A Simple Guide to Mastering the ACORD 125 Form

Think of the ACORD 125 as the essential first page of any commercial insurance application. It’s the document that gives underwriters a bird's-eye view of a business before they get into the nitty-gritty of specific coverages.

What Is the ACORD 125 Form

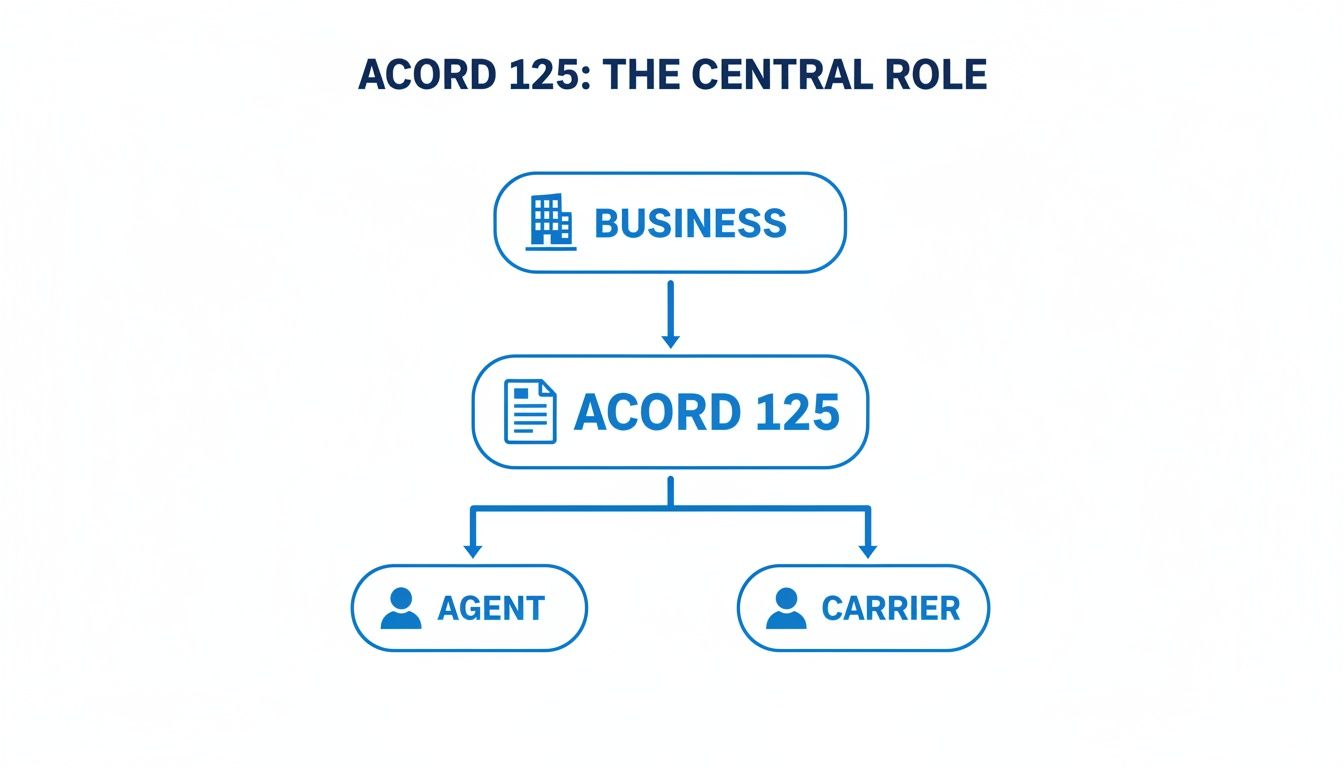

Imagine you're applying for a loan. Before the bank looks at your detailed financial history, they start with a simple application to get the basics: your name, address, and what you do for a living. The ACORD 125 form does the exact same thing for insurance. It’s not just a piece of paper; it's the standard language everyone in the industry—from agents to carriers—uses to start the conversation.

