactly where invoice scanning software comes in. Think of it as a smart, digital assistant for your finance department. It can instantly read any invoice you throw at it, understand what it says, and file the data away perfectly, every single time. For any business serious about improving accuracy and speed, this technology is quickly becoming a must-have.

The Shift to Smarter Workflows

The days of dedicating entire rooms to bulky filing cabinets are thankfully behind us. But even though most invoices arrive as PDFs or other digital files, the core problem hasn't gone away. All that critical financial data is still locked inside a static document, and someone has to manually transfer it. The only thing that's changed is that your team is now typing from a screen instead of a piece of paper.

The real job of scanning invoice software is to build a bridge between a simple document and usable financial data. It transforms a picture of an invoice into structured information your systems can immediately work with.

This isn't just a minor upgrade; it's a fundamental change in how modern businesses manage their finances. The proof is in the numbers. The global market for this kind of software is expected to explode from USD 36.1 billion in 2025 to a staggering USD 189.2 billion by 2035. This massive growth shows just how serious companies are about reducing human error and building more efficient workflows. You can discover more insights about this market growth on futuremarketinsights.com.

Let's break down the difference between the old way and the new way. The table below gives a quick snapshot of how manual and automated processes stack up against each other.

Manual vs Automated Invoice Processing at a Glance

| Process Step | Manual Method (The Old Way) | Automated Method (With Software) |

|---|---|---|

| Data Extraction | Someone physically reads the invoice and types every detail into the system. It’s slow and prone to typos. | OCR technology instantly scans and extracts all data from the document in seconds. |

| Validation | The team has to cross-reference purchase orders and receipts by hand, a time-consuming check. | The software automatically matches the invoice against POs and other records, flagging any discrepancies. |

| Approval Routing | Paper invoices or emails are manually sent to managers for approval, often getting lost in the shuffle. | A digital workflow automatically routes the invoice to the right person for approval based on preset rules. |

| System Entry | Once approved, the data is manually entered again into the accounting software, creating another chance for error. | Approved data is automatically synced with the accounting system, no re-keying needed. |

As you can see, the automated approach doesn't just speed things up—it introduces checks and balances at every step, making the entire process far more reliable.

Why Automation Is No Longer Optional

By handing these repetitive tasks over to software, businesses free up their finance teams to focus on work that actually requires a human brain. Instead of mindlessly typing out line items, they can spend their time analyzing spending trends, managing cash flow more effectively, and building better relationships with suppliers.

Ultimately, invoice scanning software isn't just about processing documents faster. It’s about building a smarter, more resilient financial backbone for your entire company.

