Best ap automation software for small business: Top 12 picks

For any small business, managing accounts payable can feel like a constant battle against piles of invoices, manual data entry, and the ever-present risk of errors or late fees. This tedious process consumes valuable time that could be spent on core business growth. AP automation software transforms this workflow by capturing invoice data, routing bills for approval, and executing payments automatically, significantly reducing administrative burdens.

But with dozens of options available, choosing the right tool is a challenge. This guide cuts through the noise to help you find the perfect fit. We provide a detailed breakdown of the 12 best AP automation software for small business, analyzing each tool based on its specific strengths, pricing models, ease of use, and critical integration capabilities.

Inside, you'll find in-depth profiles with screenshots and direct links, tailored for bookkeepers, e-commerce retailers, and any operations staff tired of processing paperwork. Our goal is to provide a comprehensive resource that helps you compare solutions directly and select the platform that will most effectively reclaim your time and streamline your financial operations. Let's find the right software for you.

1. DocParseMagic

DocParseMagic distinguishes itself as a premier AP automation solution for small businesses by focusing on a critical, often-overlooked step: transforming unstructured documents into flawlessly structured, spreadsheet-ready data. Instead of just basic OCR, its AI-powered engine intelligently parses invoices, receipts, and statements, then enriches the output by inferring missing data like vendor details or clarifying ambiguous line items. This approach ensures the final CSV file is immediately usable, eliminating the tedious manual cleanup required by many other tools.

The platform's standout feature is its proprietary calculation engine, which guarantees accurate math for totals, taxes, and multi-currency conversions, a crucial advantage over general AI models that can struggle with arithmetic. This makes it an exceptionally reliable tool for finance teams who cannot afford calculation errors. Its ability to handle a vast array of input formats without needing pre-built templates makes it one of the most flexible and best AP automation software solutions for small business teams dealing with diverse supplier documents.

Key Features and Pricing

- AI-Powered Data Enrichment: The system doesn't just extract text; it understands context to fill gaps, providing more complete data sets than standard OCR.

- Guaranteed-Accurate Calculations: Its specialized engine performs complex calculations, avoiding common AI math errors and ensuring financial data integrity.

- Template-Free Processing: DocParseMagic adapts to various document layouts on the fly, saving significant time on setup and maintenance. For more details on this process, you can explore DocParseMagic's invoice data extraction software guide.

- Customizable Output: Users can define unlimited custom columns using plain-English instructions to tailor the output precisely to their needs.

Pricing is transparent and accessible for small businesses, starting with a Starter plan at €9/month for 30 credits. The Professional plan is €29/month for 150 credits, and the Enterprise plan is €99/month for 750 credits. A free trial with credits is available without requiring a credit card.

| Pros | Cons |

|---|---|

| AI intelligently enriches data, reducing manual fixes. | High-volume users may find costs scale quickly. |

| Proprietary calculation engine ensures financial accuracy. | Extremely poor-quality scans might still require human review. |

| Handles virtually any document format without templates. | Lacks third-party certifications or awards listed on the site. |

| Predictable, credit-based pricing with a free trial. |

Website: https://docparsemagic.com

2. BILL (Bill.com)

BILL (formerly Bill.com) is a titan in the SMB fintech space, offering one of the most comprehensive and mature accounts payable and receivable platforms available. It excels at centralizing the entire AP lifecycle, from capturing an invoice in a dedicated inbox to executing payments via multiple methods like ACH, checks, virtual cards, or even international wires. This robust functionality makes it a top contender for small businesses looking for an all-in-one solution that can scale with them.

What sets BILL apart is its vast network of vendors who are already using the platform, which can significantly speed up electronic payments. Its deep, two-way sync with accounting software like QuickBooks and Xero is another key strength, ensuring your general ledger is always up-to-date without manual data entry. While its per-user pricing model can become costly for larger teams, its transparent fee structure and powerful feature set provide clear value. Many consider it among the best accounts payable automation software options due to its proven track record and reliability.

Key Details & Features

- Best For: Small businesses needing a comprehensive AP solution with strong accounting software integration and multiple payment options.

- Pricing: Tiered plans start with the "Essentials" plan, with costs increasing for advanced features like purchase order matching. Per-user fees apply.

- Key Features: Automated invoice capture, customizable approval workflows, extensive payment options (ACH, check, virtual card, international), and deep two-way sync with major accounting platforms.

