How to Organize Business Receipts Without Losing Your Mind

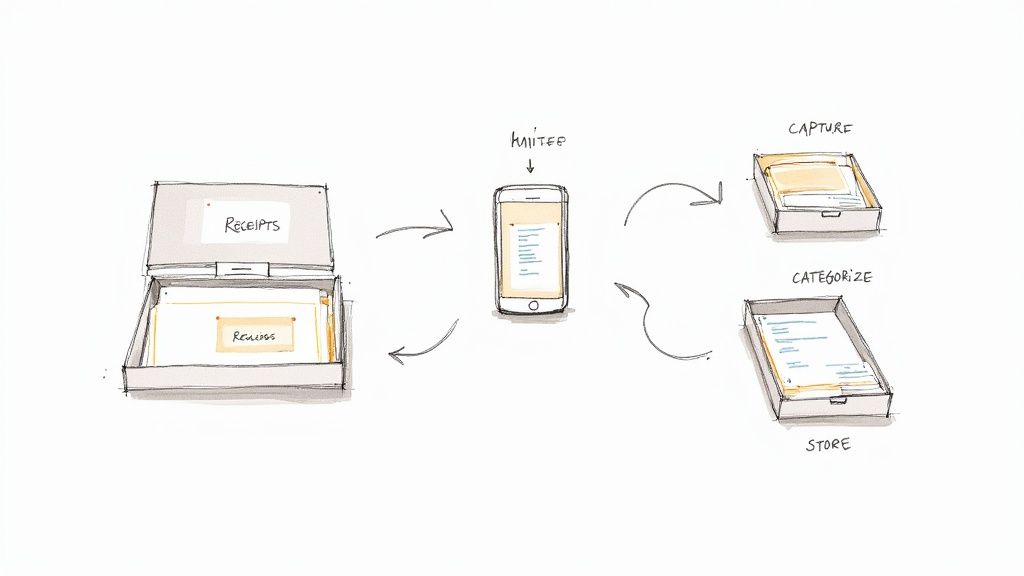

If you've ever stared at a shoebox full of crumpled paper and dreaded tax season, you're not alone. The real secret to conquering business receipts isn't some complex, expensive system. It’s about building a simple, consistent habit of capturing every expense right away, categorizing it properly, and storing it digitally and securely.

This modern approach moves you past the paper pile-up and transforms that financial chaos into a smooth, audit-proof workflow.

Your Simple System for Organizing Business Receipts

Let's finally ditch that overflowing shoebox. A truly effective system is less about fancy software and more about a practical process you can actually stick with. The goal is to create one central hub for every single receipt—from the paper slip you got at a coffee meeting to the PDF invoice that just hit your inbox.

At its heart, this method is built on a few key principles. Once you get these down, you'll shift from being reactive and scrambling for records to proactively managing your finances, ensuring nothing ever slips through the cracks.

The Four Pillars of Effective Receipt Management

I've found that any successful receipt management system, no matter the specific tools you use, is built on four core ideas. Mastering these will give you the foundation for a stress-free financial workflow.

| Pillar | Action | Why It Matters |

|---|---|---|

| Capture | Digitize every receipt the moment you get it. | This single habit prevents lost receipts and makes the information instantly ready for the next step. |

| Categorize | Assign each expense to a specific business category (e.g., "Office Supplies," "Client Meals"). | Doing this on the fly makes tax prep a breeze and gives you a clear, real-time picture of your spending. |

| Store | Use a secure, searchable digital location for all your files. | It protects your financial data and lets you pull up any receipt in seconds for an audit or review. |

| Review | Regularly check your records for accuracy and completeness. | A quick monthly check-in catches errors early and keeps your financial reports reliable and up-to-date. |

Think about it—this isn't just about being tidy. It's about gaining real financial clarity. Proper organization can save you countless hours of administrative headaches and, most importantly, helps you claim every single deduction you're entitled to. For many small businesses, finding the right document management software for small business is a crucial part of making this system work seamlessly.

