How to Automate Invoice Processing From Start to Finish

Automating how you handle invoices means letting software do the heavy lifting of capturing, extracting, and approving invoice data. This isn't just about scanning a document; it's about using smart tech like AI and OCR to read the information, check it for accuracy, and then push it directly into your accounting system. What was once a multi-step, headache-inducing manual job becomes a quick, smooth, and mostly hands-off workflow.

This shift is more than just a simple efficiency boost. It's a strategic move to slash hidden costs and, more importantly, free up your finance team to do work that actually matters.

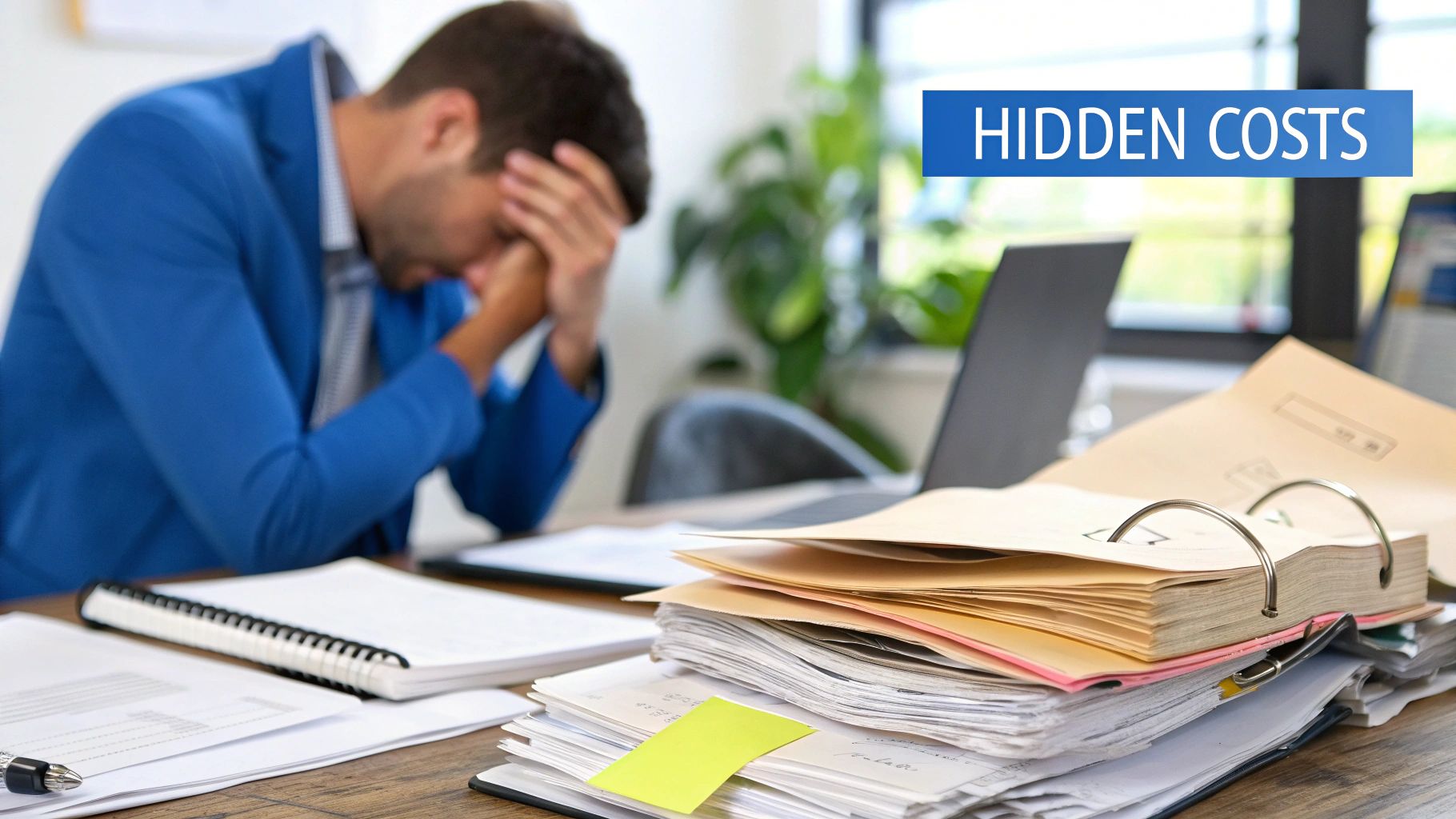

Why Manual Invoice Processing Is Costing You More Than You Think

Before we jump into the how of automation, let's talk about the why. It's easy to get so used to the daily routine of printing, scanning, and punching in numbers that you completely miss how much this outdated process is bleeding your business dry. The cost goes far beyond just the hours your team spends on mind-numbing data entry.

The Hidden Financial Drains

Manual processing is a minefield of hidden costs that quietly chip away at your profits. Think about it: every time an invoice gets lost in a cluttered inbox or sits on someone's desk for a week, you're risking late payment fees.

Then there are the missed opportunities. Many suppliers offer early-payment discounts, often around 1-2% of the invoice total. When your process is slow and clunky, you simply can't move fast enough to grab those savings. Over a year, that adds up to a significant amount of cash left on the table.

Human error is another major financial risk. A single typo—an extra zero, a misplaced decimal—can lead to a huge overpayment that’s a nightmare to recover. Or, you might underpay, which can damage your relationship with a key supplier. Every mistake costs time and money to fix, piling on to the initial cost of the error itself.

The real problem with manual invoicing isn't just that it's slow; it's the strategic opportunities you lose. Every minute your team spends chasing down paper is a minute they aren't focused on high-value work like financial analysis, cash flow forecasting, or negotiating better terms with vendors.

The True Cost of Inefficiency

There's a good reason the finance world is moving so quickly toward automation. By 2025, it's expected that over 60% of finance professionals will have fully automated their accounts payable.

