A Clear Reconciliation in Accounting Example

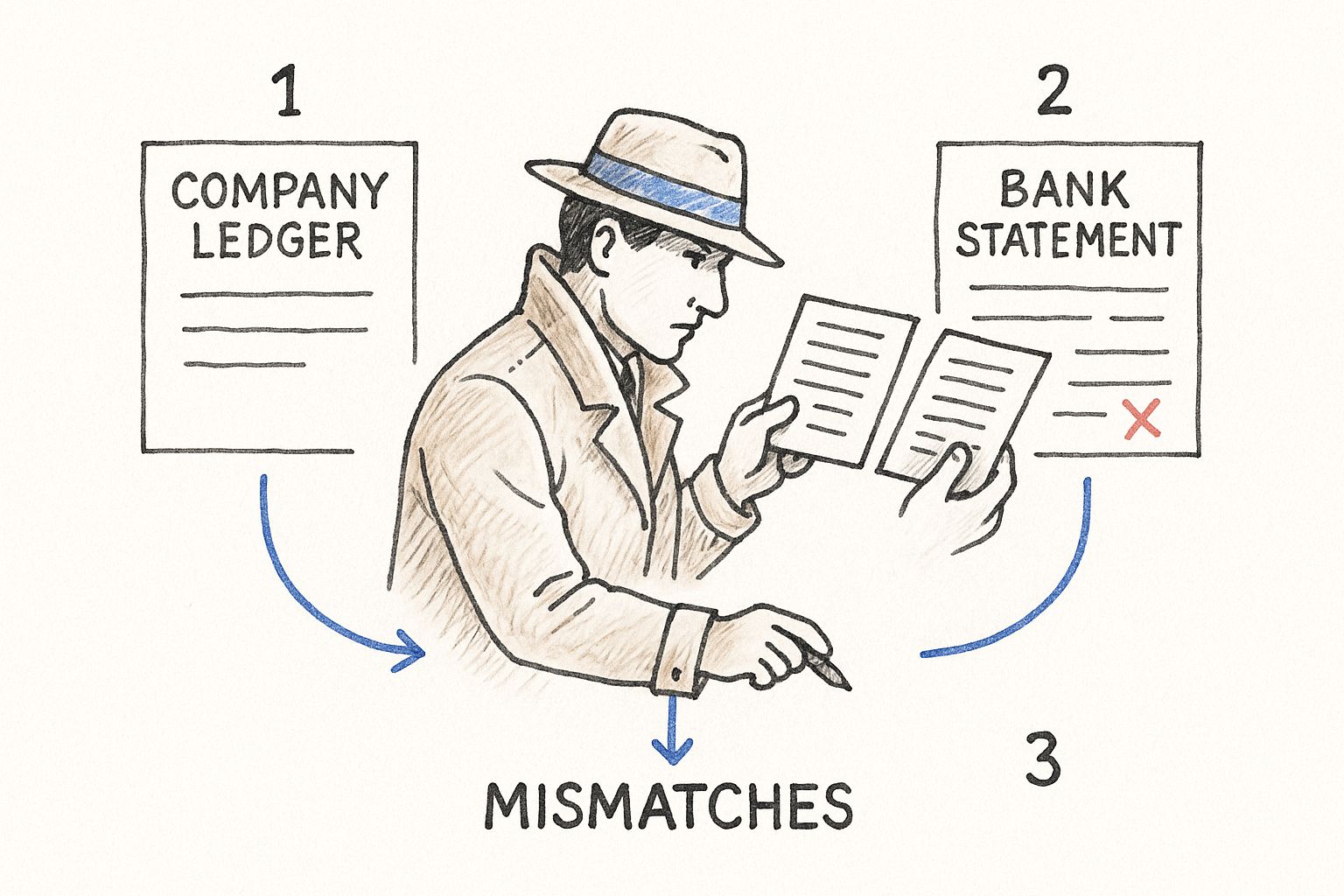

Think of accounting reconciliation as playing detective with your finances. You have two sets of books that are supposed to tell the same story—your internal records and an external source like a bank statement. The goal is to make sure they match up perfectly.

A classic reconciliation in accounting example is when you sit down with your company's cash book and the monthly bank statement. This process is the only way to be certain that the cash balance on your books is the actual amount of cash in your bank account.

