Automated Claims Processing An Essential Guide

Think about the last time you dealt with an insurance or healthcare claim. Was it a mountain of paperwork? A black hole of waiting? Now, imagine that entire process shrinking from weeks to mere minutes. That’s the core idea behind automated claims processing.

It’s like the difference between sending a letter by postal mail and sending a text message. One is slow, uncertain, and clunky; the other is instant, verified, and efficient.

From Paper-Piling to Problem-Solving

For decades, the claims industry has been stuck in a cycle of manual work. Picture an adjuster’s desk piled high with forms. Each piece of paper requires a person to read it, type the information into a system, and check it against policy rules.

This old-school approach isn't just slow—it's a recipe for trouble. Every claim handled by hand is an opportunity for human error, whether it's a simple typo in a policy number or a complex misunderstanding of coverage.

These tiny mistakes cause massive delays. A single error can reject a claim, sending it right back to square one. This kicks off a frustrating chain of phone calls and emails, stretching a process that should take hours into weeks. In fact, studies show manual processing can cost up to 10 times more than an automated equivalent.

How Automation Changes the Game

Automated claims processing breaks this inefficient cycle by letting technology do the heavy lifting. Instead of an employee spending their day on data entry, intelligent software can read, understand, and validate information in the blink of an eye.

This shift delivers a powerful one-two punch:

- Slashes Processing Time: Claims that once crawled through the system for weeks can be settled in minutes.

- Wipes Out Human Error: Automation ensures data is entered correctly and checked against policy rules with 100% consistency.

- Cuts Operational Costs: Less manual work and fewer corrections mean lower administrative overhead.

- Boosts Customer Happiness: Getting paid faster with clear communication makes for a much better customer experience.

The age of endless paperwork is finally giving way to a new standard of efficiency, with modern solutions built to significantly speed up claim resolutions.

By taking over the repetitive tasks, automation frees up your team to focus on what humans do best: handle complex cases, show empathy, and solve real problems for your customers. It’s about shifting your most valuable resource—your people—from tedious data entry to high-impact work.

How Automated Claims Processing Actually Works

To really get what makes automated claims processing so effective, you have to follow a claim's path from start to finish. It’s less of a single action and more like a perfectly choreographed relay race, where technology hands off tasks with incredible precision. This completely sidesteps the usual delays and human errors that bog down manual workflows, turning what used to be a week-long headache into a process that can take just minutes.

It all kicks off the moment a customer files a claim, usually through a web portal or a mobile app. This initial submission is what we call the First Notice of Loss (FNOL). In an automated system, this isn't just a form being filled out; it’s the starting gun that sets the entire chain of events in motion, instantly creating a digital case file and starting the validation process.

This visual really captures the shift from piles of paperwork to high-speed, automated resolution.

As you can see, the fundamental change is swapping slow, mistake-prone paper shuffling for a clean, tech-driven workflow that gets things done way faster.

Stage 1: Data Capture and Extraction

Right after the FNOL is logged, the system gets to work gathering all the related documents. This could be anything from photos of a dented car bumper to a medical invoice or a police report. This is where smart technologies like Optical Character Recognition (OCR) and Natural Language Processing (NLP) step in to act as digital translators.

- OCR is the tech that scans all the documents—even messy handwritten notes or a blurry photo from a phone—and turns them into text the computer can read.

- NLP takes it a step further by actually understanding the context of that text. It knows how to spot and pull out the crucial bits of information, like names, policy numbers, dates, and what actually happened.

This first stage alone cuts out countless hours of mind-numbing manual data entry. You can get a deeper look into how this technology works by reading our guide on what is intelligent document processing.

The big takeaway here is that automated extraction isn't just a fancy copy-paste. It's about taking messy, unstructured information and organizing it into a clean, structured format the system can use immediately. This is where you can see savings of up to 80% on processing costs.

Stage 2: Validation and Verification

With all the data pulled and neatly organized, the system switches into detective mode for the validation phase. It instantly cross-references the claim information with the customer’s policy details stored in your main system.

This automated check confirms a few critical things right away:

- Is the policy active? The system makes sure the customer's policy was current and in good standing when the incident occurred.

- Is the loss actually covered? It compares the claim against the specific coverages, limits, and deductibles in that person's policy.

- Does everything add up? The system is great at flagging inconsistencies or missing info, like a wrong address or a forgotten signature, before it becomes a problem.

This step is a gatekeeper, ensuring only valid and complete claims move forward. It prevents that frustrating back-and-forth that happens when someone finds an error halfway through the process.

