best accounts payable software for small business: Top picks

Is your desk cluttered with a growing pile of supplier invoices? If you're spending more time on manual data entry, chasing down payment approvals, and worrying about late fees than on running your business, you're not alone. This administrative burden is a common-yet-solvable challenge for small businesses, often leading to costly errors, strained vendor relationships, and poor cash flow visibility.

Accounts payable (AP) automation software is the definitive solution. These platforms transform the entire process, from capturing invoice data and routing it for approval to executing and reconciling payments, all within a centralized, digital system. This shift isn't just about saving a few hours a week; it's about gaining strategic control over your company's expenditures.

This guide cuts through the marketing noise to deliver an in-depth, practical comparison of the best accounts payable software for small business available today. We've analyzed 12 top-tier solutions, focusing on real-world applications, specific features, and potential limitations that matter most to small business owners, bookkeepers, and finance teams.

Inside, you'll find detailed breakdowns of each platform, complete with screenshots and direct links, designed to help you make a confident and informed choice. We'll explore ideal use cases for freelancers, e-commerce retailers, and growing teams, ensuring you find a tool that aligns perfectly with your operational needs and budget. Let's find the right software to streamline your finances and get you back to focusing on growth.

1. DocParseMagic

DocParseMagic stands out as a top choice for small businesses seeking to automate their accounts payable workflow without the complexity of traditional enterprise software. It focuses on one critical task and executes it exceptionally well: transforming unstructured documents like invoices, receipts, and statements into clean, spreadsheet-ready data. Instead of relying on rigid templates that break with layout changes, its AI intelligently understands document context to extract, enrich, and calculate the data you need.

This platform is a powerful tool for eliminating manual data entry, reclaiming hours of administrative time each week. Its core strength lies in its ability to not only pull information like invoice numbers and line items but also to enrich it. The system can infer missing vendor details or standardize inconsistent date formats, delivering more complete and usable data from the start. This makes it an ideal solution for bookkeepers, accounting teams, and operations staff who frequently process documents from various suppliers.

Why It's a Top Pick

DocParseMagic earns its spot as one of the best accounts payable software for small business options due to its unique blend of power and simplicity. A key differentiator is its proprietary calculation engine, which is specifically designed to handle financial math accurately. It avoids common AI errors when calculating totals, taxes, and multi-currency conversions, ensuring the data you export is reliable for accounting.

Furthermore, its flexibility is a significant advantage. Users can define custom columns using plain language, combining extracted data with inferred values or computed fields. For example, you can create a column that calculates a 30-day payment deadline based on the extracted invoice date. The platform accepts a wide range of file types (PDF, Word, images, emails) and exports a standard CSV compatible with virtually all accounting software, including QuickBooks and Xero, without needing complex API integrations. For a deeper dive into its capabilities, you can learn more about how DocParseMagic extracts data from invoices.

Pricing & Key Details

DocParseMagic operates on a transparent, credit-based pricing model that scales with your needs. This approach allows businesses to start small and grow without a large upfront investment.

- Pricing:

- Starter: €9/month for 30 credits

- Professional: €29/month for 150 credits

- Enterprise: €99/month for 750 credits

- Free Trial: A free trial with credits is available upon signup, with no credit card required.

- Best For: Bookkeepers, small accounting teams, freelancers, and operations staff who need fast, accurate document data extraction.

Pros and Cons

Pros:

- Context-Aware AI: Intelligently extracts and enriches data, filling in gaps and reducing manual cleanup.

- Reliable Calculations: Proprietary engine ensures accurate totals, taxes, and multi-currency math.

- Flexible & Simple: Supports multiple file formats and uses plain-language rules to define custom output columns.

- Accessible Pricing: Low-cost entry point with a free trial makes it easy to test and validate for your workflow.

Cons:

- Usage-Based Costs: High-volume users with documents containing many line items should monitor credit usage to ensure cost-effectiveness.

- Limited Public-Facing Compliance Info: The website does not prominently feature third-party security certifications (like SOC 2) or detailed case studies, so enterprises with strict compliance needs should request this documentation directly.

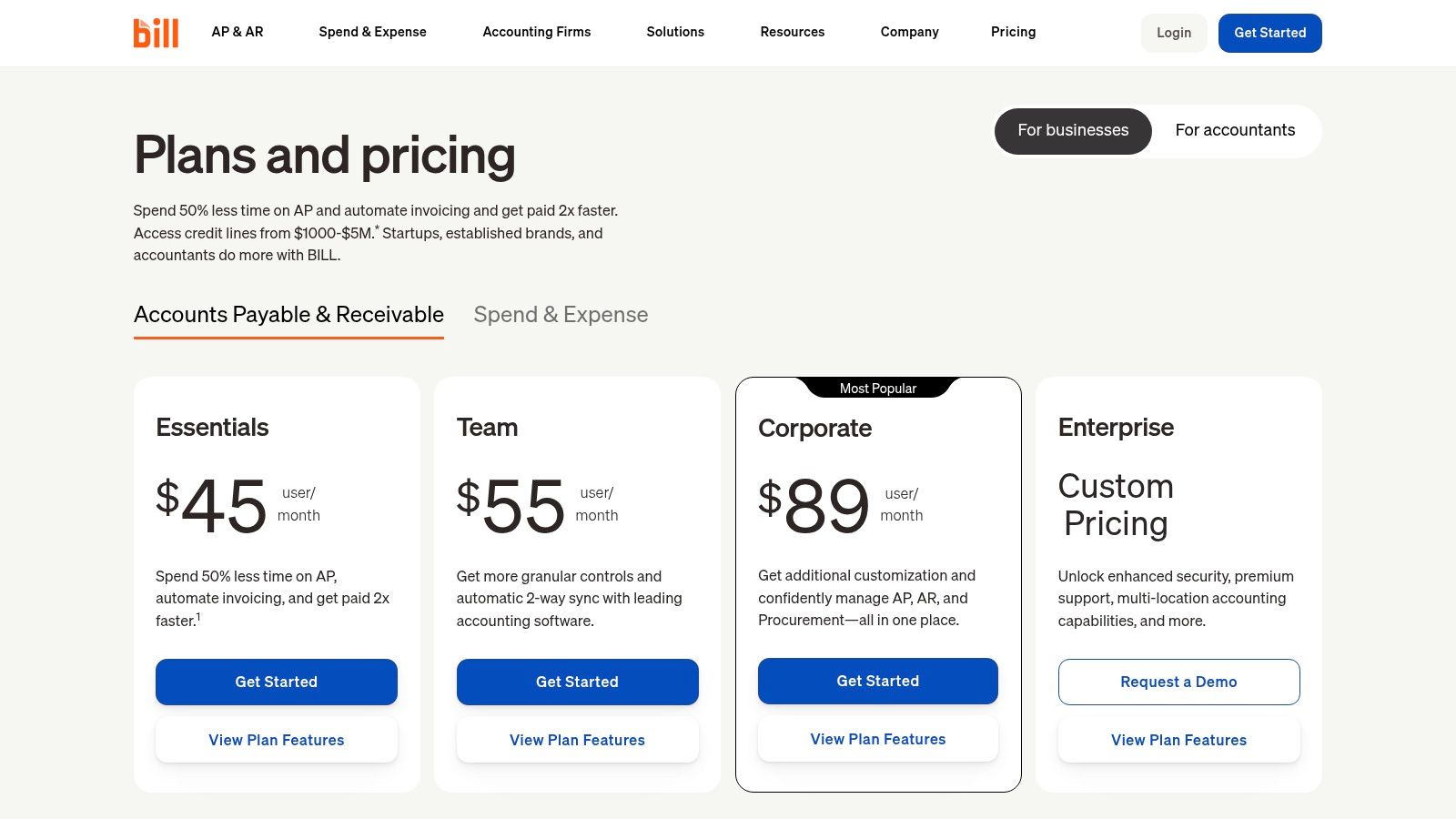

2. BILL (formerly Bill.com)

BILL is arguably one of the most established and robust platforms for accounts payable automation in the U.S., making it a top contender for the best accounts payable software for small businesses. Its core strength lies in its comprehensive, end-to-end workflow management that centralizes everything from invoice capture to payment execution. Businesses can forward bills to a dedicated inbox, where the system uses AI to automatically capture key data.

