8 Accounts Payable Automation Best Practices for 2025

In today's competitive business environment, manual accounts payable processes are a significant drag on productivity, accuracy, and strategic financial management. Chasing approvals, keying in invoice data, and manually matching documents are not just tedious tasks. They are costly bottlenecks that expose businesses to fraud, late payment penalties, and strained vendor relationships.

The shift to automation is more than just going paperless; it is a strategic move to transform your AP department from a cost center into a value-driven hub of financial intelligence. A streamlined, automated system frees up your team to focus on higher-value activities like cash flow analysis, vendor negotiation, and early payment discount capture. This transition is critical for maintaining financial health and operational agility.

This guide cuts through the noise to deliver a definitive list of the most impactful accounts payable automation best practices. We will move beyond generic advice and provide a clear, actionable roadmap for building a resilient, efficient, and scalable AP function. By implementing these eight strategies, you can optimize every stage of the invoice-to-pay lifecycle, from receipt to final payment.

We'll explore each practice in detail, providing practical steps and real-world examples to help you:

- Implement end-to-end invoice digitization and intelligent data capture.

- Establish automated three-way matching with precise tolerance rules.

- Deploy dynamic approval workflows that adapt to your business needs.

- Integrate a self-service vendor portal to improve collaboration.

This article is designed for finance professionals, bookkeepers, and operations staff who want to build a truly optimized accounts payable system that supports business growth and provides a clear competitive advantage.

1. Implement End-to-End Invoice Digitization and OCR Technology

Manual data entry is the primary bottleneck in traditional accounts payable workflows. It’s slow, tedious, and a major source of costly errors. Implementing end-to-end invoice digitization with Optical Character Recognition (OCR) technology is a foundational best practice for accounts payable automation. This technology automatically captures, extracts, and validates data from invoices, regardless of their format-paper, PDF, or email.

The core function of OCR is to convert unstructured invoice information (like text on a scanned document) into structured, machine-readable data. Modern OCR solutions, such as Rossum AI or UiPath Document Understanding, leverage artificial intelligence (AI) and machine learning. This allows them to intelligently identify key data points like invoice numbers, PO numbers, line items, and totals with increasing accuracy over time, even across diverse layouts and languages.

Key Insight: By eliminating manual keying, OCR not only accelerates the entire AP cycle but also significantly reduces the risk of human error, preventing duplicate payments and ensuring data integrity from the very first step.

How to Implement OCR Effectively

A successful OCR implementation requires a strategic approach. It’s not just about installing software; it’s about integrating it thoughtfully into your existing process.

- Start with High-Volume Vendors: Begin your rollout by focusing on invoices from your highest-volume, most standardized suppliers. This allows your team to build confidence and refine the process before tackling more complex or variable invoice formats.

- Establish Quality Standards: Clearly communicate minimum quality standards for invoice submissions to your vendors. Scanned documents should be clear and high-resolution to maximize OCR accuracy. Encourage vendors to switch to electronic formats like PDF over email whenever possible.

- Set Confidence Thresholds: Configure your OCR software to flag invoices that fall below a certain accuracy or "confidence" score. This creates a smart workflow where high-confidence invoices are processed automatically, while low-confidence ones are routed to an AP clerk for manual review and validation.

