automate accounts payable process: Streamline Approvals

Automating your accounts payable means swapping out old-school manual tasks—think data entry, invoice matching, and chasing approvals—for a software-driven process. The whole point is to cut down on mistakes, get vendors paid faster, and give your finance team their time back. It's about turning a clunky, expensive part of your business into something efficient and smart.

Why Manual AP Is Holding Your Business Back

Let's be real for a moment. Manual accounts payable is a massive drain on your company's resources, time, and even morale. It’s an endless loop of printing invoices, hunting down signatures, and punching numbers into a spreadsheet, all while hoping you don't make a costly mistake. This old way of doing things doesn't just make payments slow; it actively kneecaps your company's financial flexibility and stalls growth.

The direct costs are pretty shocking when you add them all up. Between the hours spent on data entry, performing three-way matching, and fixing inevitable errors, the cost to process just one invoice can be eye-wateringly high. Those costs add up fast, turning your AP department from a strategic asset into a major cost center.

The Hidden Costs of Human Error

Any process that relies on human hands is going to have errors. It's just a fact. A simple typo can lead to a significant overpayment, a misplaced decimal can throw off your entire month's reporting, and a lost invoice can mean late fees and a strained relationship with a key supplier. Every single mistake eats up valuable time to track down and fix, pulling your team away from work that actually moves the needle.

The real problem with manual AP isn't just that it's slow; it's the total lack of visibility. When invoices are sitting on someone's desk or buried in an email thread, you have no real-time control over your cash flow. You're essentially flying blind.

The Strategic Shift to Automation

Moving to an automated system isn't just about getting new software; it’s a fundamental strategic decision. When you automate the accounts payable process, you're changing it from a reactive, paper-pushing chore into a proactive, data-driven engine. This gives you a crystal-clear, up-to-the-minute view of your company’s financial obligations and cash position.

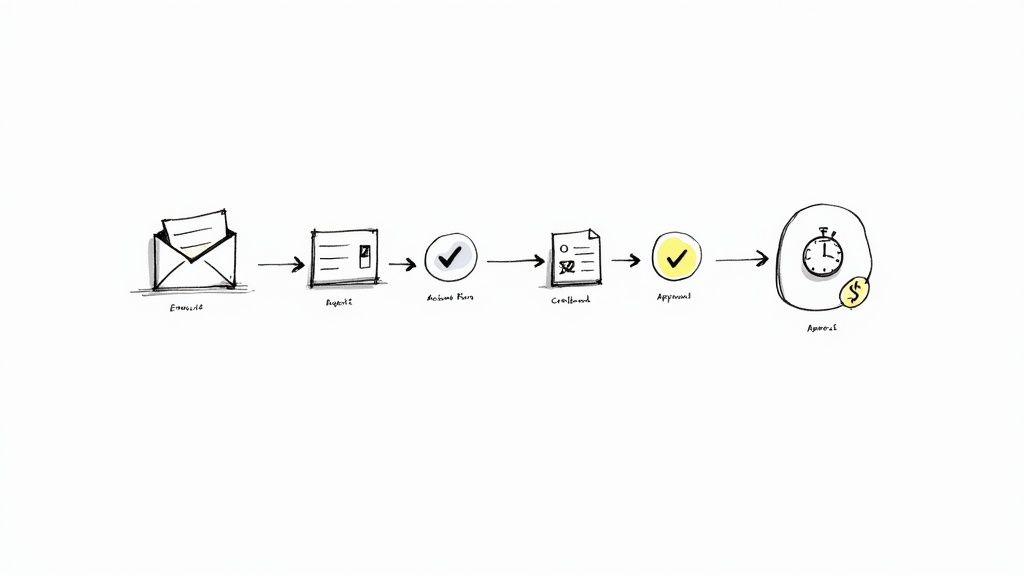

As you can see, the typical AP workflow is full of steps that are perfect candidates for automation, from the moment an invoice arrives to when the payment goes out.

Each of these stages is an opportunity to get rid of manual touchpoints, clear out bottlenecks, and have your internal controls enforced automatically.

This isn't some future-forward idea anymore; it's becoming the standard. Globally, roughly 50% of companies have already made the switch to automated AP systems. The result? They've seen an average 29.2% reduction in invoice processing costs. These numbers aren't trivial—they highlight the immediate financial upside of ditching manual methods. For a deeper dive, you can check out the full accounts payable trend report.

