Convert Bank Statement to Excel The Smart Way

Manually converting bank statements to Excel is more than just tedious—it's a genuine business risk packed with hidden costs. Every minute someone spends punching in numbers is a minute they aren't spending on actual analysis. And let's face it, even the most meticulous person can make a simple mistake, like a misplaced decimal, that throws off an entire financial report.

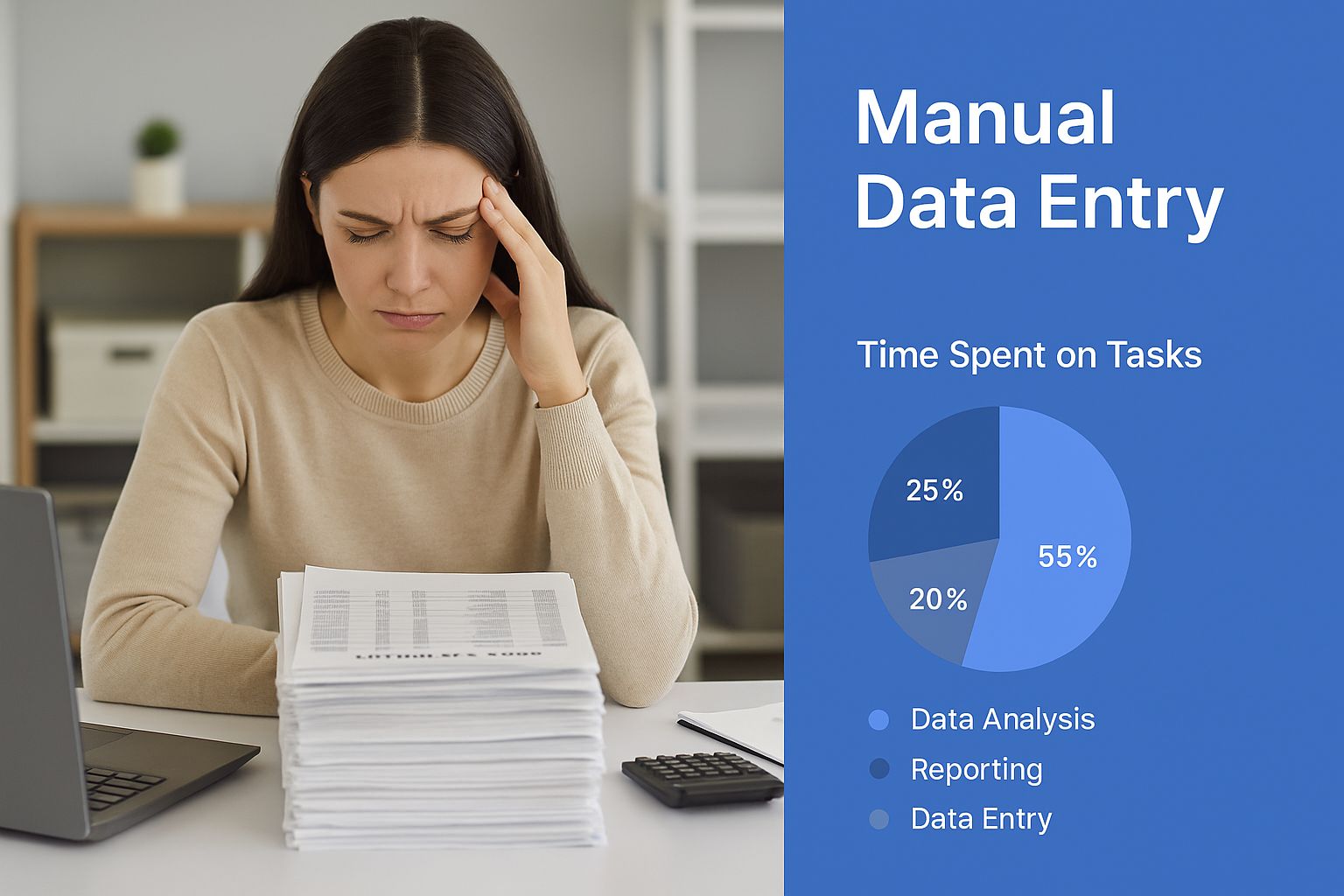

The Hidden Costs of Manual Data Entry

We've all been there. Staring at a mountain of PDF bank statements, knowing each line item is another chance to make a tiny but costly mistake. This old-school process isn't just an annoyance; it's a real threat to your financial accuracy and how efficiently your business runs.

The true costs aren't always obvious. You see the payroll expense for the time spent, sure, but the real damage runs deeper.

- Lost Productivity: Skilled employees get stuck doing clerical work instead of valuable tasks like forecasting or financial analysis. It's a massive waste of talent that directly hits your bottom line.