How the Technology Actually Works

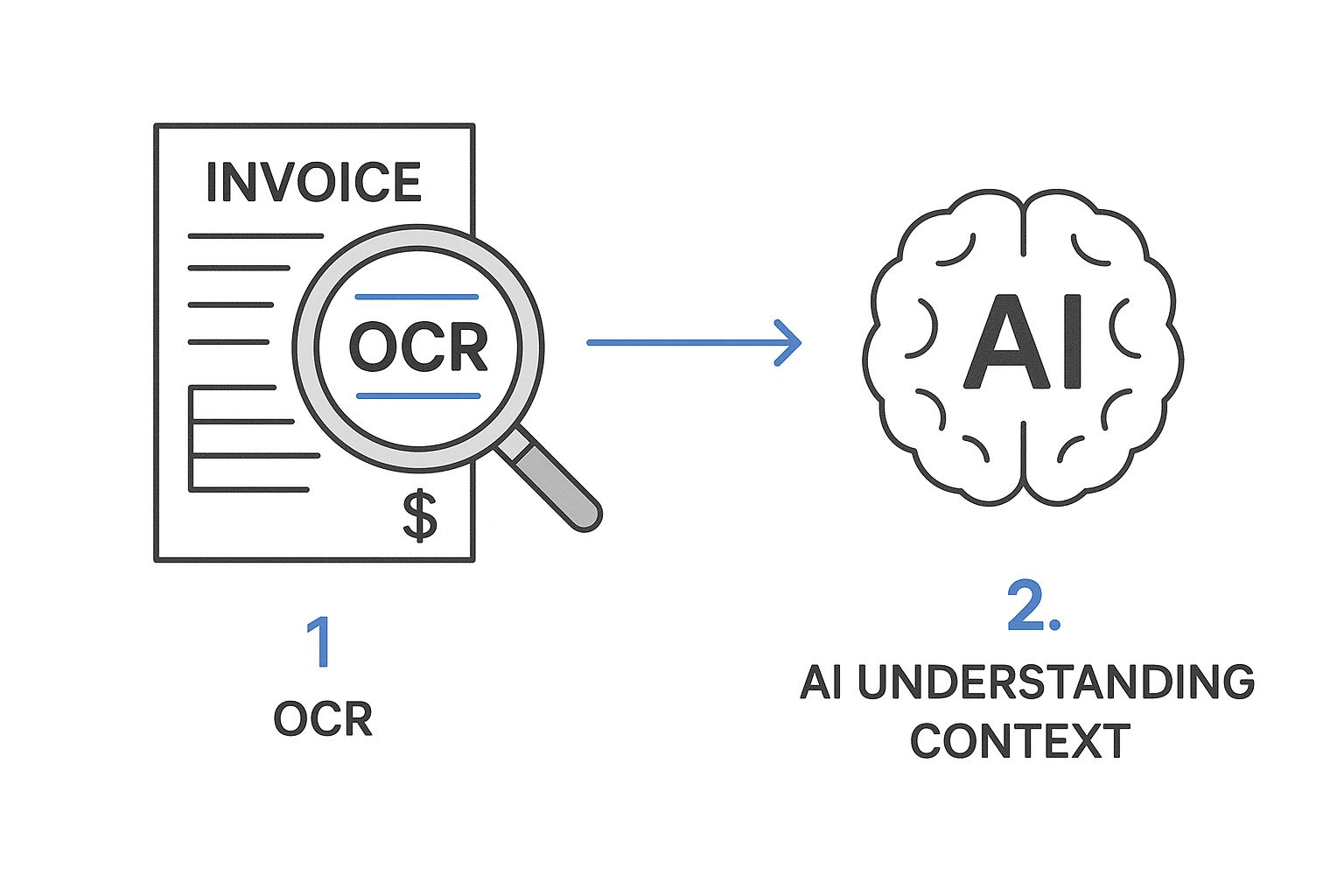

To really get what's happening under the hood with invoice scanning software, it helps to think of it as a two-part system: it has "eyes" and a "brain." The whole process isn't just about reading words on a page; it's about making sense of what those words mean together. This is the combination that turns a static invoice into usable, structured data for your business.

First up are the "eyes," a technology that’s been around for a while but has become incredibly powerful: Optical Character Recognition (OCR). When you feed the software an invoice—whether it's a paper scan or a PDF from an email—OCR gets to work converting the image of the text into actual, machine-readable text.

Think of it like taking a photo of a page in a book. You can read the words, but to your computer, it's just a single image file. OCR is the magic step that actually reads that picture and spits out an editable text document.

From Simple Text to Intelligent Data

Once OCR has done its job, you’re left with a big chunk of raw text. The problem is, this text has no context. The system doesn't know that "Invoice #12345" is an invoice number or that "$59.99" is the total due. That's where the "brain" of the operation—Artificial Intelligence (AI) and Machine Learning (ML)—comes in.

The AI sifts through all that extracted text, hunting for patterns and keywords to figure out what each piece of information is. Over time, it learns to recognize that a string of numbers after the word "Invoice" is the invoice number, and that the biggest dollar amount near the bottom is almost certainly the total.

This infographic breaks down how these two technologies work in tandem.

The key thing to remember is this: OCR grabs the text, but AI provides the understanding needed for real automation.