The platform shines with its customizable, multi-step approval workflows. You can set up specific rules based on dollar amounts, vendors, or departments, ensuring that the right people review invoices before payment. This granular control, combined with a detailed audit trail, provides a level of financial governance that growing businesses need.

Key Features and Pricing

BILL offers deep, two-way synchronization with major accounting software like QuickBooks and Xero, which simplifies reconciliation. Its expansive payment capabilities are also a major differentiator, offering ACH, virtual cards, checks, and international wires all from one dashboard. You can explore a deeper dive into these features and learn how to automate invoice processing for maximum efficiency.

| Feature | Details |

|---|---|

| Pricing | Starts at $45 per user/month for the Essentials plan. Custom pricing for enterprise-level needs. |

| Best For | SMBs and accounting firms needing robust approval workflows, multiple payment options, and strong accounting software integrations. |

| Unique Offering | An extensive, pre-vetted network of U.S. vendors, which can significantly speed up electronic payments and vendor onboarding. |

| Implementation | Straightforward setup, especially for businesses using QuickBooks or Xero. Connecting bank accounts and syncing vendors is intuitive. |

Pros:

- Mature platform with a strong reputation and large U.S. vendor network.

- Excellent audit trail and granular user permissions for tight financial control.

- Deep integration with leading accounting systems simplifies bookkeeping.

Cons:

- The per-user pricing model can become costly as your team expands.

- Transaction fees for certain payment methods (like checks or expedited payments) can add up.

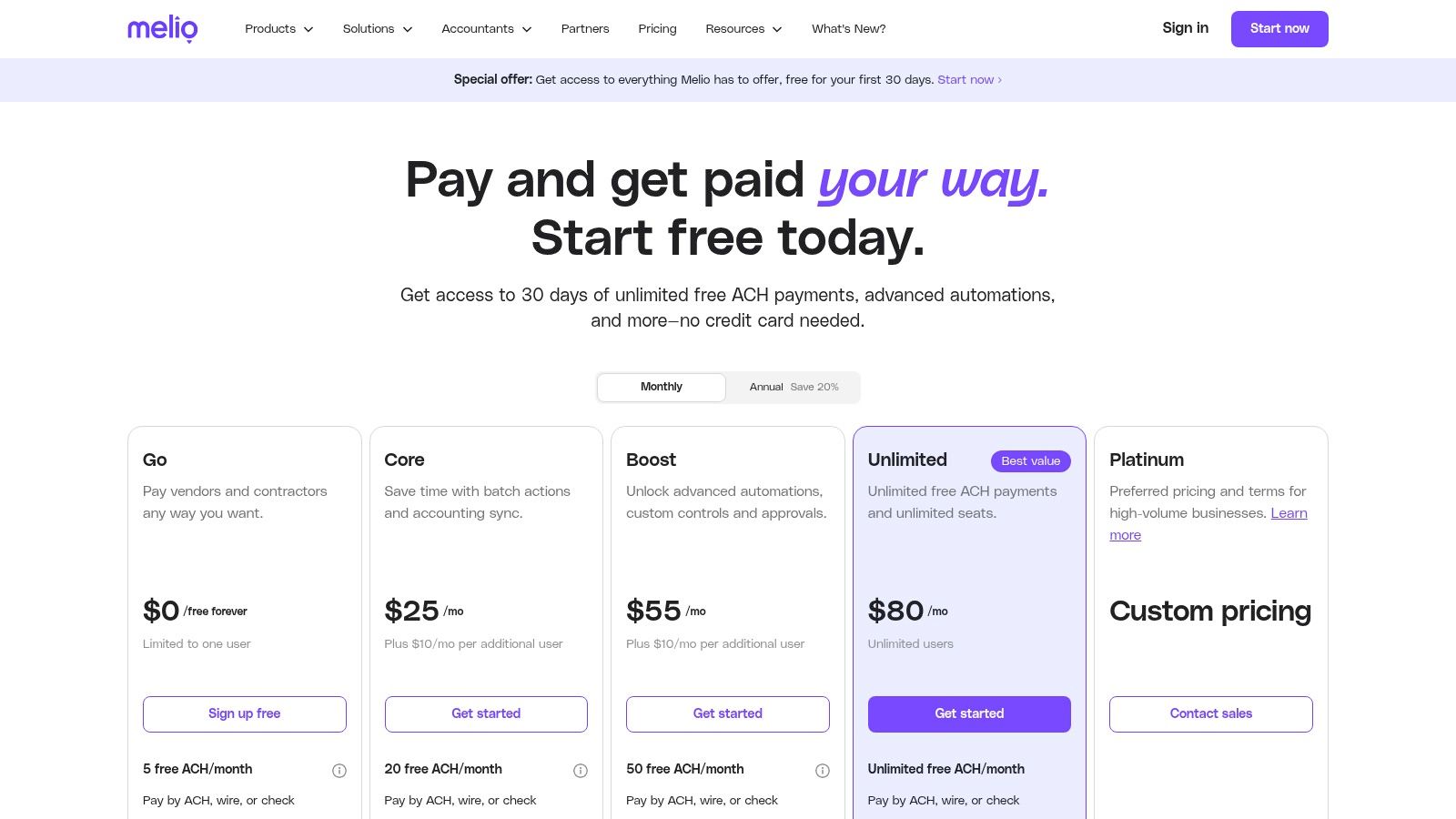

3. Melio

Melio has carved out a niche as one of the best accounts payable software for small businesses by focusing on simplicity, flexibility, and cash flow management. It empowers businesses to pay vendors via bank transfer, debit card, or credit card, even if the recipient only accepts checks. This unique capability allows small businesses to extend their cash float by using a credit card for payments while Melio sends the vendor a check or ACH transfer.

The platform is designed for easy adoption, particularly for micro-businesses and freelance teams. Its interface is clean and straightforward, enabling users to quickly schedule payments, set up approval workflows, and manage both payables and simple receivables. Melio’s integration with QuickBooks and Xero ensures that payment data syncs directly, reducing manual entry and streamlining reconciliation.

