12 Best Document Management Software for Accountants in 2025

The days of overflowing filing cabinets and chaotic shared drives are over. For modern accounting firms, efficient, secure, and intelligent document management isn't just a convenience; it's a critical component of profitability, client trust, and scalability. Handling sensitive client data, managing tax season workflows, and ensuring compliance demands more than a generic cloud storage solution. You need a system built for the unique challenges of the accounting profession.

This guide cuts through the noise to analyze the best document management software for accountants, focusing on the specific features that streamline workflows, enhance security, and ultimately, give your firm a competitive edge. We dive deep into each platform, providing a practical analysis of its strengths, weaknesses, and ideal use cases. You'll find direct links and screenshots for every tool, allowing you to see them in action.

Whether you're a solo practitioner, a small business accounting team, or a growing firm, finding the right software is a strategic decision. This resource is designed to simplify that process. We'll explore everything from all-in-one practice management suites with integrated document features to specialized AI-powered data extraction tools. Our goal is to provide the clarity needed to identify the perfect fit for your team's specific needs and budget, helping you make a confident investment in your firm's operational backbone. This comprehensive review will help you choose the right solution to organize, secure, and optimize your firm’s document-centric operations.

1. DocParseMagic

Best for AI-Powered Data Extraction and Automation

DocParseMagic positions itself as a powerful, specialized tool rather than a traditional, all-in-one document repository. Its core strength lies in its advanced AI-driven data extraction, making it an exceptional choice for accounting professionals whose primary challenge is converting unstructured document data into structured, actionable information. This platform excels at eliminating the manual, error-prone task of keying in data from invoices, receipts, bank statements, and forms.

The service's contextual AI is a significant differentiator; it doesn't just read text but interprets the layout and relationships between data points, even on messy or scanned documents. This allows accounting teams to process a diverse mix of file types, including PDFs, images, Word docs, and emails, through a single, streamlined workflow. By defining a template once with simple, plain-English instructions, users can automate the extraction of critical fields like invoice numbers, vendor details, line items, and totals across thousands of documents with remarkable accuracy.

Key Features and Analysis

DocParseMagic offers a suite of features tailored for high-accuracy financial data processing. Its proprietary calculation engine is a standout, as it cross-verifies totals, taxes, and percentages to guarantee 100% computational accuracy, a critical requirement for financial record-keeping. Furthermore, its intelligent data enrichment feature can infer missing information, such as correcting incomplete vendor names or standardizing date formats, which saves considerable time during data cleanup. The seamless export to CSV ensures effortless integration with essential accounting software like QuickBooks and Xero without requiring complex API configurations. This makes it one of the best document management software for accountants focused on workflow automation and data integrity.

Pricing and Implementation

The platform operates on a flexible, credit-based monthly subscription model. This approach allows firms to scale their usage up or down based on seasonal demand, like tax season, without being locked into a rigid pricing tier. Free signup credits are available, enabling teams to test the full capabilities of the service risk-free. While the initial template setup involves a minor learning curve, it requires no coding, and the platform’s support resources help new users get operational quickly.

-

Pros:

- Superior AI understands document context across multiple formats.

- Proprietary calculation engine guarantees 100% accurate totals and taxes.

- Intelligent data enrichment automatically fills in missing or incomplete data.

- Simple, no-code template creation and direct CSV export for easy integration.

-

Cons:

- Credit-based pricing requires usage monitoring for high-volume users.

- Initial template setup may require a brief learning period.

