Invoice Data Extraction Software: Automate AP with Precision

Let's be honest, manual data entry is the bane of every accounts payable department. It's slow, tedious, and a breeding ground for costly mistakes. This is where invoice data extraction software comes in—it’s the modern answer to an age-old problem. Think of it as an intelligent assistant for your finance team, one that can read, understand, and organize all the critical information from any invoice you throw at it.

This technology automatically pulls key details like vendor names, invoice numbers, and payment totals, and feeds them directly into your accounting systems. It's about turning a painful, error-prone manual process into a hands-off, automated workflow.

What Is Invoice Data Extraction Software

Picture your AP team's desk. It’s covered in a mix of invoices—some are crisp PDFs from a major supplier, others are grainy scans from a small vendor, and a few are just smartphone photos of a paper receipt. For a human, each one is a mini-project. They have to hunt for the right information, copy it down, and then paste it into your accounting software. It's not just mind-numbingly slow; it's a minefield for typos and transposition errors.

Invoice data extraction software was built to dismantle this entire chaotic process. It’s a specialized tool designed to automatically capture information from invoices and get it ready for your other business systems, without anyone having to lift a finger.

Your Digital Invoice Translator

The best way to think about this software is as a multilingual translator who’s also a speed-reader and an expert organizer. When it sees an invoice, it doesn't just see a jumble of text and numbers. It uses sophisticated technology to actually understand the document’s layout and context.

This means the software can intelligently find and classify data points, no matter where they are on the page. It knows that "INV-987" is the invoice number and "$1,250.75" is the total due, even if they’re in completely different spots on invoices from two different suppliers. This contextual understanding is what sets modern tools apart from older, more rigid systems.

At its heart, invoice data extraction software turns messy, unstructured invoice data into clean, structured information that your accounting system can use right away—no manual clean-up required.

It’s More Than Just Reading Text

The whole point of this software is to get rid of the expensive and soul-crushing work of manual data entry. Businesses still stuck in that world are dealing with a massive operational drag. In fact, some studies show that processing a single invoice manually can cost over $20. With automation, that cost drops to just a few cents.

The main goals of invoice data extraction software are to deliver:

- Speed: It can process thousands of invoices in the time it takes a person to get through a small stack.

- Accuracy: It eliminates the risk of human error. No more typos or switched numbers that lead to incorrect payments.

- Efficiency: By taking this repetitive task off their plate, your finance team is free to focus on work that actually matters—like financial analysis, managing vendor relationships, and optimizing cash flow.

In short, this software transforms a time-sucking bottleneck into a fast, automated, and reliable part of your workflow. With a foundation of clean, accurate data, your entire AP process runs smoother, leading to faster payment cycles and a much clearer view of your company's finances.

How Modern Invoice Extraction Technology Works

To really get what makes modern invoice data extraction software tick, we need to pop the hood and look at the engine. It’s not just one piece of tech, but a clever combination of systems that work together, a lot like how our own eyes and brain process information. The whole process starts with the software "seeing" the document and then moves to its "brain" to actually understand it.