Modern tools combine these technologies to get incredibly accurate results. Some of the best systems now boast OCR accuracy rates in the high 90% range, reliably pulling key details like vendor names, dates, amounts, and even individual line items. On top of that, Natural Language Processing (NLP) helps the system understand weird, vendor-specific jargon, classify expenses correctly, and flag things that look off.

The Step-by-Step Process of an Invoice Scan

So, what does this actually look like from start to finish? The journey from a piece of paper to a clean entry in your accounting system is a quick, seamless flow.

Here’s a simple breakdown of the steps:

- Document Ingestion: It all starts when an invoice arrives. This could be a scanned paper copy, a PDF attached to an email, or even a picture you snapped with your phone. The software is built to handle all sorts of formats.

- Image Pre-processing: Before trying to read anything, the software first cleans up the image. It might straighten a crooked scan, get rid of shadows, or boost the contrast to make the text as crisp as possible for the next step.

- OCR Data Extraction: Now, the clean image is handed off to the OCR engine. It goes through the document line by line, converting every visible letter and number into digital data.

- AI-Powered Data Parsing: This is where the real intelligence kicks in. The AI model combs through the raw text, identifying and labeling every data point. It uses its training to know the difference between a date, a PO number, and a line-item description.

- Data Validation and Enrichment: The software then runs a few sanity checks. It might cross-reference the vendor's name against your supplier list or flag a duplicate invoice number it's seen before. This step is crucial for catching errors before they get into your system.

- Integration and Export: Finally, the structured and validated data is formatted and pushed directly into your accounting software or ERP system. You can also just export it as a spreadsheet.

This entire sequence happens in just a few moments, turning a tedious manual task into a hands-off, automated workflow. This whole concept is part of a bigger field known as Intelligent Document Processing. To learn more, you can check out our guide on what is intelligent document processing.

What Features Should You Actually Look For?

Knowing the tech is one thing, but pinpointing the features that will genuinely make a difference to your bottom line is the real goal. When you're looking at different invoice scanning tools, it's easy to get bogged down in a sea of technical terms. The trick is to cut through the noise and focus on what will solve your team's biggest headaches.

Not all software is built the same. A basic tool might digitize a document, but a truly great platform will overhaul your entire accounts payable process. Let's dig into the essential features that deliver the most bang for your buck.

Automated Data Extraction

At its core, this is what invoice scanning software is all about. This feature isn't just basic text recognition; it’s about intelligently identifying and pulling specific information from any invoice, no matter how chaotic the layout.

Think of it less like a scanner and more like a highly trained assistant. Instead of just giving you a digital copy, the software reads the document and meticulously fills out a digital form with all the key details:

- Vendor Name: Who sent the bill?

- Invoice Number: The unique code for tracking.

- Invoice Date and Due Date: Critical dates for timely payments.

- Total Amount, Subtotal, and Tax: The complete financial breakdown.

- Line-Item Details: Specific products, quantities, and prices for deep expense analysis.

This detailed extraction is a game-changer. Imagine a construction manager being able to track the fluctuating cost of lumber across dozens of supplier invoices without ever having to manually enter a single line item. That's the power of this feature.

Intelligent Data Validation

Once the data is pulled, the next crucial step is making sure it's correct. Intelligent validation is your automated proofreader, catching tiny errors before they snowball into major problems in your accounting system.

This is your first line of defense against costly mistakes. It’s designed to automatically flag inconsistencies that a busy human might easily overlook, preventing issues like overpayments and compliance problems.

This is where the software's AI really proves its worth. It runs several checks in the background:

- Duplicate Invoice Detection: The system scans for matching invoice numbers from the same vendor, flagging potential duplicates to stop you from paying the same bill twice.

- PO Matching: It automatically cross-references the invoice with the original purchase order, ensuring what you were billed for is exactly what you ordered.

- Mathematical Verification: No more manual calculator work. The software instantly confirms that the subtotals, taxes, and grand total all add up correctly.