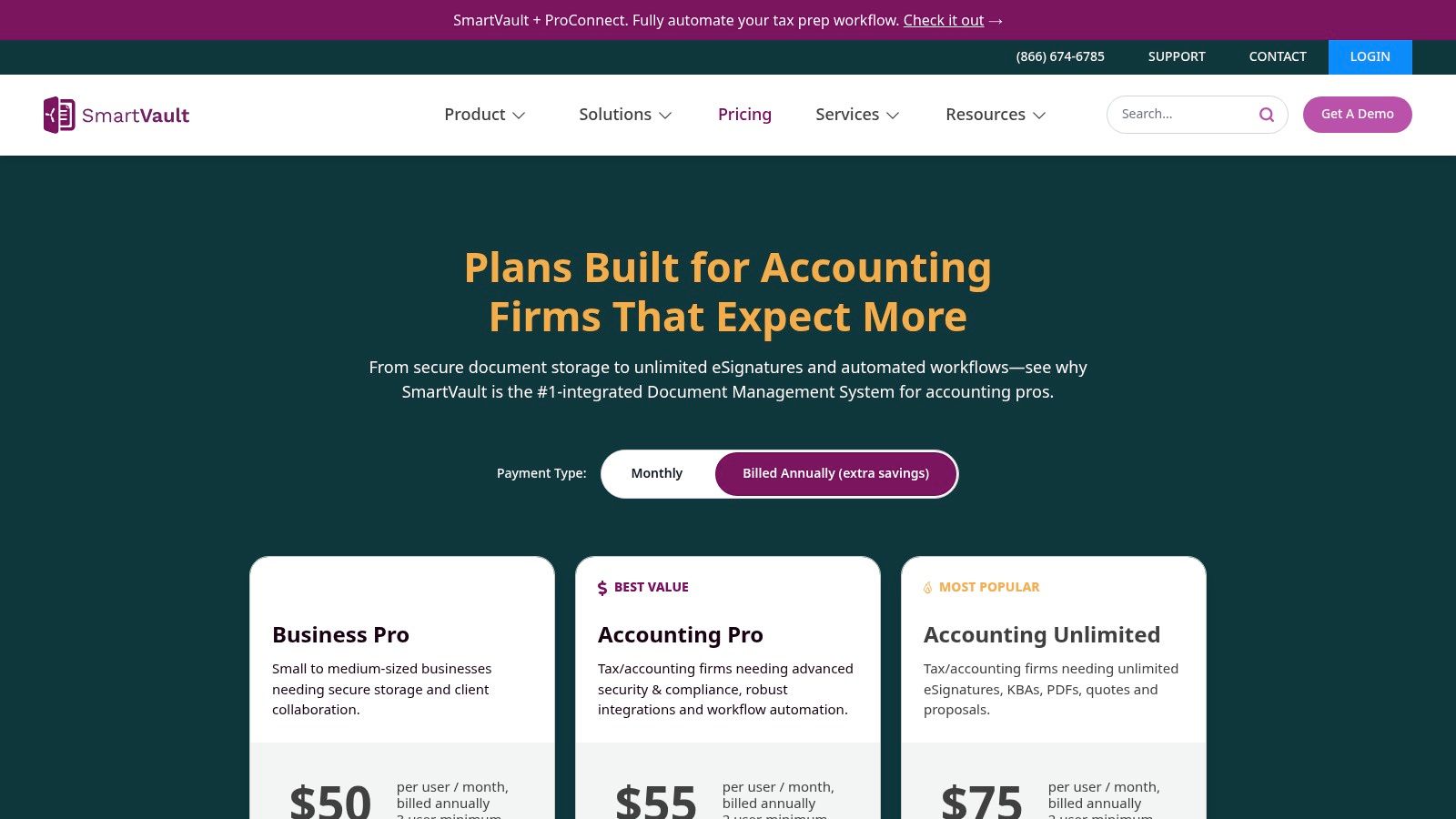

2. SmartVault

SmartVault positions itself as more than just a document management system; it's a complete client portal and file-sharing solution built from the ground up for accounting professionals. This specialization is its core strength, evident in features like pre-built folder templates designed for common accounting workflows, including 1040 tax engagements, bookkeeping, and payroll. This structured approach helps firms standardize their client file management from day one.

The platform deeply integrates with essential accounting tools like QuickBooks, Lacerte, and ProSeries, allowing for streamlined workflows such as printing tax returns directly to the correct client vault. The built-in client portal provides a secure, branded environment for clients to upload source documents and receive completed files, significantly reducing the reliance on insecure email attachments. The inclusion of unlimited e-signatures with KBA/ID verification on its top-tier plans makes it a compelling, all-in-one solution. This combination of DMS, client portal, and e-signature functionality makes it one of the best document management software for accountants seeking to consolidate their tech stack.

Key Features & Pricing

SmartVault’s pricing is transparent and designed for firms of various sizes. Its plans are structured to bundle features logically, providing a clear path for scaling.

| Feature Highlights | Accounting Pro Plan | Business Pro Plan |

|---|---|---|

| Pricing | Starts at $40/user/month | Starts at $60/user/month |

| User Minimum | 2 users | 5 users |

| Key Differentiator | DMS & Client Portal | Adds unlimited e-signatures & KBA |

| Integrations | QuickBooks, Tax Software | Same as Accounting Pro |

Pros:

- Purpose-Built for Accountants: Onboarding and templates are tailored specifically for accounting and tax workflows.

- Clear Pricing: Published pricing with relatively low seat minimums makes it accessible for smaller firms.

- Integrated E-Signatures: Offers a complete solution for sending, signing, and storing engagement letters and tax forms.

Cons:

- Annual Billing Required: The best pricing is locked behind an annual commitment.

- User Minimums: The higher-tier plans require a minimum of five users, which may be a barrier for solo practitioners.

Learn more about how SmartVault helps businesses manage documents efficiently.