What Is Accounting Reconciliation

At its heart, reconciliation is simply the process of comparing two different sets of records to check for accuracy and consistency. It's a fundamental quality control step for your accounting, ensuring your financial statements are reliable. But it’s not just about ticking and tying numbers; it's about understanding why they might not match.

When you systematically compare your general ledger to an outside source like a bank statement or a vendor invoice, you start to uncover the reasons behind any differences. These usually fall into a few common categories:

- Timing Differences: This happens all the time. Think of checks you’ve sent out that haven't been cashed yet by the recipient.

- Simple Errors: A typo during data entry can throw everything off. It could be on your end or even the bank's.

- Missed Entries: It's easy to overlook things like bank service fees or interest earned until you see them on the statement.

- Fraudulent Activity: This is the most serious. Reconciliation can be the first line of defense in spotting unauthorized charges.

This infographic does a great job of showing what this detective work looks like in practice, comparing a company ledger and a bank statement side-by-side to pinpoint the mismatches.

As you can see, it's a systematic investigation, not just a quick glance. With the sheer volume of transactions modern businesses handle, trying to do this manually has become a major headache for many finance teams.

This challenge has sparked a huge move toward automated solutions. The global market for account reconciliation software was valued at around USD 3 billion and is expected to soar past USD 10 billion by 2033. This growth isn't surprising, especially with increasing regulatory pressure for accurate and transparent financial reporting. You can dig into more of these market trends over at Fortune Business Insights.

Before we dive deeper into specific methods, it helps to understand why this process is so non-negotiable for a healthy business.

Why Regular Reconciliation Matters

Here’s a quick look at the primary business benefits of consistent accounting reconciliation.

| Benefit | Impact on Your Business |

|---|---|

| Accurate Financials | Ensures your income statement and balance sheet are reliable for decision-making. |

| Cash Flow Management | Gives you a true picture of your cash position, preventing overdrafts or missed opportunities. |

| Fraud Detection | Acts as an early warning system for unauthorized transactions or theft. |

| Error Correction | Catches costly mistakes (like bank errors or double payments) before they escalate. |

| Audit Readiness | Makes audits smoother and less stressful by keeping your records clean and well-documented. |

Simply put, making reconciliation a regular habit keeps your financial house in order and protects your company from unnecessary risk. Now, let’s get into the foundational types of reconciliation you'll encounter.

The Universal Reconciliation Framework

While every reconciliation in accounting example might seem a little different on the surface, they all share the same fundamental DNA. Think of it as a universal recipe you can follow whether you're tackling a bank account, a vendor statement, or a customer ledger. This framework gives you a clear, repeatable path to get your numbers right every time.

The process always kicks off with gathering your source documents. This means pulling together the two sets of records you need to compare—for instance, your internal general ledger and the bank statement that just arrived. Getting this foundational step right ensures you have all the puzzle pieces before you even start.

Next, you dive into the comparison, methodically matching transactions line-by-line. The real goal here is to find the things that don't match. Thankfully, technology has made this stage much easier, moving us far beyond the manual grunt work of old spreadsheets. Early accounting software helped, but modern tools are a world apart. You can explore how automating bank reconciliation has evolved from its incredibly labor-intensive roots.

The Five Core Reconciliation Stages

The whole process really boils down to five distinct stages that take you from a pile of documents to a perfectly balanced account. Following these steps helps make sure nothing slips through the cracks and your final numbers are rock-solid.

-

Collect Records: Get your hands on all the necessary documents. This includes your general ledger, bank or vendor statements, and any supporting paperwork like invoices or receipts.

-

Compare Entries: Go through your internal and external records, systematically checking off the transactions that appear in both places.

-

Identify Differences: Now, isolate everything that doesn't match. These are your "reconciling items"—things like outstanding checks, deposits in transit, bank fees, or simple data entry mistakes.

-

Investigate Discrepancies: Time to put on your detective hat. You need to figure out the story behind each discrepancy. Was it just a timing difference, a human error, or something that requires a deeper look?

-

Adjust and Correct: Finally, you make the necessary adjusting journal entries in your general ledger. This is where you correct any errors and account for legitimate items like bank service charges. This last step officially brings your books back into alignment.

The point of these adjustments isn't just to make the numbers match. It's about ensuring your company's financial records reflect economic reality as accurately as possible.