Customizable Approval Workflows

Let's be honest: manual approval routing is where productivity goes to die. Invoices get lost in email chains, buried under piles of paper, or sent to the wrong person entirely. Customizable workflows put an end to that chaos.

You get to set the rules. For example, you can create a rule that sends any marketing invoice over $5,000 straight to the CMO's queue. An invoice for new laptops? It goes directly to the Head of IT. This ensures the right eyes are on the right invoice at the right time—no manual forwarding needed. To build an efficient system, it's wise to follow established guidelines; you can learn more by exploring some common accounts payable automation best practices.

Seamless ERP and Accounting Integration

Your invoice scanning software shouldn't be a lonely island of data. Its real power is unleashed when it talks directly to the financial systems you already rely on. This is all about seamless integration.

This feature ensures that once an invoice is scanned, checked, and approved, all that rich data automatically flows into your ERP or accounting software, whether it’s QuickBooks, Xero, or NetSuite. This completely removes the tedious—and error-prone—final step of manual data entry. The information just moves where it needs to go, creating a truly automated, end-to-end process and ensuring your financial records are always accurate.

To help you connect these features to real-world problems, here’s a quick breakdown of what you should expect from a modern platform.

Table: Essential Features of Modern Invoice Scanning Software

| Feature | What It Does | Business Benefit |

|---|---|---|

| AI-Powered OCR | Intelligently reads and extracts data from any invoice format, including line items. | Eliminates manual data entry, reduces human error, and saves countless hours. |

| Data Validation | Automatically checks for duplicates, verifies math, and matches invoices to POs. | Prevents overpayments, ensures accuracy, and strengthens financial controls. |

| Custom Workflows | Routes invoices to the correct approvers based on predefined rules (e.g., amount, vendor). | Speeds up approval cycles, eliminates bottlenecks, and improves accountability. |

| ERP/Accounting Sync | Integrates with systems like QuickBooks, NetSuite, Xero, and more for automatic data transfer. | Creates a single source of truth, keeps financial records up-to-date, and closes the loop on automation. |

| Centralized Dashboard | Provides a real-time overview of all invoice statuses, from receipt to payment. | Offers complete visibility into the AP process, making it easy to track bottlenecks and cash flow. |

| Secure Cloud Archive | Stores all processed invoices in a searchable, organized, and audit-ready digital archive. | Simplifies audits, improves compliance, and makes finding past invoices effortless. |

Ultimately, these features work together to transform a simple scanning tool into the central nervous system for your entire accounts payable operation.

The Real-World Payoff: Why AP Automation Is a Game-Changer

It’s one thing to talk about the features of scanning invoice software, but the real magic happens when you see what it actually does for a business. Let's be clear: switching to an automated accounts payable (AP) process isn't just about getting new software. It’s a fundamental shift that turns your finance team from a reactive, paper-shuffling cost center into a proactive, data-driven unit.