The numbers tell the story. The average cost to process a single invoice manually can be over $12. With AI-powered automation, that cost can plummet to as low as $2.36. The time savings are just as dramatic, with processing times dropping from 10-30 minutes per invoice down to just a few seconds. For a deeper dive into these industry trends, Softco.com offers some great insights.

Ultimately, switching to a tool like DocParseMagic isn't just about getting new software. It's a core business strategy that helps you build a more resilient, intelligent, and profitable finance department. You're not just fixing a broken process; you're turning your accounts payable function from a necessary cost center into a real strategic asset.

Laying the Groundwork for Your Automated Invoice Workflow

Moving away from messy stacks of paper and toward a clean, digital system all starts with a solid foundation. Before you can even think about pulling data, you need to build a predictable and organized process from the ground up. The very first move? Creating a single, digital front door for every single invoice.

Stop chasing down attachments across a dozen different inboxes or digging through shared drives for scanned documents. Instead, set up one dedicated entry point. This could be a specific email address like invoices@yourcompany.com or a designated folder in Google Drive or Dropbox. The key is to get all your vendors sending their invoices to this one spot, which immediately brings order to the chaos.

Getting a Handle on Access and Security

Once you have that central hub, it's time to figure out who can do what. A critical part of automating invoice processing responsibly is setting up clear user roles and permissions in your tool, like DocParseMagic. This isn't just about locking things down; it's about building a workflow with clear accountability.

For instance, you'll want to create specific roles:

- Administrator: This is your power user. They can build new workflows, add or remove team members, and connect to other software.

- Reviewer: This person is on the front lines. They can look at the extracted data, fix any mistakes, and give the final approval on an invoice, but they can't mess with the underlying settings.

- Uploader: This role is simple and focused—their only job is to get new invoices into the system for processing.

By separating these duties, you protect your automated workflow from accidental changes and make sure the rules you're about to create stay consistent and secure.