- Pros: Large established vendor network, excellent accounting integrations, transparent transaction fees.

- Cons: Per-user pricing can get expensive, and extra fees apply for expedited payment services.

Website: https://www.bill.com/product/pricing/

3. Melio

Melio has rapidly become a favorite in the SMB community, focusing on simplifying bill payments and making cash flow management more flexible. Its platform is designed for ease of use, allowing businesses to capture bills via a dedicated inbox, route them for approval, and schedule payments quickly. The standout feature is its payment flexibility; businesses can pay their vendors with a credit card, even if the vendor doesn't accept them, while the vendor receives a standard ACH or check payment. This helps small businesses extend their float and earn card rewards.

What makes Melio a strong choice is its accessible pricing model, including a free entry-level plan for basic bill pay. It offers deep integrations with QuickBooks and Xero, ensuring that payment and bill data sync seamlessly, which is crucial for maintaining accurate books. While some advanced automation features are reserved for paid tiers, its core functionality and payment options make it a powerful tool. For businesses prioritizing payment flexibility and low starting costs, Melio is one of the best AP automation software for small business options available.

Key Details & Features

- Best For: Small businesses and freelancers who want flexible payment options, including paying standard bills by credit card, with a low-cost entry point.

- Pricing: Offers a free "Go" plan with limited ACH transfers. Paid plans like "Core" and "Pro" add more features and unlimited ACH at a flat monthly rate.

- Key Features: Card-to-bank payments, automated bill capture and approval workflows, batch payments, international payments, and deep QuickBooks/Xero synchronization.

- Pros: Generous free plan for basic needs, unique ability to pay any vendor by card, strong integration with top accounting software.

- Cons: Some automation features are gated behind higher-tier plans, and ACH payments beyond the free allotment cost extra on the entry-level tier.

Website: https://meliopayments.com/pricing/

4. QuickBooks Bill Pay (Intuit)

For businesses already embedded in the Intuit ecosystem, QuickBooks Bill Pay offers the most native and seamless accounts payable experience. This add-on service is built directly into QuickBooks Online, eliminating the need for complex integrations or data syncing. It allows users to manage the entire bill payment process, from automated invoice capture via email to executing payments via ACH or check, all without leaving the familiar QuickBooks interface.

What truly sets QuickBooks Bill Pay apart is its deep integration. Because it’s a first-party tool, reconciliation is instantaneous and perfectly aligned with the general ledger. Higher-tier plans add crucial features like custom approval workflows and user permissions, making it a viable option for growing teams. While it lacks some of the advanced features of standalone platforms, its convenience for existing QuickBooks users is unmatched, positioning it as one of the best AP automation software choices for those prioritizing simplicity and a single source of truth for their accounting.

Key Details & Features

- Best For: Small businesses heavily invested in QuickBooks Online seeking a simple, fully integrated bill pay solution.

- Pricing: A basic tier is included with QuickBooks Online plans. Paid tiers offer more features and higher monthly ACH allotments before per-transaction fees apply.

- Key Features: Automated bill creation from emailed invoices, roles-based permissions and approval workflows (higher tiers), included 1099 e-filing, and payment scheduling via ACH or check.

- Pros: Unbeatable integration for QuickBooks Online users, scalable plans with included ACH payments, potential discounts through the accountant program.

- Cons: Additional fees apply for payments beyond monthly allotments and for expedited payment services.

Website: https://quickbooks.intuit.com/bill-pay/

5. Ramp (Ramp Bill Pay)

Ramp expands the concept of accounts payable automation by bundling it into a comprehensive spend management platform. Its core offering combines corporate cards with a powerful, free Bill Pay feature, making it a unique contender for small businesses aiming to consolidate their financial tools. Ramp uses AI to automatically capture invoice data, suggest general ledger coding, and route bills through customized approval workflows, streamlining the entire process from receipt to payment via ACH or check. This integrated approach provides a holistic view of all company spending in one place.

What makes Ramp stand out is its pricing model. The core platform, including unlimited users, corporate cards, and Bill Pay, is free to use, as Ramp earns revenue from interchange fees. This makes it an incredibly accessible piece of AP automation software for small business teams of any size. The tight integration between cards and bill payments allows for superior spend controls and real-time visibility. While more advanced features like multi-entity support require a paid subscription, the free tier offers a robust solution for businesses wanting to manage all their non-payroll spending efficiently.

