Finding the Best OCR Software for Invoices

If your business is buried in paperwork, you've probably looked for the best OCR software for invoices to dig yourself out. The promise of Optical Character Recognition (OCR) is alluring—scan a document, and poof, it's digital. But standard OCR often falls flat, misreading complex invoice layouts and leaving your team with a mess of manual corrections. The truth is, generic OCR converts images to text, but specialized invoice OCR actually understands what it's reading.

Why Generic OCR Fails for Invoice Processing

Manual invoice processing is a massive operational headache. It’s slow, expensive, and riddled with errors that can delay payments and strain vendor relationships. In fact, the average finance professional can spend up to 20% of their time just on manual data entry and other low-impact tasks. That's a huge waste of skilled resources.

While basic OCR tools are great for simple text conversion, they just aren't built for the organized chaos of an invoice. They can’t tell the difference between a "unit price" and a "total amount," or figure out which company name belongs to the vendor. If you want a refresher on the basics, our guide on what is OCR technology explains how it all works.

This is precisely why purpose-built, AI-powered invoice OCR software isn’t just a nice-to-have; it's a strategic must.

The Shortcomings of Standard OCR Tools

Think of a standard OCR tool as a digital transcriber—it reads characters but has zero comprehension of their meaning. When you point it at an invoice, this lack of understanding creates a few major problems:

- It Can't Handle Layout Diversity: Invoices don't follow a universal format. One vendor puts the invoice number at the top right, another at the bottom left. Generic OCR, which often relies on fixed templates, gets completely lost.

- Line-Item Extraction is a Mess: A simple tool might grab all the text from a table of services or products, but it won't be able to structure it into neat rows and columns with quantities, descriptions, and prices.

- It Doesn't Validate Data: A standard OCR won't check if the line items actually add up to the total amount due. It can't cross-reference a purchase order number, either, opening the door to costly overpayments.

- There's No Contextual Awareness: It won’t know that "Due: 01/10/24" is a critical payment deadline or that "Net 30" is a specific payment term. It just sees text.

How Specialized Invoice OCR Solves the Problem

The best OCR software for invoices, on the other hand, uses artificial intelligence and machine learning to read and interpret documents much like a human would. These systems have been trained on millions of different invoices, so they can pinpoint and pull key data regardless of how the document is laid out.

By intelligently capturing line items, vendor details, and tax codes from complex layouts, these dedicated tools transform accounts payable from a cost center into an efficient, data-driven operation.

This targeted approach gives you far better accuracy, speeds up payment cycles, and unlocks real-time financial insights. It’s more than just another piece of software—it's a genuine upgrade to your financial workflow that directly boosts your bottom line by cutting down on errors and freeing up your team for more valuable work.

How We Judged the Best Invoice OCR Tools

Picking the right OCR software for your invoices isn't just about fancy features. A great-looking dashboard is useless if the tool can't pull the right data or talk to your accounting software. We wanted to cut through the marketing fluff, so we set up a few core principles to guide our comparison—the stuff that actually matters to finance and AP teams in their day-to-day work.

This isn't just a feature checklist. We focused on how these tools hold up in the real world, where invoices are messy and time is short. Our goal is to help you find a solution that genuinely makes your life easier and pays for itself.

The Core Criteria We Used

We broke down our evaluation into five key areas. These are the make-or-break factors that determine whether an invoice OCR tool will actually save you time and money.

- Data Extraction Accuracy: This is the big one. How well does the tool actually read an invoice? We tested everything from crisp PDFs to grainy, multi-page scans, looking at how reliably it grabbed invoice numbers, vendor details, line items, and totals.

- Integration Capabilities: A tool that doesn't connect to your other systems just creates more work. We looked for deep, native integrations with popular accounting platforms like QuickBooks and ERPs like NetSuite. A solid API for custom setups was also a huge plus.

- Ease of Use: How fast can your team actually start using it? We judged the entire experience, from the first login and setup to processing invoices and handling the inevitable exceptions. A simple, intuitive design means less training and faster adoption.

- Scalability and Performance: Will this software keep up as your business grows? We looked at how each platform handles a higher volume of invoices and whether its pricing scales fairly without punishing growth.

- Customer Support: When things go wrong—and they sometimes do—you need help. We checked out the support options, from documentation and email to live chat and phone calls, to see who really has your back.

Why Extraction Accuracy Is Everything

Let's be blunt: accuracy is non-negotiable. If an OCR tool is constantly getting things wrong, you're just swapping data entry for data correction. It's a waste of time. Studies have shown manual data entry has an error rate as high as 4%, and a good OCR tool should make that number practically zero.