Building Your First Invoice Parser

Alright, here comes the fun part: teaching the software how to read your documents. The engine that drives this whole operation is called a parser. You can think of it as a smart template you design for each of your vendor's unique invoice layouts. My advice? Start with an invoice from one of your highest-volume suppliers. You'll get the biggest bang for your buck right out of the gate.

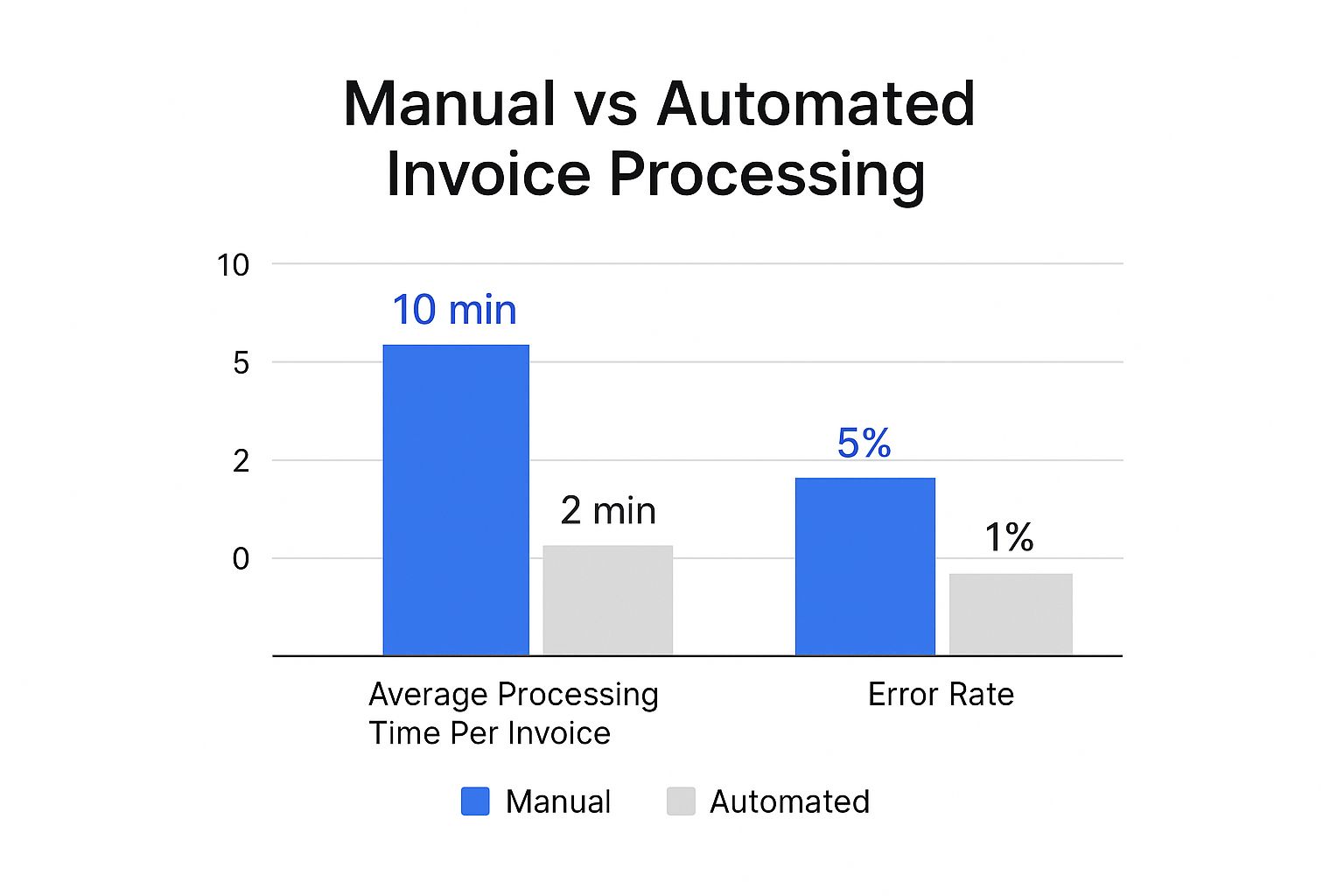

The difference automation makes is staggering, as this chart shows.

