Automated Invoice Processing Software Explained

If you’ve ever worked in accounts payable, you know the feeling: staring at a mountain of paper invoices, each one demanding your time and attention. Automated invoice processing software is the answer to that all-too-common headache. Put simply, it’s a system that uses smart technology to grab, read, and manage all your invoice information automatically, cutting out the tedious and error-prone manual work for good.

Moving Beyond Manual Data Entry

Think of a librarian manually cataloging thousands of new books—painstakingly writing down every title, author, and publishing date on little index cards. It's slow, mistakes are inevitable, and finding anything later is a real chore. Now, imagine that same librarian simply scanning a barcode, and all that information instantly appears in a searchable digital database. That’s the kind of jump businesses make when they switch to automated invoice processing.

For too long, AP departments have been stuck in that manual, "index card" era. The routine is the same everywhere: an invoice comes in, someone types the details into the system, hunts down the right manager for an approval signature, and then enters it all over again for payment. Every single step is a chance for something to go wrong, leading to expensive errors, late fees, and frustrated vendors.

What Is Automated Invoice Processing Software

At its heart, automated invoice processing software is a specialized tool built to handle all the repetitive tasks that come with supplier invoices. It acts like a super-efficient digital mail clerk and a data entry whiz, completely overhauling your AP workflow from start to finish.

Instead of a person doing the work, the software takes care of the heavy lifting:

- Data Capture: It pulls in invoices from anywhere—email attachments, scanned paper, or digital portals.

- Information Extraction: Using technology like Optical Character Recognition (OCR), it reads the document and pulls out key details like the vendor’s name, invoice number, due date, and line-item amounts.

- Workflow Routing: The system then automatically sends the invoice to the right person for approval based on rules you set, getting rid of those frustrating back-and-forths.

The ultimate goal is to create a "touchless" invoice process. An invoice arrives, gets verified, is approved, and is queued for payment, all with little to no human effort. This frees up your finance team to focus on high-value work, not just pushing paper.

The proof is in the numbers. This technology is catching on fast. The global market for this software is booming, jumping from $33.59 billion in 2024 to $40.52 billion in 2025—that's a massive 20.6% annual growth spurt. It's expected to hit $82.22 billion by 2029, which tells you everything you need to know: automation isn't just a nice-to-have anymore; it's essential. You can read more about the market's incredible trajectory on openpr.com. For businesses looking to stay sharp and efficient, this software is quickly becoming a must-have.

How AI and OCR Power Smart Invoice Automation

At the heart of any modern automated invoice processing system, you'll find two technologies working in tandem: Optical Character Recognition (OCR) and Artificial Intelligence (AI). The easiest way to think about them is as the eyes and the brain of your accounts payable process. Together, they transform a static document, like a PDF invoice, into smart, actionable data that drives the entire workflow.

This powerful duo is what sets today's automation apart from the clunky, rule-based systems of the past. It’s the "secret sauce" that lets the software handle invoices in all sorts of formats without needing a human to step in every time. Let's look at how each piece plays its part.

The Eyes: Optical Character Recognition (OCR)

First things first, the software needs to actually read the invoice. That's where Optical Character Recognition (OCR) comes into play. Think of it like this: when you take a picture of a page in a book, you get an image, but you can't copy and paste the words. OCR technology is what scans that image and turns the letters and numbers into digital text your computer can work with.

But for invoices, modern OCR does more than just basic text conversion. It's the first step in making sense of the document, identifying potential data points—like vendor names, dates, and line items—and getting them ready for the AI to analyze. To get the most out of this, you really need to find the best OCR software for invoices that fits how your business operates.

In short, OCR acts as a digital translator, turning a flat document into a live set of data. It’s the foundation that makes everything else possible, digitizing the information so the AI can do its job.

This tech is the entry point, pulling raw text from any source, whether it's a scanned paper invoice, a PDF attached to an email, or a download from a vendor portal. Without solid OCR, the system simply has no data to work with.

The Brain: Artificial Intelligence (AI)

Once OCR has captured the raw text, Artificial Intelligence (AI) and its partner, Machine Learning (ML), take the baton. This is where the real smarts come in. If OCR provides the words, AI provides the understanding. It acts as the system's brain, getting smarter and more efficient with every single invoice it processes.