Ultimately, automation is no longer a "nice-to-have." It’s essential for staying competitive and building a resilient financial operation.

Mapping Your Current AP Workflow

Before you even think about shopping for software, you have to get an honest look at how things work right now. I've seen too many companies jump straight to demos without this foundational step, and it almost always leads to choosing the wrong tool for the job. You can't automate a process you don't fully understand.

So, grab a whiteboard, pull your team into a room, and physically trace the life of an invoice. Start from the moment it lands in someone’s inbox or on their desk. Who touches it first? Where does it go for approval? How is it entered into the system? Be brutally honest. This isn’t just about making a flowchart; it’s about uncovering the hidden friction that’s costing you time and money.

Identifying the Real Bottlenecks

As you map everything out, the pain points will start to become obvious. These are the areas where work grinds to a halt, and they're your prime targets for automation. Don't just assume you know where the problems are—talk to the people who live this process every day.

You'll likely find the usual suspects:

- Manual Data Entry: The soul-crushing task of typing invoice data from a PDF into your accounting software. It's not just slow; it’s where most of the errors happen.

- Chaotic Approval Chains: Chasing down managers for a signature is a full-time job for some AP clerks. Invoices get buried in email threads or lost in a pile of paperwork, delaying payments and frustrating vendors.

- The Three-Way Match Nightmare: Manually lining up purchase orders, receiving reports, and invoices is critical for financial control, but it's an absolute time sink when done by hand.

The key is to put numbers to the pain. Don't just settle for "approvals take too long." Dig deeper. Find out that, on average, it takes 8.4 days to get an invoice signed off. That specific, hard number is what builds a compelling case for investing in a better way.

Calculating the True Cost of Inaction

Once you’ve pinpointed the bottlenecks, it’s time to figure out what they’re actually costing you. This is where you get management’s attention. Calculate the hours your team spends on these manual tasks and multiply that by their loaded hourly rate. The "cost per invoice" is a powerful metric, and it’s probably much higher than you think.

This is where you can see the immediate value of a new system. For example, technologies like Intelligent Document Processing (IDP) can make manual data entry a thing of the past. If you want to dive deeper, you can learn more about what is Intelligent Document Processing and see how it automatically reads and extracts invoice data, turning your biggest bottleneck into a hands-off, automated step.

With a detailed map and a solid cost analysis in hand, you’re ready to set meaningful goals. Instead of a vague objective like "improve efficiency," you can aim for something concrete: "Cut our invoice processing time from 15 days to 3," or "Start capturing 95% of our available early payment discounts." This approach ensures you choose a solution that solves your actual problems and delivers a return you can actually measure.

Finding the Right AP Automation Software

Walking into the world of AP automation software can feel like stepping into a crowded, noisy marketplace. Everyone's shouting about their features, but the trick is to find the tool that actually solves your company's problems. It’s less about finding the “best” software and more about finding the right fit for your specific pains and growth plans. I’ve seen companies rush this decision and end up with a system that just adds another layer of complexity instead of taking it away.

So, where do you start? The first real fork in the road is figuring out what kind of solution you actually need.

If you’re a small business wrestling with a few hundred invoices a month, your main headache is probably manual data entry. In that case, a dedicated invoice capture tool using Optical Character Recognition (OCR) could be exactly what you need. These are lean, focused tools designed to do one thing exceptionally well: pull data off an invoice and push it into your accounting software. They save a ton of time.

But if you’re a larger organization or one that's scaling fast, you’ll quickly outgrow a simple capture tool. You're probably looking for a full procure-to-pay (P2P) suite. These platforms are the whole package, handling everything from creating the initial purchase order to processing the final payment, including complex approval chains and three-way matching.

Core Features That Actually Matter

Don't get bogged down by flashy dashboards or a million bells and whistles. When you're evaluating software, zoom in on the core engine that powers the whole thing.

-

Smart OCR and AI: You need more than just basic text recognition. A truly intelligent system understands context. It knows that "Inv. #" and "Reference" both mean "invoice number." This is the secret sauce that reduces the need for a human to double-check every single field.

-

Customizable Approval Workflows: Your approval process is unique to your business. The software has to be flexible enough to let you build rules based on vendor, department, or invoice amount. A rigid, one-size-fits-all workflow just creates bottlenecks and frustration.

-

Rock-Solid Accounting Integration: This one is non-negotiable. The tool absolutely must have a seamless, two-way sync with your financial system of record, whether that's QuickBooks, NetSuite, or Xero. If you have to manually export and import data, you haven’t truly automated anything.