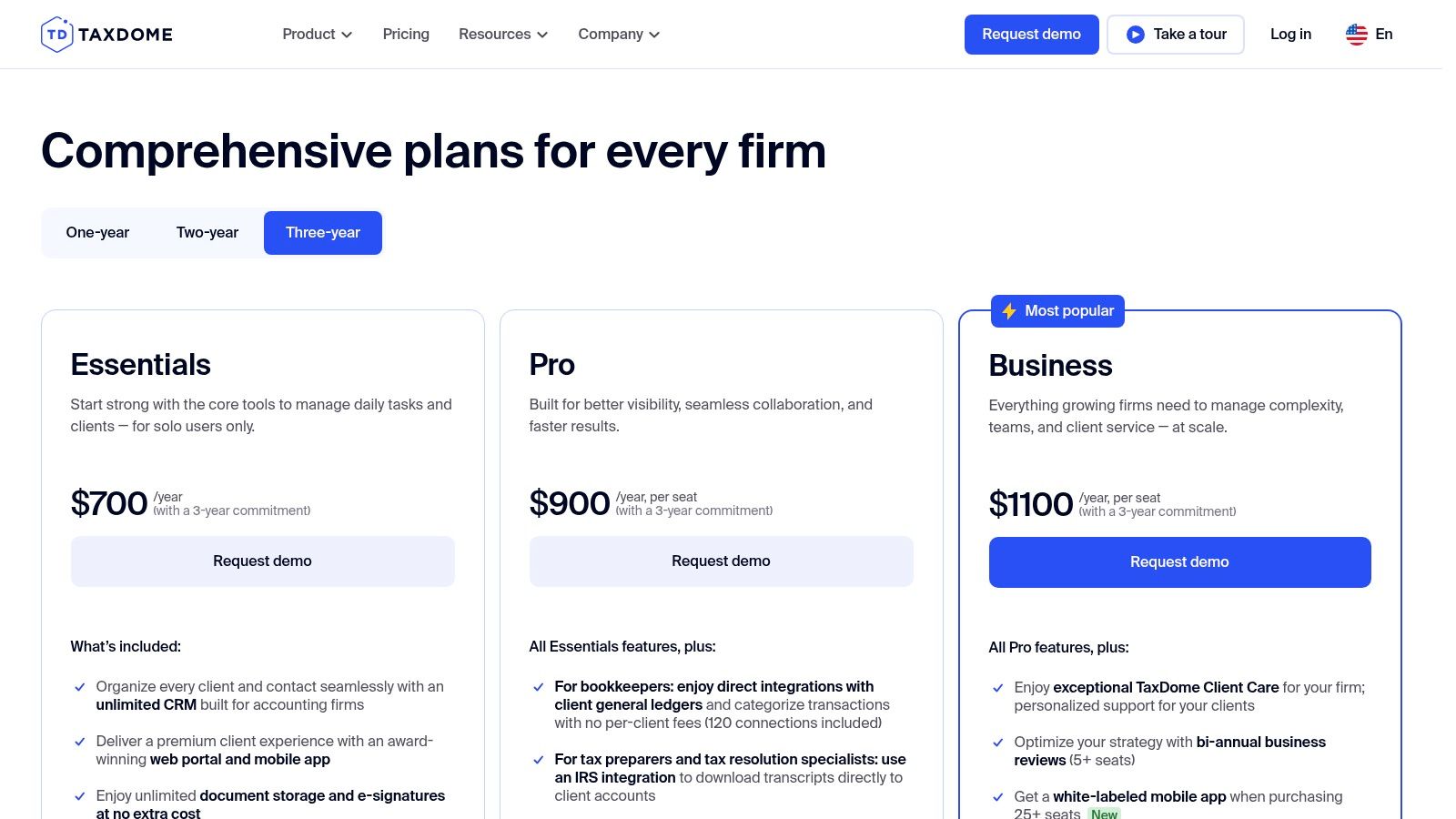

3. TaxDome

TaxDome is an all-in-one practice management platform where document storage is a core, integrated component rather than a standalone feature. It’s designed for firms aiming to consolidate their technology stack, combining a client portal, workflow automation, CRM, and billing into a single system. This unified approach eliminates the friction of moving data between separate applications, allowing for powerful automations like locking documents to invoices or automatically organizing files based on a client’s progress in a workflow.

The platform’s strength lies in its expansive feature set, which includes unlimited document storage and unlimited e-signatures with KBA on all plans. This makes it an incredibly cost-effective choice for growing firms. The client experience is managed through a branded portal and a dedicated mobile app, enabling secure file exchange, document approvals, and even payments on the go. By bundling these critical functions, TaxDome stands out as one of the best document management software for accountants who want a single source of truth for all client work and communication, not just file storage.

Key Features & Pricing

TaxDome’s pricing is famously straightforward, with a flat per-user fee that includes nearly every feature, avoiding complex tiers or add-on costs for core functionalities.

| Feature Highlights | TaxDome Lite | TaxDome Pro |

|---|---|---|

| Pricing | Starts at $50/user/month | Starts at $75/user/month |

| User Minimum | 1 user | 1 user |

| Key Differentiator | DMS, Portal & Unlimited E-sign | Adds workflow automation & CRM |

| Integrations | QuickBooks, Zapier, Tax Software | Same as TaxDome Lite |

Pros:

- All-in-One Platform: Combines DMS, workflow, CRM, billing, and proposals in a single subscription.

- Transparent Pricing: Simple, flat per-seat pricing with unlimited storage and e-signatures included on all plans.

- Powerful Automations: Directly links document management to workflow stages and client billing.

Cons:

- Potential Learning Curve: The sheer breadth of features can be overwhelming for firms only seeking a simple DMS.

- Annual Prepayment: The best pricing is only available with an annual commitment.

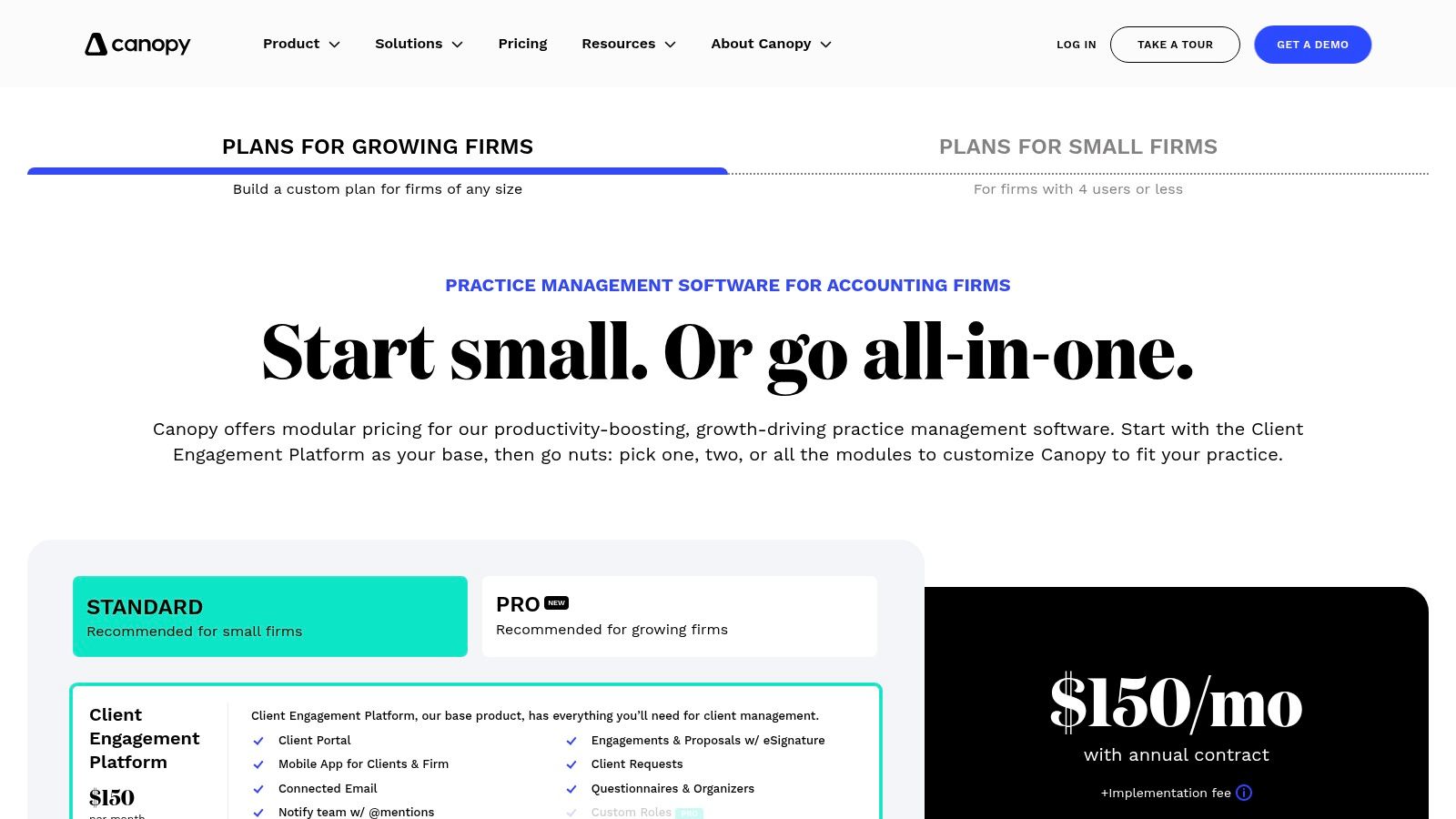

4. Canopy (Document Management module)

Canopy is a comprehensive practice management suite where firms can choose to purchase the Document Management module as a standalone solution or as part of a larger, integrated platform. This modular approach is ideal for accounting firms looking for a scalable system that can grow with their needs. The platform focuses on providing a centralized, secure hub for all client files, complete with unlimited storage and customizable folder templates to enforce firm-wide organizational standards from the outset.