This AI-driven brain handles several crucial jobs:

- Intelligent Data Extraction: AI doesn't just see a string of characters; it understands that

INV-9452is an invoice number and that$540.75appearing next to the word "Total" is the amount due. It learns the unique layouts of each vendor's invoices, which means its accuracy improves over time. - Contextual Understanding: The AI can tell the difference between a "shipping date" and a "due date" based on their location and surrounding words—a detail that trips up basic OCR tools. This prevents costly mistakes and ensures data gets filed correctly in your accounting software.

- Anomaly Detection: The system can spot red flags automatically. Think duplicate invoice numbers from the same vendor or a sudden, unexplained price hike for a routine purchase. This provides an automated first line of defense against both fraud and simple billing errors.

This kind of intelligence is a complete game-changer for finance teams. In fact, AI has been shown to cut down on human errors by up to 40%. The industry is taking notice, too. Projections suggest that by 2025, over 60% of finance leaders expect their AP invoice processes to be fully automated, highlighting just how valuable this technology has become.

Putting It All Together

The real magic of automated invoice processing software is how these technologies combine to create a seamless, end-to-end workflow.

Take the classic three-way matching process. The AI-powered system takes the invoice data pulled by OCR and instantly cross-references it with the purchase order (PO) and the goods receipt note. It verifies that the quantities, prices, and item descriptions line up across all three documents.

If everything checks out, the invoice is approved for payment on the spot—no human intervention needed. If there's a mismatch, the system flags the exception and routes it to the right person for review, with all the necessary documents already attached. This transforms a tedious, error-prone chore into a fast and reliable automated checkpoint.

The Real-World Benefits of Invoice Automation

It’s one thing to talk about technology, but what does it actually do for your business? When you switch to automated invoice processing software, you’re not just swapping out an old process for a new one. You’re making a strategic move that delivers real, measurable results across the board. The impact goes way beyond just making the back-office run a little smoother; it creates a positive ripple effect that touches your bottom line, your operational speed, and even your relationships with suppliers.

When you connect the software's features to these kinds of tangible outcomes, building the business case for making a change becomes a no-brainer. The results typically show up in four key areas that every business leader cares deeply about: cost, speed, accuracy, and relationships.

Driving Significant Cost Savings

Let's start with the most obvious win: a dramatic drop in processing costs. Manual invoice handling is surprisingly expensive once you add up the labor, time, and hidden fees. Automation tackles these costs head-on.

The savings really add up from a few different places:

- Reduced Labor Costs: Think of all the hours your team spends just keying in data, double-checking numbers, and chasing down approvals. Automation wipes that busywork off their plates. They can finally focus on more strategic work, and you won't need to hire more people just because your invoice volume is growing.

- No More Late Payment Fees: With automated workflows and reminders, invoices stop getting stuck in someone's inbox. They get processed and paid on time, every time. Those pesky late fees that nibble away at your profits? Gone.

- Capturing Early Payment Discounts: Lots of suppliers offer a small discount for paying early. Manually, it's tough to move fast enough to catch them. Automation gives you the speed and visibility to consistently grab those discounts, effectively turning your AP department from a cost center into a savings generator.

Just imagine: a business processing 1,000 invoices a month could easily save thousands of dollars a year. That's just from dodging late fees and grabbing a 2% discount on even a fraction of their payments. Over time, those small wins compound into a major financial advantage.

The secret is how quickly the software turns a messy invoice document into clean, usable data. If you're curious about the tech behind that, our guide to invoice data extraction software breaks it down.

Achieving Massive Efficiency Gains

Beyond the direct savings, automation gives your accounts payable process a massive speed boost. Tasks that used to drag on for days or even weeks can now be wrapped up in a few hours—or sometimes, just minutes.

This new level of efficiency comes from smoothing out the entire workflow. For example, an invoice that once had to be physically walked from desk to desk for signatures can now be zapped to all approvers at once. They get a notification on their phone or computer and can approve with a click, collapsing an approval cycle that took a week into a single afternoon.