The real win here isn't just about digitizing a messy paper process. It's about letting the software enforce a new, more efficient workflow. A great system doesn’t just make you faster; it makes you better.

Matching the Tool to Your Company's Stage

A common mistake is buying software that doesn't match your company’s size or complexity. A startup paying for enterprise-level features is wasting money, while a growing company that picks a tool with no room to scale will have to go through this whole painful process again in a year. Think about your needs today, but also have a serious conversation about where you'll be in three to five years.

To get a feel for what’s out there, our guide on the best accounts payable automation software breaks down how different platforms compare.

The market itself tells a compelling story. Valued at $3.08 billion in 2023, the global AP automation space is booming for a reason—businesses are seeing real, measurable returns from this technology. You can explore more accounts payable statistics to get a better sense of the industry trends.

AP Automation Software Feature Comparison

Choosing the right software often comes down to understanding which features are must-haves for your current operations versus which are nice-to-haves for future growth. This table breaks down the essentials from the more advanced capabilities.

| Feature Category | Essential for Small Businesses | Advanced for Scaling Enterprises |

|---|---|---|

| Data Capture | OCR for basic invoice data extraction (vendor, date, total) | AI-powered line-item extraction, multi-language support |

| Approval Workflows | Simple, single-step or two-step approval chains | Multi-step, conditional workflows based on complex rules |

| Integration | Direct sync with QuickBooks, Xero, or other common SMB software | API access, custom ERP integration, multi-entity support |

| Payment Processing | Basic ACH and check payment capabilities | Global payment processing, virtual cards, early payment discounts |

| Reporting | Standard dashboards for invoice status and aging reports | Customizable analytics, accrual reports, spend analysis |

Ultimately, picking the right software is about finding a partner for growth. Start with a solution that solves your biggest headaches right now, but make sure it has the power to support you down the road.

Rolling Out Your Automated AP System

You’ve picked your software. Now the real work begins: bringing that system to life. This is the implementation phase, where your plans to automate the accounts payable process become a reality. The trick is to do it in stages to avoid throwing your daily operations into chaos. You’re not just flipping a switch here; you’re managing a careful transition.

A successful rollout always starts with your data. The first big hurdle is usually migrating all your vendor information. You'll need to work closely with your software provider to get a clean import of your master vendor files—all the names, contacts, payment terms, and tax info. Getting this right from the start prevents a world of headaches, like payment errors and frustrating delays down the line.