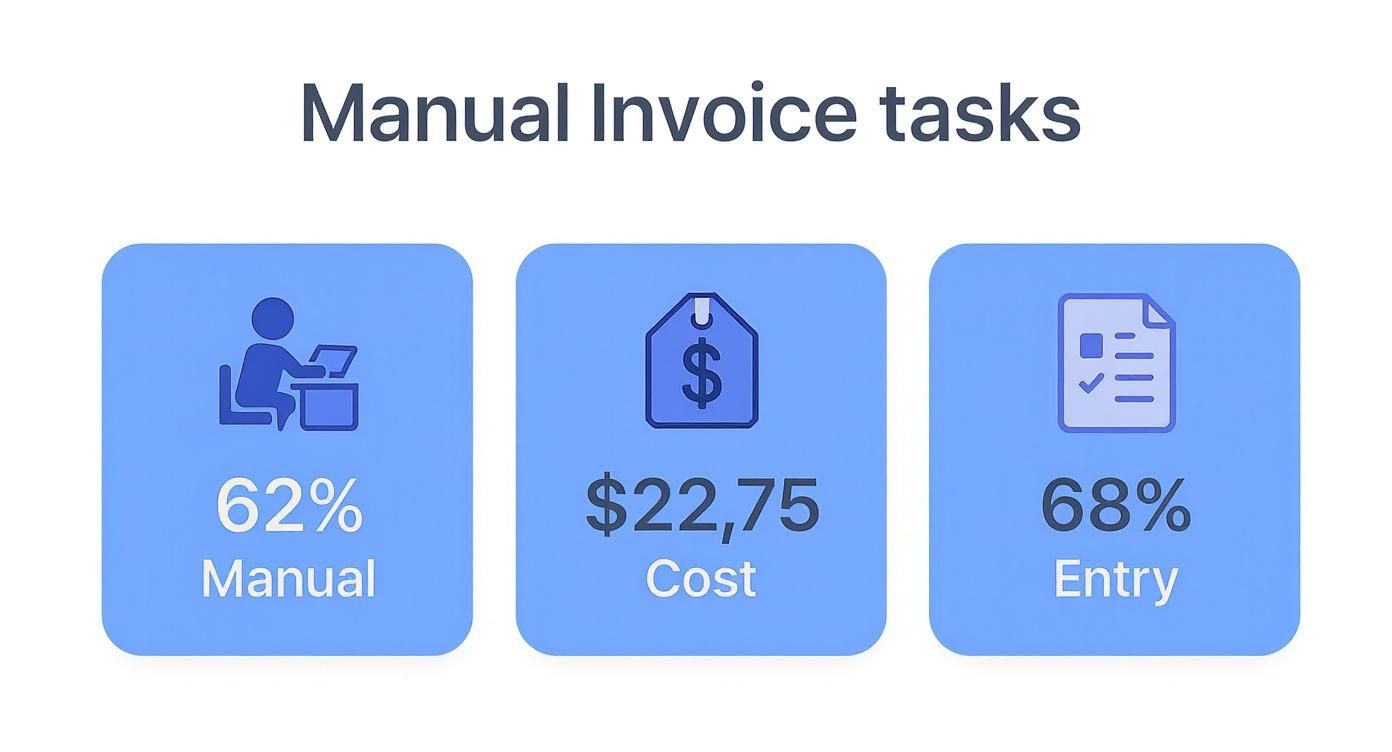

This layered approach is a game-changer. Even with all the talk about automation, processing invoices is still a major headache for most companies. By 2025, it's predicted that only 8% of finance teams will have their processes fully automated. A whopping 60–64% will still be stuck doing things by hand or with semi-manual systems. That manual work isn't just a time-sink; it's expensive, costing an average of $22.75 to process a single invoice.

The Foundation: Optical Character Recognition

The first step for any scanned document is turning the image into actual text. That’s the job of Optical Character Recognition (OCR).

Think of OCR as a digital typist. It looks at the invoice image, pixel by pixel, and translates it into characters—the letters and numbers a computer can read.

But on its own, basic OCR is pretty limited. It can read the characters, but it has zero understanding of what they mean. It might see "INV-789" but has no clue that it's an invoice number. It sees "$500.00" but doesn't know this is the total amount due. It's like having a page of words with no grammar or context to give them meaning.

The Brain: Intelligent Document Processing

This is where the real magic happens. The next layer, built right on top of OCR, is Intelligent Document Processing (IDP). If OCR gives you the raw text, IDP gives you the understanding. It uses artificial intelligence (AI) and machine learning (ML) to analyze that text and figure out its context and how different pieces of information relate to each other.

IDP is the software's brain. It doesn't rely on clunky, rigid templates. Instead, it’s been trained on millions of different invoices, so it has learned what an invoice number, a vendor name, or a line item usually looks like and where to find it.

This ability to learn is what makes today’s invoice extraction tools so powerful. Here’s a quick breakdown of how it works:

- Contextual Analysis: The AI scans all the text on the page to find patterns. It recognizes that the string of numbers after the words "Invoice #" is, well, the invoice number. It knows the figure next to "Total" is the final amount to be paid.

- Spatial Awareness: The system also understands document layouts. It can pinpoint the vendor's address in the top left corner or the payment terms at the bottom, even if the layout is completely different from the last invoice it saw.

- Continuous Learning: Every time the software handles a new invoice format or gets a correction from a human user, its machine learning models get a little bit smarter. This “human-in-the-loop” feedback helps the system improve its accuracy over time, adapting to new vendors without you having to manually configure anything.

Key Takeaway: OCR reads the text, but IDP understands what that text means. This powerful duo is what allows the software to pull out data with incredible accuracy, no matter how the invoice is laid out.