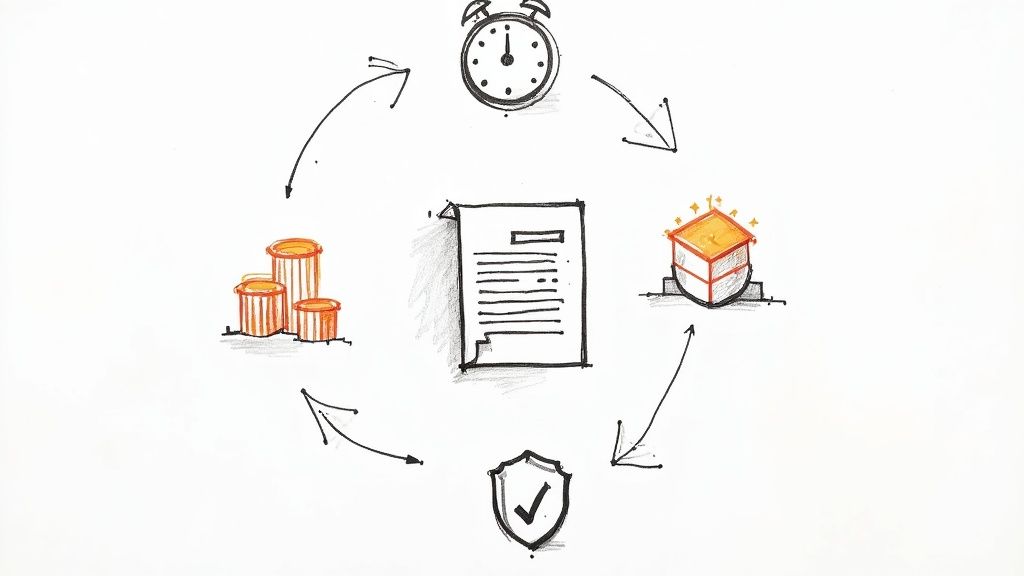

The benefits are immediate and tangible, but the real value is in the long-term strategic advantages that boost your company's financial health and give you a serious competitive edge.

And businesses are catching on. The market for this software, valued at around USD 3.37 billion in 2024, is expected to explode to USD 8.91 billion by 2032. Why the rush? Companies are tired of wasting money on manual processes and are demanding better accuracy. You can learn more about these market trends and their drivers to see the bigger picture.

Get Your Team's Time Back and Cut Costs

The first thing you’ll notice is just how much time you get back. Think about the countless hours your team spends every single week just typing in data, chasing down approvals, and fixing simple typos. That's not just inefficient—it’s a huge drain on your payroll.

Automated invoice scanning frees your people from that grind. A task that once ate up days of someone's time can now be done in minutes. This allows your skilled finance pros to stop being data-entry clerks and start focusing on what they were hired to do: analyzing cash flow, forecasting budgets, and finding ways to save the company money.

A business processing just 500 invoices a month can save over 400 hours of manual data entry every year by making the switch. That's ten full workweeks of reclaimed time that goes straight to your bottom line.

Stop Costly Mistakes Before They Happen

Let’s face it, manual data entry is where mistakes are born. A misplaced decimal point or a typo can lead to a massive overpayment. A duplicate invoice can easily slip through the cracks, causing you to pay the same bill twice. It happens all the time.

Scanning invoice software is your first line of defense. It acts like a vigilant gatekeeper, using smart validation rules to catch these errors before they do any damage. The system will automatically flag a duplicate invoice number, check that the math on the invoice is correct, and match it against the original purchase order. You only pay for what you actually ordered.

This level of precision is a powerful safety net that protects your cash and ensures your financial records are always clean and reliable.

Build Better Vendor Relationships and Grab Early-Pay Discounts

Nothing sours a relationship with a supplier faster than paying them late. When invoices get lost in a manual approval maze, payments get delayed, goodwill evaporates, and you can even put your supply chain at risk. Automation flips this entire dynamic on its head.

By speeding up the whole journey from invoice receipt to final payment, you pay your vendors faster and more predictably. This simple act of consistency builds incredible trust and strengthens your partnerships.

Even better, paying on time often means paying less. Faster processing puts you in a position to easily capture early payment discounts, turning your AP department from an expense into a revenue generator.

- The Old Way: An invoice for a critical shipment gets buried on a manager’s desk for a week. Payment is late, and the vendor is frustrated.

- The New Way: That same invoice is scanned, approved, and scheduled for payment in just a few hours, easily locking in a 2% early payment discount.

Get a Clear, Real-Time View of Your Finances

When your invoice data is stuck in filing cabinets or buried in a dozen different email inboxes, you're essentially flying blind. You have no real-time visibility into your company's financial obligations. It's like trying to navigate a ship in thick fog—you have no idea what’s right in front of you.

A centralized, digital system gives you a live dashboard of your entire AP workflow. In a single glance, you can see which invoices are pending, which are approved, and what your cash needs are for the coming weeks. This clarity lets you make smarter, more strategic decisions about cash flow and budgeting. It also makes tax season and audits infinitely less painful, since every single transaction has a secure, searchable digital paper trail.