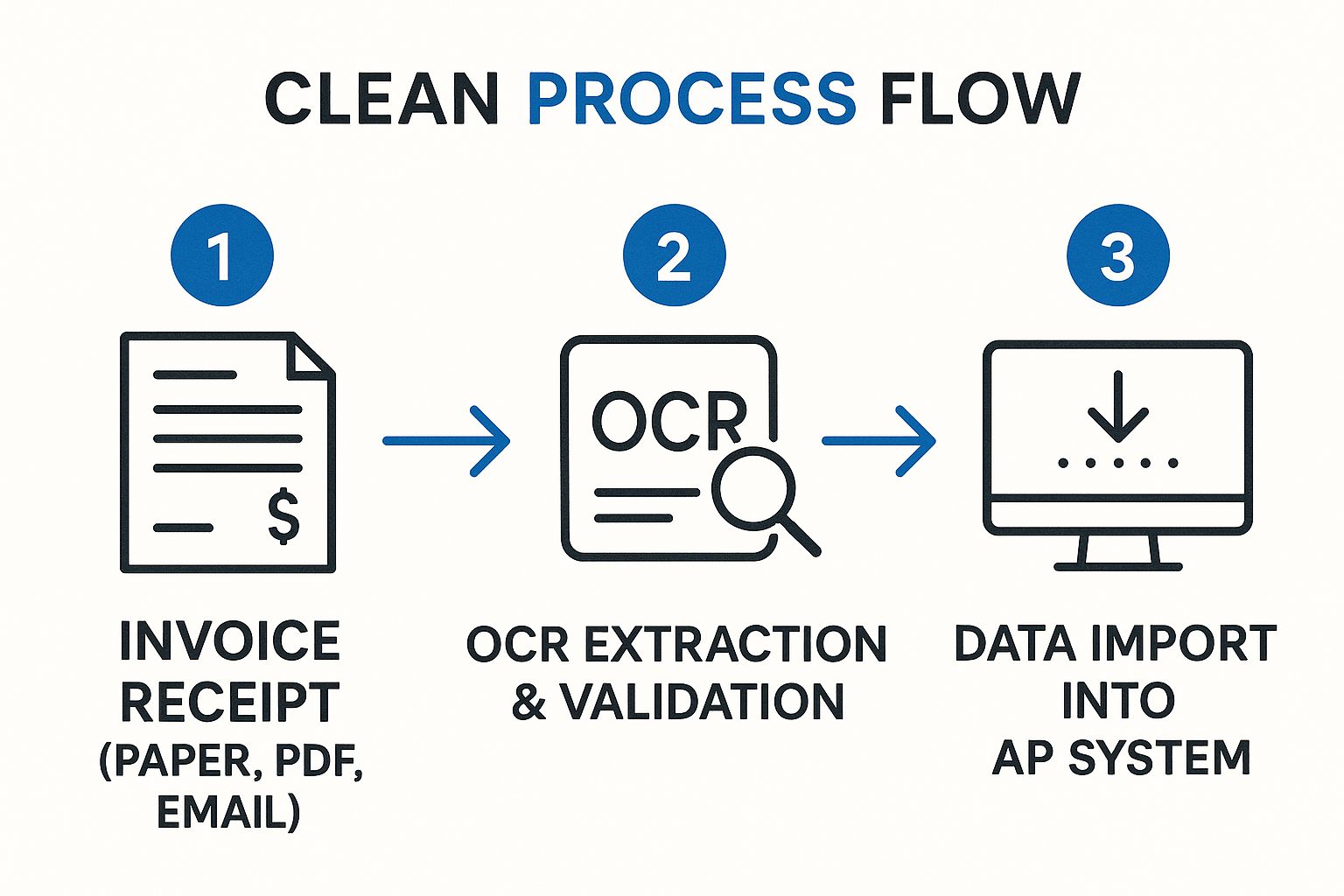

The following infographic illustrates the streamlined, three-step process of automated invoice capture.

This simple yet powerful flow transforms the AP front-end from a manual bottleneck into an efficient, automated data pipeline.

2. Establish Automated Three-Way Matching with Tolerance Rules

Paying incorrect or unauthorized invoices is a significant financial risk that can cripple cash flow and erode profits. One of the most critical accounts payable automation best practices is to establish an automated three-way matching process. This internal control mechanism automatically verifies the invoice against its corresponding purchase order (PO) and the goods receipt note (GRN) before scheduling payment.

