Convert Bank Statements to Excel The Definitive Guide

Getting your bank statements into Excel is one of the smartest things you can do to get a real handle on your finances. It takes all that static, unchangeable data locked away in a PDF and turns it into a living, breathing spreadsheet. Suddenly, you can sort, filter, and analyze everything, making tasks like tax prep or expense tracking so much easier.

Why Bother Converting Bank Statements to Excel?

Before we get into the nuts and bolts of how to do it, let's talk about why it's worth the effort. Moving your financial data from a PDF into a spreadsheet is more than just a neat organizational trick. It’s about unlocking the story your money is telling.

Think about it from a small business owner's perspective. Instead of manually flipping through pages of a statement, you could instantly get a clear picture of your cash flow. You can sort transactions by supplier, categorize expenses for your tax filings, or even build charts to see spending trends over the last quarter. That's how you start making sharp, data-backed decisions.

Taking Charge of Your Financial Data

It's not just for businesses, either. For personal finance, this is a game-changer. The process smoothes out some of the most common financial headaches we all face:

- Tax Time Made Simple: Need to find all those tax-deductible expenses? Just filter for business meals, home office supplies, or donations and get a total in seconds.

- Budgeting That Actually Works: Tag your transactions with categories like 'Groceries,' 'Utilities,' or 'Subscriptions.' You'll see exactly where your money is going each month, no guesswork involved.

- Spotting Red Flags: Sorting transactions by amount or merchant can make a weird or fraudulent charge jump right off the page—something you'd easily miss scrolling through a long PDF.

I remember helping a client apply for a mortgage. The lender needed a detailed financial breakdown. Handing them a clean, organized Excel file showing their income and spending patterns made a far better impression than a messy stack of printed statements. It just looks more professional and shows you're on top of your game.

When you convert bank statements to Excel, you're really turning a passive record into an active tool. It’s the first step to finding new savings, understanding your financial habits, and truly taking control, whether you're managing your household budget or scaling a business.

Picking The Right Way To Get Your Bank Statements Into Excel

Choosing how to convert your bank statements to Excel really boils down to your specific needs. There’s no single best answer here. What works for a quick personal budget check won't cut it for a small business that needs to reconcile dozens of statements every month. The right choice depends on the volume of statements you're handling, how accurate the data needs to be, and frankly, how much time you're willing to sink into the process.

Let's walk through the common paths people take.

The Easy Way: Direct Bank Downloads

The simplest approach is often just downloading the data directly from your bank's online portal. Most major banks let you export your transaction history as a CSV (Comma-Separated Values) file, which Excel opens up perfectly. This is usually the fastest and cheapest (it's free!) way to go.

The catch? You're stuck with whatever format the bank gives you, and they often limit how far back you can go—maybe just 90 days or a year at most. If you need older data or have statements from a bank without this feature, you'll have to look elsewhere.

When PDFs Are Your Only Option

What happens when you're stuck with PDF statements? This is super common for historical records or statements from smaller credit unions. Now you've got a decision to make: do it by hand or let technology handle it?

- Manual Copy-and-Paste: This costs you nothing but your time and patience. You have full control, but it's painfully slow and a recipe for typos. One little copy-paste error can throw off your entire spreadsheet, leading to headaches you don't need.

- AI-Powered Automation: This is where tools like DocParseMagic come in. They use artificial intelligence to read your bank statements—even scanned, image-based PDFs—and pull the data out cleanly. For anyone dealing with a high volume of statements or complex layouts, this is a game-changer. It's fast, incredibly accurate, and saves you from hours of tedious work.

This visual shows that whether you're tracking business cash flow or just managing your personal budget, getting your financial data organized is the first critical step.

Comparison of Bank Statement Conversion Methods

To make the choice clearer, here’s a side-by-side look at how these methods stack up against each other.

| Method | Best For | Speed | Accuracy | Cost |

|---|---|---|---|---|

| Direct Bank Export (CSV) | Quick, recent transaction analysis for personal or small business use. | Very Fast | High (data is direct from the source) | Free |

| Manual Copy & Paste | One-off conversions of very short, simple statements. | Very Slow | Low (prone to human error) | Free (but costs time) |

| AI Automation (DocParseMagic) | High-volume, recurring, or complex PDF statements (including scans). | Extremely Fast | Very High (AI minimizes errors) | Subscription-based |

Ultimately, while direct exports are great when available, AI automation is the clear winner for anyone who regularly works with PDFs and values their time and data integrity.