By using AI to interpret documents much like a person would, this technology moves light-years beyond simple text grabbing. It delivers the clean, structured data you need to finally automate your accounts payable workflow. For a deeper dive into this technology, check out our guide on what is Intelligent Document Processing.

The Business Impact of Automating Your AP Department

It's one thing to understand the tech behind invoice data extraction software, but the real story is what it does for your business—for your operations and your bottom line. Bringing this kind of automation into your accounts payable (AP) department isn't just a simple upgrade; it's a strategic shift that delivers real, measurable results across the entire company.

When you automate AP, you're essentially turning a traditional cost center—often bogged down by manual work and bottlenecks—into an efficient, data-rich part of your business. This simple change frees up your team's time and unlocks financial wins that were simply out of reach before.

Slashing Invoice Processing Costs

The first thing you'll notice is the dramatic drop in what it costs to process an invoice. Doing it by hand is surprisingly expensive, not just in staff hours but in the hidden costs of fixing mistakes. Companies that switch to AI-powered invoice processing often see a return on their investment in just a few months.

Think about it: manual processing costs an average of $15 to $22.75 per invoice. That adds up fast. With automation, that cost can shrink to just pennies, creating massive savings that go straight to your bottom line. This isn't just about saving a few dollars; it's a fundamental change in your AP department's financial footprint.

The infographic below really drives home the pain points of sticking with the old way of doing things.

These numbers show just how much manual work dominates traditional AP, which is exactly what invoice data extraction software is built to fix.

Accelerating Payment Cycles and Capturing Discounts

Speed is the next game-changer. Manual processing can drag out payment cycles for weeks, leading to late fees and frustrating your vendors. An automated system, on the other hand, can take an invoice from receipt to approval in minutes.

This speed has two huge benefits:

- Capturing Early Payment Discounts: Many suppliers offer discounts for paying early, like the common "2/10, n/30" term. When you're processing invoices by hand, it's almost impossible to move fast enough to grab those savings. Automation makes it easy, turning your AP department into a quiet profit center.

- Strengthening Vendor Relationships: Paying your suppliers on time, every time, builds a ton of trust. Good relationships can lead to better terms, priority service, and a much stronger supply chain.

By shrinking the procure-to-pay cycle from weeks down to hours, you're not just cutting costs—you're actively creating value.

Eliminating Costly Human Errors

Let's be honest: no matter how careful your team is, manual data entry leads to mistakes. A misplaced decimal, a transposed invoice number, or a duplicate payment can cause major headaches and financial loss. One of the best things about invoice data extraction software is its incredible accuracy.

AI-powered tools don't get tired or distracted. They capture data with over 99% accuracy, which all but eliminates common slip-ups like:

- Duplicate payments

- Incorrect payment amounts

- Data entry typos

- Miskeyed vendor information

This precision means the financial data flowing into your accounting system is clean and reliable from the get-go. For a deeper dive, check out our guide on accounts payable automation best practices.

Gaining Unprecedented Financial Visibility

Finally, automation gives you a crystal-clear view of your finances that’s impossible to get when you’re wrestling with paper. When your data is stuck in filing cabinets or scattered across spreadsheets, getting a true picture of company-wide spending is a nightmare.

Invoice extraction software pulls all your payables data into one organized, easy-to-access place. This gives your finance leaders a real-time look into spending patterns, liabilities, and cash flow. With accurate, up-to-the-minute data, you can make smarter decisions, forecast with more confidence, and manage your working capital like never before.

Essential Features of Top Invoice Extraction Tools

When you start looking at invoice extraction software, it's easy to get buried in marketing buzzwords. To find a tool that actually works, you have to cut through the noise and focus on the core features that will genuinely impact your team's accuracy and efficiency. A truly great solution is so much more than a glorified scanner; it's a smart system built to handle the messy reality of accounts payable.

Think of it like shopping for a new car. The fancy sound system is nice, but what you really need is a reliable engine, responsive steering, and solid brakes. For invoice automation, the "engine" is its data extraction accuracy, and the "steering" is how smoothly it connects with the software you already use.

High-Accuracy Data Extraction

This is the absolute deal-breaker. If a tool can't pull data correctly, it just creates more headaches than it solves. The best systems on the market use sophisticated AI to hit accuracy rates consistently above 99%, even when dealing with crumpled, scanned, or poorly formatted invoices.

This level of precision is crucial for capturing all the details, including:

- Line-Item Details: It's not enough to grab the grand total. The software must be able to pull every single line item, including product descriptions, SKUs, quantities, and unit prices.