A key strength of Canopy is its modern and intuitive client portal, which allows for secure file exchange via a desktop or mobile app, significantly improving client experience and security over traditional email. The inclusion of unlimited e-signatures and a desktop sync with a print driver enhances productivity, allowing professionals to save documents directly to a client's folder from any application. This combination of robust storage, client collaboration, and integrated tools makes it a strong contender for the best document management software for accountants prioritizing a modern interface and scalability.

Key Features & Pricing

Canopy's pricing for its Document Management module is structured as an add-on, allowing firms to start small and expand their feature set over time.

| Feature Highlights | Client Management + Docs | Full Suite |

|---|---|---|

| Pricing | $45/user/month (base) + $40/user/month (Docs) | Contact Sales |

| User Minimum | 1 user | Contact Sales |

| Key Differentiator | Modular DMS & Client Portal | All-in-one practice management |

| Integrations | QuickBooks Online, IRS, Zapier | Same as base plan |

Pros:

- Modular Purchase Approach: Start with just document management and add other practice management tools as needed.

- Unlimited Storage & E-Signatures: No caps on document storage or the number of e-signatures sent.

- Modern User Experience: The interface for both the firm and the client portal is clean and user-friendly.

Cons:

- Cost Can Increase Quickly: The total per-user cost can become substantial as you add more modules or users.

- Complex Pricing Tiers: Full suite pricing requires contacting sales for an accurate quote, adding a step to the evaluation process.

Learn more about how Canopy streamlines document workflow automation.

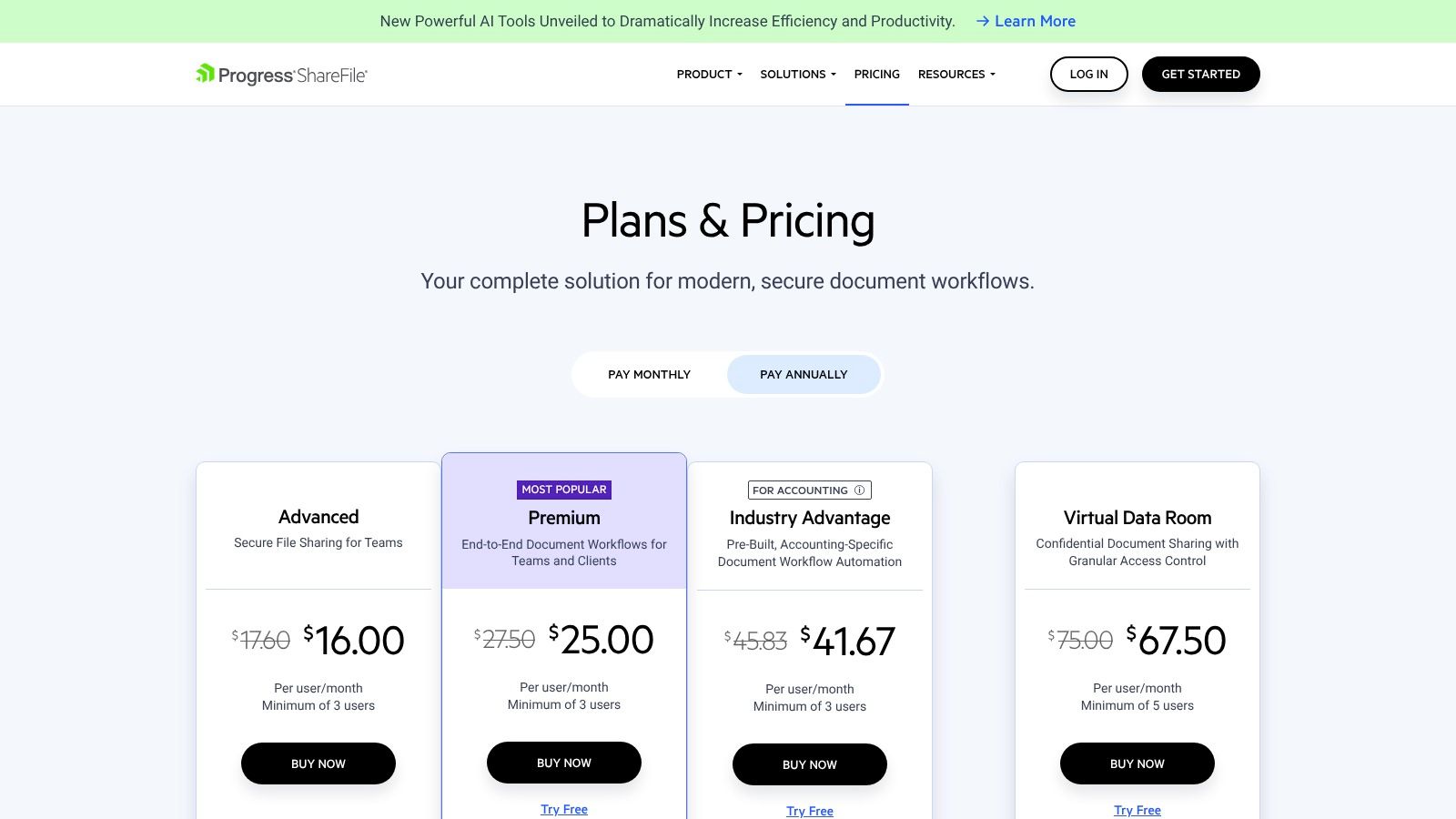

5. ShareFile (Accounting Industry plan)

ShareFile carves out its space by offering a robust, secure document management platform with an "Industry Advantage" plan specifically tailored for accountants. This plan moves beyond generic file storage, providing pre-built workflow templates for common tasks like tax engagements and client onboarding. This focus on accounting-specific processes allows firms to standardize their client interactions and document handling from the outset, ensuring consistency and efficiency across the team.