A Step-By-Step Bank Reconciliation Example

Theory is great, but let's get our hands dirty with a practical reconciliation in accounting example. We’ll walk through the process with a fictional small business, "Maplewood Crafts," to see exactly how it's done at the end of the month.

This is a classic scenario: Maplewood Crafts' internal records—their "book balance"—show they have $4,550 in cash. But the bank statement just arrived, and it says they have $5,480.

That gap means it’s time to start digging.

Identifying the Discrepancies

The bookkeeper begins the hunt, comparing every single line item in the company’s general ledger to what’s on the bank statement. It's a bit like a game of spot-the-difference, and you need a sharp eye. Going through this manually can be a real grind, but a little automation goes a long way. Tools that can quickly convert bank statements to Excel make this comparison much faster.

Here’s what they uncovered:

- Deposits in Transit: A customer payment of $500 was recorded in the company’s books on the last day of the month, but it hasn't shown up at the bank yet. This is a common timing difference.

- Outstanding Checks: They found two checks they mailed to suppliers that haven't been cashed yet: Check #121 for $1,200 and Check #123 for $250.

- Bank Service Charges: The bank charged a $20 monthly service fee. Maplewood hadn't recorded this yet because they didn't know about it until they saw the statement.

- Interest Earned: On the bright side, the bank paid them $40 in interest. This is also news to the bookkeeper.

These four items are the culprits behind the initial mismatch. The next step is to put them all together in a formal statement that proves the numbers are actually in sync.

Building the Reconciliation Statement

The reconciliation statement is elegantly simple. It has two main sections: one that adjusts the bank's number and another that adjusts the company's number. The goal is to make them meet at the same, correct figure.

A rookie mistake is thinking you only need to adjust your own books. A true reconciliation adjusts both sides for the things each one doesn't know about yet. This process reveals the actual, unified cash balance you can rely on.

Let's see how this looks for Maplewood Crafts. Below is a sample reconciliation that organizes all those loose ends into a clear, balanced picture.

Sample Bank Reconciliation for Maplewood Crafts

This table shows how we take the starting bank and book balances and adjust them with the items we found until they both equal the same "true" cash amount.

| Description | Bank Balance Adjustments | Book Balance Adjustments |

|---|---|---|

| Starting Balance | $5,480 | $4,550 |

| Add: Deposits in Transit | +$500 | |

| Add: Interest Earned | +$40 | |

| Less: Outstanding Checks | -$1,450 | |

| Less: Bank Service Fees | -$20 | |

| Adjusted Cash Balance | $4,530 | $4,530 |

And there it is—both sides balance perfectly to $4,530.

The job isn't quite done, though. The final, critical step is for Maplewood Crafts to make adjusting entries in their accounting software to record the $20 bank fee and the $40 in interest. This officially updates their book balance, ensuring it reflects their true cash position moving forward.

Exploring Other Critical Reconciliation Types

While bank reconciliation usually gets all the attention, that same detective work is just as vital in other corners of your business. Applying this discipline to your vendor and customer accounts protects your cash flow from all sides, making sure you don't overpay suppliers or miss out on money you've earned.

Think of these other reconciliations as specialized check-ups for your key financial relationships. Each one is designed to confirm that your records tell the exact same story as the people you do business with. Let's start with a common scenario: reconciling with a vendor.

Reconciling Vendor Accounts

Vendor reconciliation is simply the process of matching your internal accounts payable records against the statements your suppliers send you. The goal is straightforward: confirm you’re paying precisely what you owe—no more, no less. It’s a critical step, because without it, you could easily get burned by duplicate invoices or simple pricing errors.

To get this done, you'll need two core documents:

- Your Internal Accounts Payable Ledger: This is your detailed history of every invoice received and every payment made to a specific vendor.

- The Vendor’s Statement of Account: This is their version of the story, showing the invoices they've sent you and the payments they've logged from your company.

Lining these two documents up, side-by-side, makes discrepancies jump right out. You might spot a payment you sent that the vendor hasn’t credited yet, or maybe an invoice they’ve accidentally billed you for twice.

Reconciling Customer Accounts

On the flip side, customer reconciliation (often called accounts receivable reconciliation) is all about making sure your clients are paying you correctly and on time. This involves comparing what your sales ledger says a customer owes against their own records or payment confirmations.