Finding the Right Invoice Scanning Software for Your Business

Picking the right invoice scanning software can feel like a huge task, but it doesn't have to be. The trick is to break the decision down into a few manageable steps. It's not about finding some mythical "best" tool, but about finding the one that slots perfectly into how your company actually works. The goal here is a long-term partner—a tool that solves today’s headaches and can still keep up as you grow.

First things first, you need to get real about your current situation. Don't estimate—get the actual numbers. How many invoices are you really pushing through each month? Is it 50, 500, or closer to 5,000? That number alone will immediately narrow down your options and point you toward the most cost-effective pricing plans.

At the same time, think about your team. Are they tech-savvy, or will a complex system just cause frustration? A small team that needs to be up and running by Friday can't afford a steep learning curve. On the flip side, a larger enterprise might need those more complex features and have the resources to invest in proper training.

Define What You Can't Live Without

Once you have that baseline, you can start building a checklist of your must-haves. This isn't just a wish list; it's a practical framework to help you compare different platforms objectively. It's how you cut through the marketing noise and focus on the features that will genuinely make a difference in your day-to-day operations.

Think of it like drawing up a blueprint before you build a house. The more detail you include now, the better the final fit will be.

Make sure your evaluation homes in on these key areas:

- Plays Well with Others (Integrations): Does the software easily connect to the accounting or ERP system you already use? If you have to manually shuffle data between your new tool and something like QuickBooks, Xero, or NetSuite, you're not really automating anything. Look for direct, seamless integrations.

- Room to Grow (Scalability): The software that fits your business today has to fit the business you'll be in three years. Can it handle a sudden spike in invoice volume without the performance tanking or the price skyrocketing? A scalable tool means you won’t have to go through this whole selection process again when you land that big new client.

- Actually Easy to Use (User-Friendliness): How intuitive is the dashboard? A clunky, confusing interface is just going to trade one tedious task for another. The best scanning invoice software is built for regular people, not IT wizards. It should be simple to find an old invoice, set up an approval chain, and see what's pending at a glance.

Make Sense of the Pricing Models

Software pricing can be a bit of a maze, so it's vital to know exactly what you’re paying for. Most vendors stick to one of a few common models, and understanding them will help you budget accurately and dodge any surprise bills later on.

Here’s a quick rundown of what you’ll likely see:

- Pay-as-You-Go: You're charged a small amount for each invoice you process. This is often a great fit for businesses with unpredictable or low invoice volumes since your costs scale directly with your usage.

- Tiered Subscriptions: You pay a flat monthly or annual fee for a package that includes a certain number of invoices and users. As your volume grows, you can move up to the next tier. This model gives you predictable costs, which finance teams love.

- Per-User Pricing: Some tools charge based on how many people need access. This can get pricey for larger teams, so be sure to ask if there are different costs for administrators versus basic approvers.

Always, always ask about the hidden costs. What about setup and implementation? Is customer support included, or is it an extra fee? Does data storage cost more after a year? A cheap sticker price can look a lot different once you add everything up.

Don't Buy It Until You've Tried It

Finally, never make a decision based on a features list or a polished marketing video. You have to see the software in action, working with your documents. Insist on a live, personalized demo. This is your chance to really test the system and ask tough questions that are specific to your company's quirks.

Come prepared for the demo. Send the salesperson a few of your typical invoices, and be sure to include that one weird vendor format that always causes problems. Watch how accurately the OCR captures the data. Ask them to walk you through setting up an approval workflow that mimics your exact process.

This hands-on test drive is the single most important step. By following a structured approach, you can move past the sales pitches and confidently choose a tool that truly fits your budget, your workflow, and your vision for the future.

Building Your Future-Proof AP Workflow

Let's pull all these pieces together and walk through what a modern accounts payable workflow actually looks like in action. This isn't just theory; it's a practical blueprint for building a more agile, accurate, and resilient finance operation. When you bring in invoice scanning software, you’re doing more than just adding a new tool—you're fundamentally redesigning how your business manages its financial backbone.