Key Features and Pricing

Melio stands out with its accessible pricing model, which includes a robust free plan. Key features like AI-powered bill capture, batch payments, and vendor management tools are available even at the entry level. The platform also supports international payments and provides essential tools for managing 1099 forms, making it a comprehensive solution for small-scale operations.

| Feature | Details |

|---|---|

| Pricing | Free plan available for core features. Paid plans start at $29/month for advanced controls like higher ACH limits and custom roles. |

| Best For | Micro-businesses and freelancers seeking cash flow flexibility and a simple, low-cost way to manage vendor payments. |

| Unique Offering | The ability to pay any invoice with a credit card, while the vendor receives a check or ACH, offering a powerful cash management tool. |

| Implementation | Very fast setup. Users can connect their accounting software and bank accounts to start making payments in minutes. |

Pros:

- A generous free tier makes it highly accessible for new and small businesses.

- The card-to-check payment feature provides excellent cash-flow flexibility.

- Simple, intuitive user interface requires minimal training.

Cons:

- Advanced approval workflows and higher transaction limits are locked behind paid tiers.

- Certain features are dependent on integration with specific accounting systems like QuickBooks.

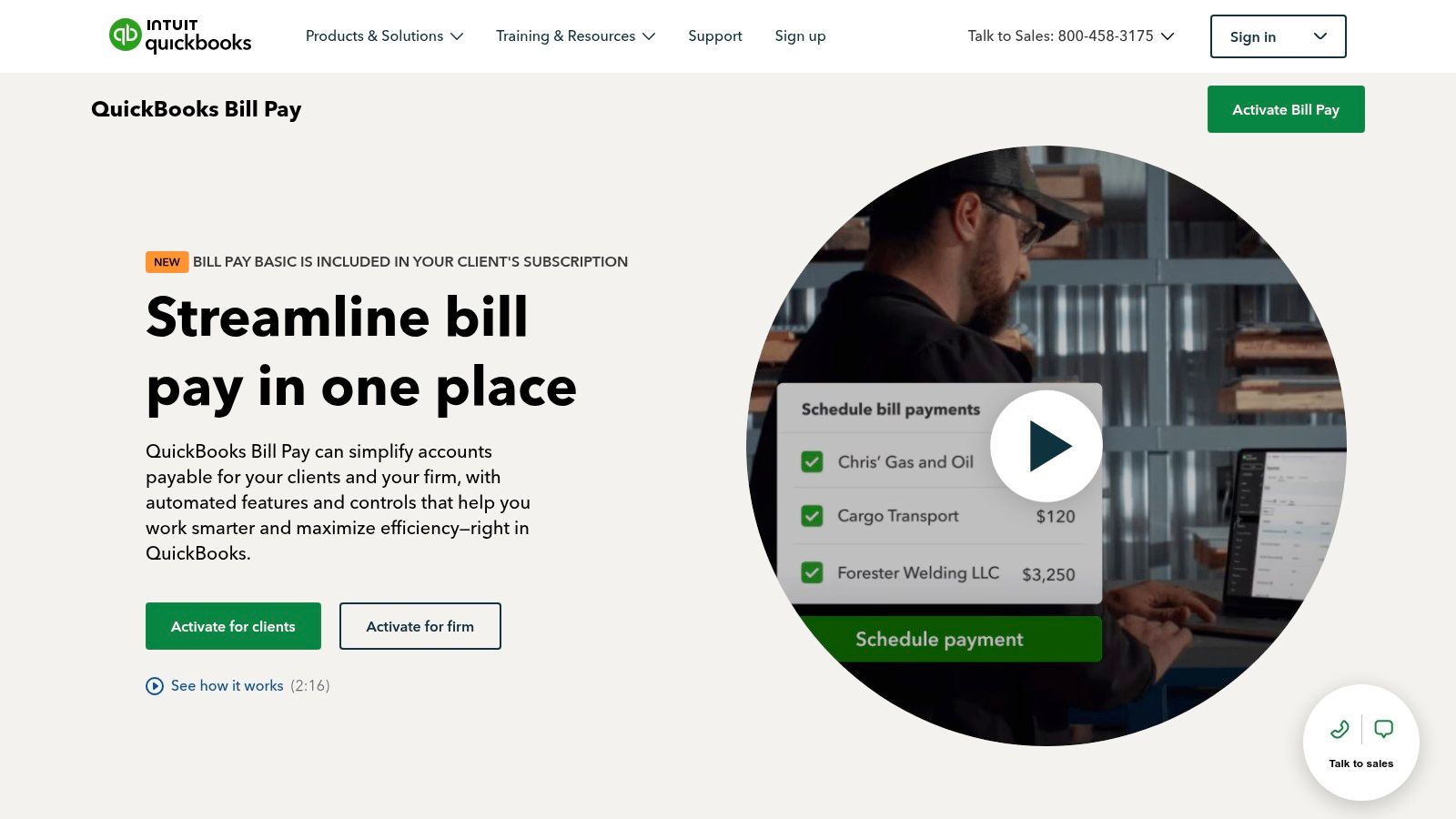

4. QuickBooks Bill Pay (Intuit)

For businesses deeply embedded in the QuickBooks ecosystem, QuickBooks Bill Pay offers the most seamless and integrated accounts payable experience. As a native Intuit solution, it eliminates the need for third-party connectors or complex syncing, making it a compelling choice for the best accounts payable software for small businesses already using QuickBooks Online. Its primary advantage is convenience, allowing users to manage, approve, and pay bills directly within the accounting platform they use daily.

The platform streamlines the AP process by enabling automated bill capture from emails or uploads and matching them to existing transactions. While basic on its own, it offers more advanced features like approval workflows and role-based controls on higher-tier plans. This native integration ensures that every payment is automatically recorded and reconciled in the general ledger, significantly reducing manual data entry and potential errors.

Key Features and Pricing

QuickBooks Bill Pay supports standard payment methods, including ACH and mailed checks, with options for faster ACH processing at an additional cost. The pricing is tied directly to your QuickBooks Online subscription, avoiding separate per-user fees common with other platforms, which can be highly cost-effective.

| Feature | Details |

|---|---|

| Pricing | Included with QuickBooks Online subscriptions (Essentials, Plus, Advanced). Transaction fees apply for certain payment types. |

| Best For | Businesses committed to the QuickBooks Online ecosystem seeking a native, fully integrated bill payment solution. |

| Unique Offering | True native integration eliminates app sprawl and simplifies reconciliation by keeping all AP activity within QuickBooks. |

| Implementation | Extremely simple for existing QBO users. Activation is straightforward, as it leverages existing company, vendor, and chart data. |

Pros:

- Seamless, native integration with the QuickBooks Online general ledger.

- Simplifies tech stack and reduces the need for third-party software.

- Pricing is bundled with QBO plans, which can be more economical.

Cons:

- Only available to businesses with an active QuickBooks Online subscription.

- Features like approval workflows are limited to more expensive QBO plans.

- Transaction fees can apply for certain payment methods beyond plan allotments.