For a deeper dive into how this technology works, check out our guide on PDF data extraction to Excel. It breaks down exactly how these tools turn a static document into a perfectly structured spreadsheet, ready for analysis.

Getting Your Hands Dirty: Manual Conversion and Data Cleanup

Sometimes, you just have to roll up your sleeves and do it yourself. This is especially true when you're only dealing with a few statements or come across one with a truly bizarre layout that confuses automated tools. But a smart manual conversion is much more than just a simple copy-and-paste job.

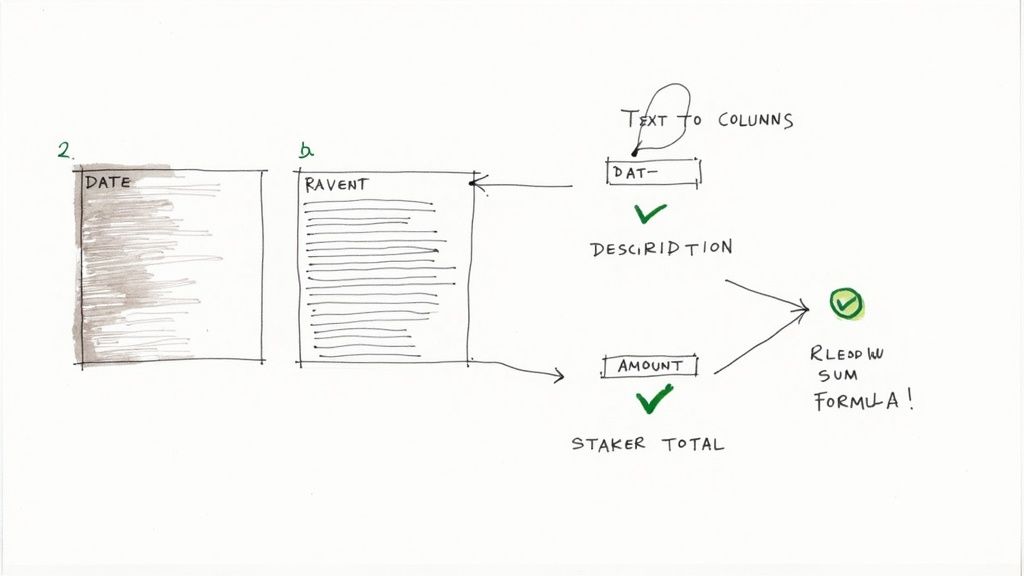

If you’ve ever tried it, you know the problem: pasting data from a PDF bank statement often crams everything into one long, messy column in Excel. This is where knowing your way around Excel’s own features makes all the difference. The goal is to take that jumbled mess and transform it into clean, usable columns for dates, descriptions, debits, and credits.

Turning Chaos into Order with Excel

Your go-to tool for this kind of work is 'Text to Columns'. Once you've pasted the raw data, just select the column with all the jumbled transaction info. You'll find the 'Text to Columns' wizard under the 'Data' tab in Excel's ribbon.

It’s a lifesaver. The tool walks you through splitting that single column based on consistent separators like spaces or commas, effectively turning one messy column into several organized ones. For more stubborn formatting issues, our guide on data parsing in Excel dives into some more advanced tricks.

Once the data is in separate columns, the real cleanup starts. You'll almost always need to:

- Ditch the Currency Symbols: Use the 'Find and Replace' feature (Ctrl+H is your friend here) to get rid of all dollar signs ($) or other currency symbols. This is crucial for letting Excel treat the numbers as actual numbers you can calculate.

- Standardize Your Dates: Make sure every date follows the same format, like MM/DD/YYYY. This is non-negotiable if you want to sort your transactions chronologically.

- Check Your Work: Pop a quick

SUMformula at the bottom of your debit and credit columns. Do the totals match the summary on the original bank statement? If they do, you're good to go.