Stage 3: Adjudication and Routing

Here’s where the real decisions get made. For straightforward, low-risk claims, an AI-powered rules engine takes the lead. This engine is programmed with an insurer’s specific business logic and all the relevant regulations. If a claim checks all the right boxes—think a simple windshield replacement that falls under a certain dollar amount—it can be approved on the spot. We often call this "touchless" processing.

But let's be real, not every claim is that simple. When the system sniffs out complexity, ambiguity, or red flags for potential fraud, it doesn’t just shut down. It smartly routes the claim to the right human expert. A tricky liability claim might get escalated to a senior adjuster, while a suspicious case is flagged for the special investigations team. To ensure precision, these systems often use specific formulas for valuations, like those found in a Diminished Value 17c Calculator.

Stage 4: Settlement and Payment

The final lap is all about closing the loop. Once a claim is approved (either by the system or a person), the platform automatically calculates the final payout, factoring in any deductibles or policy limits.

From there, it triggers the payment through whatever method the customer prefers—a direct deposit, a check, or another digital wallet. At the same time, the system generates all the closing paperwork and updates the customer’s file, leaving a perfect audit trail. It’s this seamless final step that wraps up a positive customer experience and locks in all the efficiency gains from the entire process.

The Core Technologies Driving Automation

An automated claims processing system is a bit like a high-performance engine. From the outside, it looks like a single, powerful unit, but under the hood, a handful of sophisticated technologies are working in perfect sync. Getting to know these core components is the key to understanding how automation can take a clunky, paper-heavy process and make it run like a well-oiled machine.

The "brains" of the entire operation are Artificial Intelligence (AI) and its powerful offshoot, Machine Learning (ML). AI gives the system its ability to reason, analyze, and make decisions in a way that mimics a human adjuster.

Machine Learning, on the other hand, is what allows the system to get smarter over time. It sifts through mountains of historical claims data, learning to spot patterns, identify potential red flags, and even predict outcomes. This is how the software can catch subtle signs of fraud that might otherwise go unnoticed, contributing to the estimated $80 billion saved annually by reducing fraud in the U.S.

Robotic Process Automation: The Digital Workforce

If AI and ML provide the brainpower, then Robotic Process Automation (RPA) provides the tireless "hands" to do the heavy lifting. RPA deploys software bots to handle all the repetitive, rule-based tasks that bog down your human team.

Think of these bots as a digital workforce that never needs a break. They're perfect for jobs like:

- Pulling data from an email and plugging it into the claims management system.

- Logging into various portals to gather policy details.

- Sending out standardized acknowledgment letters to claimants.

By delegating these monotonous chores to RPA, your skilled adjusters are freed up to focus on the work that truly requires a human touch, like talking to customers or negotiating tricky settlements. It’s the foundational layer of automation that builds speed and consistency into the process.

Intelligent Document Processing: Turning Paper Into Data

One of the biggest hurdles in claims has always been the sheer volume of unstructured documents—think PDFs, photos, and scanned forms. This is where Intelligent Document Processing (IDP) steps in, acting as the system's expert translator.

IDP uses a combination of technologies to not just read documents but actually understand what’s in them. It starts with Optical Character Recognition (OCR), which turns images of text into usable digital data. You can learn more about what optical character recognition is and how it forms the basis for modern document handling.

But IDP is much more than just OCR. It uses AI to interpret the context of the data it extracts. For example, it knows the difference between a "date of loss" and a "date of birth" and can pinpoint a policy number even if it's in a different spot on every form. This intelligent extraction is what allows the system to be fed accurate, structured information automatically, without manual keying.

IDP is the bridge between the messy, real-world formats of submitted evidence and the clean, organized data that an automated system needs to function. It effectively eliminates the manual data entry bottleneck.