With all this newfound time, your AP team is no longer buried in paperwork. They can shift their attention to higher-value activities like analyzing spending, forecasting cash flow, and building smarter vendor management strategies.

Improving Financial Accuracy and Control

Let's be honest, manual data entry is a breeding ground for mistakes. A single typo—a wrong digit in an invoice number or a misplaced decimal point—can cause overpayments, duplicate payments, and hours of headache-inducing reconciliation work.

Automated software practically eliminates these human errors. Using AI-powered data capture, the system pulls information with incredible precision, instantly checks it against purchase orders, and flags anything that looks off for a human to review.

This creates a single, reliable source of truth for everything you owe. You get a real-time view of your financial obligations, which means you can make much smarter decisions about your cash flow, budgets, and overall spending.

Building Stronger Supplier Relationships

Finally, how you pay your vendors says a lot about your company. Consistently paying late or making mistakes can strain those crucial partnerships, hurting your reputation and maybe even leading to less favorable terms down the road.

When you pay your suppliers accurately and on time, you build trust. It’s that simple. Vendors love the predictability and transparency, and they start to see your company as a great partner to do business with. This not only fosters positive long-term relationships but can also give you more leverage in future negotiations.

Your Implementation Roadmap to Automation

Making the switch to automated invoice processing can feel like a massive project, but it doesn't have to be. The key is to break it down into a clear, manageable roadmap. By following a series of deliberate steps, you can confidently move your team from manual chaos to automated efficiency.

Think of it this way: you're not just plugging in a new tool. You're fundamentally upgrading a core business function. A successful transition is all about smart preparation and knowing exactly what you want to achieve. This roadmap will walk you through the five essential phases, from an honest look at your current state to fine-tuning your new, smarter way of working.

Phase 1: Audit Your Current AP Process

Before you can fix a problem, you have to understand it inside and out. The first step is a no-holds-barred audit of your existing accounts payable workflow. This means you need to map out every single touchpoint an invoice goes through, from the moment it lands on someone's desk (or in their inbox) until it’s paid and filed away.

The real goal here is to find the bottlenecks. Where do invoices get stuck? How many hours are burned on manual data entry? What are the common errors that keep popping up? Pinpointing these specific pain points gives you a crucial baseline to measure your future success against.

Be sure to investigate these key areas:

- Invoice Entry: How long does it actually take someone to key in a single invoice? Time it.

- Approval Cycles: What's the average time from when an invoice is received to when it finally gets approved?

- Error Rates: How often are you dealing with duplicate payments, incorrect data, or price discrepancies?

- Late Payments: What percentage of your vendor payments end up incurring late fees?

Phase 2: Select the Right Software Partner

Once you have a crystal-clear picture of your challenges, you can start shopping for the right automated invoice processing software. This is not a one-size-fits-all situation. The trick is to find a partner whose technology actually solves your specific problems, plays nice with your existing systems, and can grow with your business.

As you evaluate vendors, integration should be at the top of your list. Make sure the platform offers a seamless connection to your current accounting or ERP system. Look for smart features like AI-powered data capture, approval workflows you can actually customize, and analytics that give you real insights. A good partner won't just sell you software; they'll help you solve your problems.

Don't get blinded by a long list of features. The user experience is just as important. The best software is the one your team will actually use. Always schedule live demos and ask for case studies from businesses that look like yours.

Phase 3: Prepare Your Data and Systems

With a partner chosen, it’s time to get your house in order for the transition. This phase is all about laying a solid foundation for a smooth rollout, which means cleaning up your data and getting your systems ready.

This prep stage usually involves a few key tasks:

- Vendor Data Cleanup: Go through your vendor master file with a fine-tooth comb. Make sure all names, addresses, and payment terms are accurate and up-to-date. Clean data is the bedrock of a good automation system.

- System Integration: This is where you work with your new software provider to connect their platform to your accounting system. The goal is a seamless flow of information, eliminating any need for double-entry.

- Workflow Design: Now for the fun part. You get to map out your ideal approval chains and rules for handling exceptions right inside the new software. This is your chance to automate and enforce your internal controls.