It's pretty clear from the data: automation doesn't just cut down processing time by a massive 80%, it also drops the error rate by five times.

To get started, you'll upload a sample invoice into the tool and begin telling it which pieces of data you care about.

It's a surprisingly intuitive process. You just draw a box around a piece of information, like the invoice date or the total amount due, and give it a label. Every time you do this, you're training the AI and creating a reusable rule that will apply to every future invoice from that same vendor. This is how you lay the foundation for truly intelligent data capture.

Training Your System for Intelligent Data Extraction

With your basic workflow in place, it's time to teach the system how to think. This is where we move beyond simple, rigid templates and get into true, intelligent automation. You’re essentially training an AI assistant to read and understand invoices just like a person would, only much, much faster and with way better accuracy.

The initial parser you built is a great starting point. Now, the real goal is to refine it with data extraction rules that can handle the real-world messiness of invoices. This is where we bring in the power of Optical Character Recognition (OCR) and the AI smarts of a tool like DocParseMagic to pinpoint everything from invoice numbers to complex line-item details.

Defining and Refining Extraction Rules

Let’s think about a common scenario. You have a vendor who sends invoices that mostly look the same, but once in a while, the "Due Date" is labeled "Payment Due." A simple template system would just give up. An intelligent one learns to see both variations and understand they mean the same thing.

You make this happen by setting up smart rules. For instance, you can tell the system:

- Invoice Number: Look for keywords like "Invoice #," "Inv. No.," or "Reference Number."

- Total Amount: Search for terms like "Total," "Amount Due," or "Balance." I always add a rule to select the largest monetary value on the page to avoid accidentally grabbing a subtotal.

- Vendor Name: It’s a good practice to anchor this rule to something consistent, like a logo or a specific address block, so you always get the right one.

This whole process feels less like coding and more like teaching. You just show the system what you need from a few examples, and it quickly learns how to find that information again, even if the document layout isn't identical next time.

Handling Line-Item Complexity

Extracting header information like dates and totals is a solid win, but the real magic of automating invoices comes from capturing all the line-item data. This is where you get the nitty-gritty details—item descriptions, quantities, unit prices, and SKU numbers.

The core idea here is to create a 'table extraction rule.' You simply highlight the entire table of items on your sample invoice and tell the system to treat it as a repeating set of rows. It's smart enough to figure out the columns and pull out each line item separately.

For anyone in inventory management or job costing, this is an absolute game-changer. Instead of a team member manually typing out a dozen lines from a single invoice, the system does it in an instant. It can even be configured to perform validation checks, like making sure Quantity x Unit Price actually equals the line total.

Achieving Near-Perfect Accuracy Over Time

The best part of this approach is that the system gets smarter with every single document it processes. Each time you correct a misidentified field, you’re providing crucial feedback that refines the AI model. This continuous learning loop is what pushes accuracy rates higher and higher.

The difference this makes is stark when you compare it to the old way of doing things. Take a look at the data.

Manual vs. Automated Invoice Processing Accuracy

This table breaks down how traditional manual processing stacks up against modern AI-powered automation. The improvements in accuracy and efficiency are pretty dramatic.

| Metric | Manual Processing | AI-Powered Automation |

|---|---|---|

| Data Entry Error Rate | 3-5% on average | <0.5% |

| Document Accuracy (OCR) | N/A (human reading) | 95-99% |

| Time to Process | 5-15 minutes per invoice | <1 minute per invoice |

| Validation Checks | Prone to human oversight | Automated & consistent |

As the numbers show, the shift to AI-driven processing all but eliminates the costly errors that plague manual data entry, turning a liability into a reliable asset.