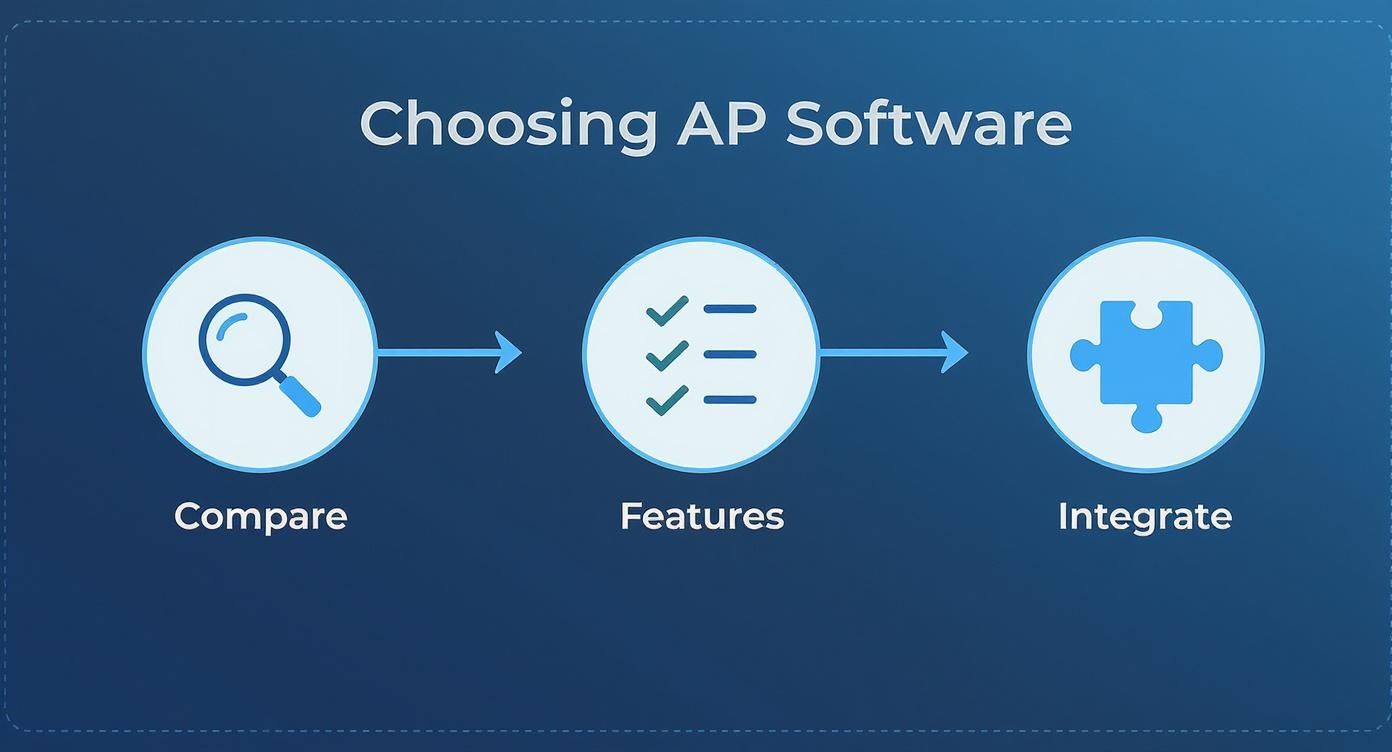

This visual guide breaks down the core steps you'll navigate as you select and integrate your new AP software.

From comparing your options all the way through to ensuring the system integrates deeply with your other tools, each step is critical for building a system that actually helps your business.

Configuring Smart Approval Workflows

This is where you take that process map you built and translate it into digital rules inside your new software. Modern AP systems let you create incredibly specific approval chains that automatically send invoices to the right person based on rules you set. This is far from a one-size-fits-all setup.

For example, you can create rules that route invoices based on:

- Invoice Amount: Anything under $1,000 might go straight to a department manager, while invoices over $10,000 require a sign-off from the CFO.

- Department or Project: Invoices for a marketing campaign get routed to the CMO, while costs tied to a specific construction job go directly to the project manager.

- Vendor Type: You could create an accelerated approval path for key suppliers to make sure you always capture those early payment discounts.

This step completely replaces the manual chase of figuring out "who needs to sign this?" with a fully automated and auditable trail. You're essentially building your company's internal controls directly into the software, which keeps you compliant without slowing things down.

Driving Team and Supplier Adoption

The technology is only half the battle. The other half is getting your people on board. Any change can be met with resistance, so clear communication and solid training are absolutely essential. Don't just show your team how to use the new tool; explain why it's going to make their lives easier. Frame it as a way to get rid of their most mind-numbing tasks—no more manual data entry, no more hunting down managers for signatures.

A common oversight is forgetting about your suppliers. An effective rollout includes a plan for onboarding your vendors. Proactively communicate the change and show them how easy it is to submit invoices, whether through a dedicated portal or a specific email address. A smooth supplier experience is vital for a truly efficient process.

Recent research really puts a spotlight on why this transition is so important. As of 2025, a staggering 63% of AP teams still sink over 10 hours a week into manual invoice processing. On top of that, 66% are still manually keying invoice data into their ERPs. These numbers show just how much time is being wasted. You can learn more about the latest AP automation trends to see how quickly AI is changing the industry.

By focusing on a structured rollout—from data migration and workflow configuration to comprehensive training for everyone involved—you’re setting the stage for a successful and lasting transformation of your entire accounts payable function.

Tracking and Optimizing Your AP Performance

Getting your new AP automation system up and running is a great first step, but it's not the end of the road. The real magic happens when you start tracking performance, measuring the results, and fine-tuning the process. This is how you turn a simple efficiency tool into a powerhouse for financial strategy.

You need to get beyond feelings like, "I think things are moving faster now." You need hard data. Your automation software should have a dashboard loaded with key performance indicators (KPIs) giving you a crystal-clear picture of your AP department's health. Without it, you’re just guessing.

Key Metrics to Monitor Closely

To get started, zero in on a handful of KPIs that really speak to the efficiency and financial impact of your AP operations. These numbers will show you exactly what’s working and where you can make things even better.

- Average Cost Per Invoice: This is the big one. It’s the total cost of your AP department—software, labor, and any other fees—divided by the number of invoices you process. Your goal is to see this number plummet compared to your old manual ways.