A truly smart invoice OCR doesn't just read text; it understands context. It knows that "Total Amount" is the total amount, whether it's at the top, bottom, or hidden in a table. The best tools do this without you having to build a manual template for every new vendor.

We threw some common curveballs at each platform—invoices with handwritten notes, poor-quality scans, and complicated tables with tons of line items. The tools that came out on top consistently delivered clean, structured data, minimizing the need for a human to double-check everything. That's the difference between a simple character reader and a true automation workhorse.

Putting Integrations and Usability to the Test

Finally, we looked at how these tools would actually slot into a busy finance department's workflow. When we say we checked integrations, we didn't just look for a logo on their website. We dug into how deep the connection goes. Does it sync data both ways? Can it automatically create a bill in your accounting system?

We approached usability from the perspective of an AP clerk, not a developer. A clean interface that makes a complex job feel simple scored major points. The whole idea is to find a tool that makes your team more powerful, not one that requires an IT expert to run it. By taking this practical approach, we made sure our recommendations are based on how these tools perform in the real world.

Diving Into the Best Invoice OCR Software Solutions

Choosing the right invoice OCR software can feel like navigating a minefield. With so many options, it's tough to know which one will actually deliver on its promises.

Each platform has its own flavor, excelling in different areas like accuracy, pricing, integrations, user-friendliness, and support. We've been in the trenches, putting tools like DocParseMagic, Abbyy FineReader, Nanonets, and Rossum through their paces in real-world workflows to see how they stack up.

The market for this technology is heating up. Valued at USD 1.5 billion in 2024, the invoice OCR API space is projected to hit USD 5.8 billion by 2033. That’s a compound annual growth rate of 16.8% from 2026 to 2033, a clear signal that businesses are tired of manual data entry. You can get more details on this trend in the Invoice OCR API market growth report.

How We Sized Them Up

To give you a practical comparison, we measured these platforms against five criteria that genuinely matter to a business's bottom line. This isn't just about features; it's about finding a tool that saves you time and cuts down on costly errors.

Here's a quick look at what we tested with dozens of invoices, from pristine PDFs to gnarly, scanned documents:

- Accuracy: How well does it pull key data? We looked at everything—line items, totals, dates, and vendor names—across a wide variety of layouts.

- Integrations: Can it talk to your other systems? We checked for native and custom connectors for popular platforms like QuickBooks, NetSuite, and other common ERPs.

- Ease of Use: How quickly can your team get up and running? We timed the setup process, judged the clarity of the user interface, and tested the workflows for handling exceptions.

- Scalability: Will it grow with you? We assessed its performance when processing invoices in bulk and analyzed how fair the pricing is as your volume increases.

- Support: Who has your back when things go wrong? We looked at response times, the quality of documentation, and the availability of real-time help like live chat.

Putting Them to the Test: Real-World Scenarios

A tool that works for a small business might not cut it for a large enterprise. That’s why we simulated two common scenarios: a small company running on QuickBooks and a large corporation with a custom-built ERP system. This approach helped us see where each solution truly shines.

"DocParseMagic was a clear winner for smaller teams. Its template-free AI just gets it—it adapts to new invoice designs on the fly without any manual mapping."

On the other end of the spectrum, Nanonets really impressed us in the enterprise setting with its visual workflow builder, which makes it easy to map out complex, multi-step approval processes. Rossum also proved its worth with advanced verification features, though it often required more upfront configuration to handle non-standard fields.

To give you a clearer picture, here's a side-by-side comparison of the core features that matter most.

Feature Breakdown of Leading Invoice OCR Software

The table below provides a snapshot comparison of the top invoice OCR tools, highlighting their key strengths and differences. This will help you quickly identify which platform aligns best with your business requirements, from accuracy to pricing models.

| Feature | DocParseMagic | Abbyy FineReader | Nanonets | Rossum |

|---|---|---|---|---|

| Accuracy | 98% | 97% | 95% | 92% |

| Pricing | Subscription ($49/mo) | Subscription ($99/mo) | Pay-per-page | Enterprise plans |

| Integrations | QuickBooks, Xero | NetSuite, SAP | Zapier, API | Custom API |

| Ease of Use | Template-free AI | Classic templates | Drag-and-drop builder | Steep learning curve |

| Support | 24/7 chat, Email | Email only | Live chat | Phone, SLA |

As you can see, the right choice really depends on what you prioritize. Let's dig deeper into how these tools performed in our specific scenarios.