Even with all the amazing automation available today, manual skills are still a must. I've found that around 20-30% of conversions still need some level of human oversight to guarantee accuracy, particularly with older or non-standard statements. Knowing how to combine a quick copy-paste with Excel's functions is a core skill.

Mastering these techniques means you can confidently convert bank statements to Excel and trust the financial data you’re working with, no matter how difficult the original document might be.

Automating Conversion with AI and OCR Tools

Manually converting a few bank statements is manageable. But what happens when you're staring at a year's worth of records? It quickly turns into a tedious, mind-numbing task that drains your time and invites mistakes. This is where AI-powered tools come in and completely change the game.

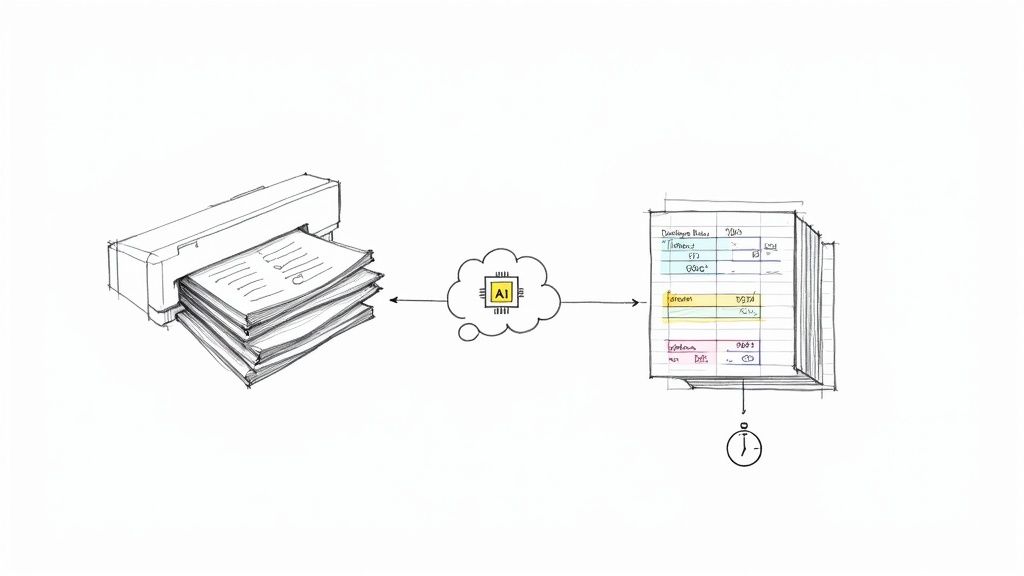

The technology behind this isn't science fiction; it’s a powerful combination of AI and Optical Character Recognition (OCR).

At its most basic, OCR acts like a digital set of eyes. It scans images or PDFs, identifies text, and converts it into data your computer can actually work with. But modern tools layer AI on top of that, giving the software a brain. It doesn't just see the text anymore—it understands it. The system can instantly tell the difference between a date, a transaction description, a debit, and a credit.

How AI Makes It All Work

Let's get practical. Imagine you have a folder filled with 12 monthly bank statements in PDF format. Instead of opening them one by one to copy and paste, you can simply upload the entire batch to an intelligent conversion tool. The AI takes over from there, processing every single page in a matter of minutes.

Here’s a look at how it breaks down:

- Bulk Uploads: You can feed the system a whole stack of files at once, whether they're digital PDFs from your bank or clear scans of old paper statements.

- Intelligent Extraction: The AI automatically finds and pulls the crucial bits of information—dates, descriptions, amounts, and running balances.

- Clean Formatting: All that extracted data is then neatly organized into a structured spreadsheet, perfectly formatted for Excel or Google Sheets.

This isn't just a time-saver. It's an accuracy-saver. We've all been there—a single typo or a misplaced decimal can throw off an entire financial analysis. Automation takes human error out of the equation, ensuring your data is consistent and reliable, no matter how large the dataset.

I’ve seen OCR technology evolve firsthand, and it's incredible. Modern tools can now achieve up to 95% accuracy when pulling data from complex bank statements. Specialized converters can chew through dozens of statements in seconds and even push the final data directly into accounting software like QuickBooks or Xero.

