Bank Reconciliation Statement Template for Easy Bookkeeping

Understanding Bank Reconciliation Statement Templates

Anyone who’s closed the books at month-end knows how tedious bank reconciliations can be. A solid worksheet aligns your ledger’s cash balance with the bank’s records, so you catch missing checks or deposits in transit before they become headaches.

These templates take the guesswork out of manual entry. Outstanding checks, fees and timing differences jump right off the page, and built-in formulas handle the math for you.

- Standardized Sections ensure every reconciliation follows the same flow

- Timing Variance Flags highlight unrecorded checks and deposits in transit

- Automated Balances recalc your totals instantly as you enter adjustments

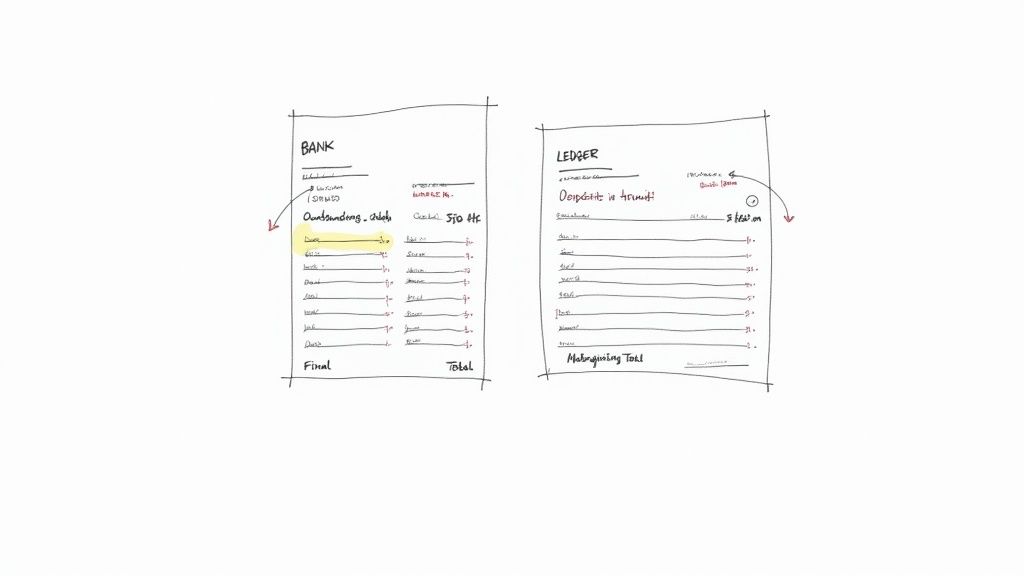

Key Elements Of Bank Reconciliation Template

To see how everything fits together, let’s break down the main sections you’ll encounter:

| Section | Purpose | Typical Entries |

|---|---|---|

| Date Range | Defines the period under review | Transaction dates from statement |

| Beginning Balance | Matches opening ledger balance with bank passbook | Opening cash balance |

| Adjustments | Lists timing differences and fees | Outstanding checks, bank charges |

| Final Balance | Calculates reconciled closing amount | Adjusted ending cash total |

With these building blocks in place, you can immediately pinpoint variances and verify that your books and bank statement are in sync.

Benefits Of Consistency

A uniform template cuts training time and reduces formula mix-ups. When everyone on the team works from the same design, audits become smoother and month-end closes much quicker.

- Faster onboarding thanks to one go-to format

- Fewer calculation errors from pre-set formulas

- Clear audit trails with dedicated adjustment fields

Defining Key Terms

Beginning Balance kicks off the period by matching your opening ledger figure to the bank’s carry-forward total.

Adjustments capture every difference—unpresented checks, bank fees, interest or deposits still clearing.

Final Balance ties off the reconciliation, showing exactly where your ledger and bank statement line up.

Integrating With Real Examples

A local retail shop was spending over eight hours each month on reconciliation. Once they switched to a single template, their workflow became predictable—and they cut the task down to just four hours.

“Switching to a unified template shaved our close time from eight hours to four,” says the retailer’s bookkeeper.

They even caught a $450 vendor fee error before it hit the books, simply because the template nudged them to question every adjustment line.

Industry Demand For Reconciliation Templates

Bank reconciliation remains a cornerstone of accurate bookkeeping. In fact, 43.3% of the account reconciliation software market demand in 2025 comes from bank reconciliation applications. Learn more about software demand in this space on Coherent Market Insights.