Phase 4: Roll Out and Train Your Team

With all the technical groundwork in place, you’re ready to go live. A phased approach is almost always the best bet. Start with a small pilot group or a single department to test the system in a controlled environment. This gives you a chance to gather real-world feedback and iron out any kinks before a company-wide launch.

And then there's training. This is, without a doubt, the most critical part of the rollout. Your team needs to feel comfortable and confident with the new tool. Run comprehensive training sessions that cover not just how to use the software, but why you're making this change. When people understand how it makes their jobs easier, they'll be your biggest advocates.

Phase 5: Measure and Optimize Performance

Your work isn't done just because the software is live. To get the best return on your investment, you have to continuously monitor performance and hunt for ways to make things even better. Go back to those metrics you defined in Phase 1—invoice cycle times, error rates, processing costs—and track them relentlessly.

Use the software's built-in analytics to spot new opportunities for improvement. Are certain approvers always holding things up? Can you tweak a workflow rule to speed things up even more? This constant cycle of measuring and optimizing is what transforms your AP department from a cost center into a data-driven, strategic asset for the business.

Building the Business Case: How to Calculate Your Automation ROI

Let's be honest—any time you propose new technology, the first question from leadership is always, "What's the return?" To get buy-in for automated invoice processing software, you need more than just a vague promise of efficiency. You need a rock-solid business case built on a clear, data-backed Return on Investment (ROI) calculation.

This isn't just about crunching numbers on cost savings. It's about telling a complete story of the value automation delivers, from the obvious financial wins to the less tangible, but equally important, operational upgrades. To make your case truly compelling, you need to blend the "hard savings" with the "soft benefits."

Nailing Down the Hard Savings

Hard savings are the direct, measurable financial gains that will make your finance team sit up and take notice. These are the clean, easy-to-track numbers. The best place to start is by figuring out exactly what your current manual process is costing you.

Here are the key metrics to get a handle on:

- Cost-Per-Invoice: How much time does your team really spend on one invoice, from the moment it lands on their desk to the final payment? Calculate that time, multiply it by their hourly wage, and you'll have your baseline. Automation absolutely slashes this number.

- Late Payment Fees: Pull the records and add up every penalty you paid over the last year. With automated workflows, this figure should realistically drop to zero.

- Early Payment Discounts: This is the hidden gem. How much money did you leave on the table by missing out on early payment discounts? Automation gives you the speed to consistently capture these, effectively turning your AP department into a profit center.

Don't Overlook the Soft Benefits

While it’s tougher to stick a price tag on them, the soft benefits are where the real magic happens. These are the advantages that boost team productivity, strengthen your company's financial footing, and improve strategic decision-making.

Think about the real-world value of:

- Happier, More Productive Teams: When you free your AP staff from the drudgery of manual data entry, they can focus on more valuable work like vendor analysis and cash flow strategy. That's a huge boost for job satisfaction and retention.

- Crystal-Clear Financial Visibility: Imagine having real-time access to invoice data. This unlocks better cash flow management, more accurate financial forecasting, and smarter business decisions.

- Stronger Supplier Relationships: Paying your vendors on time, every time, builds immense trust. That trust can lead to better payment terms, preferential treatment, and a more resilient supply chain.