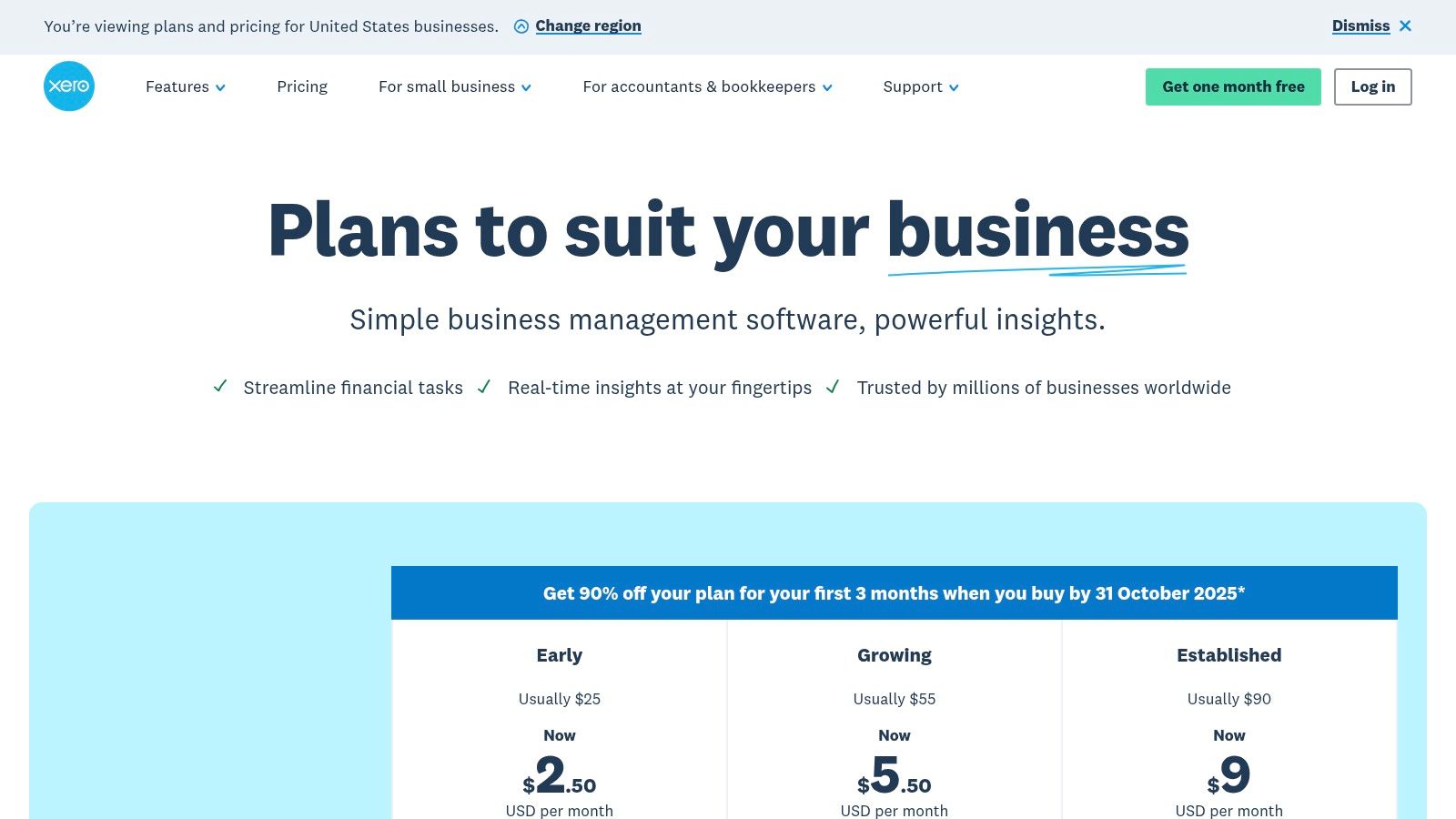

5. Xero (Bills + Online Bill Payments)

For small businesses already using Xero for their cloud accounting, leveraging its built-in accounts payable features is a highly efficient choice. Xero offers a seamless, integrated experience, allowing users to manage bills from entry to payment without leaving their accounting ecosystem. The inclusion of Hubdoc for document capture automates data entry by pulling key information from invoices and receipts directly into the platform.

The platform’s strength lies in its simplicity and unified workflow. You can easily enter, approve, and schedule bill payments within the same clean interface used for bookkeeping. For U.S. customers, Xero offers online bill payments powered by BILL, which adds the convenience of ACH and check disbursements directly from the software, making it a strong contender for the best accounts payable software for small business owners who prioritize integration.

Key Features and Pricing

Xero's core AP functionality is included in its accounting plans, making it a cost-effective solution for existing users. The platform's app marketplace also allows for extended functionality through third-party integrations if more advanced AP features are required.

| Feature | Details |

|---|---|

| Pricing | Included with Xero plans, which start at $15/month. Online bill payments powered by BILL carry additional per-transaction fees. |

| Best For | Small businesses already using or planning to use Xero for accounting that need a simple, integrated AP and bill payment solution. |

| Unique Offering | A fully integrated accounting and AP system where bill management is a native function, not a bolt-on. |

| Implementation | Extremely straightforward for existing Xero users. New users will find a clean UI and guided setup for banking and bill pay connections. |

Pros:

- Clean, user-friendly interface with solid reporting capabilities.

- Seamlessly integrated accounting and bill payment options within one platform.

- Hubdoc inclusion simplifies invoice data capture and document storage.

Cons:

- Online bill pay features incur per-bill fees on top of the Xero subscription.

- Businesses needing more complex approval workflows may require add-ons from the Xero App Store.