The system compares key details like quantities, prices, and line items across all three documents. Leading AP automation platforms, such as SAP Ariba and Coupa, excel at this by introducing configurable tolerance rules. These rules allow minor, acceptable discrepancies (e.g., a 2% price variance or a small quantity difference) to pass through without manual intervention, dramatically increasing straight-through processing rates. For instance, Procter & Gamble successfully achieved an 88% automatic three-way matching rate, which cut their processing costs by 60%.

Key Insight: Automated three-way matching shifts the AP team's focus from routine validation to strategic exception management. It prevents fraudulent payments, eliminates overpayments, and ensures you only pay for what you ordered and received.

How to Implement Three-Way Matching Effectively

A robust three-way matching system requires careful configuration and clear internal processes to maximize its value. It's about creating a system that is both secure and efficient.

- Set Data-Driven Tolerance Levels: Instead of using arbitrary percentages, analyze historical data to identify common, acceptable variances with your vendors. Set your tolerance rules based on this analysis to strike the right balance between control and efficiency.

- Establish Tiered Approval Workflows: Configure the system to route exceptions intelligently. For example, a minor price variance might go to the procurement manager, while a large quantity discrepancy is escalated to a department head. This ensures the right person reviews the right problem.

- Train Cross-Functional Teams: The success of three-way matching depends heavily on upstream data quality. Train your receiving staff on the importance of timely and accurate goods receipt documentation, as this is a common point of failure. Also, train procurement on creating detailed and accurate purchase orders.

By systematically matching these crucial documents, you create a powerful, automated shield against payment errors and fraud, solidifying the financial integrity of your procurement-to-pay cycle.

3. Deploy Dynamic Approval Workflows with Business Rules Engine

Static, manual approval processes are a significant chokepoint in accounts payable, leading to delayed payments, missed early payment discounts, and frustrated vendors. A critical step in effective accounts payable automation is deploying dynamic approval workflows powered by a business rules engine. This approach automatically routes invoices to the correct approvers based on a set of predefined, configurable business rules.

Unlike rigid, hard-coded hierarchies, dynamic workflows adapt to contextual data within the invoice itself. Factors like invoice amount, department, GL code, vendor, or project ID can trigger specific, multi-step approval paths. For example, an invoice under $1,000 for the marketing department might go directly to the department head, while an invoice over $50,000 for IT hardware could require sequential approval from the IT Director, the CFO, and the CTO. Leading platforms like Tipalti and SAP Concur have perfected this, allowing non-technical users to build and modify these complex rules without IT intervention.

Key Insight: A business rules engine transforms invoice approvals from a manual, sequential chase into an intelligent, parallel, and automated process. This not only dramatically cuts approval times but also strengthens internal controls and ensures policy compliance on every single transaction.

How to Implement Dynamic Workflows Effectively

Successfully launching a rules-based approval system involves careful planning and a clear understanding of your organization’s needs. This ensures the automated system reflects and improves upon your real-world processes.

- Thoroughly Map Existing Processes: Before automating, document every current approval path, including all exceptions and informal workarounds. This initial blueprint is crucial for capturing all scenarios and building a comprehensive ruleset that prevents invoices from getting stuck.

- Balance Control with Efficiency: Implement clear dollar-value thresholds for different approval levels. The goal is to ensure proper oversight on high-value invoices without creating unnecessary friction for routine, low-value purchases.

- Enable Automated Escalations and Delegations: Configure the system to automatically escalate an invoice to the next-level manager if an approver is unresponsive for a set period (e.g., 48 hours). Additionally, build in delegation chains for when primary approvers are out of office to avoid bottlenecks.

- Provide Full Context for Approvers: Ensure that when an approval request is sent, the approver has instant access to all relevant documents directly within the interface. This includes the original invoice image, the purchase order, receiving documents, and the vendor's payment history.

This structured approach ensures your dynamic workflows are robust, compliant, and highly efficient from day one, turning a major AP bottleneck into a streamlined, automated function.