- Header and Footer Data: This covers all the basics like the vendor's name, invoice number, PO number, and the all-important payment due date.

- Tax and Subtotal Fields: A smart tool can tell the difference between subtotals, shipping costs, and various tax amounts, ensuring everything is categorized correctly in your books.

When a system gets this right, you can trust that the data flowing into your financial software is clean from the very beginning. No more tedious manual clean-up.

Broad Format and Layout Compatibility

Let's face it: your vendors aren't all sending you pristine, standardized invoices. They come in all shapes and sizes, from various channels. A powerful extraction tool needs to handle this real-world variety without you having to constantly step in.

The best tools are incredibly versatile and can process:

- Different File Types: Whether it's a digital PDF, a Word doc, or a scanned image like a JPEG or PNG, the software should handle it.

- Multiple Delivery Channels: Look for systems that can monitor a dedicated email inbox (like ap@yourcompany.com) and automatically pull invoices from email bodies and attachments.

- Diverse Layouts: Modern AI doesn't rely on rigid templates. It should be smart enough to find the key data points on an invoice layout it has never seen before.

This kind of adaptability is a game-changer. It means you can work with new vendors immediately without wasting time setting up custom rules or templates.

A key differentiator of leading software is its ability to adapt to your vendors' documents, not the other way around. It should handle the chaos of real-world invoices so your team doesn't have to.

Seamless System Integrations

Pulling data is only the first step. The real magic happens when that data flows effortlessly into the other business systems you depend on every day. Without strong integrations, you’re just moving a manual task from one place to another.

Make sure any tool you consider has solid, well-documented integrations with your existing tech stack, especially your:

- Accounting Software: Direct connections to platforms like QuickBooks, Xero, and Sage are non-negotiable for automating bookkeeping.

- ERP Systems: For larger organizations, smooth integration with systems like NetSuite, SAP, or Microsoft Dynamics is vital for connecting the dots from procurement to payment.

- Cloud Storage: Links to services like Google Drive or Dropbox can simplify how you store and archive your documents for the long term.

Manual vs Automated Invoice Processing at a Glance

To truly grasp the impact of these features, it helps to see a direct comparison. The difference between the old way and the new way is stark.

| Metric | Manual Processing | Automated Extraction |

|---|---|---|

| Time per Invoice | 5-15 minutes | < 60 seconds |

| Cost per Invoice | $12 - $30 | $1 - $5 |

| Accuracy Rate | 85% - 97% (prone to human error) | 99%+ |

| Scalability | Low (requires more staff to scale) | High (handles volume spikes with ease) |

| Data Visibility | Low (data is locked in documents) | High (data is structured and accessible) |

As the table shows, automation doesn't just make the process faster—it makes it cheaper, more accurate, and far more scalable.

User-Friendly Validation Interface

Even the best AI isn't perfect 100% of the time. Now and then, it might get stuck on a blurry scan or a really bizarre invoice format. That's where a "human-in-the-loop" workflow comes in, and it needs to be dead simple.

The software should flag any fields it has low confidence in and present them in a clean, intuitive interface. This screen should show the original invoice right next to the extracted data, allowing a team member to quickly spot any issues and make corrections in seconds. This final check ensures that only 100% verified data makes its way into your financial systems, giving you the best of both worlds: the speed of automation and the confidence of human review.

How to Choose the Right Software for Your Business

Choosing the right invoice data extraction software isn’t like buying something off the shelf. Think of it more like hiring a new digital employee for your finance team. You need a perfect fit—something that clicks with your existing workflows, your people, and your tech stack. What works for a massive enterprise could be total overkill for a small business, and the other way around.

To get it right, you have to look beyond the slick sales demos and laundry lists of features. The real goal is to find a solution that solves your specific problems and gives you a clear, measurable return on investment. That means taking a step back and figuring out what your business truly needs before you start shopping.

And the market for these tools is exploding. Projections show the invoice processing software market rocketing from $36.1 billion in 2025 to a staggering $189.2 billion by 2035. This isn't just hype; it's driven by a real need for efficiency. In fact, by 2025, it's expected that 50% of B2B invoices will be processed with zero human touch. You can get more details on this trend from Future Market Insights.

Assess Your Current Invoice Volume and Complexity

First thing's first: you need a clear picture of your current situation. Don't guess—dig up the actual numbers. How many invoices does your team handle every month? Are we talking a few dozen or a few thousand? That single number will point you toward either a pay-per-invoice model or a more predictable flat-rate subscription.