Picture this: an invoice lands in your team's email. Instead of a person manually opening it, printing it out, and walking it over to someone's desk, the software grabs it instantly. The system reads all the critical data, cross-references it with the right purchase order, and zips it over to the correct manager for approval. They can give the green light right from their phone in a matter of seconds.

The New Standard for AP Efficiency

Once approved, the data flows right into your accounting system, all teed up and ready for payment. This entire sequence happens without a single keystroke of manual data entry. You've eliminated the risk of a misplaced decimal, the bottleneck of waiting for a physical signature, and the costly mistake of paying the same invoice twice.

This level of automation is the foundational step in your company’s digital transformation. It positions your business for sustainable growth by making your financial processes scalable, transparent, and completely audit-ready.

A smooth workflow like this does far more than just save a few hours. It shifts your AP department from a reactive cost center into a strategic part of the business. Your team is no longer bogged down by tedious data entry. Instead, they can focus their brainpower on valuable analysis, nurturing vendor relationships, and fine-tuning your company's cash flow.

Ultimately, the ability to process invoices with speed and precision is a real competitive edge, strengthening financial health across the board. The first step is acknowledging where manual processes are holding you back. To get a head start, check out our guide on how to automate invoice processing. It’s all about building a future-proof system that can handle whatever comes next and setting your business up to thrive.

Frequently Asked Questions

It's natural to have questions when you're thinking about changing a core business process like accounts payable. Let's tackle some of the most common ones we hear from people exploring invoice scanning software.

How Accurate Is This Stuff, Really?

This is usually the first thing people ask, and for good reason. The good news is that modern invoice scanning tools are remarkably accurate, combining Optical Character Recognition (OCR) with smart AI.

Most top-tier platforms hit accuracy rates above 95%. The AI is doing more than just reading characters on a page; it's learning to understand the context of different invoice layouts. The more invoices it sees, the smarter it gets.

Of course, no system is infallible. That's why the best solutions have a "human-in-the-loop" feature. If the software gets tripped up on a weird format or a faded number, it simply flags it for a quick review by one of your team members. This gives you the speed of automation with the final gut-check of a human eye.

Is This Software Actually Affordable for a Small Business?

Yes, absolutely. It's a common myth that this kind of automation is only for big corporations with deep pockets. Thanks to cloud-based software, powerful invoice scanning is well within reach for small and medium-sized businesses.

You're not looking at a huge, one-time capital expense anymore. Most providers use a subscription model, where you pay a predictable monthly or annual fee based on how many invoices you process. When you compare that cost to the hours your team gets back and the expensive human errors you'll avoid, the ROI becomes a no-brainer.

For a small team, the impact is huge. Think about what you could do with an extra 10 hours a month that used to be spent on mind-numbing data entry. That's time you can put back into growing the business, making the software an investment that pays for itself very quickly.

How Painful Is It to Get This Set Up?

Getting started is much simpler than you probably imagine. The days of needing a dedicated IT crew and a six-month implementation plan are long gone. Today's invoice scanning tools are built to be user-friendly from the get-go.

Here’s what you can generally expect:

- Simple Dashboards: Clean, intuitive interfaces that your team can get the hang of in a few hours, not weeks.

- Helpful Onboarding: Most companies provide step-by-step guides, tutorials, and real support to make sure you're set up for success.

- Easy Integrations: These tools are designed to play nicely with the accounting software you already use, like QuickBooks or Xero. Connecting them is often just a matter of a few clicks.

The whole point of this software is to reduce your headaches, not add new ones. A smooth, fast setup is a key part of delivering on that promise.

Ready to stop wasting time on manual data entry and see how automation can transform your workflow? DocParseMagic uses powerful AI to extract data from your invoices and deliver it as a clean spreadsheet in under a minute. Sign up for free and see the magic for yourself.