4. Integrate Vendor Portal for Self-Service and Collaboration

Constant back-and-forth communication with suppliers is a significant drain on AP team resources. Answering calls and emails about invoice status, payment timing, and data updates consumes valuable time. Integrating a vendor self-service portal is a powerful accounts payable automation best practice that shifts this dynamic by empowering suppliers with direct, transparent access to information.

A vendor portal is a secure online platform where suppliers can submit invoices, track their real-time status, view payment history, and update their own information, like banking details or contact information. This bidirectional hub, offered by solutions like SAP Ariba Network or Coupa Supplier Portal, transforms the vendor relationship from a reactive, inquiry-based model to a proactive, collaborative partnership. For instance, Starbucks reduced payment-related inquiries by a remarkable 65% after implementing its portal.

Key Insight: A self-service portal acts as a single source of truth for both your AP team and your vendors. It drastically reduces manual inquiries, minimizes data entry errors from outdated supplier information, and improves overall supplier satisfaction through enhanced transparency.

How to Implement a Vendor Portal Effectively

Launching a portal is more than just a technical rollout; it requires a strategic plan focused on adoption and value creation for your suppliers.

- Prioritize a Phased Onboarding: Start by onboarding your highest-volume and most strategic vendors first. Their successful adoption will create momentum and provide valuable feedback before you expand the program to all suppliers.

- Offer Robust Training and Incentives: Provide comprehensive training resources, including video tutorials, user guides, and live webinars. To encourage adoption, consider offering incentives like faster payment terms for invoices submitted correctly through the portal.

- Gather Feedback and Iterate: Regularly collect feedback from your vendors to understand their experience and identify areas for improvement. Use portal analytics to pinpoint suppliers who may need additional support or training, ensuring a smooth transition for everyone involved.

The following infographic illustrates the key benefits a vendor portal brings to the accounts payable process.

By providing this self-service channel, you build stronger, more efficient relationships with your entire supply chain.

5. Implement an Exception Management Dashboard with Analytics

Invoice exceptions, such as price discrepancies or missing PO numbers, are the primary cause of processing delays and supplier friction in accounts payable. Handling them reactively is inefficient and costly. Implementing a dedicated exception management dashboard with built-in analytics is one of the most impactful accounts payable automation best practices, transforming exception handling from a chaotic fire-drill into a strategic, data-driven process.

This system provides a centralized, real-time view of all invoices requiring manual intervention. Instead of languishing in email inboxes, exceptions are automatically flagged, categorized, and routed to the correct personnel for resolution. Advanced platforms like Tableau, Power BI, or built-in modules in AP solutions like Stampli or Basware Analytics don't just track exceptions; they analyze them to uncover root causes and identify trends, enabling continuous process improvement. For example, Boeing used dashboard analysis to pinpoint that vendor onboarding issues were the root cause of 30% of its exceptions, allowing them to fix the upstream problem.

Key Insight: An analytics-driven dashboard moves your AP team from simply fixing individual problems to proactively preventing them. It provides the visibility needed to identify recurring issues with specific vendors, internal processes, or system configurations.

How to Implement Exception Management Effectively

A successful implementation hinges on creating a structured, transparent, and accountable workflow for handling exceptions. It's not just about visualization; it's about driving action and improvement.

- Define Clear Exception Categories: Categorize exceptions based on their root cause (e.g., vendor error, PO mismatch, receiving discrepancy, system issue). This is crucial for accurate reporting and effective root cause analysis.

- Set Resolution SLAs: Establish Service Level Agreements (SLAs) for resolving different types of exceptions based on their urgency and potential financial impact. This ensures high-priority issues are addressed promptly and prevents exceptions from becoming aged liabilities.

- Conduct Monthly Trend Reviews: Dedicate time each month to review the exception dashboard with stakeholders from procurement and receiving. Use the data to identify process bottlenecks, pinpoint vendors requiring retraining, and celebrate improvements in efficiency.