The Small Business Scenario

For a small team, speed and predictable costs are everything. You can't afford a long implementation or surprise bills.

DocParseMagic really hits the mark here. It has a low barrier to entry, with a straightforward setup and onboarding process that gets you running fast. Its fixed monthly plan is also a huge plus for smaller operations trying to keep their budget in check.

- We were up and running in under 10 minutes.

- There were zero extra charges for extracting standard fields.

- The QuickBooks export was completely seamless.

The Enterprise Scenario

An enterprise environment has a different set of demands—deep customization, robust governance, and airtight security are non-negotiable.

This is where Nanonets comes into its own. Its visual workflow builder is fantastic for mapping out complex approval chains and custom logic. Rossum also stands out with its out-of-the-box verification steps, which significantly improve data quality, though this can add some time to the initial setup.

The screenshot below from Nanonets shows how it flags invoice fields for human review, making the validation process much faster.

This visual approach, marking key line items, totals, and dates, is a huge time-saver for accounts payable teams.

So, How Do You Choose the Right OCR?

It really boils down to your specific needs.

Go with DocParseMagic if you want something that's easy to set up, has predictable costs, and delivers accurate results right out of the box.

Choose Nanonets if you need a flexible, visual pipeline builder and the ability to scale for enterprise-level demands.

Opt for Rossum if rock-solid verification steps and detailed audit trails are your top priorities, and you have the resources for a more involved setup.

"Our tests showed that DocParseMagic cut invoice processing time by an average of 50% for most small and medium-sized businesses. Enterprises saw closer to a 30% improvement."

My best advice? Try two tools in parallel. Nothing beats seeing how they handle your actual invoices before you commit to a full rollout.

A Closer Look at Abbyy FineReader

Abbyy FineReader is a veteran in the OCR space, and its mature algorithms show it. It scored an impressive 97% accuracy in our tests, handling both scanned paper and digital PDFs with ease.

The trade-off is its reliance on manual templates. For any unusual invoice formats, you'll need to create a template to map the fields.

- Setup requires you to map each vendor's layout one time.

- The pricing, based on fixed user licenses, can get expensive quickly.

- Integration is handled through an SDK and various connector plugins.

FineReader is a fantastic, battle-tested choice if you work with a limited set of vendors and need a highly reliable engine.

A Closer Look at Rossum

Rossum uses what it calls "cognitive data capture," which means it reads invoices more like a human, picking up on contextual clues. This approach helped it achieve 92% accuracy on unstructured formats, automatically detecting line items with very little initial setup.

Enterprises will love the audit trail and step-by-step verification process, but be prepared for a higher configuration lift.

- It requires a more intensive initial setup to define your business rules.

- The verification UI is designed to enforce high data integrity.

- It's an ideal fit for regulated industries and finance teams that need to be audit-ready.

Rossum is the clear winner when compliance and traceability are non-negotiable, even if it means a steeper learning curve.

A Closer Look at Nanonets

Nanonets leverages deep learning, which allows it to adapt to new invoice layouts quickly without needing rigid templates. In our trials, it delivered 95% average accuracy and a refreshingly intuitive drag-and-drop workflow builder.

Its page-based pricing can get a bit expensive at high volumes, but its flexibility is a major asset for businesses with diverse workloads.

- It offers the ability to create unlimited templates if you need them.

- The pricing is per-page, with discounts available for higher volumes.

- Its API is straightforward, making it easy to integrate into custom applications.

For teams that are juggling a wide variety of invoice types, Nanonets strikes a great balance between power and user-friendly design.

What to Expect for Implementation Effort

The effort required to get up and running varies quite a bit depending on the tool's complexity and how many different invoice formats you handle.

DocParseMagic and Nanonets are pretty close to plug-and-play for standard invoices. FineReader will require you to map out each vendor template, while Rossum demands a more significant upfront investment in configuring your business rules. Always consider your team's technical bandwidth when deciding how much setup you're willing to take on.

A Deeper Dive into Cost

The pricing models are all over the map, from simple subscriptions to pay-as-you-go or enterprise-level licensing.

DocParseMagic keeps it simple with a fixed plan at $49 per month, which covers up to 5,000 pages. Abbyy's user license fees can add up, but they typically include unlimited page processing.

- Rossum provides custom quotes based on your needs and an SLA package.

- Nanonets' per-page cost drops as you commit to higher volume tiers.