Key Details & Features

- Best For: Startups and small businesses looking for an all-in-one spend management platform that combines corporate cards with free, integrated AP automation.

- Pricing: The core platform and Bill Pay feature are free. Ramp Plus is available for advanced features and enterprise needs.

- Key Features: AI-assisted invoice capture and automatic coding, approval workflows, real-time accounting sync, ACH and check payments, and unlimited users and cards.

- Pros: Core platform and Bill Pay are free to use, includes unlimited users and strong spend controls, excellent combination of corporate card and AP automation.

- Cons: Advanced features require a Ramp Plus subscription, and extra fees apply for international payments and same-day ACH.

Website: https://ramp.com

6. Plooto

Plooto is an accounts payable and receivable platform specifically designed with the needs of small to medium-sized businesses in mind. It streamlines both sides of the cash flow equation, enabling users to manage vendor bills and customer invoices from a single dashboard. The platform focuses on simplifying payment processes and approval workflows, removing manual steps like check printing and spreadsheet tracking to give SMBs better financial control.

What makes Plooto a unique option in the AP automation software space is its flexible pricing structure, which includes optional monthly bundles for domestic transactions. This allows businesses with predictable payment volumes to control per-transaction costs effectively. With straightforward integrations for QuickBooks Online and Xero, and a strong emphasis on ease of use, Plooto is an accessible solution for businesses aiming to automate their payment operations without a complex or costly implementation process.

Key Details & Features

- Best For: SMBs and accounting firms looking for a user-friendly, dual AP/AR platform with predictable transaction costs.

- Pricing: Subscription-based plans with per-transaction fees. Optional add-on bundles are available to lower the cost per domestic transaction.

- Key Features: Dual AP and AR management, customizable approval rules, multiple payment options (ACH, check, card), and integrations with QuickBooks Online, Xero, and NetSuite (higher-tier plan).

- Pros: Purpose-built for SMBs with simple onboarding, flexible transaction bundles help manage costs, transparent pricing and documentation.

- Cons: Advanced ERP integrations like NetSuite require higher-tier plans, and extra bank-related fees for things like NSF can apply.

Website: https://www.plooto.com/

7. Tipalti

Tipalti is an end-to-end AP automation platform designed for businesses with more complex needs, particularly those managing global mass payments, multi-entity operations, and stringent tax compliance. While it's a more powerful solution than many entry-level tools, its strength lies in scaling with a growing small business that has ambitions for international expansion. It automates the entire payables process, from invoice intake and supplier onboarding to global payment execution and reconciliation, making it one of the best AP automation software options for small businesses on a high-growth trajectory.

What truly distinguishes Tipalti is its focus on global supplier management and compliance. The self-service supplier portal handles W-9/W-8 collection and TIN validation, reducing tax-time headaches significantly. Its ability to pay vendors in over 120 currencies across 200+ countries is a major advantage for companies working with international contractors or suppliers. While implementation is more involved than lighter SMB tools, its robust feature set and unlimited user policy provide significant value for businesses that need its advanced capabilities. You can learn more about its advanced capabilities in a detailed Tipalti overview.