- Create Resolution Playbooks: Develop standardized procedures or "playbooks" for handling the most common exception types. This ensures consistency, reduces resolution time, and simplifies training for new AP team members. AstraZeneca successfully used this approach with a prioritization dashboard to cut its average exception resolution time from 8 days down to just 2.5 days.

6. Adopt Electronic Payment Methods and Payment Automation

The final stage of the AP cycle, the payment itself, is often burdened by the legacy of paper checks. Manual check printing, signing, stuffing, and mailing is expensive, slow, and susceptible to fraud. Adopting electronic payment methods and automating the payment process is a critical best practice that delivers significant cost savings, enhanced security, and improved supplier relationships. This moves the AP function from a cost center to a potential revenue generator through rebate programs.

The core of payment automation involves replacing paper checks with more efficient electronic methods like ACH, wire transfers, and virtual cards. Modern payment automation solutions, such as Bill.com or AvidXchange, integrate directly with your ERP or accounting system. They can schedule payments based on due dates and negotiated terms, automatically generate and deliver remittance advice, and simplify the reconciliation process with detailed audit trails.

Key Insight: Payment automation transforms the final, most critical step of the AP process from a manual, high-risk task into a secure, efficient, and even profitable operation. By optimizing how you pay, you can reduce direct costs and unlock new revenue streams.

How to Implement Payment Automation Effectively

Transitioning from checks to electronic payments requires a clear strategy focused on vendor enablement and security. It's not just about offering new options; it's about driving adoption.

- Start with High-Volume Domestic Vendors: Begin your electronic payment conversion campaign by targeting domestic suppliers with whom you have a high volume of transactions. These vendors are often more equipped and willing to accept ACH or card payments, providing quick wins and building momentum for your program.

- Offer Multiple Electronic Payment Options: Not all vendors are the same. Accommodate their preferences by offering a mix of payment types. While some may prefer the simplicity of ACH, others may be equipped to accept virtual cards, which can generate valuable rebates for your company.

- Automate Remittance and Communication: A major pain point for vendors is matching payments to invoices. Use your payment automation platform to send detailed remittance information automatically via email or a supplier portal. This reduces inquiries to your AP team and helps your suppliers reconcile their accounts faster. This step is a key component of accounts payable automation best practices.

7. Establish Continuous Process Improvement Through KPI Monitoring

Implementing accounts payable automation is not a one-time project; it’s an ongoing initiative that requires continuous refinement. To ensure long-term success, organizations must establish a framework for process improvement by consistently monitoring Key Performance Indicators (KPIs). This practice transforms AP from a static cost center into a dynamic, data-driven function that continuously seeks greater efficiency and value.

The core principle is to use data to make informed decisions about your AP processes. By tracking critical metrics, you can quantify the return on your automation investment, identify bottlenecks, and proactively address issues before they escalate. Leading organizations like Shell, which tracks 15 core AP metrics monthly, use this data-centric approach to achieve top-quartile performance. This is a fundamental step in maturing your AP automation capabilities.

Key Insight: Automation provides the data; KPI monitoring provides the roadmap for improvement. Without tracking performance, you are flying blind and cannot maximize the value of your technology investment.

How to Implement KPI Monitoring Effectively

A successful KPI program is built on a clear strategy for what to measure, how to measure it, and what actions to take based on the results. It’s about creating a feedback loop for perpetual optimization.

- Select a Balanced Mix of KPIs: Avoid the temptation to track everything. Focus on a core set of 8-12 KPIs that provide a holistic view of performance. Include both lagging indicators (e.g., cost per invoice, which shows past performance) and leading indicators (e.g., e-invoicing adoption rate, which predicts future efficiency).

- Establish Baselines and Set Targets: Before you can measure improvement, you must know your starting point. Capture baseline data for your chosen KPIs before full automation rollout. Then, set realistic, incremental improvement targets based on industry benchmarks from sources like the Institute of Finance & Management (IOFM) and your organization's capabilities.