- Slow Decision-Making: When your team is busy with data entry, they can't provide the timely reports you need to make quick, informed decisions.

This is the bottleneck that so many modern businesses face when they need to get data from bank statements into Excel.

The High Price of Human Error

Human error is easily the most dangerous hidden cost. I've seen a single transposed number or a misplaced decimal point cause a ripple effect, leading to hours of frustrating reconciliation work just to find the source of the problem.

Studies consistently show that manual data entry comes with an error rate between 1% and 5%. That might sound small, but when you're dealing with thousands of transactions, those "small" errors add up fast.

The result? Flawed financial insights. Making business decisions based on bad data can be catastrophic, impacting everything from your budget to your tax filings.

The real cost of manual entry isn't just the time it takes; it's the compromised integrity of your financial data. When you can't trust your numbers, you can't make sound business decisions.

At the end of the day, automation isn't just a "nice-to-have." It’s essential for any business that cares about accuracy and efficiency. Moving from manual keying to an automated solution like DocParseMagic just makes sense—it eliminates these risks and ensures your financial data is both reliable and ready to use.

Your Bank Statement Conversion Options

So, you've got a pile of bank statements and need to get that data into Excel. What's the best way to tackle it? You've got a few different routes you can go, each with its own pros and cons when it comes to speed, accuracy, and the sheer amount of manual work involved.

Let's start with the old-school approach: manual copy-pasting or just typing it all in by hand. If you have a single, super-simple statement, this might seem like the quickest path. But let's be real—the minute you hit a second page or a slightly weird layout, you're in for a world of pain. It quickly turns into a tedious game of fixing misaligned columns and converting numbers that Excel thinks are text.

Comparing Your Main Choices

A much better option is using a built-in software feature, like Excel’s own "Get Data from PDF" tool. This is a solid step up from doing it all by hand. It uses Power Query to pull data directly out of a PDF file, which can be a real time-saver. It generally works great with clean, text-based statements. The catch? It can stumble over scanned documents or bank statements with non-standard layouts, often leaving you with a messy import that needs a lot of manual cleanup.

This brings us to dedicated AI-powered converters, like DocParseMagic. These tools are purpose-built for one thing: accurately extracting transaction data. They use sophisticated OCR (Optical Character Recognition) and AI to intelligently figure out what's a date, a description, a debit, or a credit—even if you're working with a blurry scan of a paper statement.

For anyone dealing with more than just a couple of statements a month, the right choice becomes pretty obvious. While manual methods don't cost any money upfront, the hidden costs in your time and the inevitable errors can be huge. An automated tool gives you a reliable and scalable way to get the job done right.

Bank Statement Conversion Methods At a Glance

To help you visualize the trade-offs, here's a quick comparison of the different ways you can convert a bank statement to Excel.

| Method | Typical Accuracy | Speed | Best For |

|---|---|---|---|

| Manual Copy-Paste | Low (5-10% error rate) | Very Slow | A single, simple statement once in a blue moon. |

| Excel 'Get Data from PDF' | Medium to High | Moderate | Clean, text-based PDF statements with standard layouts. |

| AI Converter (DocParseMagic) | Very High (99.9%+) | Very Fast | Any volume of statements, including messy scans and varied formats. |

Ultimately, the best method really boils down to your specific needs. How many statements are you processing, and what kind of condition are they in? For consistent, accurate, and stress-free financial data management, an AI tool is almost always the most efficient path forward.

The Old-School Way: Getting Your Bank Data into Excel Manually

Sometimes, you just need to convert a single bank statement and don't need a fancy automated tool. If that's you, a little hands-on work in Excel can get the job done. It’s not the fastest method for a big batch of statements, but it's a great skill to have when you're in a bind.

The most straightforward approach is a simple copy-and-paste. You just open your PDF statement, highlight all the transaction data, and drop it into a fresh Excel sheet.

Of course, the result is usually a mess. You'll likely see dates, descriptions, and dollar amounts all jumbled into a single column. But don't worry, that's where Excel’s "Text to Columns" feature comes in to save the day.

Cleaning Up the Mess with Text to Columns

Once you've pasted your data, just select the one column that has all the jumbled information.

- From there, head over to the Data tab in your Excel ribbon.

- Find and click on Text to Columns.

- You'll want to choose the "Delimited" option because the different pieces of information (like the date and the description) are usually separated by spaces.

- On the next screen, tick the box for "Space" as your delimiter. Excel will give you a live preview showing how it will neatly split everything into separate columns.

It's a surprisingly effective trick. In a few clicks, you can turn that single chaotic column into organized fields for dates, transaction details, and amounts. It might still need a little manual cleanup, but it beats retyping everything from scratch.