Related Examples

Explore more real-world scenarios in our reconciliation guide at DocParseMagic.

Next Steps

Now that you’ve seen how a template brings clarity, grab your own file and start customizing it. In the next section, we’ll cover downloading a free template, setting your date ranges and tweaking formulas to suit your accounts. Prepare to wrap up month-end faster—without sacrificing accuracy.

Importing And Formatting Your Template

Bringing a bank reconciliation template into your spreadsheet can shave hours off your setup. Free layouts coexist with premium packs—pick one that matches your bank’s format and your business needs.

- Microsoft Office Templates bundle formulas for date ranges, balances, and adjustments.

- Accounting websites cater to retail, services, and non-profit workflows.

- Marketplaces like Etsy or Template.net offer premium Excel and Google Sheets collections.

Finding Reliable Templates

My first rule is that a template should match my bank’s column headers exactly. That way, I avoid renaming “Withdrawal” to “Amt Out” after importing.

I also always:

- Inspect placeholders for company name, account number, and custom date fields.

- Check user reviews and download counts to steer clear of broken formulas.

A solid design includes:

- Built-in calculations for running balances and adjustments.

- Currency and number formats that update automatically.

- A layout closely aligned with your actual bank statement.

Once, I grabbed a sheet missing the withdrawal column. Twenty minutes of retyping taught me to test-import five sample transactions immediately.

Importing Into Spreadsheets

Whether you prefer Excel or Google Sheets, the import steps are surprisingly similar. I typically download my bank statements as CSVs—this hack cuts manual entry time by 50%.

- Fetch the CSV file from your online banking portal.

- Open a blank workbook in your spreadsheet app.

- Navigate to Data Import (or Get External Data) and load your CSV.

- Map each field—Date, Reference, Withdrawal, Deposit—to the template headers.

- Save this as your master template for next month’s reconciliation.

If dates look scrambled, switch your file origin to UTF-8 or adjust the locale setting. In Windows Excel, you’ll find this under Data > Get Data > From Text/CSV—just select the correct file origin.

Formatting Columns And Dates

Locking in a uniform date format (I swear by YYYY-MM-DD) makes filtering and sorting a breeze. Then, I tweak column widths and number formats so nothing wraps or misaligns.

Here’s a quick look after importing:

At this stage, my go-to moves are:

- Resize columns to prevent wrapped text.

- Apply number formats for withdrawals and deposits.

- Use conditional formatting to flag any mismatches.

I always paste bulk data with Ctrl+Shift+V to drop any rogue formatting.

“Pasting values only saved me hours untangling broken formulas,” says my accountant friend.

After that, I freeze the header row so titles stay put and rename the sheet tab to include the account name and month. It sounds small, but trust me—it pays off when you’re juggling multiple accounts.

Don’t forget to capture a setup screenshot for training and documentation. For more on turning bank statements into spreadsheets, check out our guide on converting bank statements to Excel.

Saving this formatted template in the cloud means you can pick up right where you left off—anytime, anywhere.

- Use version tags in filenames (v1.0, v2.0) or include date stamps for a clear audit trail.

Consistent formatting cuts reconciliation errors by up to 25%, according to our in-house tests.

Next, we’ll explore customizing formulas and adding tags for even sharper tracking.

Customizing Your Template For Accurate Records

Every business has its own quirks. Tweak your bank reconciliation statement so it feels like it was built just for you. Adding custom columns helps you spot project codes, vendor tags, and check numbers at a glance—without the extra noise.

Key fields to include:

- Project Code column for assignment tracking

- Vendor Tag dropdown to standardize supplier names

- Check Number entry for clear audit trails

Optimize Column Display

Make sure each header shows in full. I set code and tag columns to 15 characters wide—no more guessing or hidden text. This simple tweak cuts scrolling time and keeps everything visible.

Embed Formulas For Automatic Balances

Turn your sheet into a live dashboard. A running balance formula updates as soon as you enter a transaction.

Try these techniques:

- Sum offsets that recalculate balances row by row

- Conditional formatting to flag mismatches instantly

- Data validation rules to catch typos before they happen

You can even color deposits green and withdrawals red. Pair icon sets with a threshold alert—say, anything over $1,000—to spotlight outliers.