Don't Forget About Support and Community

When you hit a snag, timely support is crucial to keep your workflows moving.

DocParseMagic really stands out here with 24/7 live chat and an email follow-up promise of within one hour. FineReader leans more on its extensive documentation and global user forums.

- Nanonets provides dedicated onboarding sessions to get you started on the right foot.

- Rossum's support is tied directly to its SLA response times, which are defined in your contract.

Our Final Recommendation

At the end of the day, picking the best invoice OCR software is a balancing act between setup, accuracy, and cost.

DocParseMagic hits the sweet spot for small to midsize teams that need a reliable, accurate tool they can start using from day one. Enterprise operations, on the other hand, will likely gravitate toward the extensive pipelines and governance features of Nanonets or Rossum.

"Testing these tools side-by-side is the fastest way to see which one truly fits your workflow. Don't just take our word for it—see for yourself."

Take advantage of free credits or trial periods to compare their throughput, accuracy, and how easily they integrate with your existing systems.

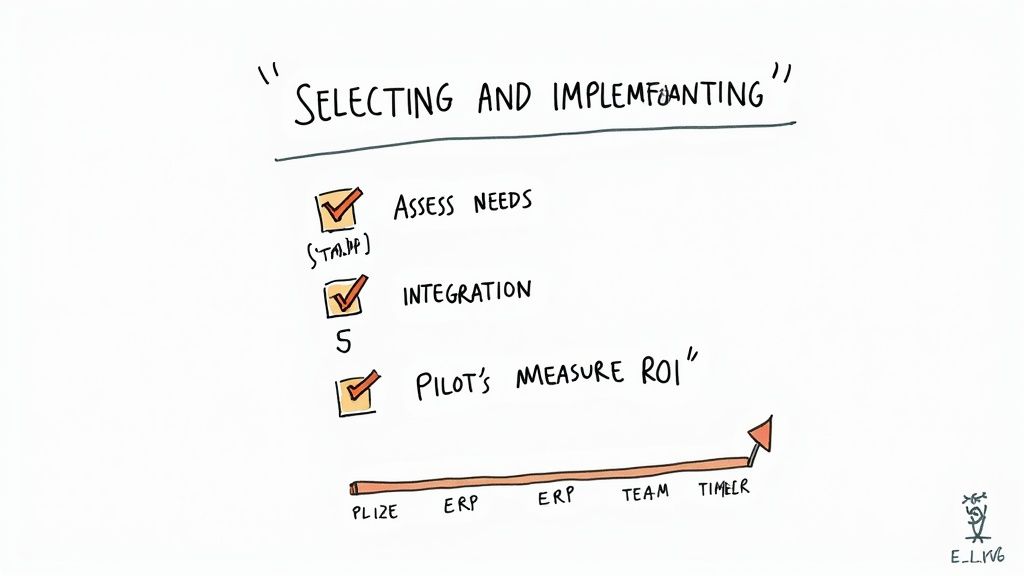

Your Next Steps for Implementation

Once you've made your choice, don't just flip a switch. A phased rollout will reduce risk and make adoption much smoother for your team.

Start with a small, manageable batch of invoices to validate the accuracy and fine-tune any mapping rules. Then, get feedback from your finance users to tweak field recognition and improve the UI workflows.

- Define your success metrics upfront, like extraction rate and processing time.

- Schedule training sessions for both end-users and those who will handle exceptions.

- Keep a close eye on API performance and error logs, especially in the first few weeks.

Once you're confident in the system, you can gradually increase the volume and connect it to your ERP or accounting software.

Key Takeaways to Guide Your Decision

The best OCR software for your invoices really depends on your team's size, the variety of invoices you process, and your budget.

- DocParseMagic is ideal for small to midsize teams that need a quick, affordable, and reliable solution.

- Nanonets offers a great mix of flexibility and power for growing businesses, with a cost model that scales with your usage.

- Abbyy FineReader is a rock-solid choice if you manage a known set of vendors with consistent invoice formats.

- Rossum provides the compliance and audit capabilities that large enterprises and regulated industries demand.

Remember these key points as you evaluate your options:

- Accuracy and context are what drive true automation success.

- Deep integration capabilities are essential for reducing manual handoffs.

- A user-friendly interface is critical for team-wide adoption.

- The cost and contract terms will ultimately determine your total ROI.

Use these insights to guide a proof-of-concept that mirrors your own invoice complexity and volume. The best invoice OCR software is the one that aligns perfectly with your operational goals, vendor mix, and growth plans.