A Better Manual Method: Excel’s PDF Importer

For a cleaner and more powerful approach, try using Excel's built-in PDF import tool. It’s designed to intelligently find tables inside a PDF, which can save you a ton of manual formatting work.

To find it, navigate to Data > Get Data > From File > From PDF.

Just point it to your bank statement file, and Excel will open its Power Query Navigator. This window shows you all the tables it found in the document. You just have to select the main transaction table and click "Load."

The data you get might not be perfect right away. I've often seen it pull in extra header rows or summary totals from the bottom of the statement. The trick is to use the Power Query Editor before loading the data. It’s the perfect spot to remove those extra rows, make sure your numbers are formatted as currency, and tidy everything up.

This method takes a few more clicks than a simple copy-paste, but the results are far more accurate and reliable. For anyone looking to convert a bank statement to Excel without third-party software, this is easily the best manual option out there.

Letting AI Tools Handle the Conversion

Manually wrestling with bank statements is fine if you're only doing it once or twice. But if you handle financial documents regularly, you'll quickly realize that automation is the only sane path forward. This is where dedicated AI-powered tools like DocParseMagic come in. They are specifically built to convert bank statements to Excel with astonishing accuracy, going way beyond just pulling text from a page.

These platforms are smart. They don't just see a jumble of words and numbers; they understand the structure of a bank statement. The AI can tell the difference between a transaction date, a description, a withdrawal, and a deposit, then neatly slot each piece of information into the correct column in a spreadsheet. It’s this intelligent parsing that makes them so much more powerful than a generic OCR tool.

The Accountant's Secret Weapon

Picture this: it's tax season, and an accountant is facing a shoebox full of a client's bank statements from the entire year. The old way meant days, maybe even a week, of mind-numbing data entry, with a high chance of typos. With a good AI converter, that same job is done in an afternoon. It's not just faster; it's far more accurate.

The demand for this kind of efficiency has exploded. Top online converters now support statements from over 500 banks around the globe, including heavyweights like Chase, Bank of America, and Wells Fargo. The best tools boast accuracy rates of 99.9%, which blows the typical 5–10% human error rate out of the water. Of course, security is a huge deal here. Reputable services use bank-grade 256-bit encryption and automatically delete your files after processing to keep your financial data safe. You can dig deeper into these security features and their importance over at converthub.com.

These tools fundamentally change how professionals work. An accountant can stop being a data entry clerk and start being a financial analyst, spending their time on high-value strategy instead of manual grunt work.

How AI Bank Statement Converters Work

Getting started is usually dead simple. You just upload your PDF statements—even crooked scans or low-quality images often work—and let the AI do its thing.

Most platforms have a clean, straightforward interface, like the one you see here, where you can just drag and drop your files.

This intuitive design is a big part of the appeal; there’s no complicated software to install or configure. In just a few minutes, you get a perfectly structured Excel file back, ready for analysis, importing into bookkeeping software, or building financial models. For anyone who's ever felt buried in financial paperwork, this kind of automation is a lifesaver, turning a task you dread into a quick and easy win.

How to Pick the Right Bank Statement Converter

Finding the right tool to get your bank statements into Excel isn't just about picking one that works—it's about finding the one that works best for your specific needs. You’ve got a lot of options out there, from all-purpose PDF editors to highly specialized financial data tools. The one you choose will make a huge difference in your workflow and, most importantly, the accuracy of your numbers.

Let's start with the non-negotiable: accuracy. A converter that constantly gets dates wrong or can't tell a debit from a credit is worse than useless. It just creates a bigger mess for you to clean up later. This is where dedicated financial tools really shine compared to their generic counterparts.

A 2025 industry comparison really drove this home for me. It showed that specialized platforms were hitting 99.9% accuracy on transaction data. Meanwhile, general PDF software like Adobe Acrobat was stuck in the 75–85% accuracy range for the same job. When your books depend on getting it right, that's a massive gap. You can dig into the performance details and see how different tools stack up in this comparison of the best bank statement converter tools.

Does the Price Make Sense for You?

Once you've zeroed in on accurate tools, the next thing to look at is the price versus how much you'll actually use it. A lot of converters have a free tier, which is great if you're just converting a statement here and there. Maybe you're a freelancer who just needs to process a couple of statements a month—a free plan that lets you do up to 10 pages a day is probably perfect.

But if you're a bookkeeper or a small business owner swimming in dozens of statements every month, you’re going to hit those free limits fast. That's when a subscription becomes a no-brainer. These paid plans, usually running anywhere from $9.99 to $49.99 a month, will give you much higher page limits (think 400 pages or even unlimited) and access to more powerful features.

Think of a good converter as an investment in data you can actually trust. A "free" tool that gives you sloppy, inaccurate data ends up costing you far more in manual correction time than a reliable paid service will ever cost you in subscription fees.