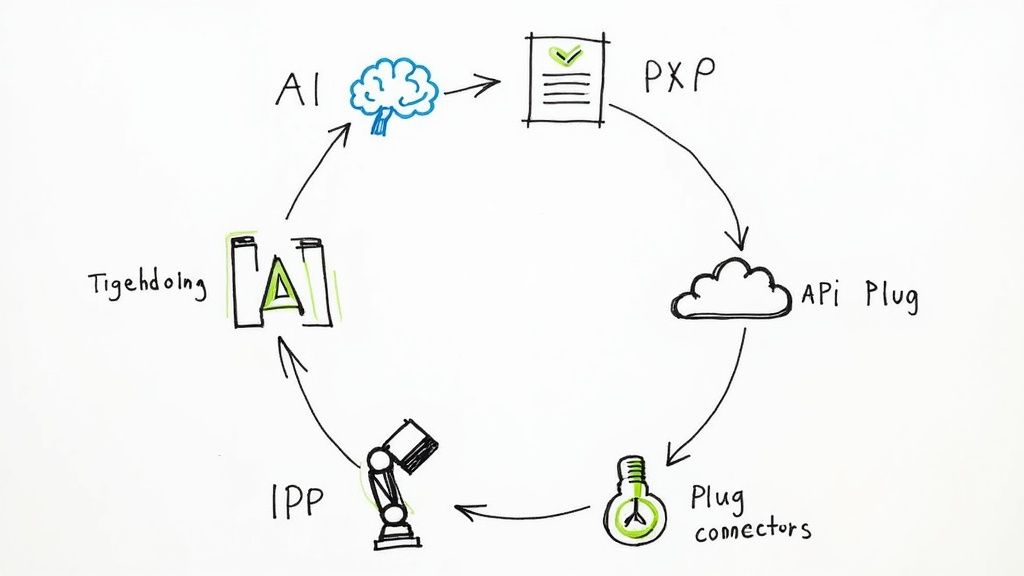

APIs: The Connective Tissue

So, how do all these different technologies work together without a hitch? The secret ingredient is Application Programming Interfaces (APIs). APIs are the messengers that allow separate software systems to communicate and share information seamlessly.

In an automated claims workflow, APIs are the connective tissue holding everything together.

- An API connects your customer-facing portal to the IDP software.

- Another API links your claims system to your main policy administration platform.

- A third API might ping an external database to run a quick fraud check.

This integration is what creates a truly unified, end-to-end process. Instead of having isolated systems that require someone to manually move information from one to the other, APIs create a cohesive ecosystem where data flows instantly and accurately. They complete the tech stack that makes modern claims automation possible.

The Business Case for Automating Claims

Moving to an automated claims system isn't just a tech upgrade—it's a smart business move with a very clear return on investment. The payoff goes way beyond convenience. We're talking measurable gains in efficiency, accuracy, and even the happiness of your customers and employees. When you ditch the old paper-shuffling manual workflows for an intelligent system, you gain a real competitive edge.

The core value here is built on solid results that directly boost your bottom line and make your operations more stable. Let's dig into the three key reasons that make automating your claims process such a no-brainer.

Radical Efficiency Gains

The first thing you'll notice is a massive speed boost. Manual claims handling is slow by nature, weighed down by endless data entry, shuffling physical documents, and a constant back-and-forth to fix mistakes. Automated systems simply blow past these bottlenecks. They work at machine speed, around the clock.

This speed directly translates into cost savings. The impact of automated claims processing is huge, with some studies showing it can cut processing times by as much as 50%. That kind of efficiency gain often leads to a 20-30% drop in operational costs.

Take, for example, a global third-party administrator that switched to an automated document management system. They sliced their claim lifecycle in half and saved $1.3 million a year. You can find more real-world examples and future trends over at insights.conduent.com.

Unbreakable Accuracy and Compliance

Let's face it, human error is an expensive part of any manual process. One wrong digit in a policy number or a missed detail can lead to a denial, which means costly rework and an unhappy claimant. Automation brings a level of consistency and precision that humans just can't match.

Think of an automated system as your perfect, tireless auditor.

- Eliminates Data Entry Errors: It uses technology to pull information directly from documents, getting rid of typos for good. You can see exactly how this works in our deep dive on business document processing.

- Ensures Consistent Rule Application: The system applies your specific business logic and regulatory rules to every single claim, every single time. No exceptions, just fair and consistent results.

- Creates a Perfect Audit Trail: Every single action, from the moment data is extracted to the final decision, is automatically logged. This leaves you with a flawless, searchable record that makes compliance checks and internal reviews a breeze.

This precision doesn't just cut the costs of fixing mistakes; it also reduces compliance risks and builds your organization’s reputation for reliability.

By removing the element of human variability from routine checks, automation ensures that every claim is judged against the same precise standards, building a foundation of trust and reliability.

Enhanced Human Experience

Finally, the business case is about people—both your customers and your employees. For customers, a slow, confusing claims process is one of the quickest ways to lose their business.

Faster payouts and clear, automated updates create a much better experience, which builds loyalty in a crowded market. When a claim gets settled in days instead of weeks, it confirms to the customer that they made the right choice by picking your company.

Internally, automation completely changes the game for your skilled claims adjusters. It frees them from the boring, repetitive tasks and lets them focus on the high-value work that truly requires a human touch—like empathy, negotiation, and complex problem-solving. Instead of chasing paperwork, they can tackle the tough cases, comfort clients in distress, and make judgment calls a machine never could. This shift leads directly to higher job satisfaction, better employee retention, and a smarter, more effective claims department.