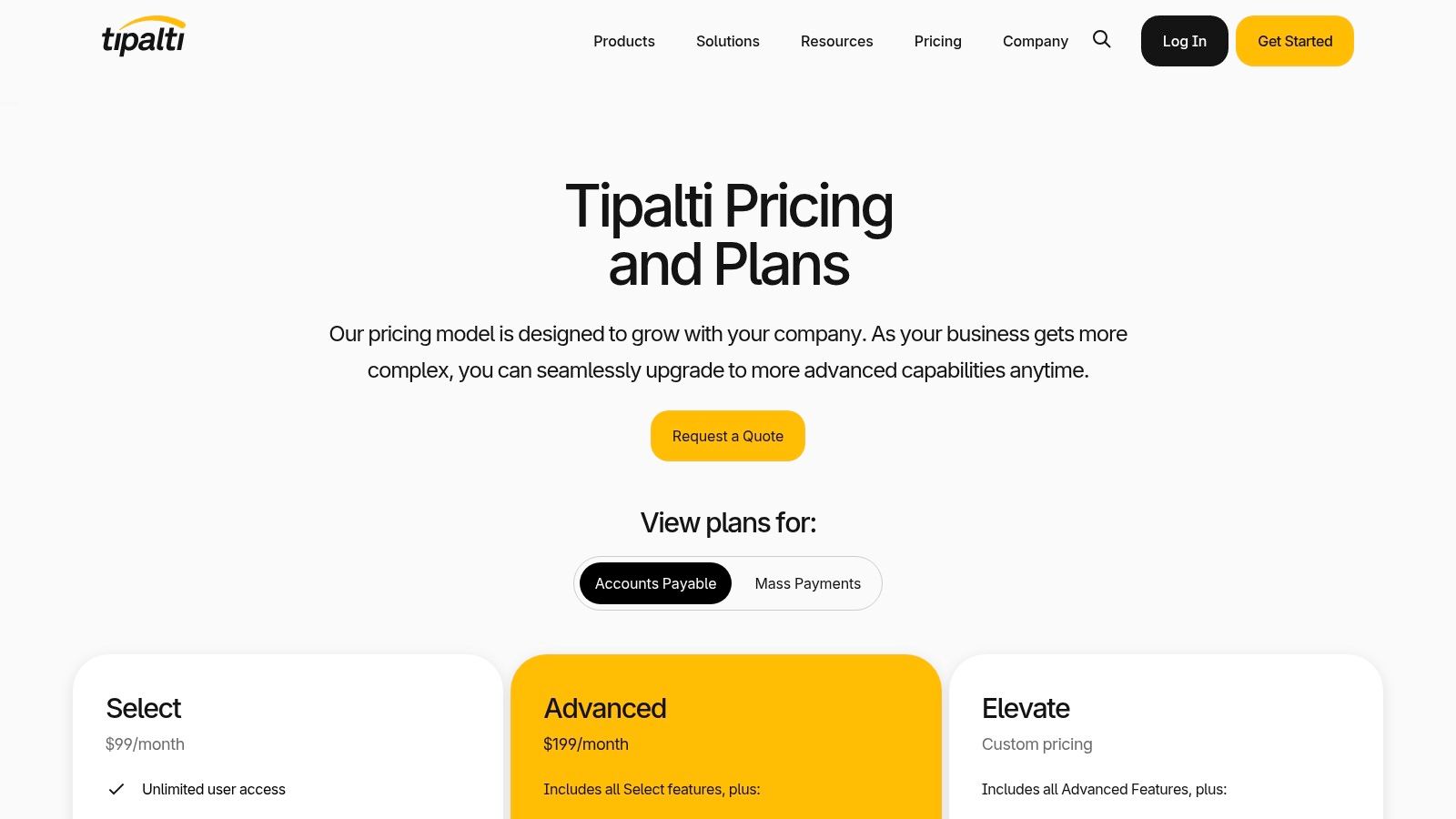

Key Details & Features

- Best For: Fast-growing SMBs with international vendors, complex tax compliance needs, or multi-entity structures.

- Pricing: Purchase is through sales, with listed platform fees starting from $149/month.

- Key Features: Global payouts in 120+ currencies, automated supplier portal with W-9/W-8 tax form collection, AI-powered invoice processing, and optional 2/3-way PO matching.

- Pros: Excellent for international payments and tax compliance, unlimited users included in all plans, strong ERP integrations.

- Cons: Implementation can be more complex than simpler tools, and some advanced features are reserved for higher-tier plans.

Website: https://tipalti.com/pricing/

8. Quadient AP by Beanworks

Quadient AP, formerly known as Beanworks, offers a robust cloud-based AP automation solution targeting small to mid-market companies. The platform is designed to handle the complete procure-to-pay lifecycle, covering invoices, purchase orders, expenses, and payments. Its primary strength lies in its user-friendly approach and broad compatibility with popular SMB accounting systems, making it a strong contender for businesses looking to streamline their financial operations without a complex implementation process.

What truly sets Quadient AP apart is its pricing model, which includes unlimited users in its standard packages. This is a significant advantage for growing teams where per-user fees can quickly add up, making it one of the more scalable options. The platform’s focus on reducing time-to-value for AP teams is evident in its intuitive approval routing and AI-powered invoice capture. For businesses that need a comprehensive system that can grow with them, Quadient AP is a solid choice among the best AP automation software for small business.

Key Details & Features

- Best For: Growing teams and mid-market companies needing unlimited user access and strong integration with accounting systems like Sage or Microsoft Dynamics.