This form creates a quick, scannable profile of a business's potential risks. This ensures every underwriter, no matter which company they work for, begins with the same foundational information. It sets the stage for all the other, more specific applications that will follow.

The Universal Starting Point for Coverage

The ACORD 125 is the go-to document for businesses looking to get covered, especially for critical policies like liability insurance for contractors. By gathering all the core details in one place, its universal structure turns a potentially messy process into a straightforward one.

Here’s what it really accomplishes:

- Creates a Business Snapshot: It captures the must-know details like the business name, location, what it does, and who to contact.

- Standardizes Submissions: It forces information into a consistent format, which helps carriers review applications much faster.

- Details Prior History: The form outlines past insurance carriers and any previous losses, giving underwriters crucial context.

A Foundation Built for Efficiency

The ACORD 125 has been a cornerstone of commercial insurance for decades. Even today, modern platforms can identify and pull 60 to 70 different pieces of information from the various versions of the form, from the 2011 edition to the 2024 update. This shows just how much the industry relies on it to make risk assessment more efficient. You can get a deeper look into this with these insights on ACORD 125 data fields.

By putting all the fundamental applicant data in one spot, the ACORD 125 gets rid of repetitive questions and creates a single, reliable record for the entire application. This lets underwriters spend their time actually analyzing risk, not chasing down basic information.

Getting this form right is the first real step toward a quick and successful insurance application. It's the key that opens the door to getting the commercial coverage your business needs. And as technology advances, new tools for insurance document processing are making this initial data collection even faster, speeding up the entire underwriting journey.

Breaking Down the ACORD 125: What Matters Most

The ACORD 125 can feel a bit intimidating at first glance, but it’s best to think of it as a structured conversation. Each section is designed to ask for specific details that, together, paint a clear picture of your business for an underwriter. If you get these core parts right, the whole process of getting a quote becomes much smoother.

The form starts with the basics and drills down into the specifics. We'll walk through the big four sections that really count: your company's basic info, where you operate, what you actually do, and your past insurance history. Knowing why each field is important helps you give underwriters exactly what they're looking for.

This form really is the central connector between your business, your agent, and the insurance carrier. It standardizes everything so everyone is speaking the same language.

As you can see, the ACORD 125 is the bridge that turns your company's details into a format that agents and carriers can quickly and accurately assess.

Who You Are and Where You Work

The first page sets the scene, establishing your business identity and physical locations. The Applicant Information is more than just a formality; it defines the legal entity that the insurance policy will protect.

- Named Insured: This has to be the full, correct legal name of the business. Any discrepancy here is a common and frustrating cause for delays.

- FEIN/SSN: Your Federal Employer Identification Number (FEIN) is the standard. If you’re a sole proprietor, you’ll likely use your Social Security Number instead.

- Business Structure: Are you an LLC, a corporation, or something else? This detail is crucial because it affects liability and how the policy needs to be written.

Right after that, the Premises Information section gets into your physical footprint. Every location has its own risk profile, so underwriters need to know the address, whether you own or lease, and what happens at each site. This information is a direct input for calculating your property and liability premiums.

Explaining Your Business Operations

This is where you tell your story. The Nature of Business section is your opportunity to describe what your company does every day. A generic answer like "contractor" tells an underwriter almost nothing and usually results in a ton of follow-up questions.

A much better approach is to be specific, like "General contractor specializing in commercial tenant improvements for office spaces under 10,000 sq. ft." That one sentence provides a world of clarity.

The "Description of Operations" field is probably the most important narrative part of the entire form. A well-written, honest description that mentions your safety protocols or risk management practices can make a huge difference in the terms and pricing you get.

Don’t forget to include your NAICS or SIC code. These industry classification codes are one of the first things an underwriter uses to benchmark your risk. A software developer and a restaurant might share a building, but their risk profiles (and codes) are night and day.

Your Insurance Track Record

Finally, the form looks to the past to help predict the future. The Prior Carrier & Loss History section is all about your insurance background and any claims you’ve had. Carriers will almost always ask for a complete history going back three to five years.