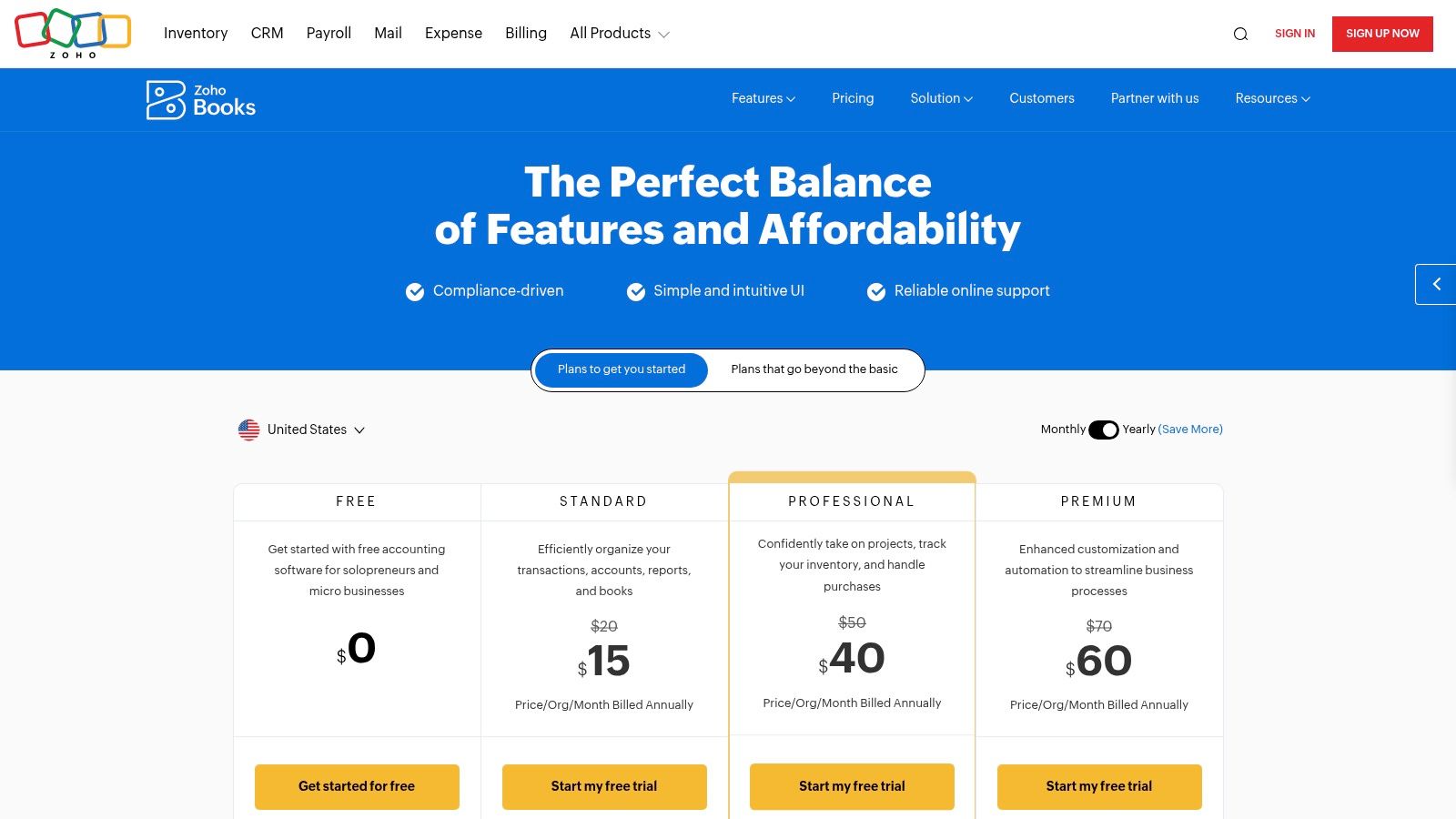

6. Zoho Books (+ BillPay add-on)

Zoho Books is a comprehensive cloud accounting solution that extends into accounts payable management, making it an excellent choice for businesses already invested in the Zoho ecosystem. It handles the entire procure-to-pay cycle, from creating purchase orders to tracking bills and setting up approval workflows. Its strength lies in its integration capabilities and competitive pricing structure.

The platform is designed for growing businesses that need more than just bill payment. With built-in features for W-9 and 1099 compliance and multi-currency support, it caters to diverse operational needs. The optional BillPay add-on transforms it into a more powerful AP tool, enabling ACH payments, advanced approval rules, and a dedicated vendor portal for self-service onboarding.

Key Features and Pricing

Zoho Books stands out by offering a full accounting suite with scalable AP features. The BillPay add-on is what makes it a strong contender for the best accounts payable software for small business, providing batch payment capabilities and purchase order matching to streamline vendor management and ensure accuracy.

| Feature | Details |

|---|---|

| Pricing | Free plan available. Paid plans start at $15 per organization/month (billed annually). BillPay add-on is an additional cost. |

| Best For | Small businesses already using or planning to use the Zoho suite, and those needing a cost-effective, all-in-one accounting and AP tool. |

| Unique Offering | Deep integration with the vast Zoho ecosystem (CRM, Projects, Inventory), creating a unified business management platform. |

| Implementation | Can be more involved if integrating multiple Zoho apps, but the core accounting and AP setup is guided and relatively straightforward. |

Pros:

- Very competitive pricing, with generous user limits on higher-tier plans.

- Seamlessly connects with other Zoho products for a cohesive business operating system.

- Strong multi-currency support is included in most paid plans.

Cons:

- The essential BillPay add-on for streamlined AP is an extra cost and not available on the Free plan.

- The extensive ecosystem can feel overwhelming and may require more setup time for teams new to Zoho.

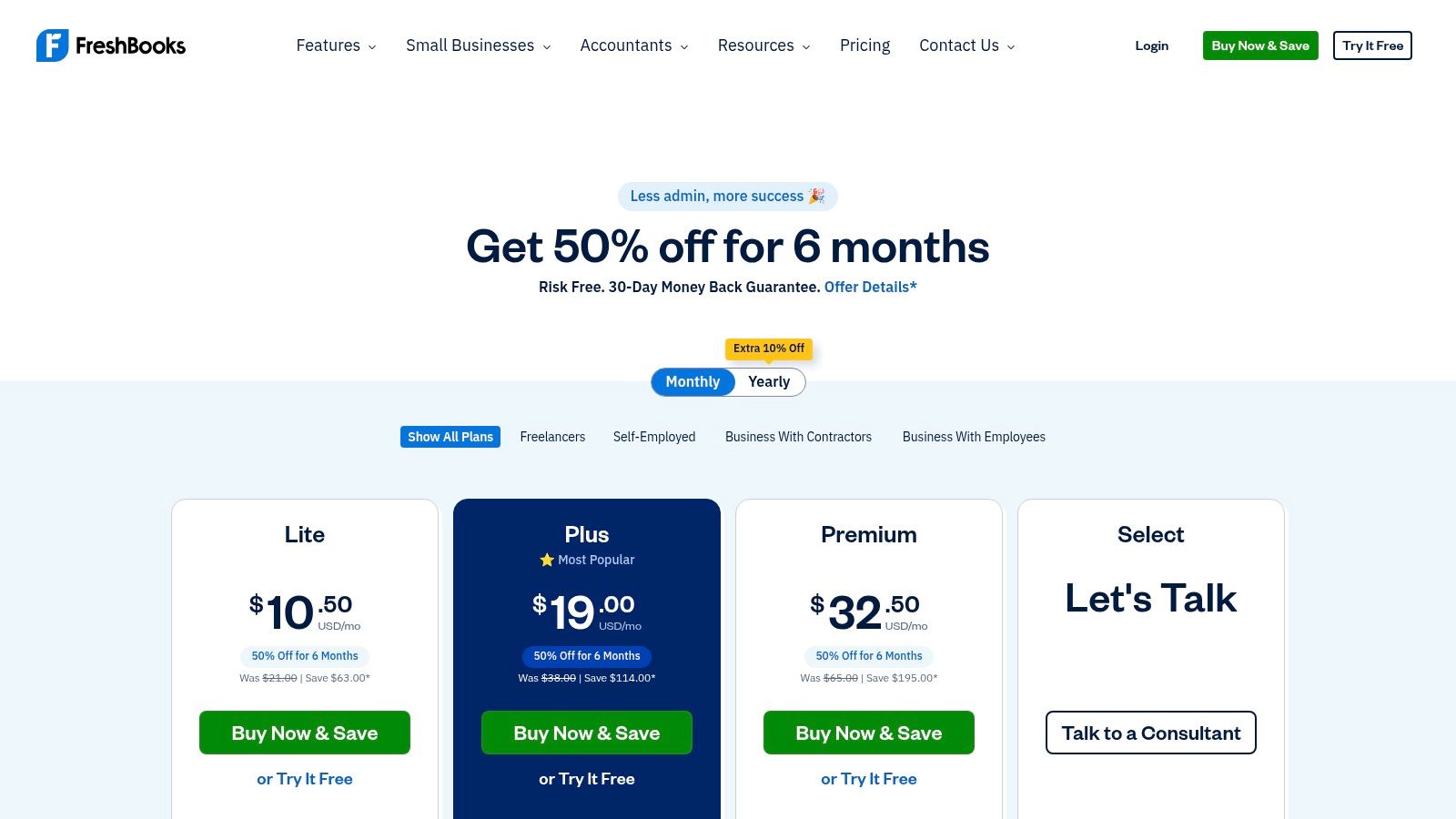

7. FreshBooks (Bills & Vendors on Premium/Select)

FreshBooks is renowned for its user-friendly accounting interface tailored to freelancers and very small service-based businesses. While not a dedicated AP platform, its higher-tier plans (Premium and Select) incorporate essential accounts payable features, making it a solid choice for businesses transitioning from spreadsheets to a more structured, all-in-one financial system. The platform excels at unifying invoicing, expense tracking, and basic bill management.