- Invoice Cycle Time: How much time passes from the second an invoice hits your system to the moment payment is sent? A shorter cycle time keeps your suppliers happy and opens the door to more early payment discounts.

- Early Payment Discount Capture Rate: This KPI is pure bottom-line impact. A high capture rate, say over 90%, proves your system is nimble enough to snag savings that were likely impossible to catch before.

Your AP data isn’t just a payment log—it's a goldmine of business intelligence. Digging into it helps you spot spending trends, identify your most important suppliers, and get a much firmer grip on cash flow.

Turning Data into Actionable Improvements

Once you’re consistently tracking these numbers, you can begin to ask smarter questions.

Is your invoice cycle time still dragging? It might be time to look at your approval workflows. You may find that one or two managers are consistent bottlenecks. Maybe their approval threshold is set too low for routine purchases, and you can tweak the rules to keep things moving.

If your early payment discount capture rate isn't where you want it, use your data to pinpoint which suppliers offer the most attractive terms. From there, you can prioritize their invoices to ensure you never miss out on a chance to save money. This analytical mindset shifts your AP team from just processing payments to proactively managing company finances.

To take it a step further, it's always smart to learn from proven strategies. You can uncover more powerful techniques by exploring some essential accounts payable automation best practices, which cover everything from workflow design to better supplier communication.

By keeping a close eye on performance and making smart, data-backed adjustments, you guarantee your automated system delivers its full potential long after launch. That commitment to continuous improvement is what separates the companies that just use automation from those that truly master it.

Common Questions About AP Automation

Even with all the benefits laid out, I get it—deciding to automate your accounts payable process brings up a ton of questions. It's a big shift, and you're smart to poke holes in the idea before you dive in. Let's walk through some of the most common concerns I hear from finance teams considering the move.

"Will We Lose Control Over Approvals?"

This is probably the number one worry I encounter. Will automating approvals mean we lose our grip on spending? It’s a fair question, but here’s the reality: modern AP automation tools are designed to give you more control, not less. You’re essentially building your company's unique approval hierarchy directly into the software.

Every single invoice gets automatically routed to the right person based on rules you set—things like vendor name, department, or dollar amount. The system then creates a crystal-clear, unchangeable audit trail that shows exactly who approved what, and when. Frankly, compared to a manual process where an invoice can get lost in an email chain or sit on someone's desk for a week, this is a massive upgrade for both control and compliance.

"How Much Does This Stuff Actually Cost?"

The conversation always turns to cost, and for good reason. While there's an upfront investment in software and setup, the better question isn't "what does it cost?" but "what is the return on this investment?"

Think about it this way: studies consistently show that manually processing a single invoice costs a business anywhere from $16 to $22. With a good automation platform, you can slash that cost by as much as 70%. Multiply that savings by the hundreds or thousands of invoices you handle each year, and you’ll find the software often pays for itself surprisingly fast.

The true cost isn't the software subscription; it's the hidden expense of sticking with an inefficient manual system. You're already paying for it in wasted hours, late payment fees, missed early-pay discounts, and costly human errors.

"Will My Team Be Able to Use It?"

Bringing in new tech always raises questions about adoption. Will your team push back? Is it going to be a nightmare to learn? The best AP automation platforms are built for actual humans to use. They have clean dashboards and simple workflows that are a world away from the clunky, outdated accounting software many of us are used to.

The key to a smooth rollout is solid training and clear communication from the start. When you show your team how this new tool eliminates their most soul-crushing tasks—like mind-numbing data entry and chasing down signatures—they usually get on board pretty quickly.

A few other practical questions that come up:

- Initial Setup: How long does it take to get going? Most cloud-based tools can be up and running in a few weeks, not months. The provider should walk you through getting your data moved over and the system configured.

- Supplier Onboarding: What about our vendors? Most systems make it incredibly easy for suppliers to just email their invoices or upload them to a simple portal. Trust me, they prefer this over stuffing envelopes.

- Integration: Will it play nice with our accounting software? This is non-negotiable. Any solution you consider must offer a seamless, two-way sync with your ERP or accounting system. Otherwise, you're just creating new manual work for yourself.

At the end of the day, switching to AP automation isn't about a massive departmental overhaul. It's about giving your team the right tools to work smarter, faster, and with far greater accuracy.

Ready to stop wasting time on manual data entry? DocParseMagic uses AI to pull data from any invoice directly into a spreadsheet in seconds. Sign up for free and see how it works.