Here's what you'll need to provide:

- Previous Insurers: Who wrote your policies before?

- Policy Numbers: These help underwriters verify your history if they need to.

- Premiums Paid: This gives a sense of what other carriers have charged for your level of risk.

- Loss Runs: This is the big one. It's a detailed report of every claim, including what happened, the date, and how much was paid out or set aside.

Being upfront and thorough here is non-negotiable. If you have gaps in your coverage history or can't produce loss runs, it’s a major red flag for underwriters and will absolutely slow things down. A clean, well-documented history, on the other hand, shows that you're a transparent and well-managed risk.

To put it all together, here’s a quick summary of the key sections and why they’re so critical.

ACORD 125 Section Breakdown and Purpose

| Section Name | Information Required | Why It's Important |

|---|---|---|

| Applicant Information | Legal name, DBA, FEIN/SSN, business structure, contact details. | Establishes the legal entity being insured and ensures the policy is correctly issued. |

| Premises Information | Full address for all locations, ownership status (own/lease), square footage. | Assesses property-related risks like fire, theft, and liability for each physical site. |

| Nature of Business | Detailed description of operations, NAICS/SIC codes, years in business. | Provides clarity on operational risks, helping underwriters classify the business correctly. |

| Prior Carrier & Loss History | Names of previous insurers, policy numbers, and detailed claim reports (loss runs). | Demonstrates the business's risk history, which is a key predictor of future claims. |

Each of these sections provides a vital piece of the puzzle, allowing the underwriter to build a complete risk profile and issue an accurate and competitive quote.

How to Fill Out Your ACORD 125 with Confidence

Filling out an ACORD 125 shouldn't feel like a chore. It's actually your first, best chance to tell your business's story to an underwriter. If you approach it with a clear strategy, you can turn a simple application into a powerful tool that gets you a better, faster quote. The secret is focusing on clarity, completeness, and context—especially in the sections that get the most attention.

Think of it this way: a rushed or vague form is like a weak handshake. It leads to delays, a ton of follow-up questions from the carrier, and a bad first impression. But a thoughtfully completed ACORD 125? That gets the quoting process moving and builds trust right out of the gate.

Let's dive into the two areas where you can really make a difference and avoid the most common mistakes: the 'Description of Operations' and the 'Loss History'.

Crafting a Compelling Description of Operations

I can't stress this enough: this is the most critical narrative section on the entire form. Writing something generic like "construction business" tells an underwriter almost nothing. When they don't have details, they have to assume the worst-case scenario, and that's not good for your premium.

This is your space to paint a clear, accurate picture of what your business does. More importantly, it’s where you can show how you manage risk. Highlighting the proactive safety measures you take can directly impact your quote in a positive way.

A strong business description on the ACORD 125 is a golden opportunity. Applicants can spotlight their risk management programs, safety protocols, and operational strengths to land better insurance rates. When underwriters see mentions of things like frequent inspections, building alarms, security services, or third-party audits, they see a business committed to minimizing risk.

For instance, instead of just writing "Restaurant," you could write: "Family-owned Italian restaurant with seating for 50 guests. Our kitchen is fully equipped with an ANSUL fire suppression system that's inspected semi-annually. All staff members are required to complete food safety and responsible alcohol service training." See the difference? One is a label, the other is a story of a well-run business.

Detailing Your Loss History with Accuracy

When you get to the Loss History section, transparency is everything. Underwriters need a complete and accurate look at your claims experience, usually for the last three to five years. Missing information here is one of the biggest red flags you can possibly raise.

To make sure this section is perfect, just follow these simple rules:

- Provide Full Loss Runs: Don't just summarize. Always attach the official loss run reports from your previous insurance carriers. These documents have all the detailed claim data underwriters need to see.

- Explain Any Gaps: If there was a period where you didn't have insurance, explain why. Something simple like, "The business was not operational from Q2 2022 to Q4 2022," is all it takes.