The primary appeal for small businesses is its simplicity. You can easily capture receipts, track vendor bills, and see how payables affect your general ledger without the complexity of more advanced systems. This integration of AP within a broader accounting tool is what makes it one of the best accounts payable software for small businesses that need a single solution for multiple financial tasks.

Key Features and Pricing

FreshBooks simplifies the entire financial workflow, from tracking billable hours to managing vendor payments. Its mobile app is particularly useful for capturing receipts on the go, and the 30-day free trial allows users to thoroughly test its capabilities. However, core AP functions are gated behind its more expensive plans.

| Feature | Details |

|---|---|

| Pricing | AP features are included in the Premium plan (starting around $30/month) and Select plan (custom pricing). Lower-tier plans lack bill payment functionalities. |

| Best For | Freelancers, solopreneurs, and very small service businesses that need an all-in-one invoicing, expense, and basic bill management solution. |

| Unique Offering | Seamless integration of time tracking, project management, invoicing, and accounts payable within one extremely easy-to-use interface designed for non-accountants. |

| Implementation | Very straightforward. The setup process is guided and intuitive, focusing on connecting bank accounts and setting up client/vendor profiles quickly. |

Pros:

- Gentle learning curve, making it accessible for business owners without an accounting background.

- Excellent all-in-one solution for invoicing, time tracking, expense management, and basic AP.

- Strong mobile app for managing finances on the go.

Cons:

- AP features are limited to higher-tier plans, which can be costly for a solo user.

- Lacks the advanced, enterprise-grade controls and complex approval workflows found in dedicated AP software.

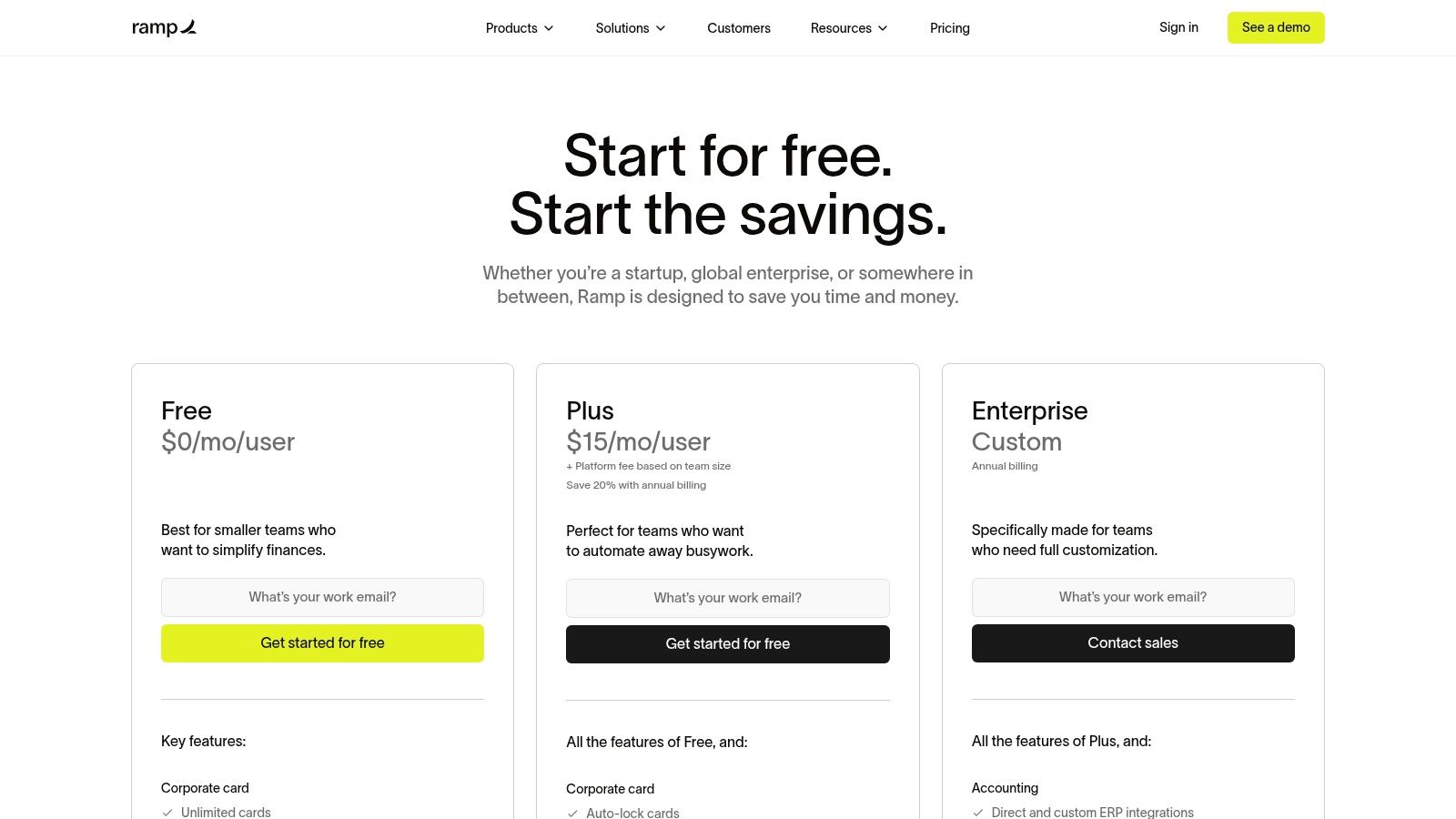

8. Ramp

Ramp offers a unique, all-in-one approach by combining a free corporate card program with a powerful, integrated Bill Pay platform. It positions itself as a comprehensive spend management solution, making it a compelling choice for startups and modern SMBs looking to consolidate their financial stack. The platform's core value is its no-fee software model for core AP features, which includes unlimited users and invoices.

The system is built around efficiency, allowing businesses to forward invoices to a dedicated inbox where Ramp's OCR technology extracts key data automatically. Its approval workflows are intuitive, and the platform provides strong automations for accounting sync and spend control. This makes it an attractive option for businesses that want to manage corporate card spending, employee reimbursements, and accounts payable from a single, unified dashboard.

Key Features and Pricing

Ramp’s integration between its card program and Bill Pay creates a seamless experience, simplifying reconciliation and providing real-time visibility into all company spending. While the core Bill Pay software is free, Ramp monetizes through interchange fees on card spending and offers paid tiers for more advanced features like procurement controls and enterprise-level integrations.

| Feature | Details |

|---|---|

| Pricing | Free for the core Bill Pay and corporate card platform. Ramp Plus offers advanced features for a fee. Optional fees for expedited payments. |

| Best For | Startups and tech-savvy SMBs that need an integrated corporate card, expense management, and AP solution with no software subscription cost. |

| Unique Offering | A completely free, unlimited-user Bill Pay platform that is fully integrated with a corporate card and broader spend management ecosystem. |

| Implementation | Requires applying for and being approved for the Ramp corporate card program. Once approved, setup is fast with direct accounting integrations. |

Pros:

- No software fees and unlimited users for the core AP platform.