- Pricing: Pricing is not publicly listed and requires a custom quote through a sales conversation.

- Key Features: AI-driven invoice capture and coding, automated approval workflows, PO matching, multi-entity support, and integrated payment processing (check, ACH/EFT, virtual card).

- Pros: Unlimited users included in standard plans, strong integration with SMB accounting software, focused on quick implementation and value.

- Cons: Lack of transparent pricing requires a sales demo, and payment capabilities can differ based on region and method.

Website: https://www.quadient.com/en/ap-automation/plans

9. Xero App Store – Bills & Expenses

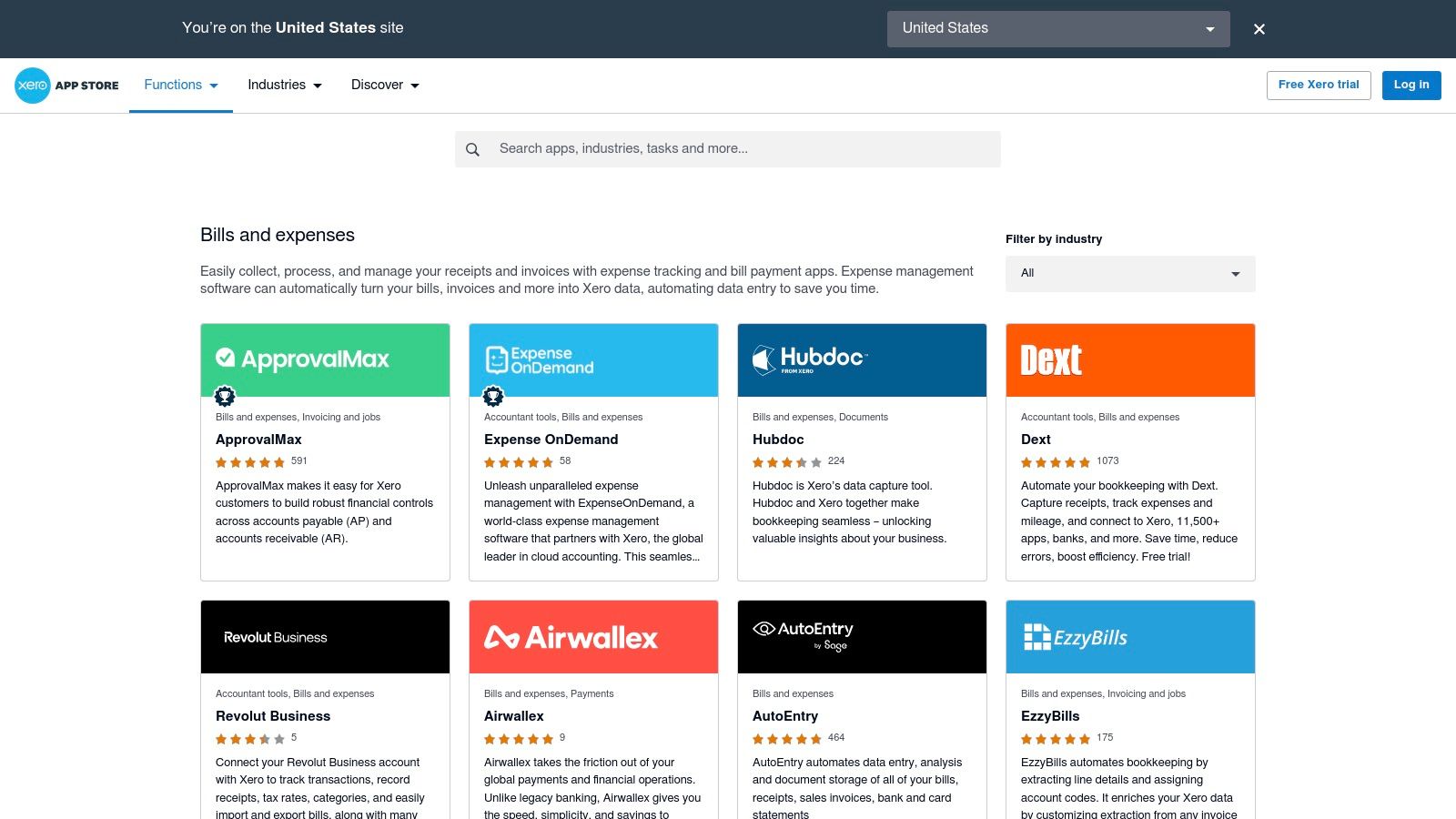

For small businesses already committed to the Xero accounting ecosystem, the official Xero App Store is the most logical starting point for finding AP automation software. Rather than a single product, it’s a curated marketplace of vetted third-party applications specifically designed to integrate seamlessly with Xero. This approach allows users to compare solutions like BILL, Dext, and Lightyear side-by-side, confident that whichever they choose will connect reliably with their general ledger.