- Detail Large Claims: If you had a significant claim, don't hide it. Briefly explain what happened and, crucially, what you did to make sure it doesn't happen again. This shows you're a proactive partner in managing risk.

Taking the time to complete these sections thoroughly doesn't just speed things up; it proves your business is a well-managed risk worth insuring. And for those of you handling a high volume of these forms, knowing how to extract data from a PDF can be a huge help, allowing you to quickly pull key information from completed applications for review. By tackling your ACORD 125 with confidence and an eye for detail, you're setting yourself up for a much smoother underwriting process.

Common Mistakes to Avoid on the ACORD 125

Filling out an ACORD 125 isn't rocket science, but simple mistakes can cause frustrating delays, inaccurate quotes, or even get your application kicked back. Think of this as your pre-flight checklist—a quick run-through of the common pitfalls that can trip people up.

Getting these details right the first time makes the whole submission process smoother for everyone involved. The most frequent issues are often the most basic, yet they can stop an application dead in its tracks. From a vague business description to a spotty loss history, every error forces an underwriter to hit pause and ask for more information.

Let's break down the top three errors we see all the time and, more importantly, how to get them right.

Vague Business Descriptions

One of the surest ways to slow things down is by being too generic about what your business actually does. When an underwriter sees "Contractor" or "Retail Store," they have no real clue about your company's risk. They're forced to guess, and they'll usually assume a higher risk, which means higher premiums for you.

- Weak Example: "Consulting business."

- Strong Example: "IT consulting firm specializing in cybersecurity audits for financial institutions with under 50 employees."

See the difference? The second one paints a clear picture. It tells the underwriter the specific work you do, the industry you serve, and the size of your clients. That kind of detail gives them the confidence they need to give you a fair, accurate quote without a lot of back-and-forth.

Incomplete Loss Histories

The loss history section is absolutely critical, but it’s amazing how often it's submitted with gaps or missing documents. Underwriters need to see a full claims history—usually for the past three to five years—to properly understand your risk profile.

An incomplete loss history is a huge red flag. It makes underwriters wonder what you might be hiding, which can lead to a much higher quote or even an outright "no." Honesty is always the best approach here.

The fix is simple: always attach the official "loss run" reports from your previous insurance carriers for the entire required period. If you had a gap in coverage for some reason (maybe the business was paused), just add a short note explaining why. That little bit of transparency goes a long way in building trust.

Using Outdated Forms

This one is an easy mistake to make, but it’s a surefire way to cause delays. ACORD updates its forms from time to time to keep up with new regulations and industry standards. When they do, carriers update their systems to match.

If you send in an old version, it might not even be readable by their system or could be missing fields they now require. The result? An automatic rejection, forcing you to start all over again with the right form. Always double-check with your agent or broker to make sure you have the most current edition of the ACORD 125 before you start filling it out.

How Automation Is Changing ACORD 125 Processing

Filling out one ACORD 125 is one thing. Managing hundreds of them is another story entirely, and it’s where you’ll find a major bottleneck in the insurance industry. For carriers and MGAs, the old-school process of manually keying in data from endless PDFs is slow, mind-numbing, and a recipe for human error. It’s a workflow that has been stuck in the past for decades—until now.

This traditional method ties up your skilled team members with low-value data entry. Every minute someone spends typing an applicant's name, policy number, or loss history is a minute they aren't spending on what actually matters: underwriting, analyzing risk, and making smart decisions. This inefficiency drags down quote turnaround times and drives up operational costs.

The Before and After of Data Entry

Think about the classic way of handling an ACORD 125 submission. An underwriter gets an email with a scanned PDF, which might be handwritten or a fuzzy copy. They then have to squint at the screen and manually type every single field into their management system, constantly double-checking for typos. This can take several minutes for just one form, and when you have a pile of them landing every day, the backlog grows fast.

Now, let’s look at the modern way. An automated platform receives that same PDF, but instead of a person doing the typing, the technology instantly reads and extracts all the critical information.

- Applicant Name and Address: Pulled with perfect accuracy.