Manual vs Automated Claims Processing A Direct Comparison

To really see the difference, it helps to put the two approaches side-by-side. The table below breaks down how automation stacks up against the old way of doing things across several key metrics. The contrast is pretty stark.

| Metric | Manual Processing | Automated Processing |

|---|---|---|

| Speed | Slow; days or weeks per claim | Fast; minutes or hours per claim |

| Cost | High labor and operational costs | 20-30% lower operational costs |

| Accuracy | Prone to human error (typos, missed details) | Highly accurate with minimal errors |

| Scalability | Difficult; requires hiring more staff | Easy; handles volume spikes without added staff |

| Compliance | Inconsistent rule application, difficult audits | Consistent rule application, built-in audit trails |

| Customer Experience | Often frustrating due to delays and opacity | Positive due to speed and transparency |

| Employee Focus | Repetitive, low-value administrative tasks | Complex, high-value problem-solving |

As you can see, the shift to automation isn't just an incremental improvement. It represents a fundamental change in how claims are handled, delivering superior results across the board.

Your Practical Implementation Roadmap

Let's be honest: bringing in an automated claims processing system can feel like a massive project. But with a smart plan, it’s just a series of manageable steps. A solid roadmap makes the transition smooth, keeps disruptions to a minimum, and starts delivering real value almost immediately. The idea is to build momentum, prove the concept works, and get your team excited from day one.

This isn't about flipping a switch and hoping for the best. Think of it more like building a bridge. You start with a strong foundation, add each section carefully, and test it thoroughly before you let all the traffic flow.

Audit Your Current Process

Before you can build something better, you need a painfully honest blueprint of what you have right now. Map out your entire claims workflow, from the moment a claim comes in to the final payment going out. The key is to pinpoint exactly where things get slow, messy, or just plain broken.

Ask yourself the tough questions:

- Where are the data entry errors costing us the most?

- Which steps involve endless back-and-forth emails and phone calls?

- How long does a "simple" claim really take to get through the pipeline?

This audit gives you a clear baseline. It's the "before" photo that will make the "after" look that much more impressive.

Define What Success Looks Like

Once you know your pain points, you can set clear, measurable goals. Vague targets like "improving efficiency" won't cut it. You need specific key performance indicators (KPIs) that directly tackle the problems you uncovered in your audit.

Your goals should sound more like this:

- Cut the average claim processing time by 40%.

- Drop the denial rate for a specific claim type by 15%.

- Lower our cost-per-claim by a concrete dollar amount.

These numbers will be your North Star throughout the project and give you hard data to prove its ROI later.

A successful implementation isn't just about installing new software; it's about solving specific business problems. Concrete metrics ensure everyone is focused on the same tangible outcomes.

Select the Right Tech Partner

Choosing your technology and implementation partner is probably the single most important decision you'll make in this process. You're not just buying software; you're looking for a partner who understands your business and can grow with you. A great partner acts more like a guide than a vendor, helping you navigate the whole transition.

When you're evaluating your options, focus on these three things:

- Ease of Integration: How well will this platform play with your existing systems, like your policy administration or accounting software? A messy integration is a non-starter.

- User Experience: Is the interface actually intuitive for your claims team? If it's clunky and confusing, they won't use it.

- Support and Training: Do they offer solid onboarding and ongoing support? Your team needs to feel confident and supported from day one.

Start with a Phased Rollout

Trying to automate everything all at once is a classic recipe for disaster. The smartest move is a phased rollout. Pick a single, high-volume, and relatively simple claim type for a pilot project. This is your proof of concept.

This approach lets you iron out the kinks in a low-risk environment, show off some early wins to get management on your side, and build confidence within the team. Once that pilot is a success, you can start expanding automation to more complex claims. This is especially true in sectors like healthcare, where nearly 50% of providers still rely on manual processes. Getting it right can slash processing time by as much as 70%. You can discover more about reducing medical claims errors to see just how big of an impact this can have.

Focus on Effective Change Management

Finally, never forget that technology is only half the battle—the other half is your people. Good change management is what makes or breaks these projects. You need your team to embrace the new system, not fight it.

Be transparent about why this change is happening. Frame it as a way to make their jobs more strategic and less tedious, not as a threat to their roles. Provide excellent training, and identify a few internal champions who can help their colleagues along the way. A truly successful implementation is when your team feels empowered by the new tools, not replaced by them.

The Future of Claims Is Already Here

While today's automation is all about making old processes faster and more accurate, the next wave of innovation is about to completely change the game. We're on the brink of shifting from simply processing claims to actively predicting and preventing losses. This isn't science fiction; it’s the next logical step, built right on top of the automated claims processing systems we have today.