The primary advantage here is trust and compatibility. Each app listed has been reviewed by Xero, eliminating the guesswork of whether an integration will work as promised. User reviews and ratings provide valuable social proof, helping you gauge which tools are truly effective. While the store itself is a discovery platform rather than a direct sales channel, it’s an indispensable resource for any Xero-based business looking for the best AP automation software that fits perfectly into their existing financial workflow.

Key Details & Features

- Best For: Xero users who want to find and compare a wide range of pre-vetted, compatible AP automation tools.

- Pricing: Free to browse; pricing is determined by the individual app vendors you choose from the marketplace.

- Key Features: Curated "Bills & expenses" category, user ratings and detailed reviews, direct links to vetted vendor sites, and guaranteed Xero integration.

- Pros: Ensures seamless integration compatibility with Xero, user reviews help in shortlisting apps, free resource to discover tools.

- Cons: Not a direct software provider but a marketplace, less useful for businesses not using Xero accounting software.

Website: https://apps.xero.com/us/function/bills-expenses

10. Microsoft AppSource – AP automation for Business Central

Microsoft AppSource is not a single AP software but a dedicated marketplace, making it an essential resource for small businesses already invested in the Microsoft ecosystem, particularly Dynamics 365 Business Central. Instead of a standalone tool, AppSource offers a curated selection of third-party AP automation apps (like SimplyAP) designed to integrate directly with Microsoft ERPs. This approach ensures seamless compatibility and a centralized hub for discovering, trialing, and deploying solutions without complex integration projects.

This platform is unique because it leverages your existing Microsoft stack, providing a familiar deployment path and certified integrations. For a company running on Business Central, finding the best ap automation software for small business often means starting here to guarantee a perfect fit. Users can browse apps, read reviews, check country compatibility, and often start a free trial with a single click. While this is ideal for Microsoft users, it offers little value to businesses on other accounting platforms like QuickBooks or Xero.

Key Details & Features

- Best For: Small businesses using Microsoft Dynamics 365 Business Central or other Microsoft ERPs who need a tightly integrated AP solution.

- Pricing: Varies significantly by app. Many listings require a quote or have pricing details available within the app after installation.

- Key Features: A centralized marketplace of certified apps, direct 'Get it now' trials, user reviews and ratings, and detailed app documentation with compatibility information.

- Pros: Guaranteed compatibility with Microsoft ERPs, simplified discovery and deployment process, many apps offer free trials.

- Cons: Only relevant for businesses within the Microsoft ecosystem, and pricing is not always transparent on the listing page.

Website: https://appsource.microsoft.com/

11. G2 – Accounts Payable Automation category

While not a software itself, G2’s Accounts Payable Automation category is an indispensable resource for comparing and vetting potential solutions. It's a leading software marketplace and review platform where real users share detailed feedback, providing an unbiased look at how different tools perform in real-world scenarios. For small businesses, this is crucial for cutting through marketing hype and understanding the true strengths and weaknesses of each platform before committing.

What makes G2 so valuable is its powerful filtering and comparison tools. You can narrow down the options by company size, specific features, user satisfaction ratings, and integration capabilities to create a personalized shortlist. The platform’s Grid Reports visually map out market leaders and high performers, offering a quick snapshot of the competitive landscape. By leveraging G2, you can confidently find the best AP automation software for your small business needs based on peer experiences rather than just vendor claims.

Key Details & Features

- Best For: Small businesses in the research phase looking to compare vendors, read authentic user reviews, and create a shortlist of top contenders.

- Pricing: Free to browse reviews, comparisons, and reports.

- Key Features: Verified user reviews, detailed feature comparison grids, category rankings (Leaders, High Performers), and filters for company size and specific AP needs.

- Pros: Provides an unbiased, broad view of the market, powerful filtering helps identify relevant solutions, excellent for validating vendor claims.