Think of this as your roadmap to turning financial chaos into a streamlined system that works for you, not against you. A well-organized receipt system is the foundation of sound financial management and peace of mind.

Choosing the Right Receipt Management Method

https://www.youtube.com/embed/cb_AtKpLad4

Let's be honest, every business is different, which means there's no magic, one-size-fits-all system for managing receipts. The best method is simply the one you'll actually stick with.

When it comes down to it, you’re really choosing between two main paths: sticking with a traditional paper-based system or moving to a digital-first workflow.

The old-school physical approach is what many people start with because it feels simple. You grab some folders, binders, or envelopes and start sorting paper receipts. Maybe you organize by month, by a specific client project, or by expense category like "Office Supplies" or "Travel." It’s easy to get going with zero tech headaches.

The problem? This system doesn't scale well. As your business grows, the physical files pile up, eating away at your office space. They’re also at risk of getting lost or damaged. And if you've ever tried to find one specific receipt from two years ago in a stack of folders, you know how frustrating that manual hunt can be.

Embracing a Digital-First Strategy

This is where most businesses are heading, and it’s easy to see why. A digital approach gets you out from under the paper pile and uses technology to build a system that's more efficient, secure, and ready to grow with you. The global market for cloud-based receipt management is exploding—it's expected to hit USD 11.36 billion by 2034. That figure alone shows you where things are going. You can dig into the full research on the growth of cloud-based receipt management at Market.us.

Even within the digital world, you have a few choices on how to tackle this:

-

Simple Cloud Storage: This is a great starting point. Using a service like Google Drive or Dropbox, you can just snap a picture of a receipt with your phone and save it to a folder. It’s basically a digital version of a physical filing cabinet.

-

Dedicated Expense Apps: This is where you really start to see the benefits. Tools like DocParseMagic or Expensify are built for one thing: handling your expenses. They don't just store the receipt; they use smart technology to automatically pull out the important details, help you categorize everything, and even sync up with your accounting software.

The right method is all about balancing what you're comfortable with against what your business actually needs to be efficient and secure. For many, a hybrid approach—scanning paper receipts right into a digital system—ends up being the perfect middle ground.

Building a Modern Digital Receipt Workflow

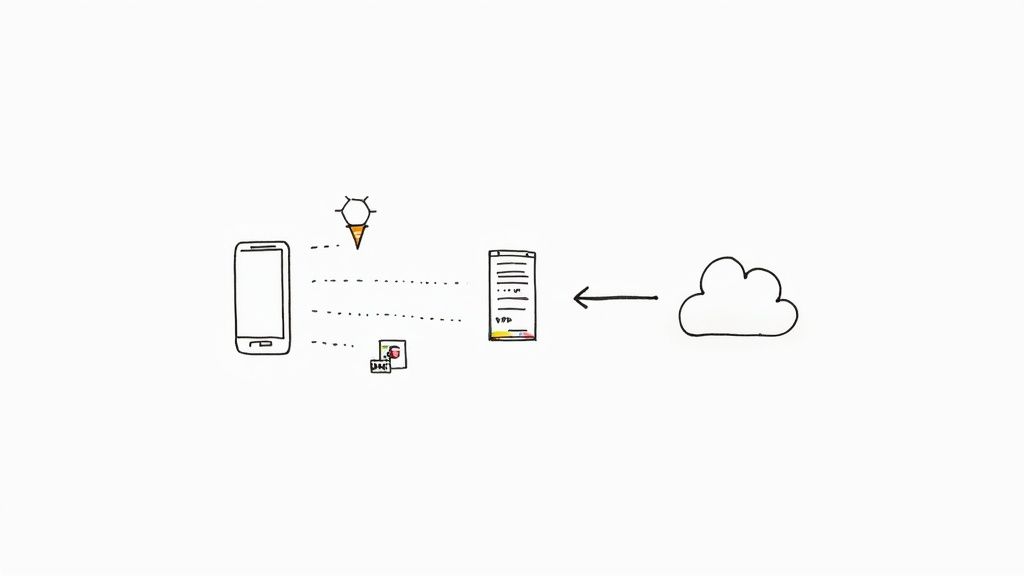

Moving your business receipts into the digital realm isn't just about scanning paper. It’s about building a smart, automated system that hands you back a ton of time. A modern workflow completely changes how you manage financial data from the second a transaction is made.