- Consolidates corporate cards, expense reimbursements, and bill payments in one place.

- Strong accounting automations and controls for managing company-wide spend.

Cons:

- Access to the platform is contingent on being approved for the Ramp card program.

- Fees apply for faster payment options like same-day ACH or international wires.

9. Tipalti

Tipalti is an end-to-end accounts payable automation platform designed to scale with a business as it grows, making it a powerful choice for SMBs with global ambitions. Its core strength lies in its ability to handle complex AP processes, from supplier onboarding and tax compliance to multi-entity management and mass global payments. The platform streamlines the entire invoice-to-pay lifecycle, starting with a self-service supplier portal.

Tipalti excels at managing cross-border payments and ensuring regulatory and tax compliance, which sets it apart from more basic AP tools. It automatically validates tax forms (like W-9s and W-8s) and screens suppliers against "do not pay" lists, significantly reducing risk for businesses operating internationally. This makes it one of the best accounts payable software options for small businesses managing a global supply chain.

Key Features and Pricing

The platform's AI-powered invoice processing includes 2- and 3-way purchase order matching, reducing manual intervention and ensuring accuracy. For businesses looking to optimize their AP department, it's worth exploring the accounts payable automation best practices that platforms like Tipalti enable. Its extensive payment capabilities cover over 196 countries and 120 currencies via 50+ different payment methods.

| Feature | Details |

|---|---|

| Pricing | Starts at $149 per month. Pricing is module-based, allowing businesses to add capabilities as they grow. |

| Best For | Growing SMBs and mid-market companies with global suppliers, multiple business entities, or complex tax compliance requirements. |

| Unique Offering | Integrated, self-service supplier onboarding portal that includes automated tax form collection and validation. |

| Implementation | More involved than simpler tools due to its comprehensive nature, but offers robust integration with major ERP and accounting systems. |

Pros:

- Exceptional global payment capabilities and built-in tax compliance.

- Scales effectively, supporting businesses from growth stage to enterprise level.

- Pricing plans often include unlimited users, which is cost-effective for growing teams.

Cons:

- Higher starting price point may not be suitable for very small businesses or startups.

- Some of the most powerful features, like multi-entity support, are on higher-tier plans.

10. Stampli

Stampli positions itself as a collaboration-first accounts payable software, designed to centralize all communication and activities directly on top of the invoice itself. Its core philosophy is to streamline the chaotic back-and-forth between approvers, controllers, and vendors that often slows down the AP process. The platform uses AI to assist with invoice capture, coding, and three-way matching, reducing manual data entry for the AP team.

What makes Stampli stand out is its emphasis on user experience and team interaction. Approvers can ask questions, tag colleagues, and access all relevant documents without leaving the invoice screen. This creates a clear, auditable trail of communication, making it one of the best accounts payable software for small business teams that value transparent and efficient workflows.

Key Features and Pricing

Stampli integrates deeply with leading ERP and accounting systems like QuickBooks, NetSuite, and Sage Intacct, ensuring that data flows seamlessly between platforms. While its primary focus is on invoice processing and approvals, it also offers optional modules for payments, corporate cards, and vendor management, allowing businesses to build a more comprehensive procurement-to-pay system as they scale.

| Feature | Details |

|---|---|

| Pricing | Custom-quoted based on invoice volume and required modules. No public pricing is available. |

| Best For | Businesses prioritizing team collaboration, transparent communication, and a user-friendly interface for invoice approvals. |

| Unique Offering | In-app, invoice-centric communication tools that keep all conversations, questions, and approvals logged in one place. |

| Implementation | Known for strong customer support and guided implementation, though advanced automation rules may require professional setup. |

Pros:

- Highly rated for its intuitive user interface and collaborative features.

- Typically includes unlimited users and vendors, making it scalable for growing teams.

- Strong integration capabilities with major ERP and accounting software.

Cons:

- Pricing is not transparent and requires a custom quote, which may not suit very small businesses.

- Advanced automation and three-way matching may require a more involved setup process.

11. Corpay (Corpay Complete / AP Automation)

Corpay extends beyond simple AP automation, positioning itself as a comprehensive spend management platform. Its Corpay Complete solution combines invoice processing, purchase order automation, and integrated payment execution into a single system. This makes it a strong choice for businesses looking to consolidate their invoice-to-pay workflow and gain tighter control over company-wide spending.

The platform is built to handle the entire lifecycle, from invoice capture and approval routing to executing payments via card, ACH, or check. Corpay also offers managed services to help offload the tedious task of vendor onboarding and payment data management, which can be a significant time-saver for lean finance teams. This service-oriented approach differentiates it from purely self-service software.

Key Features and Pricing

Corpay’s strength lies in its unified approach to payments and AP, backed by a well-known U.S. payments brand. The system is designed for touchless processing where possible, using PO matching and automation rules to minimize manual intervention. Integrations with major ERP systems are available to ensure financial data remains synchronized across your tech stack.

| Feature | Details |

|---|---|

| Pricing | No public pricing available. Pricing is customized based on a sales-led demo and scoping process to fit business needs. |

| Best For | SMBs with moderate invoice volume and mid-market companies seeking an all-in-one AP, payments, and spend management platform. |

| Unique Offering | Optional managed services for vendor enablement and payment management, offloading significant administrative work from internal teams. |

| Implementation | Requires a consultation and guided setup, tailored to connect with your existing ERP or accounting software and business workflows. |

Pros:

- A single-platform approach combines invoice automation, POs, and payments.

- Strong payment capabilities (card, ACH, check) from a trusted payments provider.

- Managed services can significantly reduce the burden of vendor management.

Cons:

- The sales-led pricing model lacks transparency for businesses wanting a quick cost estimate.

- Generally geared more toward established SMBs and mid-market clients rather than very small businesses.

12. Plooto

Plooto is an accounts payable and receivable platform designed specifically for small businesses and accountants in the U.S. and Canada. It provides a user-friendly, all-in-one solution for managing cash flow, from invoice capture to final payment. The platform automates manual data entry with OCR technology and streamlines the entire payment process, making it a strong choice for businesses looking to simplify their financial operations without a complex system.

A key advantage of Plooto is its focus on flexible payment options and cross-border capabilities. Businesses can easily manage domestic and international payments, while the accountant-centric features allow for efficient multi-client management from a single dashboard. Custom approval workflows ensure that proper oversight is maintained before any funds are disbursed, adding a layer of control critical for small business finances.

Key Features and Pricing

Plooto integrates with popular accounting software like QuickBooks and Xero, ensuring that financial data remains synchronized and accurate. Its multi-bank support and unlimited domestic transactions on certain plans make it a cost-effective option for businesses with high payment volumes. The platform’s unique "Pay by Card" feature also allows businesses to fund vendor payments via credit card, even if the vendor only accepts ACH or checks.

| Feature | Details |

|---|---|

| Pricing | Starts with a "Go" plan at $32 per month for 10 domestic transactions. A 30-day free trial is available. |

| Best For | Small businesses and accounting firms in the US and Canada needing an affordable, all-in-one AP/AR solution. |

| Unique Offering | The ability to pay vendors via ACH or check using your credit card, providing greater cash flow flexibility. |

| Implementation | Simple onboarding process with guided setup for connecting bank accounts and syncing with accounting software. |

Pros:

- Small-business-friendly pricing and a generous 30-day free trial.