The platform excels in creating a secure, custom-branded portal where clients can exchange sensitive information, complete forms, and provide e-signatures. Its strength lies in its comprehensive workflow automation, which can automate document requests and approvals, reducing manual follow-up. With granular permissions, detailed audit trails, and emerging AI-powered document automation, ShareFile is one of the best document management software for accountants focused on creating repeatable, secure client experiences while minimizing administrative overhead.

Key Features & Pricing

ShareFile offers multiple pricing tiers, with the accounting-specific features becoming more prominent in the higher-level plans. Firms should evaluate the feature set at each level to find the right fit.

| Feature Highlights | Premium Plan | Advanced Plan |

|---|---|---|

| Pricing | Starts at $100/month (for 5 users) | Starts at $75/month (for 5 users) |

| User Minimum | Typically 3 or more | Typically 3 or more |

| Key Differentiator | DMS & Client Portal with e-signature | Adds advanced workflows & integrations |

| Integrations | Microsoft 365, Outlook | Same as Premium |

Pros:

- Ready-Made Templates: Accounting-specific workflow templates accelerate setup and standardization.

- Scalable Tiers: Multiple pricing plans accommodate the needs of both growing and established firms.

- Secure Client Portal: Provides a professional, branded environment for secure document exchange and e-signatures.

Cons:

- Higher User Minimums: Plans often start with a minimum of three users, which can be costly for solo practitioners.

- Tiered Feature Access: The most valuable accounting automation features are reserved for the higher-priced plans.

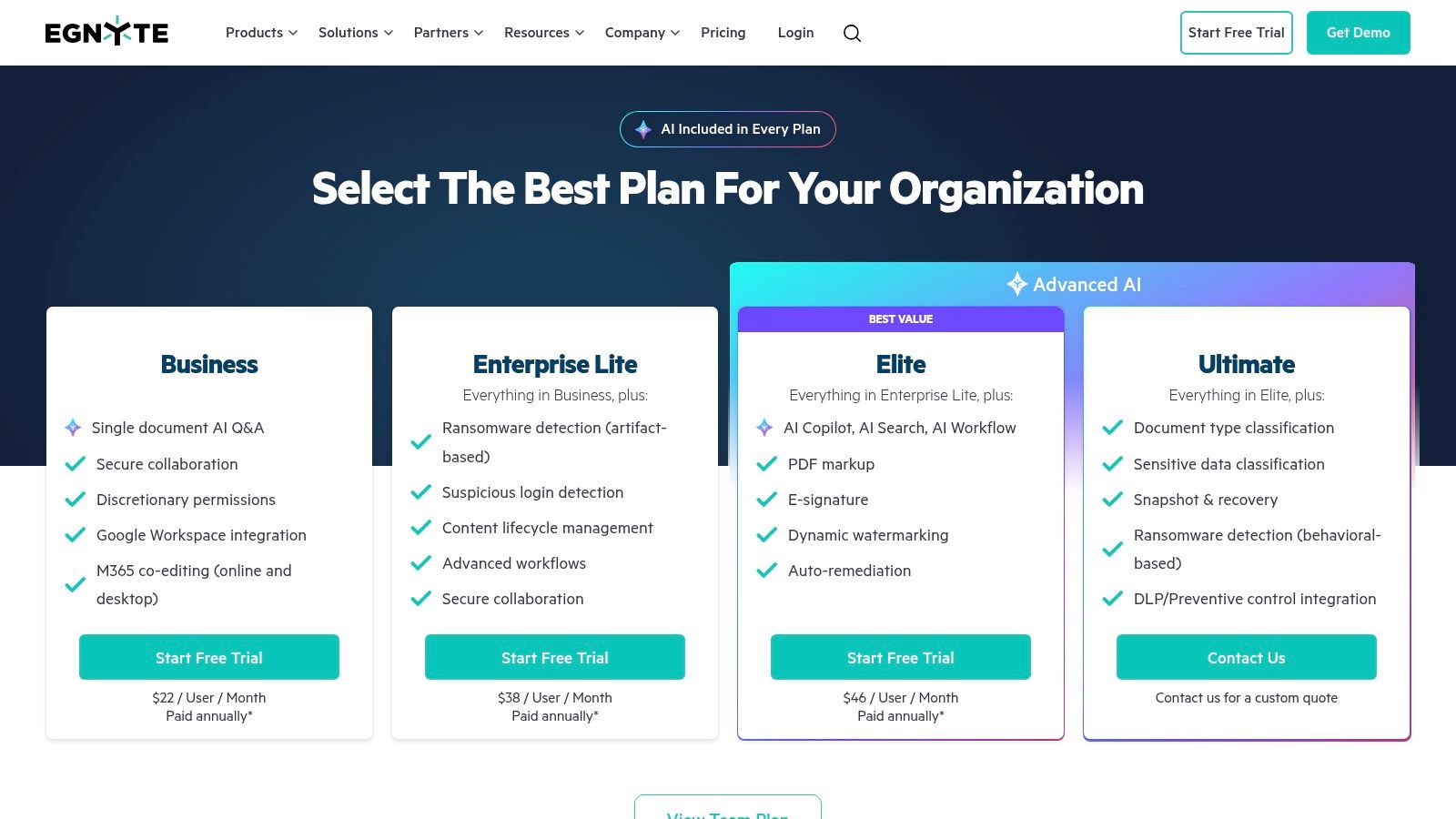

6. Egnyte for Financial Services/Accounting

Egnyte positions itself as a unified content security and governance platform, making it a strong contender for accounting firms with stringent compliance and security requirements. While not exclusively for accountants, its "Financial Services" focus provides robust features like role-based permissions, data lifecycle management, and ransomware detection. This security-first approach ensures that sensitive client data like tax returns, financial statements, and personal identification documents are protected against both external threats and internal data leakage.