Next, look at the invoices themselves. What are they like?

- Simple Invoices: Are most of them straightforward, with just basic header info and a final total?

- Complex Invoices: Do you get multi-page monsters with detailed line items, different tax rates, or purchase orders that need matching?

A business dealing with simple invoices can get by with a more basic tool. But if you're wrestling with complex documents, you’ll need a more powerful invoice data extraction software that can dig deep and pull out every last line item.

Map Out Your Essential Integrations

A great extraction tool is good on its own, but it becomes a powerhouse when it communicates with your other systems. If it can't connect to your existing tech, you've just created a new manual task: shuffling data from one platform to another. That’s a deal-breaker.

Before you even look at a single vendor, make a list of your non-negotiable integrations. Does the software need to sync up perfectly with:

- Accounting software like QuickBooks, Xero, or Sage?

- An ERP like NetSuite or SAP?

- Cloud storage like Google Drive for archiving?

A smooth, native integration means data flows automatically from the invoice right into your general ledger, no CSV files required. That end-to-end automation is where the magic really happens. For a deeper dive, our accounts payable automation software comparison guide can help you find the right fit.

Key Consideration: Don’t just accept a vague promise of "integration capabilities." Ask for proof. Make them show you that the software connects directly with the exact version of the platforms you rely on every day.

Evaluate Scalability and Future Needs

The software you pick today has to work for the business you'll be in three to five years. Think about your growth plans. If you expect to double your invoice volume, can the software keep up without the price tag exploding or performance grinding to a halt?

But scalability isn't just about handling more volume. It's also about flexibility. Will you need to process other documents down the road, like purchase orders or receipts? Choosing a platform that can grow and adapt with you is a much smarter long-term investment than a one-trick pony that only solves today's problem.

Got Questions? We've Got Answers

Even when you see the potential, adopting new tech always raises a few questions. Let's tackle some of the most common ones we hear from businesses looking into invoice data extraction software.

Think of this as your quick-start guide to the practical side of things, from accuracy to security.

How Accurate Is This Stuff, Really?

It's a fair question. The top AI-powered tools on the market today regularly hit accuracy rates above 99%. Gone are the days of old-school OCR systems that would get tripped up by a slightly skewed scan or an unfamiliar invoice layout. Modern software uses machine learning, which means it gets smarter with every invoice it processes.

Most leading platforms also have a safety net called "human-in-the-loop" validation. If the AI is even slightly unsure about a field, it flags it for a quick check by a real person. This simple step ensures the data flowing into your accounting system is 100% verified and reliable.

Can It Handle Invoices from All Over the World?

Absolutely. This is where modern tools really shine. They're built from the ground up to handle the messy reality of a global supply chain, easily processing invoices in different languages and currencies without breaking a sweat.

You can throw almost any file type at them—PDFs, JPGs, PNGs, you name it. They can even grab invoices sent as email attachments. The AI has been trained on millions of documents from around the world, so it doesn't need you to create a specific template for every new supplier. It just figures it out.

How Long Does It Take to Get Set Up?

This really depends on how deep you want to go with integrations. But you might be surprised at how fast you can get started. Many cloud-based tools are designed for a quick launch.

You could have a basic setup running in just a few hours or days. If you're looking for a more complex implementation—say, with custom approval workflows tied directly into your ERP system—that might take a couple of weeks. The best providers will walk you through the process to make sure it's painless and you start seeing a return on your investment right away.

The whole point of a modern rollout is speed-to-value. Many companies start seeing real time and cost savings from their invoice data extraction software within the first month.

Is It Secure Enough for Our Financial Data?

Yes, and this is a non-negotiable for any reputable provider. Security is paramount when you're dealing with financial information, and the leading platforms are built with enterprise-grade security at their core.

Here's what you should expect as standard:

- Data Encryption: All your information is encrypted, both when it's being sent and when it's being stored.

- Secure Infrastructure: The software is typically hosted on trusted cloud platforms like AWS or Azure.

- Compliance Standards: Look for vendors who meet strict international standards like SOC 2 and GDPR.

- Access Controls: You control who sees what with role-based permissions, so sensitive data stays in the right hands.

Ready to stop wasting time on manual data entry? DocParseMagic uses AI to pull data from your invoices directly into a spreadsheet in seconds. Get your free credits and try it now.