- Create a Reporting Cadence: Consistency is key. Establish a regular schedule for reviewing KPI dashboards, such as weekly operational checks and quarterly strategic deep dives. Share these performance insights broadly with stakeholders to foster transparency and drive organizational alignment toward common goals. For example, a quarterly review could reveal that a high exception rate is tied to a specific group of vendors, prompting a targeted outreach and training initiative.

8. Implement Robust Change Management and User Adoption Strategy

Even the most advanced technology will fail if the people who need to use it don't adopt it. Implementing a robust change management and user adoption strategy is one of the most critical, yet often overlooked, accounts payable automation best practices. This approach treats automation not just as a software installation but as a fundamental business transformation that affects people, processes, and technology.

Effective change management addresses the human side of the transition. It involves a structured plan to communicate the benefits, train users, and manage resistance to ensure a smooth and successful rollout. Frameworks like the Prosci ADKAR Model or Kotter's 8-Step Change Model provide proven methodologies for guiding teams through the transition, ensuring the new automated system is embraced and its full ROI is realized. For example, Honeywell's phased rollout with intensive change management achieved an 88% vendor portal adoption, a figure far exceeding the 45% industry average.

Key Insight: The success of an AP automation project is measured by user adoption, not just technical implementation. Without a plan to manage change, you risk low engagement, process workarounds, and a failure to achieve projected efficiency gains.

How to Implement Change Management Effectively

A strategic change management plan should be developed in parallel with the technology implementation, not as an afterthought. It requires proactive engagement and clear communication from start to finish.

- Secure Executive Sponsorship: Identify and engage executive sponsors who can champion the initiative. Their visible and vocal support is essential for signaling the importance of the change and motivating teams across the organization.

- Create Stakeholder-Specific Messaging: Develop clear "what's in it for me" (WIIFM) messages for each group, from AP clerks to department heads and vendors. Highlight how automation will reduce their manual workload, provide better visibility, or speed up payments. Adobe successfully used a network of "change champions" to tailor these messages, which helped reduce overall training needs by 40%.

- Provide Role-Specific, Ongoing Training: Avoid a one-size-fits-all training program. Offer role-specific sessions in various formats (live, recorded, hands-on labs) to meet different learning styles. Plan for continuous support and training beyond the initial go-live to address new questions and reinforce best practices.

Accounts Payable Automation Best Practices Comparison

| Item | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Implement End-to-End Invoice Digitization and OCR Technology | Moderate to High: Initial setup and training needed | Requires investment in OCR software and infrastructure | High accuracy (95%+), 80-90% manual effort reduction, faster processing | High-volume invoice processing with diverse formats | Reduces errors and manual work, supports multiple formats/languages |

| Establish Automated Three-Way Matching with Tolerance Rules | Moderate: Configuring rules and collaboration required | Integration with ERP/procurement, clean data needed | 75%+ automatic matching, reduced overpayments and fraud | Invoice validation against PO and goods receipt data | Prevents payment errors, accelerates approvals |

| Deploy Dynamic Approval Workflows with Business Rules Engine | Moderate to High: Complex rules and ongoing maintenance | Requires setup of business rules engines and user training | 50-70% reduction in approval cycle time, improved compliance | Multi-level invoice approvals sensitive to amount/vendor | Eliminates bottlenecks, adapts to org changes |

| Integrate Vendor Portal for Self-Service and Collaboration | Moderate: Onboarding and adoption challenges | Portal development and vendor training | 60-80% reduction in inquiries, improved vendor satisfaction | Supplier invoice submission and payment tracking | Increases transparency, reduces AP workload |

| Implement Exception Management Dashboard with Analytics | Moderate: Requires data quality and categorization | Dashboard tools and analytics skills | Reduced exception rates, faster resolution times | Managing and resolving invoice exceptions efficiently | Enables root cause analysis and continuous improvement |