It all starts with capturing receipts on the spot. The moment you get a paper receipt—whether it's from a client lunch or a hardware store run—snap a picture with a scanning app on your phone. For all those digital receipts and invoices cluttering your email, create a simple rule to automatically forward them to a dedicated address tied to your expense software. This tiny habit prevents anything from getting lost in a messy inbox or a crumpled pocket.

Tools like DocParseMagic are designed to make this initial step almost effortless. They use AI to grab the important information right away.

As you can see, you can set up a template once, and from then on, the system knows exactly what data to pull from any similar document that comes in.

Putting Automation and AI to Work

This is where things get really efficient. Advances in automation and artificial intelligence (AI) have completely reshaped how businesses can organize receipts. By 2025, it's estimated that 80% of companies will have some form of AI integrated into their financial workflows. This change is driven by Optical Character Recognition (OCR), an AI-based technology that can pull data from receipts with over 95% accuracy, practically eliminating manual data entry. You can read more about the future of AI-powered expense management at SuperAGI.com.

Once your receipt is scanned, OCR gets to work, reading it and extracting the key details:

- Vendor name

- Transaction date

- Total amount

- Tax information

This extracted data can then be sorted automatically based on rules you create. For example, you can set a rule so any receipt from "Home Depot" is instantly categorized as "Materials & Supplies." Many of these tools even sync directly with accounting software like QuickBooks or Xero, which means no more entering the same data twice. To see how these processes come together, take a look at our guide on document workflow automation.

A successful digital workflow isn't just about having the right apps; it's about establishing a consistent process for naming and filing that makes sense for your business.

To make your system truly bulletproof, you need a consistent file naming convention. I've found a simple format like YYYY-MM-DD_Vendor_Amount works wonders because it makes every file instantly sortable and easy to identify. Combine that with a logical folder structure—maybe organized by year, then by month—and you've built an audit-proof system you can always count on.

The Unbeatable Habit of Capturing Every Receipt

Let's be honest, the best software in the world won't help if your receipts are crumpled up at the bottom of a bag. The real secret to mastering business receipts isn't about fancy tech—it's about building a simple habit: dealing with expenses the moment they happen.

The most important rule I've learned is to capture immediately. The second a paper receipt is handed to you, pull out your phone and snap a picture with your expense app. Don't shove it in your wallet or pocket. This one small action is the difference between a clean, accurate record and a frantic, shoebox-digging nightmare come tax time.

Taming Your Digital Receipt Trail

This "capture now" mindset works just as well for online purchases, and you can even put it on autopilot. I recommend setting up a simple filter in your email. In Gmail or Outlook, you can create a rule that automatically forwards any email with words like “receipt,” “invoice,” or “order confirmation” to a specific folder or straight into your expense tool. Your inbox stays clean, and your financial records are always up-to-date without you lifting a finger.

This on-the-go approach is quickly becoming the norm. With remote work and busy schedules, mobile tools are essential. It's predicted that by 2025, about 75% of businesses will rely primarily on mobile apps for expense management. In fact, more than half of all expense reports are already submitted that way. You can dig into more of these emerging expense management technology trends on Softjourn.com if you're curious.

Don't forget, tax authorities like the IRS generally accept digital copies of receipts as long as they are clear, legible, and complete. Since you need to hold onto business records for anywhere from three to seven years, a secure digital archive is your best friend.

At the end of the day, it's consistency that turns receipt chaos into a reliable system you can count on, no matter how hectic things get.