This process is your first line of defense against payment disputes. It helps you proactively identify issues like unapplied cash, where a customer's payment hasn't been matched to the correct invoice, preventing confusion and delays.

A classic reconciliation in accounting example happens when a customer insists they've paid an invoice, but your books still show it as outstanding. By reconciling the account, you can quickly discover if their payment was mistakenly applied to someone else's account or if it's just stuck in bank processing limbo. It’s a simple check-up that keeps your cash flow healthy and your customer relationships on solid ground.

Navigating the Rough Waters of Reconciliation

Even for the sharpest accounting teams, the reconciliation process can hit some serious snags. Let's be honest, it’s rarely a straight line from A to B. The usual suspects? Missing paperwork, a tidal wave of transactions, and the headache of dealing with multiple currencies. These common issues can turn a routine check-up into a major operational bottleneck.

One of the biggest hurdles is simply the sheer volume of data. When you're staring down a spreadsheet with thousands of lines, trying to match everything by hand isn't just slow—it's an open invitation for human error. This is exactly where technology steps in to save the day. For a deeper dive into how modern tools automate this grunt work, check out our guide on what is intelligent document processing. It’s a game-changer for extracting and matching data from invoices and statements automatically.

Things get even more complicated when you're doing business across borders.

Untangling Global Reconciliation Knots

When you throw different currencies and international banking systems into the mix, finding discrepancies becomes a whole different ballgame. You're no longer just looking for a misplaced decimal point; you're navigating a maze of different financial reporting standards.

On an international scale, one of the toughest challenges is getting the balance of payments to line up with the corresponding changes in international investment positions. It’s a level of complexity that explains why so many countries find it difficult to produce fully integrated international accounts.

In fact, the problem is so widespread that one survey revealed only about 10 out of 52 countries had systems sophisticated enough to handle this kind of comprehensive flow-stock reconciliation. This statistic really shines a light on how hard it is to get a true financial picture on a global scale. You can dig into the specifics in this IMF research on international accounts.

For businesses, the key to overcoming these international hurdles is twofold: adopt rock-solid, standardized record-keeping practices and invest in software that can handle multi-currency conversions without breaking a sweat.

Answering Your Top Reconciliation Questions

Even with a clear roadmap, you're bound to hit a few bumps when you're deep in a reconciliation. That's perfectly normal. Let's walk through some of the most common questions that pop up, so you can tackle them with confidence.

How Often Should I Reconcile My Accounts?

For your main bank accounts, monthly is the sweet spot. It lines up neatly with your bank statement cycle, which makes it the perfect time to catch any issues before they snowball.

But what about high-traffic accounts, like accounts payable or receivable? For those, you might want to tighten the schedule. Some businesses with a ton of daily transactions even reconcile those accounts every single day to keep a close watch on their cash flow. The key isn't a magic number—it's consistency.

Think of reconciliation as your routine financial health check-up. It's an internal process you do to keep your books clean. An audit, on the other hand, is like a formal physical exam—an external review by an independent party.

Is Accounting Software Really Necessary for This?

Look, if you're a one-person shop with a handful of transactions, you could probably get by with spreadsheets. But I wouldn't recommend it. For any other business, modern accounting software is a game-changer for reconciliation.

These tools do the heavy lifting for you. They pull in your bank transactions automatically, suggest matches, and flag anything that looks off right away. This automation slashes the time you spend on manual data entry, which is exactly where most reconciliation errors happen. It’s less of a luxury and more of an essential tool these days.

What Do I Do if I Can't Find the Source of a Discrepancy?

First off, don't panic—and definitely don't ignore it. Start by re-checking your own work. Was there a typo? A misplaced decimal? It happens to the best of us.

If your records look clean, it's time to reach out. Call your bank or email your vendor and ask them to clarify the transaction from their end. If you're still stuck, document the issue clearly in your reconciliation report as an "unreconciled item." Then, bring it to a senior accountant or bookkeeper. They’ve seen it all and can guide you on how to handle it correctly.

Stop wasting hours on manual data entry. DocParseMagic uses AI to instantly pull data from any document—invoices, bank statements, or receipts—into a clean spreadsheet. Get started for free at DocParseMagic.