Manual invoice processing is notoriously error-prone; some studies show that nearly 39% of invoices can contain errors. In stark contrast, a well-trained automated system can slash that error rate to a mere 0.1-0.5%. This huge leap is thanks to OCR technology reaching 95-99% accuracy, combined with AI-driven validation checks that constantly confirm the data. You can dig into more accounts payable statistics and see the full picture of automation's impact on docuclipper.com.

Over time, you’ll find that the need for manual review drops off a cliff. Invoices that once required a full, line-by-line check can soon be processed automatically, with the system only flagging the rare exception for a human to look at. This is the ultimate goal: turning a tedious, manual chore into a reliable, hands-off workflow.

Creating Smart Validation and Approval Chains

Pulling the data off an invoice is a fantastic start, but that information is only as good as its accuracy. The next, and arguably most important, part of automating your invoice process is building a smart verification layer. This is where you turn raw, extracted text into trusted data that’s ready for your accounting system.

Think of this step as setting up your own tireless internal auditor. You’ll create custom validation rules that automatically check every single invoice against your company’s logic, ensuring nothing slips through the cracks.

Designing Your Automated Auditor with Validation Rules

The whole point here is to spot discrepancies before they snowball into real problems. Using a tool like DocParseMagic, you can build some surprisingly powerful rules that trigger the second data is extracted. For instance, a basic but crucial rule is to flag any invoice where the line items don't mathematically add up to the total. It sounds simple, but you'd be surprised how often that happens.

Here are a few essential validation rules I always recommend setting up right away:

- PO Matching: This one’s a must. The system should automatically check the invoice total against the amount on the corresponding purchase order. Any mismatch gets flagged for a human to look at.

- Vendor Verification: Always have the system cross-reference the vendor's name and banking info with your master vendor list. This is your front-line defense against fraudulent payments and typos.

- Duplicate Check: Set up a rule to scan for duplicate invoice numbers from the same vendor within a set period, like 90 days. It’s a simple check that can easily prevent you from paying the same bill twice.

These rules run quietly in the background, creating a safety net that drastically improves your financial accuracy. You're moving beyond a quick "eyeball check" and into systematic, reliable logic.

By automating these checks, you're not just moving faster; you're building a more robust and auditable financial process. Every validation check creates a digital footprint, showing exactly why an invoice was flagged or approved, which is an absolute lifesaver during an audit.

Mapping Approval Workflows That Make Sense

Okay, so an invoice has passed its automated checks. Now what? It needs to land on the right person's desk for approval. In the old days, this meant forwarding emails or—even worse—walking a piece of paper around the office. Automation completely eliminates that chaos.

The real magic is that the routing can be entirely data-driven. You can set up workflows that intelligently send an invoice to the correct manager based on the information extracted from the document itself.

Here’s a perfect example of this in action:

- An invoice comes in from a marketing agency for $7,500.

- The system pulls the data and sees the "Department Code" is MKTG.

- A rule you've created automatically routes any invoice over $5,000 with the MKTG code straight to the Head of Marketing.

- But if that same agency sends an invoice for $400, a different rule kicks in, sending it to the Marketing Manager instead, bypassing the department head for a faster turnaround.

This kind of conditional logic is a game-changer. It ensures high-value invoices get the senior-level oversight they need, while smaller, everyday payments are processed quickly without creating bottlenecks. Customizing these routes is at the heart of what makes invoice automation so effective—it gives you both speed and control.

Connecting Your Workflow to Your Business Systems

So, you’ve pulled the data from your invoices and double-checked that it's all correct. That’s a huge win, but the real magic happens when you connect that data to the other software you use every day. This is the final piece of the puzzle that gets rid of manual data entry for good, creating a truly automated financial workflow. A system that just sits there on its own is useful, but one that actively feeds information to your other tools? That's a game-changer.

https://www.youtube.com/embed/9GrcrmmB8iQ

The easiest way to get started is by using native integrations. Most document processing tools, like DocParseMagic, are designed to play nicely with the big names in accounting software. Hooking it up to your QuickBooks, Xero, or NetSuite account is usually a one-and-done setup. You just authorize the connection, match up a few fields, and you're set. From then on, every approved invoice can automatically show up as a new bill in your accounting system, ready for payment, with no extra work from you.