By automating how you convert bank statements to Excel, you can turn a task you dread into a simple background process. It frees you up to focus on what actually matters: using the data to gain insights and make better financial decisions. To see just how deep this technology goes, check out our guide on what is intelligent document processing.

How Automation Is Shaking Up Financial Workflows

To really see what this kind of automation can do, just look at a high-stakes industry like mortgage lending. For years, the process was painfully manual. Underwriters would spend a huge chunk of their day just keying in line-item details from an applicant's bank statements.

This wasn't just tedious; it created a massive bottleneck in the loan approval process. It slowed everything down for anxious homebuyers and tied up skilled professionals with basic administrative work. Instead of analyzing risk and verifying an applicant's financial health—the stuff they were actually hired to do—they were stuck doing data entry. The whole system was inefficient and prone to human error.

Flipping the Script in High-Stakes Industries

Automation has completely flipped this model on its head. Specialized tools powered by AI can now convert bank statements to Excel or other formats in a matter of minutes. In loan processing, this is a game-changer. Platforms like Ocrolus can slash over two hours of review time from a single mortgage application. That's a massive improvement that speeds up the entire loan cycle.

This screenshot gives you a glimpse of how these platforms help lenders automate document analysis.

You can see how the focus shifts from mind-numbing data entry to a dashboard that provides intelligent, automated analysis. This is what lets underwriters make faster, more accurate decisions.

Automation isn't just about speed, though. It also brings a powerful layer of security and accuracy. These systems are built to catch inconsistencies and flag suspicious transactions that a human eye might easily miss, giving you both efficiency and fraud detection in one package.

The mortgage lending example is the perfect illustration of how automation isn't just a minor convenience—it’s a fundamental change. It frees up financial professionals to stop being data processors and start being strategic analysts. The result? Faster approvals for customers and more secure, data-driven decisions for the business. It’s a clear case of technology turning a time-sucking task into a real competitive advantage.

Have Questions About Converting Bank Statements?

When you first dive into converting bank statements to Excel, a few questions always come up. It's totally normal to wonder about security or get stuck on a tricky technical detail. Let's walk through some of the most common hurdles people face.

Is It Safe to Upload My Financial Documents?

This is probably the biggest and most important question. Handing over sensitive financial data feels risky, and you're right to be cautious. The good news is that any reputable conversion service puts security first.

Look for tools that use end-to-end encryption. This is the key—it scrambles your data the second it leaves your computer and keeps it that way until you download the finished Excel file. Also, check for a clear privacy policy and the little padlock icon in your browser's address bar (that’s SSL encryption). If you’re still hesitant, some desktop software options process everything locally on your machine, so your data never even goes online.

What If I Have a Scanned Paper Statement?

Not every statement starts as a perfect, digital PDF. We've all been handed a stack of paper statements that need to be digitized. This is where you'll hear the term Optical Character Recognition, or OCR.

You can't just copy-paste from an image of a document, but an OCR tool can. It intelligently "reads" the scanned page, recognizes the characters and numbers, and pulls them out into an editable format. The secret to getting a good result? Start with the best scan possible—make sure it's flat, clear, and high-resolution.

How Do I Handle Password-Protected PDFs?

Banks almost always password-protect their digital statements, which is a great security feature. But it can seem like a roadblock for conversion.

Don't worry, any solid conversion tool is built for this. When you upload the file, the tool will simply ask you for the password. Once you enter it, the software can securely unlock and process the document just like any other file.

For statements with dozens of pages or complicated tables, an automated tool is really the only way to go. These systems are designed to process an entire document at once, stitch all the data together, and smartly ignore the fluff like logos or marketing ads.

My Statement Has Multiple Pages and a Weird Layout. Now What?

This is precisely why automated tools were created. Manually copying data from a 20-page statement with multiple tables is a recipe for a headache and a ton of errors.

A good tool will chew through every single page of your PDF and merge all the transactions into one clean, continuous spreadsheet. Advanced AI has seen thousands of different bank statement formats, so it knows how to spot the actual transaction table and ignore everything else. This leaves you with a clean, analysis-ready file, not a jumbled mess.

Ready to stop wasting time on manual data entry? DocParseMagic uses powerful AI to convert your bank statements to clean, organized Excel files in seconds. Try it for free and see how much time you can save!