The platform shines in its ability to support secure collaboration across desktop, web, and mobile applications. It integrates seamlessly with Microsoft 365 and Google Workspace, allowing for real-time co-editing of documents directly within Egnyte’s secure environment. Features like built-in e-signatures, watermarking, and advanced data loss prevention (DLP) in higher-tier plans provide a comprehensive toolkit. For firms managing a high volume of regulated data, Egnyte's advanced governance capabilities make it one of the best document management software for accountants who prioritize security and control.

Key Features & Pricing

Egnyte’s pricing scales based on features and governance needs, offering plans suitable for growing firms up to large enterprises. The plans are designed to add layers of security and compliance as a firm's needs evolve.

| Feature Highlights | Business Plan | Enterprise Lite Plan |

|---|---|---|

| Pricing | $20/user/month | Custom Pricing |

| User Minimum | 10 users | 25 users |

| Key Differentiator | Secure file sharing & collaboration | Adds advanced security & governance |

| Integrations | MS 365, Google, Salesforce | Same as Business, plus APIs |

Pros:

- Strong Security and Governance: Advanced features like ransomware protection and DLP are ideal for compliance-heavy firms.

- Scalable Platform: Easily scales from a small team to a large, multi-office enterprise without sacrificing performance or security.

- Seamless Co-Editing: Deep integration with Microsoft 365 and Google Workspace enhances productivity.

Cons:

- Requires Configuration: Unlike purpose-built accounting DMS, it may require initial setup to create accounting-specific workflows.

- Advanced Features Gated: Many of the best security and AI features are reserved for higher-priced, custom enterprise plans.

7. Revver (formerly eFileCabinet)

Revver, the platform formerly known as eFileCabinet, has a long-standing reputation in the accounting industry as a robust, security-focused document management system. It goes beyond simple storage by offering powerful automation features designed to streamline firm operations. Pre-built templates for client onboarding, tax season, and audit preparation allow firms to standardize their folder structures and processes, ensuring consistency across all engagements. Its strength lies in its deep DMS capabilities combined with workflow automation.

The platform is built to handle the complex needs of growing firms, featuring automated workflows, secure file requests, and role-based permissions to maintain compliance and control. Revver's Zonal OCR technology can automatically recognize, name, and file documents based on their content, significantly reducing manual data entry and filing time. For firms managing massive volumes of data, Revver offers scalable storage options up to multiple terabytes. This focus on automation and scalability makes it one of the best document management software for accountants aiming to optimize internal processes and enhance security.

Key Features & Pricing

Revver’s pricing is quote-based, tailored to the specific needs of the firm regarding user count, storage, and feature requirements. You must contact their sales team for a custom quote.

| Feature Highlights | Revver Core | Revver Business | Revver Enterprise |

|---|---|---|---|

| Pricing | Quote-Based | Quote-Based | Quote-Based |

| Key Differentiator | Foundational DMS features | Adds advanced workflow automation | Advanced compliance & integrations |

| Target User | Small to mid-sized firms | Mid-sized to large firms | Large firms with complex needs |

| Storage | Generous, scales up | High-capacity options | Multi-terabyte capable |

Pros:

- Comprehensive Automation: Sophisticated workflow tools reduce manual tasks and improve process efficiency.

- Strong Security & Compliance: Granular permissions and audit trails are ideal for security-conscious firms.

- Scalable Architecture: Designed to grow with a firm, from a few users to a large enterprise, with massive storage options.

Cons:

- Opaque Pricing: You must go through a sales demo to get pricing, which can slow down the evaluation process.

- Potential Complexity: The extensive feature set may have a steeper learning curve compared to simpler solutions.

8. Wolters Kluwer CCH Axcess Document

For accounting firms deeply embedded in the Wolters Kluwer ecosystem, CCH Axcess Document is the native, cloud-based solution. Its primary advantage is not as a standalone product but as a fully integrated component of the broader CCH Axcess suite, which includes modules for tax, practice management, and workflow. This tight integration allows for seamless document flow, such as automatically filing a completed tax return from CCH Axcess Tax directly into the corresponding client folder in CCH Axcess Document.

The platform is built for enterprise-level needs, offering features like automated retention policies to ensure compliance and a robust, open API for custom integrations. Firms using the full suite benefit from a single source of truth for all client data and documentation, reducing redundant data entry and minimizing the risk of errors. While it represents a significant investment, its value is maximized when leveraged as part of a comprehensive firm management strategy, making it one of the best document management software for accountants already committed to the CCH Axcess platform.

Key Features & Pricing

CCH Axcess Document’s pricing is quote-based, reflecting its position as an enterprise solution that is typically bundled with other modules. It is designed for firms that require a deeply integrated, all-in-one platform from a single vendor.

| Feature Highlights | CCH Axcess Document |

|---|---|

| Pricing | Quote-based; positioned as a premium solution |

| User Minimum | Varies; typically suited for mid-sized to large firms |

| Key Differentiator | Native integration with the CCH Axcess platform (Tax, Practice, etc.) |

| Integrations | Open API, CCH Axcess Marketplace, and all Axcess modules |

Pros:

- Deep Ecosystem Integration: Unparalleled connectivity for firms using CCH Axcess Tax, Practice, and other modules.

- Enterprise-Level Support: Comes with comprehensive training resources and robust customer support typical of Wolters Kluwer.

- Automated Compliance: Features like automated retention policies help firms manage regulatory requirements effectively.

Cons:

- Quote-Based Pricing: Lack of transparent pricing can be a hurdle for firms evaluating costs.

- Best Value When Bundled: The system offers the most significant benefits when used with other Axcess products, making it less ideal as a standalone DMS.

Learn more about how intelligent document processing improves accounting workflows.

Visit Wolters Kluwer CCH Axcess Document

9. Thomson Reuters Onvio (Firm Management with Documents)

Thomson Reuters Onvio is a comprehensive cloud practice management suite where document management is a core component, rather than a standalone feature. Its biggest advantage lies within its deep integration into the Thomson Reuters ecosystem, making it a natural fit for firms already invested in their tax software like UltraTax CS. This design allows for seamless data flow between tax preparation, client management, and document storage, creating a unified operational environment.