Getting Your Ducks in a Row for Tax Time and Audits

This is where all your hard work really pays off. A well-oiled receipt system can turn tax season from a mad dash into a straightforward, almost calm, process. When every expense is already captured and categorized throughout the year, handing everything over to your accountant—or facing an audit—becomes much less daunting.

Instead of dedicating days to sifting through a shoebox of crumpled paper, you can generate detailed expense reports in minutes. A solid digital system lets you filter and export records by the exact categories your accountant needs, lining them up perfectly with official tax-deductible buckets. This is how you make sure you’re claiming every single deduction you're entitled to.

Match Your Categories to Tax Rules

The secret to a painless tax filing is categorizing your expenses correctly from the get-go. Your system should really just mirror the categories that the IRS or your local tax authority uses. It makes pulling the right numbers for your return a breeze.

Common tax-deductible categories usually include things like:

- Office Supplies: Think pens, paper, software subscriptions, and other daily operational costs.

- Travel and Meals: This covers flights, hotels, and client entertainment, as long as there's a clear business purpose.

- Marketing and Advertising: Costs from your social media campaigns, website hosting, or even printed flyers fall in here.

- Professional Services: Any fees you've paid to contractors, consultants, or legal advisors.

For a more detailed breakdown, our guide on how to organize receipts for taxes gets into more specific examples and strategies to make sure you're totally prepared.

Pro Tip: For those less-obvious expenses, add a quick note right on the digital receipt. A simple comment like, "Lunch with Jane Doe to discuss Q3 project proposal," is gold months later. It clarifies the business purpose and creates the kind of bulletproof documentation you want.

This kind of meticulous organization does more than just save you a massive headache; it gives you real confidence that your financial records are accurate, complete, and ready for whatever comes their way.

Got Questions About Organizing Your Receipts? Let’s Clear Things Up.

Even when you've got a great system on the go, a few nagging questions always seem to pop up. It's totally normal. Let's walk through some of the most common ones I hear so you can feel completely confident about your receipt management.

Is a Digital Receipt as Good as the Real Thing?

This is probably the number one question on everyone's mind: are digital copies of receipts actually legit for tax purposes?

You can relax, because the answer is a resounding yes. As long as your scanned or digital copy is clear and legible, tax authorities like the IRS are perfectly happy with it. Just make sure it captures all the crucial details—the vendor's name, the date, a breakdown of what you bought, and the final total.

How Long Should I Keep Receipts?

The next big question is usually about the timeline. The general rule of thumb is to hold onto your business records for a minimum of three years, since that’s the standard window for an audit.

However, if you ask most accountants (including me), they'll often suggest keeping everything for seven years. It might feel like a long time, but it’s the safest bet to cover all your bases and give you peace of mind.

What About Those Annoying Little Cash Receipts?

Ah, the tiny, flimsy cash receipt—the natural enemy of organization. They seem designed to get lost or crumpled into an unreadable ball in your pocket.

Here’s how to handle them:

- Snap a Picture Right Away: The second that receipt is in your hand, pull out your phone and scan it with your app. Don't even give it a chance to disappear.

- Have a Designated "Holding Pen": Can't scan it immediately? No problem. Keep a dedicated envelope or folder in your bag or car just for receipts. The key is to make a habit of scanning everything in that folder at the end of the day or week.

What if you're already staring at a mountain of old receipts? Don't panic and definitely don't try to sort it all at once. Just start with today. Get your new system running for all incoming receipts. Once that feels natural, you can start chipping away at the old backlog, maybe tackling one month at a time. It’s all about making progress, not achieving instant perfection.

This strategy keeps you from feeling overwhelmed and helps you build a solid habit that will stick for the long haul.

Tired of typing out receipt details by hand? Let AI take over. DocParseMagic pulls all the key info from your receipts in a snap and organizes it into a neat spreadsheet for you. See how it works with a free trial.