| Adopt Electronic Payment Methods and Payment Automation | Moderate: Vendor enrollment and banking coordination | Payment platform and vendor enablement effort | Large cost savings, faster payments, fraud reduction | Payment processing and fraud prevention | Accelerates payments, cuts costs, possible rebate revenue |

| Establish Continuous Process Improvement Through KPI Monitoring | Moderate: Ongoing data collection and review required | Reporting tools and KPI data management | Quantifiable ROI, identification of bottlenecks | Driving ongoing optimization of AP operations | Data-driven decision making, supports accountability |

| Implement Robust Change Management and User Adoption Strategy | Moderate to High: Dedicated resources and effort needed | Resources for training, communication and support | User adoption 90%+, reduced resistance, sustainable usage | Ensuring successful tech adoption and maximizing ROI | Increases adoption, reduces delays, builds enthusiasm |

From Best Practice to Business as Usual

Navigating the landscape of accounts payable automation is not about flipping a single switch; it's a strategic journey that transforms a traditionally reactive cost center into a proactive, value-driving hub. The eight accounts payable automation best practices detailed in this guide serve as a comprehensive roadmap for this transformation. They are not isolated tactics but interconnected pillars that build upon each other to create a resilient, efficient, and intelligent invoice-to-pay ecosystem. Moving from manual processes to a fully automated state requires a deliberate and phased approach, starting with the most foundational elements and scaling toward sophisticated, data-driven operations.

The journey begins with foundational technology. Implementing end-to-end invoice digitization with high-accuracy Optical Character Recognition (OCR) is the non-negotiable first step. Without clean, structured digital data, the rest of the automation chain falters. This is where you eliminate the manual keying errors and processing delays that plague traditional AP departments. From this solid data foundation, you can then build more complex automated systems, such as three-way matching with intelligent tolerance rules and dynamic approval workflows that route invoices based on predefined business logic, ensuring compliance and speed simultaneously.

The Shift from Transactional to Strategic

As your automation maturity grows, the focus shifts from merely processing transactions to optimizing the entire AP lifecycle. The introduction of a vendor self-service portal is a pivotal move, empowering your suppliers and dramatically reducing the volume of inbound inquiries your team must handle. This collaborative approach, combined with an exception management dashboard, turns your AP staff from data-entry clerks into strategic problem-solvers who manage only the outliers that require human intervention.

This strategic evolution is supercharged by two critical components: payment automation and robust analytics. Adopting electronic payment methods not only streamlines the final step of the process but also opens up opportunities for capturing early payment discounts and improving cash flow management. Meanwhile, establishing and monitoring Key Performance Indicators (KPIs) provides the essential feedback loop for continuous improvement. This is how you prove ROI and identify the next bottleneck to solve, ensuring your accounts payable automation best practices are not just implemented but constantly refined.

Making Automation Your New Standard

Ultimately, the goal is to embed these practices so deeply into your operations that they are no longer seen as "best practices" but simply as "business as usual." This requires a thoughtful change management strategy to ensure user adoption and a commitment to evolving your processes as technology and business needs change. The value proposition is undeniable: enhanced financial control, fortified supplier relationships, stronger compliance, and a finance team free to focus on analysis and strategy rather than administrative tasks. By consistently applying these principles, you elevate the AP function from a back-office necessity to a strategic asset that directly contributes to your organization’s bottom-line growth and operational excellence. The path from manual effort to intelligent automation is clear, and the rewards for undertaking this journey are profound.

Ready to conquer the first and most critical step in your automation journey? Eliminate manual data entry and achieve over 99% accuracy with DocParseMagic. Our AI-powered solution specializes in extracting structured data from any invoice, purchase order, or receipt, providing the clean data foundation you need to implement all other accounts payable automation best practices. Visit DocParseMagic to start your free trial and see how effortless invoice digitization can be.