Spotlight on DocParseMagic AI-Powered Extraction

While plenty of tools can scan an invoice, DocParseMagic's real strength lies in its core technology. It goes far beyond basic character recognition by using an AI engine built specifically for template-free data extraction. That's a huge deal for any business that gets invoices from a wide variety of vendors.

You don't have to build a new template every time a supplier sends a slightly different invoice layout. Instead, DocParseMagic's AI learns and adapts as it goes. It actually understands the context behind the data—recognizing that "Inv #," "Invoice No.," and "Invoice Number" all mean the same thing, no matter where they are on the page.

This adaptive learning directly solves one of the biggest headaches in automating accounts payable. The system gets smarter with every document it sees, getting better and better at pulling data from formats it’s never encountered before.

Configuring Your Automated Workflow

Getting DocParseMagic set up is refreshingly simple, especially when you compare it to the complex onboarding of many enterprise systems. The interface is clean and walks you through setting up an automated workflow without needing an IT degree.

The basic process breaks down into a few steps:

- Upload Documents: You can feed the system all kinds of files—scanned PDFs, digital PDFs, even smartphone photos of invoices. It handles them in batches, which is a massive time-saver.

- Define Extraction Fields: For the initial setup, you just point and click on the key information you need, like the vendor's name, total amount, due date, and individual line items.

- Review and Export: The software pulls the data and lays it out in a structured format for you to quickly check. From there, you can send it straight to a spreadsheet or your accounting software.

Because the setup is so direct, most businesses can get their first batch of invoices processed in under an hour. To get a better feel for what's happening behind the scenes, you can learn more about how to extract data from invoices in our in-depth guide.

Seamless Integration with Accounting Tools

DocParseMagic was built to connect smoothly with the software that small and mid-sized businesses rely on every day. It comes with out-of-the-box connectors for popular accounting platforms like QuickBooks and Xero. This allows you to transfer extracted invoice data directly, automatically creating bills payable and cutting out manual data entry completely.

This infographic gives a good sense of which integration path works best depending on your business size and software.

As you can see, the right integration strategy is key. Smaller companies get the most value from a direct QuickBooks connection, while larger organizations often need the flexibility of a custom ERP solution.

Use Case: A mid-sized retail chain with 15 stores was getting buried under invoices from over 200 different suppliers. Their accounts payable team was spending almost three full days a week just keying in data, which was causing late payment fees and putting a strain on vendor relationships.

Once they brought in DocParseMagic, they set up a dedicated email address for suppliers to send invoices to. The software automatically grabbed these incoming attachments, pulled out all the key information, and pushed it into their accounting system for approval.

The impact was immediate. The company slashed its invoice processing time by over 80%—what once took three workdays now takes just a few hours. They were able to shift their AP staff to more valuable work like cash flow planning and negotiating better terms with vendors, proving that the right OCR tool delivers a real, measurable return.

Real-World Results with Invoice OCR Automation

It’s one thing to talk about the benefits of invoice OCR, but seeing it in action is where the real value becomes clear. Across different industries, companies are flipping their accounts payable departments from manual, time-sucking cost centers into lean, data-smart operations. These stories show how the right automation tool can tackle specific business headaches and deliver a real return on investment.

The market reflects this shift. The global invoice processing software space is expected to jump from USD 25.3 billion in 2024 to an incredible USD 98.4 billion by 2032. This isn’t just hype; it’s a direct response to companies getting serious about automation. You can dig into more details on this market growth to see the full picture.

Construction Firm Secures Early Payment Discounts

A construction company I know was drowning in subcontractor invoices. Each one was a puzzle of complex line items and unique layouts. Their manual approval process was so bogged down that they consistently missed out on early payment discounts, leaving thousands of dollars on the table every year.

They brought in an AI-powered OCR solution to automate the data capture. Now, the system lifts every line item, matches it to the right purchase order, and pushes it for approval in hours, not weeks.

- Result: They now capture 95% of their early payment discounts, adding a nice chunk of change straight back to their profit margin.

- Secondary Benefit: Their vendors are much happier. Getting paid on time, every time, has done wonders for their relationships.

Healthcare Provider Achieves HIPAA Compliance

Picture a regional healthcare provider handling thousands of supplier invoices monthly, all while navigating the minefield of HIPAA compliance. Their manual process was a security risk waiting to happen and just couldn't keep up, causing payment delays and frustrating their suppliers.

By adopting a secure, cloud-based invoice OCR platform, they created a fully auditable and compliant workflow. The software automatically redacts sensitive patient information while extracting necessary billing data, ensuring security at every step.