The platform includes a secure client center for file exchange and document requests, aiming to eliminate insecure email practices. A key feature is the Onvio Link, a Windows connector that lets users edit files stored in the cloud using their local desktop software, with changes automatically syncing back. This hybrid approach provides the flexibility of cloud access with the familiarity of desktop applications. While it offers a powerful all-in-one solution, its primary value is realized when used in conjunction with other Thomson Reuters products, making it a specialized choice for a specific segment of the accounting market.

Key Features & Pricing

Onvio’s features are bundled into a larger firm management suite, and pricing is customized based on firm size and required modules. Prospective users must contact sales for a quote.

| Feature Highlights | Onvio Firm Management |

|---|---|

| Pricing | Quote-based; not publicly available |

| Key Differentiator | Deep integration with Thomson Reuters tax products (UltraTax CS) |

| Core Functionality | Documents, Client Center, Time & Billing, Workflow |

| Integrations | Primarily within the Thomson Reuters ecosystem |

Pros:

- Seamless Ecosystem Integration: Unmatched workflow efficiency for firms using Thomson Reuters tax software.

- All-in-One Platform: Combines document management with time, billing, and project management.

- Mature Support: Backed by a large, established company with extensive resources and support networks.

Cons:

- Opaque Pricing: Requires a sales consultation to get pricing, making it difficult to compare.

- Potential for Downtime: Some users report occasional performance issues during peak tax season deadlines.

10. Thomson Reuters GoFileRoom

Thomson Reuters GoFileRoom is an enterprise-grade, cloud-based document management solution built for the rigorous demands of large accounting and CPA firms. Its primary strength lies in its robust architecture, designed for high-volume document processing, strict compliance, and complex workflow automation, particularly when paired with its companion product, FirmFlow. This synergy creates a powerful ecosystem for managing everything from tax preparation to audit and assurance engagements with precision.

The platform excels at enforcing firm-wide standards through features like automated retention policies and granular security controls. Its ScanFlow technology automates the process of scanning, naming, and filing documents, which significantly reduces manual data entry and indexing errors. For firms already invested in the Thomson Reuters ecosystem, GoFileRoom provides a deeply integrated and scalable platform that is among the best document management software for accountants focused on process control and compliance at scale.

Key Features & Pricing

GoFileRoom’s feature set is geared towards automation and control. Pricing is customized based on firm size and needs, requiring a direct sales consultation.

| Feature Highlights | GoFileRoom |

|---|---|

| Pricing | Custom Quote Only |

| User Minimum | Suited for larger firms |

| Key Differentiator | Deep integration with FirmFlow for workflow automation & advanced retention policies |

| Integrations | Thomson Reuters Suite, Power Automate, Zapier |

Pros:

- Proven Cloud Solution: A long-standing, reliable platform with enterprise-level security and uptime.

- Strong Workflow Integration: Pairs seamlessly with FirmFlow to create end-to-end process automation.

- Compliance-Focused: Advanced tools for managing document retention and enforcing access policies.

Cons:

- Premium Pricing: Tends to be one of the more expensive options, with no public pricing available.

- Complex Implementation: Requires careful planning and change management to fully leverage its capabilities.

Visit Thomson Reuters GoFileRoom

11. G2 — Document Management Software category

While not a software vendor itself, G2’s Document Management category is an indispensable research tool for accounting firms performing due diligence. It serves as a comprehensive, review-driven marketplace where you can compare dozens of solutions side-by-side. For accountants, this means you can filter platforms based on specific criteria like tax software integrations or client portal capabilities, and then validate your choices against hundreds of verified, peer-written reviews. This process helps cut through marketing jargon to understand real-world performance.

The platform’s strength lies in its user-generated data. You can see how different firms rate features like implementation ease, quality of support, and overall ROI. This makes it one of the best resources for creating a shortlist before committing to product demos. By leveraging G2, you can quickly identify the top-rated document management software for accountants and avoid solutions that are a poor fit for your firm’s specific needs, saving valuable time and resources in the selection process.

Key Features & Pricing

G2 is a free-to-use research platform. Pricing for individual software solutions must be sourced directly from the vendors listed on the site.

| Feature Highlights | User-Sourced Data | Vendor Comparison |

|---|---|---|

| Pricing | Free for users | Varies by vendor |

| User Minimum | N/A | Varies by vendor |

| Key Differentiator | Verified user reviews | Feature-based filtering |

| Integrations | Comparison data only | N/A |

Pros:

- Up-to-Date Peer Reviews: Provides honest, current feedback from other accounting and business professionals.

- Powerful Comparison Tools: The G2 Grid and feature filters help build and validate a software shortlist.

- Free to Use: Access to all reviews and comparison data is completely free.

Cons:

- Not a Vendor: You cannot purchase software directly; it’s a research-only platform.

- Broad Scope: Listings include many generic ECM tools that are not specifically tailored to accounting workflows.

Visit G2 — Document Management Software category

12. Capterra — Accounting/Document Management resources

While not a document management system itself, Capterra is an indispensable resource for accounting firms navigating the crowded software market. As a Gartner-backed marketplace, it offers a comprehensive directory of software solutions, including a dedicated category for accounting document management. This makes it an essential starting point for any firm wanting to compare the best document management software for accountants side-by-side, based on real user feedback and feature sets.

Capterra's platform allows you to filter potential solutions by features, pricing models, and firm size, significantly streamlining the research process. Its strength lies in aggregating user reviews and providing at-a-glance comparisons, which can uncover practical insights that vendor websites might not highlight. For accounting professionals, this means you can quickly vet options based on the experiences of your peers, saving valuable time and reducing the risk of choosing an ill-fitting platform.

Key Features & Pricing

Capterra is a free resource directory. Pricing information for individual software vendors is provided for comparison purposes but should be verified on the vendor's site.

| Feature Highlights | Directory & Buyer Guides |

|---|---|

| Pricing | Free to use |

| User Minimum | N/A |

| Key Differentiator | Aggregated user reviews and filterable comparisons |

| Integrations | N/A (Links out to vendor sites) |

Pros:

- Simple Comparisons: Offers easy-to-read pricing snapshots and feature lists for quick evaluation.