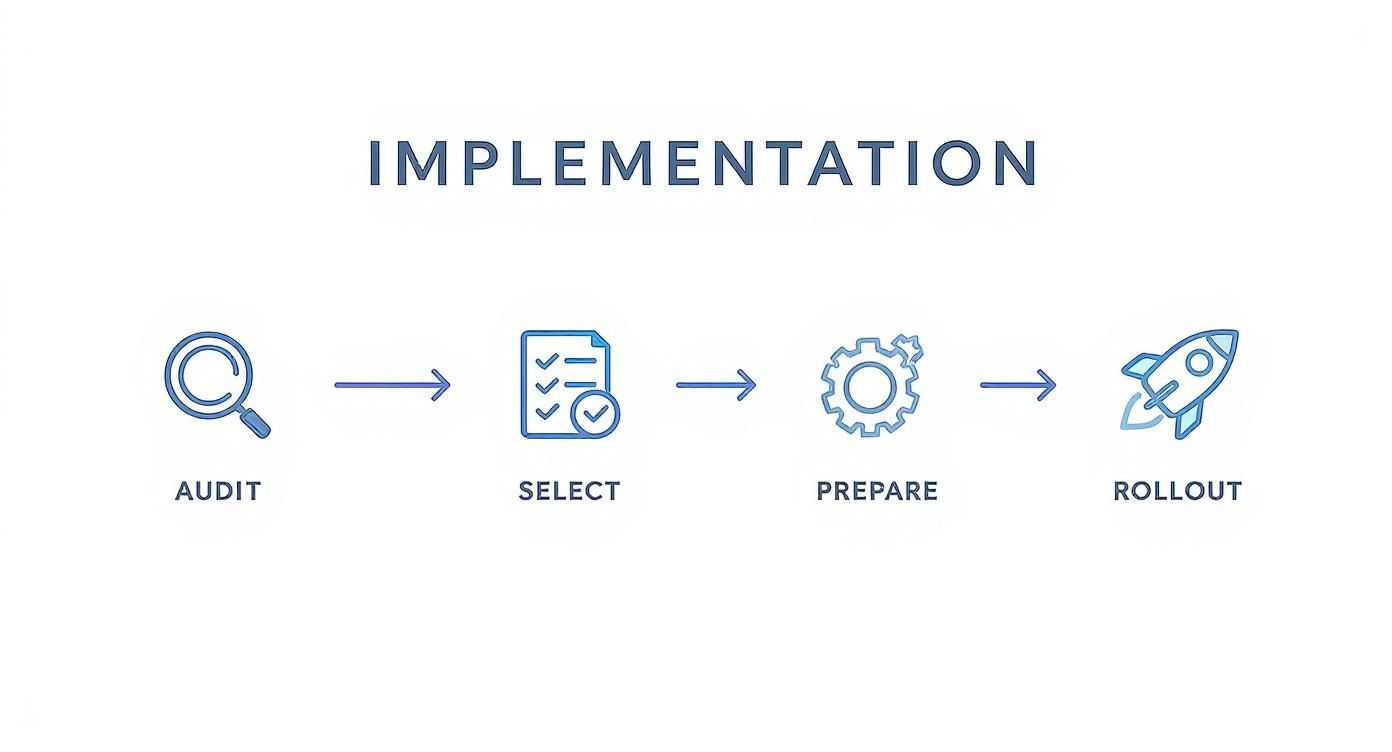

This infographic breaks down the simple, four-step journey that takes you from where you are now to a fully automated system.

As you can see, a structured implementation—starting with a clear audit and ending with a smooth rollout—is the most direct path to seeing a positive ROI.

To get started, it's helpful to track specific metrics before and after you make the switch. This data will be the proof in your ROI pudding.

Key Metrics for Calculating Automation ROI

| Metric | How to Measure | Example Impact of Automation |

|---|---|---|

| Invoice Processing Cost | Total AP department costs (salaries, overhead) / Number of invoices processed | Reduced by 50-80% as manual labor is eliminated. |

| Invoice Cycle Time | Time from invoice receipt to final payment approval | Cut from weeks to just a few days, or even hours. |

| Late Payment Fees | Total fees paid per quarter/year | Reduced to $0 with automated reminders and workflows. |

| Early Payment Discounts Captured | Percentage of available discounts successfully taken | Increased from <20% to over 90%, adding directly to the bottom line. |

| Error Rate | Number of invoices requiring correction due to data entry mistakes | Drastically lowered, minimizing costly rework and disputes. |

Tracking these KPIs provides undeniable evidence of the financial and operational improvements your new system delivers.

Here’s a real-world example: A mid-sized manufacturing company was handling 2,000 invoices a month. After switching to an automated system, they cut their processing time by a staggering 80%. More importantly, they completely eliminated $15,000 in annual late fees and started capturing $25,000 in new early payment discounts. Their investment paid for itself in less than six months.

There's a reason the market for these solutions is booming. Projections show the global Automated Invoice Processing software market is on track to hit $832.7 million in 2025. Modern Software-as-a-Service (SaaS) pricing has made this technology accessible to companies of all sizes, not just giant corporations.