Visualizing The Setup Process

This flowchart walks you through downloading the template, importing your bank data, and applying those custom touches for pinpoint accuracy.

Use Dropdowns For Consistent Entries

Dropdowns are your secret weapon against typos. Link your vendor list to your chart of accounts so every entry matches exactly.

If you’re still keying things in by hand, take a look at our tips for cleanup—check out parsing data in Excel for practical automation ideas.

Manual Vs Automated Reconciliation Features

Below is a quick look at how manual efforts stack up against the capabilities of an automated template or software tool.

Manual Vs Automated Reconciliation Features

| Feature | Manual Method | Automated Tool |

|---|---|---|

| Transaction Matching | Cross-check statements line by line | Algorithm matches at 99% accuracy |

| Error Flagging | Pore over discrepancies daily | Instant alerts via built-in rules |

| Balance Updating | Copy down formulas manually | Live recalculation on input |

Even a small shift to automation can cut hours from your month-end routine.

Real-World Example From A Design Agency

A boutique design firm slashed reconciliation time by 50% after adding project tags and live-balance formulas. Now, they spot inconsistencies in seconds and resolve them before month end.

“Customizing our sheet cut reconciliation time in half,” says the agency’s CFO.

Best Practices To Keep In Mind

- Keep a master file and copy tabs for each account to avoid mix-ups.

- Archive closed months in a dated folder—this is your safety net.

- Refresh dropdown lists every quarter to reflect your top vendors.

Tailor these strategies to your workflow and watch errors shrink while efficiency climbs.

Solving Common Reconciliation Issues

It’s all too common to spot bank fees that don’t line up with your ledger. Transactions sneak in unrecorded and duplicates inflate your totals. Formula glitches can bury discrepancies, making your ending balance a mystery.

Rather than hunting for random errors, tackle each scenario head-on. Here are the usual suspects:

- Bank Fees that never made it into your sheet

- Missing Deposits or Checks In Transit slipping through the cracks

- Duplicate Entries from imports or manual adjustments

- Date Format Mix-Ups stopping formulas from matching across columns

Formulas That Break

When totals go haywire, start by inspecting your formulas. A stray parenthesis or incorrect range name can derail running balances.

Try these tactics:

- Check each cell reference against your intended layout

- Use Excel’s Evaluate Formula tool to watch the calculation unfold

- Replace hard-coded numbers with dynamic cell links for flexibility

“A quick audit of formulas can restore accuracy in under five minutes.”

Fixing formulas is a solid first step, but you’ll still need to address missing or mismatched data.

Standardize Dates And Imports

Date inconsistencies derail countless reconciliations. Swapping between MM/DD/YYYY and DD/MM/YYYY is an easy trap.

Here’s a handy reference:

| Date Format | Common Issue | Solution |

|---|---|---|

| MM/DD/YYYY | Misread on import | Convert to YYYY-MM-DD |

| DD/MM/YYYY | Spreadsheet auto-switches formats | Manually set locale |

| Text Strings | Formulas ignore text-style dates | Apply the DATEVALUE function |

I once helped a freelancer eliminate 60 mismatches simply by locking every entry into a single date format.

Customizable Reconciliation Checklist

A living checklist is a lifesaver. Mine looks like this:

- Match bank fees line by line with the statement

- Cross-check deposits in transit against cleared transactions

- Flag duplicates using conditional formatting

- Convert text dates with DATEVALUE

- Scan audit logs for hidden edits or removed rows

- Adjust for late fees and service charges

Key takeaway: Let your checklist evolve with your workflow.

Teams using a standard list slash error rates by over 35%.

Audit Logs Reveal Hidden Changes

Audit logs show exactly who edited or deleted a row—and when. It’s the ultimate safety net.

Use these features:

- Roll back unwanted changes via Version History

- Highlight deleted rows before they skew balances

- Export logs to CSV for external review

Review logs right after importing your statement to stop small issues from snowballing. Pro tip: add conditional formatting to flag rows untouched for 30 days.

That simple habit saves hours each month and keeps your cash-flow reports rock solid.

Happy reconciling, everyone!

Best Practices You Need To Know

Make reconciliation a non-negotiable appointment in your calendar. Pick a rhythm—weekly or monthly—that matches your bank’s cycle. Treating it like a regular check-in transforms it from a dreaded task into a clear snapshot of your cash flow.

• Save files with a date stamp in the name (for example, 2024-07-15_Recon.xlsx) so you never wonder which version you’re looking at.