- User-Centric: Focuses on real-world user reviews, providing a more balanced perspective.

- Comprehensive Listings: Covers a wide range of software, including niche players you might otherwise miss.

Cons:

- Information Can Be Dated: Pricing and feature details may not always be current; verification with the vendor is necessary.

- Marketplace Only: Acts as a directory and does not facilitate direct purchases or trials.

Visit Capterra

Top 12 Document Management Software for Accountants: Feature Comparison

| Product | Core Features / Highlights | User Experience / Quality ★★★★☆ | Value & Pricing 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| 🏆 DocParseMagic | AI-powered parsing, context understanding, multi-format support | Fast, accurate, easy template setup | Flexible monthly plans, free signup credits | Bookkeepers, finance teams, freelancers | Proprietary calculation engine, auto data enrichment |

| SmartVault | Accounting templates, e-signatures, audit logs | Accounting-focused, clear onboarding | Published pricing, low seat minimums | Accounting firms | Deep accounting app integrations |

| TaxDome | All-in-one platform: DMS, CRM, payments, mobile app | Broad features, smooth integration | Flat per-seat pricing, annual plans best | US tax firms | Unlimited docs/signatures, workflow & billing combo |

| Canopy (DMS module) | Unlimited storage, client portals, e-signatures | Modular, transparent per-user pricing | Modular pricing, sales contact for quotes | Accounting firms | Standalone DMS purchase, mobile file exchange |

| ShareFile (Accounting plan) | Tax engagement templates, workflow automation | Ready-made templates, multiple pricing tiers | Minimum user count, tiered pricing | Accounting firms | Accounting-specific automation & branding |

| Egnyte for Financial Services | Security governance, co-editing, built-in e-sign | Strong security, mid-market value | Mid-market pricing, some features limited | Small to large accounting firms | Advanced governance, ransomware detection |

| Revver (eFileCabinet) | Automation workflows, portals, multi-terabyte storage | Comprehensive DMS, strong accounting focus | Pricing private, no free trial | Accounting firms | Deep automation, large storage options |

| Wolters Kluwer CCH Axcess DMS | Retention policies, API integrations, ecosystem | Enterprise support, seamless Axcess integration | Quote-based, higher-end pricing | CPA firms using CCH Axcess | Integration with Axcess suite, enterprise training |

| Thomson Reuters Onvio | Client portals, tax software sync, workflow automation | Mature support, ecosystem fit | Quote-based, occasional outage reports | Firms using Thomson Reuters tax | Tight tax software integration |

| Thomson Reuters GoFileRoom | ScanFlow autofiling, retention, multi-factor security | Enterprise-grade security, workflow automation | Premium pricing, requires planning | Accounting firms | ScanFlow automation with FirmFlow workflow |

Making Your Final Decision: Key Factors for Accountants

Navigating the landscape of document management software can feel overwhelming, but making an informed choice is a critical strategic step for any modern accounting practice. We've explored a wide range of solutions, from comprehensive practice management suites like Canopy and TaxDome to dedicated, secure file-sharing platforms like SmartVault and ShareFile. Each tool offers a unique blend of features designed to tackle the specific challenges accountants face daily.

The key takeaway is that there is no single "best" platform for everyone. The ideal choice hinges entirely on your firm's specific size, client base, existing technology stack, and biggest operational bottlenecks. Your selection process should be a deliberate evaluation, not a quick decision based on a feature list alone.

From Theory to Practice: A Strategic Selection Framework

To move from analysis to action, your team needs a clear framework for making the final call. The right document management software for accountants is not just a digital filing cabinet; it's a central nervous system for your firm’s data, client communication, and workflow efficiency.

Here are the essential factors to weigh as you create your shortlist and begin trial periods:

- Integration is Non-Negotiable: Your document management system (DMS) must communicate flawlessly with your core accounting and tax software. Whether you use QuickBooks, Xero, or specialized tax preparation tools like those from Wolters Kluwer or Thomson Reuters, seamless integration prevents data silos and eliminates the productivity drain of manual data re-entry. Always verify the depth of the integration, not just its existence.

- The Client Experience Matters: A clunky, confusing client portal is a liability. Your chosen software's portal should be intuitive and secure for even your least tech-savvy clients. The ease with which clients can upload documents, review files, and sign e-signatures directly impacts their perception of your firm's professionalism and efficiency.

- Security and Compliance Are Paramount: As a custodian of sensitive financial data, you cannot compromise on security. Look for platforms that offer robust security protocols like 256-bit AES encryption, multi-factor authentication, and detailed audit trails. Ensure the provider meets compliance standards relevant to your client base, such as GDPR, HIPAA, or FINRA regulations.

- Workflow Automation is the Goal: The true value of a great DMS lies in its ability to automate repetitive tasks. Consider your most time-consuming processes. Is it client onboarding? Chasing document signatures? Manually extracting data from bank statements and invoices? The best software will have features like automated reminders, templated folder structures, and workflow automation rules that directly address these pain points.

Identifying Your True Needs: Specialized vs. All-in-One

One of the most crucial decisions is whether you need an all-in-one practice management suite or a more specialized, best-in-class tool that solves a specific, high-impact problem. For many firms, the biggest unaddressed inefficiency isn't just file storage; it’s the manual, error-prone process of extracting data from unstructured documents like invoices, receipts, and bank statements.

This is where a dedicated tool can be transformative. If your team spends countless hours keying in data from PDFs and scanned images, a specialized solution designed for data extraction offers a much higher return on investment than a simple file storage system. It attacks the root cause of a major inefficiency, freeing up your team for higher-value analytical and advisory work. Ultimately, the best document management software for accountants is the one that aligns perfectly with your operational needs, enhances client service, and provides a clear path to greater efficiency and profitability.

Tired of manual data entry slowing your team down? While comprehensive DMS solutions manage files, DocParseMagic is expertly designed to eliminate the tedious work of extracting data from those files. Turn your invoices, bank statements, and receipts into structured, usable data for your accounting systems in seconds. Start your free trial of DocParseMagic today and see how much time you can save.