- Policy Numbers and Effective Dates: Captured and formatted correctly.

- Loss History Details: Organized and ready for immediate review.

This "before-and-after" picture isn't just a small improvement; it’s a fundamental shift in how work gets done. Automation completely removes the most time-consuming and error-prone step in the submission process, freeing up your team to focus on the work that requires their expertise.

The screenshot below gives you an idea of how these new platforms present the extracted data, making validation a breeze.

This clean, table-style view lets a user confirm the information from the ACORD 125 at a glance instead of having to hunt through the original document line by line.

The Power of Intelligent Document Processing

What makes this all possible is a technology called Intelligent Document Processing (IDP). It’s a huge leap beyond simple text recognition. Older systems needed rigid templates to work, but IDP uses AI to actually understand the context and layout of any ACORD 125, no matter the version or how it's formatted. Want a deeper dive? You can learn more in our guide on what Intelligent Document Processing is.

By automatically capturing and validating data from submissions, automation effectively handles up to 80% of the upfront work before a human ever needs to log in. This allows teams to focus exclusively on review and analysis, not tedious data entry.

The benefits here are immediate and significant. You’ll see quote turnaround times speed up, data accuracy improve, and your team’s capacity to handle more submissions increase without adding stress. For anyone in the insurance game, understanding these tools provides a clear look into the future of administrative work. Tools like AI receptionist solutions specifically for insurance agents are already changing daily operations.

Bringing automation to ACORD 125 processing isn't just about saving time. It's about building a smarter, more accurate, and more competitive underwriting operation from the ground up.

Frequently Asked Questions About the ACORD 125

As you get ready to submit your commercial insurance application, a few questions always seem to pop up. Answering them now will save you a lot of headaches and back-and-forth later on. Let’s walk through some of the most common things people ask about the ACORD 125.

We'll cover where to find the form, what other paperwork you'll need, how to deal with tricky spots like gaps in your insurance history, and why using the latest version is a non-negotiable part of the process.

Where Can I Get a Blank ACORD 125 Form?

The best and safest place to get an ACORD 125 is directly from your insurance agent or broker. They'll have the exact, up-to-date version that carriers expect to see.

ACORD forms are copyrighted, which means they are distributed through licensed members. It’s tempting to just grab one from a Google search, but that's a bad idea. You could easily end up with an old form that an underwriter will immediately reject.

Is the ACORD 125 the Only Form I Need for a Quote?

Nope. Think of the ACORD 125 as the cover page of your application—it gives the big picture of your business, but not the nitty-gritty details. It's almost never submitted alone.

To get a real quote, you'll need to fill out other, more specific ACORD forms that dig into the coverage you're actually asking for. For instance, you’ll typically pair it with an ACORD 126 for General Liability or an ACORD 140 for Commercial Property insurance.

What Should I Do If I Have Gaps in My Loss History?

Honesty is the best policy here. If you have gaps in the three-to-five-year loss history, you absolutely have to explain them. You can add a note right on the form or attach a separate letter of explanation.

Unexplained gaps are a huge red flag for underwriters. They raise questions and cause delays. Simply providing context—maybe the business was closed for a year, or a previous insurer went out of business—is key to building trust and keeping your application moving.

If you don't explain the gaps, underwriters will often assume the worst. Being upfront makes the whole process smoother.

Can I Submit an Older Version of the ACORD 125 Form?

Don’t do it. Submitting an outdated form is one of the most common and easily avoidable mistakes, and it will bring your quoting process to a screeching halt. Carriers are constantly updating their systems to match the newest ACORD standards.

An old form might be missing key fields or just won't work with their software. You'll almost certainly get a request to resubmit on the correct version, which wastes everyone’s time. Before you start, just double-check with your agent that you have the most current form.

Ready to eliminate manual data entry from ACORD forms and other documents? DocParseMagic turns messy PDFs and scans into clean, structured data in minutes. Stop copy-pasting and start focusing on what matters. Try it for free and see how much time you can save.