Think of it like this: current automation is a high-speed train. It’s incredibly fast and efficient, but it can only follow the tracks that have been laid. The future is a self-driving car, capable of navigating the world dynamically and making intelligent decisions in real-time.

The Rise of Generative AI

One of the most powerful forces behind this change is Generative AI. This isn't just about reading and sorting data anymore. This technology can actually create new, original content that's practically indistinguishable from what a person would write.

Imagine an AI that can instantly draft a clear, empathetic email to a customer explaining why their claim was denied, or one that generates a perfect one-paragraph summary of a complex case for an adjuster. This kind of tool frees up your most skilled people from tedious communication tasks, letting them focus on what they do best: applying their judgment and talking to customers. You get a more human-centric service, delivered with the speed of a machine.

Predictive Claims with IoT Data

The next frontier is using real-time data from the Internet of Things (IoT) to get ahead of claims before they even start. Smart devices are everywhere, from cars to homes, and they are constantly sending out signals that can point to potential risks.

- In-Car Telematics: A sensor in a car can detect a collision the second it happens, automatically kicking off the First Notice of Loss (FNOL) process and even dispatching emergency services.

- Smart Home Sensors: A tiny water sensor in a basement can detect the beginning of a leak and instantly alert both the homeowner and the insurer. This allows for immediate action to prevent a minor issue from turning into a massive, expensive water damage claim.

This proactive approach completely flips the script. The claims department transforms from a reactive cost center into a genuine partner in risk management, aiming to stop the loss from ever occurring.

By 2025, it's expected that around 60% of all insurance claims worldwide will use automated systems for triage and decision-making. This huge shift shows just how committed the industry is to touchless processing. Better yet, companies using these systems have already seen up to an 80% reduction in processing errors, proving just how reliable the technology is. For a deeper dive, check out this guide on the transformative power of claims process automation.

The Dawn of Truly Touchless Claims

Ultimately, all of these advancements are pointing toward one thing: "touchless claims." This is a future where a straightforward claim—whether it's a minor fender-bender or a routine medical procedure—is handled from start to finish with zero human intervention.

The system will take in the data, check it against the policy rules, run it through advanced fraud-detection models, and trigger the payment, all in a matter of minutes. This isn't just about being fast. It's about delivering a completely seamless and stress-free experience for the customer at a time when they need it most. Automation isn't just a tool for today; it's the foundation for the next generation of insurance.

Frequently Asked Questions

Switching to automated claims processing naturally brings up some important questions. You might be wondering about how it affects your team, the security of your data, or just how long it takes to get everything up and running. Let's tackle those common concerns head-on.

Getting straight answers is the best way to feel confident about making the move. Here’s a look at what people usually ask.

Will Automation Make My Team Obsolete?

Not at all. The goal of automation isn’t to replace your expert adjusters, but to free them from the mountain of repetitive work that comes with simple claims. Think of it as giving your best people a powerful assistant.

The system handles the tedious, high-volume tasks, which lets your skilled team focus on what they do best: managing complex, high-stakes claims. These are the cases that demand critical thinking, negotiation, and a human touch—things no machine can do. Your team's role actually becomes more strategic and valuable, shifting from data entry to high-impact problem-solving.

Automation elevates the role of a claims adjuster. Instead of just processing paperwork, they become strategic decision-makers focused on the nuanced cases that truly matter.

How Do I Know My Data Will Be Secure?

This is a top priority, and modern automation platforms are built for it. Security isn't an afterthought; it's a core feature. These systems use enterprise-grade security measures like end-to-end data encryption, both when your data is moving and when it's stored.

They also operate on a "need-to-know" basis with strict access controls, so only authorized people can view sensitive information. Every action is logged in a detailed audit trail, creating a clear record for compliance with regulations like HIPAA or GDPR. In many ways, automation is more secure than manual processing because it reduces the risk of human error and keeps physical documents out of the equation.

How Long Does It Take to Get Started?

The timeline really depends on the scale of your operation, but you don't have to boil the ocean all at once. The smartest approach is to start small with a pilot program. You could get a system up and running for a single claim type in just a few months.

This lets you prove the value quickly and get your team comfortable with the new process. From there, a full-scale, company-wide rollout might take anywhere from six months to a year, depending on how many different systems you need to connect with. A good partner will lay out a clear roadmap and be there to help you every step of the way.

Ready to eliminate manual data entry and reclaim hours of valuable time? DocParseMagic uses AI to extract structured data from any document—invoices, forms, receipts—and deliver a clean spreadsheet in under a minute. Start your free trial and see the results for yourself at https://docparsemagic.com.