Finally, don't forget about security and speed. You're handling sensitive financial information, so you need a tool with bank-grade encryption and a clear policy on how they handle—and delete—your data. Speed is also a huge factor. If you can find a tool that rips through a batch of 50 statements in just a few minutes, you've found a serious ally for your financial workflow.

By weighing these key factors—accuracy, cost, security, and speed—you'll be able to confidently pick the converter that's genuinely right for you.

Final Checks for Perfect Financial Data

You've converted your bank statement to Excel. The tough part is over, right? Almost. Taking just five extra minutes now to double-check your work can save you hours of frustration down the line. This final quality check is what ensures your data is clean, accurate, and truly ready for analysis.

First things first, verify the numbers. The quickest way I’ve found to do this is to run a simple SUM formula on your credits and another on your debits. Reconcile those totals against the summary or closing balance on the original PDF statement. If the numbers don't match up, it’s a red flag that a transaction might be missing or, more commonly, duplicated.

Also, take a quick glance to confirm your debits and credits landed in separate columns. It's a common snag for them to be formatted as text instead of numbers, which will completely break any formulas or calculations you try to run.

Standardize Your Transaction Data

Let's be honest, raw bank data is messy. Banks love using cryptic abbreviations for vendors that make it nearly impossible to categorize your spending at a glance. Your data is far more useful when it's consistent.

This is where Excel's Find and Replace feature (just hit Ctrl + H) becomes your best friend. For example, you can search for every instance of "CHK CRD," "POS DEBIT," or "SQ *MERCHANT" and replace them all with something clean and uniform, like "Debit Card Purchase." This simple step makes sorting and filtering your expenses infinitely easier.

A common mistake is to trust the raw data export completely. Taking the time to standardize descriptions and verify totals is the final polish that transforms a simple data dump into a reliable financial record.

Before you call it a day, run through these last quick checks. I do this every single time:

- Sort by Date: A quick sort ensures everything is in perfect chronological order.

- Scan for Blanks: Look for any rogue empty rows or cells. These can throw off pivot tables and other analysis tools later.

- Hunt for Duplicates: If you have a column with a unique transaction ID, use Excel's built-in "Remove Duplicates" tool. It’s a lifesaver for catching repeated entries that can skew your totals.

These simple techniques are the final step in turning that raw data into a trustworthy asset ready for your accounting software or financial model.

Common Questions About Bank Statement Conversions

When you're getting ready to turn a bank statement into an Excel file, a few questions always seem to pop up. It's smart to get these sorted out upfront, especially since you're handling sensitive financial data and can't afford any mistakes. Let's dig into the most common ones I hear.

Is It Safe to Use an Online Converter?

This is, without a doubt, the number one concern. Is it actually safe to upload your financial documents to a random website?

The short answer is: it depends on the tool, but the reputable ones are incredibly secure. You should look for services that are very open about their security measures. Specifically, keep an eye out for bank-grade 256-bit encryption, which should protect your data both while it's being uploaded and while it's stored on their servers.

Another huge factor is their data retention policy. A trustworthy service will automatically and permanently delete your files shortly after you're done. They have no reason to keep your statements, and the best services make that a core part of their process.

Should I Use a Mobile App or a Web-Based Tool?

People also get stuck on whether they should download a mobile app or use a website-based converter. Your choice really comes down to what you're trying to accomplish.

- Mobile apps are great for one-off tasks. Snapped a picture of a single statement and need a quick conversion? An app can work just fine.

- Web-based platforms are built for heavier lifting. If you're managing business finances, processing multiple statements, or need high accuracy for accounting, a web platform is almost always the better choice.

While mobile apps have seen massive download numbers across the globe—you can explore detailed mobile app statistics to see the trend—the professional world still relies on web services. Why? They offer better accuracy, can handle large batches of documents at once, and often plug directly into accounting software like QuickBooks or Xero.

For a quick, casual conversion, an app might be all you need. But for anything serious—business accounting, bulk processing, or when accuracy is non-negotiable—a dedicated web-based tool is the way to go.

Can These Tools Handle Statements From My Bank?

Finally, there's the question of compatibility. Will a converter be able to read statements from a small local credit union just as well as one from a major international bank?

The best tools are designed specifically for this challenge. They are built to recognize layouts from hundreds of different banks worldwide. More importantly, they can handle a huge range of document types, from perfect digital PDFs to blurry photos of crumpled paper statements you found in a drawer. This flexibility is what makes a good converter so valuable—you get clean, usable data regardless of where the statement came from or what condition it's in.

Stop wasting hours on manual data entry. DocParseMagic uses AI to instantly pull transaction data from any bank statement directly into a clean, ready-to-use spreadsheet. Reclaim your time and ensure 100% accuracy on every document. Try it for free at docparsemagic.com and see the results in under a minute.