• Keep backups in two spots: a secure local folder and a cloud drive.

• Tag each template by account name to avoid digging through the wrong sheet.

Add a version suffix whenever you tweak a file by hand. Then log every change in a dedicated audit sheet—who did what, when and why.

“Maintaining a clear audit trail is your best defense against errors and audits”

If multiple people touch the template, share it via Google Drive, OneDrive or your ERP. That single source of truth slashes email chains and ensures everyone sees the live file.

Maintaining Regular Reconciliation Habits

Consistency beats intensity. By checking in frequently, you’ll catch mistakes long before they spiral out of control. A local cafe owner I know spotted a duplicated bank fee within an hour of her weekly review—saving her from an unpleasant surprise at month end.

• Block off one hour each Monday to import the latest CSV.

• Match payments, deposits and fees, flagging anything that looks off immediately.

• Wrap up with a quick review, clear your checklist and export your report.

If you script the CSV import and formatting, that whole routine can shrink to a few minutes. And don’t forget backups—accidents happen. A simple three-tier approach works best:

• Local Drive: instant access, offline-friendly

• Cloud Storage: easy sharing, real-time sync

• External Media: air-gapped safety, immune to online threats

| Option | Pros | Cons |

|---|---|---|

| Local Drive | Fast access and offline use | At risk if hardware fails |

| Cloud Storage | Centralized access and live updates | Dependent on internet |

| External Media | Airgapped copy immune to online threats | Requires manual rotation and physical security |

Leveraging Automation Shortcuts

Experienced bookkeepers automate the repetitive stuff. A quick VBA macro can import your CSV, format columns and reset filters in one click—freeing you up to focus on analysis and forecasting.

• Build a macro that sorts by date, recalculates formulas and highlights mismatches.

• Use Google Apps Script to schedule daily imports into your sheet.

• Connect your workbook to an API or ERP so balances update in real time.

Automation adoption has soared as demand for reconciliation software grows alongside a USD 3.5 billion global market in 2024. Discover more insights about account reconciliation software market statistics on IMARC.

Treat these guidelines as your reconciliation playbook. Over time, you’ll spot anomalies faster and keep a tighter grip on cash flow.

“Automating reconciliation transforms crowded spreadsheets into clear financial insights”

Start small, document each step and tweak your system as volume increases.

• Review and update your reconciliation checklist quarterly to capture new best practices.

Errors will fall away as you refine.

Frequently Asked Questions

What Is A Bank Reconciliation Statement Template

A bank reconciliation statement template is essentially a prebuilt spreadsheet that brings your ledger and bank statement into sync. It highlights timing gaps, bank fees, and any transactions you might have missed. By sticking to a consistent layout, every reconciliation follows the same reliable process.

Can I Use This Template For Multiple Accounts

Absolutely. You can duplicate the entire workbook or add an Account column to filter entries on a single sheet. Then, simply rename each tab with the bank or business unit for crystal-clear organization.

- Duplicate tabs per account

- Adjust date ranges to match statement cycles

- Label sheets clearly for quick navigation

How Often Should I Reconcile Accounts

Most small businesses reconcile once a month along with their statement closing date. If your transaction volume is high, consider weekly checks to catch discrepancies early. This approach helps you stay on top of cash flow with minimal surprises.

Customizing Template Tips

What If Formulas Return Errors

Start by verifying cell references—missing rows or shifted ranges often trigger #REF! or #VALUE! errors. Then use your spreadsheet’s error-checking tools to pinpoint broken links. Ensuring numbers and text aren’t mixed usually clears things up.

How Do I Add Custom Fields

Think about what your operation tracks: vendor tags, project codes, or check numbers. Insert new columns and set up data-validation dropdowns to enforce consistency. Add conditional formatting rules to highlight anything that falls outside expected values.

“Adding tags and dropdowns cut our reconciliation time in half,” notes a bookkeeper peer.

Maintenance Best Practices

How Do I Maintain A Template

Keep a master copy stored in the cloud and adopt a simple versioning system like v1, v2, v3. At month’s end, archive completed reconciliations into dated folders. Grant your team view-only access on the master file so no one accidentally overwrites critical formulas.

Ready to say goodbye to manual data entry? Give DocParseMagic a spin at DocParseMagic and see how easily you can test parsing with your own bank statements—for free today.