- Strong features for accountants managing multiple clients.

- Flexible domestic and international payment options.

Cons:

- Transaction fees can apply for certain payment types or plan tiers.

- Advanced features like OCR invoice capture (Plooto Capture) are add-ons.

Visit Plooto

Top 12 Accounts Payable Software Comparison

| Product | Core capability | ✨ Unique selling points | 💰 Pricing / value | 👥 Target audience | ★ UX / Quality |

|---|---|---|---|---|---|

| 🏆 DocParseMagic | AI document parsing → CSV in <1 min; supports scanned & digital multi-format | Context-aware extraction, inferred/enrichment, proprietary calc engine ✨ | 💰 Starter €9/mo (30), Pro €29 (150), Ent €99 (750); free signup credits | 👥 Bookkeepers, small accounting teams, e-commerce, finance/data teams, freelancers | ★★★★☆ fast, accurate |

| BILL (formerly Bill.com) | Centralized bill inbox, approvals, AP/AR workflows, payments | Mature US vendor network, multiple payment rails ✨ | 💰 Per-user + txn fees; tiered plans | 👥 SMBs & accountants needing robust AP workflows | ★★★★☆ stable, feature-rich |

| Melio | Simple AP/AR, vendor payments via bank/card/check | Card-to-check, easy onboarding, batch payments ✨ | 💰 Free tier; fees on some payment rails | 👥 Small businesses, micro teams | ★★★☆☆ simple, cost-effective |

| QuickBooks Bill Pay (Intuit) | Native bill pay embedded in QuickBooks Online | Seamless QBO ledger integration, fewer apps ✨ | 💰 Included with QBO (requires subscription); payment fees beyond allotments | 👥 QBO users, accountants | ★★★★☆ integrated, convenient |

| Xero (Bills + Online Payments) | Cloud accounting + bill capture (Hubdoc) + online payments | Clean UI, integrated reporting, app marketplace ✨ | 💰 Xero subscription + per-bill payment fees | 👥 Xero small businesses | ★★★★☆ intuitive, integrated |

| Zoho Books (+BillPay) | Accounting with vendor bills, approvals & BillPay add-on | Competitive pricing, ties into Zoho ecosystem ✨ | 💰 Low-cost tiers; BillPay add-on extra | 👥 SMBs in Zoho ecosystem | ★★★☆☆ value-packed |

| FreshBooks (Premium/Select) | Invoicing + basic AP (Bills & Vendors on higher plans) | Easy UX for freelancers; mobile apps ✨ | 💰 Premium plans; 30‑day trial | 👥 Freelancers & tiny service businesses | ★★★☆☆ simple, friendly |

| Ramp | Free corporate card + spend platform + Bill Pay | No software cost, unlimited users; strong automations ✨ | 💰 Core platform free; fees for expedited/international rails | 👥 Startups & SMBs wanting card+AP consolidation | ★★★★☆ automated, low-cost |

| Tipalti | AP automation with global payments & tax compliance | 50+ payment methods, supplier onboarding, multi-entity support ✨ | 💰 Higher entry price; enterprise pricing | 👥 Mid-market & global businesses | ★★★★☆ scalable, compliant |

| Stampli | Invoice capture, approvals, collaboration-focused AP | In-app vendor communication, strong usability ✨ | 💰 Quote-based (no public pricing) | 👥 Teams needing collaboration & support | ★★★★☆ highly usable |

| Corpay (Complete) | Invoice-to-pay + payments & spend management | Managed services for vendor enablement, PO automation ✨ | 💰 Sales-led pricing; tailored | 👥 SMBs with moderate volume / mid-market | ★★★☆☆ one-platform approach |

| Plooto | AP/AR with OCR, approvals, domestic & intl payments | Accountant-friendly, multi-bank support, Pay-by-Card ✨ | 💰 Small-business pricing; 30‑day trial; txn fees possible | 👥 Small businesses & accountants (US/CA) | ★★★☆☆ practical, affordable |

Making the Final Decision: The Best AP Tool for Your Unique Business

Choosing the right accounts payable software can feel overwhelming, but after reviewing twelve of the top contenders, a clear theme emerges: the best accounts payable software for a small business is not a one-size-fits-all solution. Your ideal tool depends entirely on your current challenges, operational scale, and existing technology. The perfect choice for a freelancer will differ significantly from that of a growing e-commerce retailer managing hundreds of supplier invoices each month.

We've explored a wide spectrum of platforms, from comprehensive, all-in-one payment ecosystems like BILL and Tipalti to seamlessly integrated solutions within accounting giants like QuickBooks and Xero. Each serves a distinct purpose. Ramp excels for businesses seeking unified spend management, while Melio offers a straightforward, affordable way to digitize payments. The key takeaway is to move beyond feature lists and focus on your primary bottleneck.

A Framework for Your Final Choice

Instead of getting lost in comparison charts, use this guide to narrow your focus. Ask yourself these critical questions to create a shortlist of two or three platforms to test drive:

- What is my single biggest AP problem? Is it disorganized invoice approval workflows, the high cost of ACH and check payments, or the sheer time spent on manual data entry? Be honest about your most significant pain point.

- How does this tool fit my existing system? If you live and breathe QuickBooks Online, an integrated solution like QuickBooks Bill Pay is a natural starting point. If your process involves multiple, disconnected systems, a more flexible tool might be necessary.

- What is my real budget? Consider not just the monthly subscription but also per-transaction fees, user seat costs, and potential implementation expenses. A "free" tool might become costly as your payment volume increases.

Once you have your shortlist, the next step is crucial: sign up for free trials. Don't just click around the interface. Take 3-5 of your most common or problematic invoices and run them through each system from start to finish. This real-world testing is the only way to know for sure if a platform will truly solve your problems or just create new ones.

The Critical Role of Data Extraction

One of the most universal challenges for any small business is getting information off of a document and into a system. Whether it's a PDF invoice from a new vendor, a paper receipt, or a bank statement, the manual task of typing line items into a spreadsheet or accounting software is a massive time sink and a major source of errors.

For many businesses, the primary bottleneck isn't payment processing or approval routing; it's this initial data capture step. If your team spends hours each week manually transcribing invoice details, PO numbers, and line-item data, a full-blown AP automation platform might be overkill. You may not need complex approval workflows or payment services, you just need to eliminate the manual entry.

This is precisely where a specialized tool like DocParseMagic shines. It is designed to solve the data extraction problem with surgical precision. It’s the ideal solution for teams that need to turn unstructured documents into clean, structured, and usable data without the complexity or cost of overhauling their entire AP system. For businesses looking for the best accounts payable software for small business challenges rooted in data entry, a targeted extraction tool offers the highest ROI. It automates the most tedious part of the process, freeing your team to focus on analysis, vendor relationships, and strategic financial management.

Ready to eliminate manual data entry from your accounts payable process? DocParseMagic transforms your invoices, receipts, and bank statements into structured spreadsheet data in seconds. Stop typing and start analyzing by signing up for your free trial at DocParseMagic today.