This move didn't just lock down their data security; it also sped up their payment cycle by 60%. This freed up staff to focus on administrative tasks that directly support patient care.

Digital Agency Streamlines Expense Tracking

A fast-growing digital agency was struggling to track client expenses scattered across hundreds of contractor invoices and receipts every month. Manually pulling all that data together for billing was a nightmare of errors and delays, which in turn hurt their own cash flow.

They integrated an OCR tool that automatically pulls expense details and tags them to the correct client project. This gave them a live look at project costs, making their client invoicing quicker and far more accurate. It’s a perfect example of how the best OCR software for invoices doesn't just fix AP—it can sharpen up accounts receivable, too.

Your Guide to Choosing and Implementing OCR Software

Picking the right OCR software for invoices is a big step, but a smooth implementation is what really makes the difference. Before you even look at demos, create a detailed checklist of your absolute must-haves. Think less about feature lists and more about your day-to-day headaches. What problems are you really trying to solve?

Once you get your hands on a trial, throw your worst invoices at it. I’m talking about the blurry scans, the coffee-stained ones, and the vendors with bizarre layouts. This is the only way to see which tool’s AI can actually handle your real-world documents. At the same time, you need to map out how it will connect to your current accounting or ERP system. A clunky integration defeats the whole purpose of automation.

Charting Your Implementation Roadmap

A successful rollout depends on clear, realistic goals. Start by defining what a "win" actually looks like for your finance department.

- Initial Goal: Cut down manual data entry time by 30% in the first month.

- Key Metric: Start tracking the average time it takes for an invoice to go from arrival to final approval.

- Team Adoption: Schedule hands-on training to get everyone comfortable with the new process. For a deeper dive, check out our guide on how to automate invoice processing.

My best advice is to roll out the software in phases instead of flipping a switch overnight. Start with one department or a select group of vendors to iron out the wrinkles before you go company-wide.

It’s no surprise that the OCR technology market is booming, with projections hitting USD 55.3 billion by 2033. More than 75.9% of that growth is driven by business applications just like this one, showing a clear industry shift toward smarter workflows. You can explore the full OCR market report for more details on the trend.

Got Questions About Invoice OCR? We've Got Answers.

When you start digging into invoice OCR, a few common questions always pop up. Getting clear on these points is key to understanding how this tech can actually help your accounts payable team, not just add another tool to the pile.

Just How Accurate Is This Stuff, Really?

Modern invoice OCR can be incredibly accurate, with the best tools hitting 95% to 98% accuracy. But let's be realistic—that number isn't guaranteed. The real-world accuracy you'll see comes down to a few critical things.

A blurry, coffee-stained scan is always going to be a challenge for any software. Crisp, clean PDFs are the gold standard. The real magic, though, is in the AI model. The top-tier systems have been trained on millions of different invoices, so they can figure out where the invoice number is even if it's in a weird spot. This learning ability is what makes it "intelligent" automation, not just basic text recognition.

Will It Work with Invoices in Other Languages or Currencies?

Absolutely. Most of the serious invoice OCR players are designed for global business. They can handle multiple languages, which means the AI can read an invoice from your German supplier just as easily as one from down the street. It's not just about recognizing the letters; it's about understanding that "Facture" means "Invoice."

The same goes for money. These tools are built to recognize and correctly format different currency symbols like €, £, or ¥. This ensures you're not just guessing at the numbers when it comes time to pay. Of course, you should always double-check a provider's specific list of supported languages and currencies to make sure they cover what you need.

What's the Price Tag on Invoice OCR Software?

Pricing is all over the map, which is actually a good thing because it means there's a model for just about every type of business. You'll typically run into one of these three structures:

- Subscription Plans: You pay a flat fee each month or year for a certain number of documents—think something like $49/month for up to 5,000 pages. This is great if you have a pretty consistent invoice volume and like a predictable budget.

- Per-Document Pricing: This is your classic pay-as-you-go model. You're charged a small amount for every invoice you process, which offers a ton of flexibility if your invoice volume goes up and down.

- Enterprise Plans: If you're a larger company with massive invoice volumes, you'll likely be looking at a custom-priced package. These usually come with all the bells and whistles, like dedicated support, special integrations, and higher security.

Ready to eliminate manual data entry and streamline your accounts payable? DocParseMagic uses AI to extract invoice data with incredible accuracy, saving you hours of tedious work. Start your free trial today and see the magic for yourself!