Taking It Further with Webhooks and APIs

But what happens when you need to send invoice data to something more specific, like a custom-built ERP or your project management tool? That’s where webhooks and APIs come in. A webhook is just a simple, automatic message sent from one app to another whenever something happens.

In our case, you can configure a webhook to fire off the second an invoice gets the final thumbs-up. It will instantly send a neat package of clean data—vendor name, invoice total, line items, you name it—to any other system that's set up to listen for it.

For instance, I've seen a construction company use a webhook to:

- Push an approved supplier invoice directly into their project management software.

- Tie that cost to the right project budget automatically.

- Ping the project manager to let them know the materials have been officially billed.

That kind of real-time financial visibility is something you just can't get when you're doing things by hand.

Building Custom Connections Without a Single Line of Code

If webhooks sound a little too technical for your taste, don't worry. There's another fantastic option: integration platforms like Zapier or Make. These services are like universal adapters for thousands of web apps. They let you build powerful, custom connections using a simple drag-and-drop interface.

Think of these platforms as digital Lego blocks. You can snap your invoice tool together with just about any other software in your arsenal, creating unique "if this, then that" automations that fit your business perfectly.

For example, you could easily create a workflow where a single approved invoice in DocParseMagic does three things at once: creates a bill in Xero, adds a new line to a Google Sheet for your finance team’s tracking, and posts a notification in a specific Slack channel. This gives you incredible flexibility to get your data exactly where it needs to be, keeping your books current and your team in the loop without anyone having to lift a finger.

Common Questions About Invoice Automation

Jumping into automation always brings up a few practical questions. How much work is this really going to be? And can the tech actually handle the messy, real-world documents my team deals with every day? Let's tackle some of the most common things people ask when they're thinking about automating their invoice workflow.

How Long Does It Take to Set Up an Automated Invoice System?

Honestly, it’s a lot faster than you’d expect. For a simple setup—say, focusing on one or two of your most frequent invoice layouts—you can be up and running in just a couple of hours. That includes creating your dedicated inbox, adding your team members, and training your first parser model.

Now, a more complex project involving dozens of unique vendor templates, custom validation rules, and a deep integration with your ERP system might take a few days to get just right. My advice? Start with your highest-volume vendor. This gives you a quick, noticeable win right out of the gate and builds momentum to expand the system to your other suppliers. The time you save in the long run will make that initial setup effort feel like a distant memory.

Can Automation Handle Invoices with Complex or Varied Layouts?

Absolutely. This is where modern AI and OCR technology have made huge leaps. While a clean, typed invoice is always going to be the easiest to process, today's systems are designed to learn and adapt to all sorts of formats, even when the layout changes slightly from the same vendor. The software gets smart about identifying key data points, like an invoice number or total amount, no matter where they are on the page.

For those really tricky documents, like a scanned invoice with handwritten notes scribbled on it, many platforms have a "human-in-the-loop" feature.

This is a game-changer. It automatically flags any fields with low confidence for a quick manual check. You get the raw speed of automation with the final gut-check of a human eye exactly when you need it.

What Is the Typical ROI on Automating Invoice Processing?

The return on investment is usually what seals the deal for most companies. It really breaks down into three key areas: a massive drop in per-invoice processing costs (we've seen clients go from over $12 down to under $3), the real money you save by capturing early payment discounts and avoiding late fees, and the strategic value of freeing up your finance team to work on analysis instead of data entry.

Most businesses find that their automated system pays for itself within 6 to 12 months. The more invoices you process, the faster you'll see a positive and substantial ROI. It effectively turns a classic cost center into a lean, efficient part of your operation.

Ready to finally ditch the manual data entry grind and see these benefits for yourself? DocParseMagic can extract data from your first batch of invoices in minutes. Try it for free and see your results instantly at docparsemagic.com.