By combining hard data with these powerful operational benefits, you can build a business case that’s impossible to ignore. For a closer look at specific platforms, our accounts payable automation software comparison is a great resource for finding a tool that aligns with your ROI goals.

Common Questions About Invoice Automation

It's natural to have questions when you're thinking about bringing new technology into your business. And when it comes to something as critical as your financial workflow, you need clear, direct answers before you can feel confident making a move. So, let's tackle the most common questions and concerns we hear from businesses looking at automated invoice processing software.

My goal here is to get straight to the point, giving you the clarity you need to decide if this is the right fit. We'll dig into the big topics—security, integration, and flexibility—so you can see how this all works in the real world.

How Secure Is My Financial Data with This Software?

This is usually the first question people ask, and for good reason. Handing over sensitive financial data is a big deal. Reputable software providers get this, and they make security their top priority, building their platforms with multiple layers of protection to guard your information from start to finish.

Think of it like a digital fortress. A solid security framework will always include:

- End-to-End Data Encryption: This means your data is scrambled and unreadable while it's moving and while it's stored. It’s the digital equivalent of an armored truck and a locked vault.

- Compliance with Industry Standards: Look for certifications like SOC 2 and GDPR compliance. These aren't just acronyms; they prove that the provider has passed rigorous, independent audits of their security and data-handling practices.

- Role-Based Access Controls: You get to be the gatekeeper. You can set specific permissions to ensure team members only see the invoice data and functions they absolutely need for their job, which dramatically reduces internal risks.

Don't be shy about asking a potential vendor for the details on their security protocols and certifications. Any partner worth their salt will be completely transparent about how they keep your financial data safe.

Will This Software Integrate with My Accounting System?

Yes, and this is a non-negotiable feature. Any modern automation platform is designed to connect your financial tools, not create another island of data you have to manage. The whole point is to build a smooth, uninterrupted bridge for your information, killing off manual data entry and keeping your books perfectly in sync.

Most of the leading automated invoice processing software solutions come with pre-built connectors for popular systems like QuickBooks, NetSuite, SAP, and Xero. This means getting set up can be as simple as a few clicks. If your business runs on a custom-built or older legacy system, providers usually offer robust APIs (Application Programming Interfaces). These let your own developers build a reliable, custom connection, ensuring you always have a single, accurate source of truth for all your financial data.

How Does It Handle Invoices in Different Formats?

This is where the AI really gets to show off. The best systems are designed to be format-agnostic, which is a fancy way of saying they can intelligently process all kinds of invoice types without skipping a beat. It doesn’t matter if an invoice shows up as a scanned paper document, a PDF, or just an attachment in an email—the system knows what to do.

This magic is powered by AI-driven Optical Character Recognition (OCR). The AI has been trained on millions of different document layouts, so it knows how to find and pull out the important stuff—like invoice numbers, line items, and totals—no matter where they are on the page. Many platforms are also multilingual, making them a fantastic fit for companies doing business across the globe.

Can I Customize Approval Workflows for My Company?

Absolutely. In fact, this is one of the biggest reasons businesses make the switch. No two companies handle approvals the same way, and a good system is built to adapt to your reality, not the other way around.

You can design custom, rules-based approval chains that mirror your company's specific policies. For example, you can easily set up rules based on different criteria:

- Invoice Amount: Automatically send any invoice over $10,000 straight to the CFO.

- Vendor: Route all invoices from a key supplier to a specific project manager for review.

- Department: Make sure all marketing invoices are seen and signed off on by the department head.

- PO Matching: Create a rule to instantly approve any invoice under $1,000 as long as it perfectly matches an existing purchase order.

This level of control ensures your internal financial rules are followed every single time, automatically. It tightens up compliance and gets invoices paid faster, all without losing an ounce of oversight.

Ready to stop the manual data entry grind and see what AI-powered automation can do for you? DocParseMagic extracts data from any invoice into a clean spreadsheet in under a minute, saving you hours of tedious work. Try it free and see your first results today at https://docparsemagic.com.