- Cons: Sponsored placements can influence visibility, some reviews may lean towards mid-market or enterprise perspectives.

Website: https://www.g2.com/categories/ap-automation

12. Capterra – Accounts Payable Software (2025 Shortlist)

Rather than a single software, Capterra offers a powerful starting point for your research: a curated shortlist of leading accounts payable solutions. This platform functions as a comprehensive research hub, aggregating vendor profiles, user reviews, and key feature summaries into an easily digestible format. For a small business owner overwhelmed by options, Capterra provides a crucial at-a-glance comparison, helping you quickly identify a few top candidates that fit your specific needs before diving into demos.

What makes Capterra so useful is its filtering capability and side-by-side view of pros and cons, which are pulled from real user experiences. You can sift through options like QuickBooks, Ramp, and Melio, comparing their scores and offerings. While it's an invaluable tool for creating a preliminary list, remember that some placements can be sponsored. Always verify pricing and feature specifics directly with the vendor. This resource is one of the best ways to begin the search for AP automation software for a small business.

Key Details & Features

- Best For: Small business owners and finance teams in the initial research phase who want to compare multiple AP tools at once.

- Pricing: Free to browse and use for research and vendor comparison.

- Key Features: Curated 2025 shortlist of top AP tools, user-generated pros and cons, vendor profiles with direct links, and robust filtering options.

- Pros: Easy-to-use comparison format, covers a wide range of solutions, and is completely free for research purposes.

- Cons: Some listings are sponsored, so rankings may not be purely merit-based; pricing information is often a range and requires vendor verification.

Website: https://www.capterra.com/accounts-payable-software/shortlist/

Top 12 AP Automation Solutions — Small Business Comparison

| Product | Core features ✨ | Unique selling point ✨ | Quality ★ | Pricing 💰 | Target audience 👥 |

|---|---|---|---|---|---|

| DocParseMagic 🏆 | AI parsing & enrichment; multi-format input; auto calculations; CSV output | Infers missing fields & guaranteed-accurate calculations | ★★★★★ fast & accurate | 💰 Starter €9/30cr · Pro €29/150cr · Ent €99/750cr · free test credits | 👥 Bookkeepers, finance teams, e‑commerce, freelancers |

| BILL (Bill.com) | Bill capture, approvals, multi-rail payments, QBO/Xero sync | Mature AP workflows + broad vendor network | ★★★★☆ robust SMB | 💰 Per-user + transaction fees (public fee schedule) | 👥 SMBs needing full AP + payments |

| Melio | AI bill capture, ACH/check/card payments, batch pay, W‑9/1099 flows | Pay vendors by card even if they don't accept cards | ★★★★☆ cost-conscious | 💰 Free "Go" tier; paid tiers; extra ACH fees | 👥 Small businesses wanting low-cost pay options |

| QuickBooks Bill Pay (Intuit) | Auto bill creation, approvals, ACH/check, 1099 e-filing | Native QuickBooks Online bill-pay integration | ★★★★☆ seamless for QBO users | 💰 Add-on pricing; fees for extra ACH/checks/faster options | 👥 QuickBooks Online customers |

| Ramp (Ramp Bill Pay) | Spend management + free Bill Pay, card issuance, AI invoice capture | Free core Bill Pay + unlimited users & cards | ★★★★☆ strong spend controls | 💰 Core free; Ramp Plus for advanced features | 👥 Companies wanting card + AP in one platform |

| Plooto | ACH/check/card payments, approval rules, QB/Xero/NetSuite | SMB-focused onboarding + transaction bundles to control costs | ★★★☆☆ practical SMB | 💰 Subscription + optional transaction bundles | 👥 SMBs managing per-transaction costs |

| Tipalti | AI invoice capture, global payouts (200+ countries), tax/compliance tools | Mass global payments + supplier tax compliance | ★★★★☆ enterprise-grade for global pay | 💰 Sales-quoted; tiered enterprise pricing | 👥 Global SMBs / mid-market with complex payouts |

| Quadient AP (Beanworks) | AI invoice capture, PO matching, payments, broad ERP integrations | Unlimited users included; strong ERP compatibility | ★★★★☆ ERP-friendly | 💰 Quote-based (requires sales) | 👥 Growing SMBs & mid-market on ERPs |

| Xero App Store – Bills & Expenses | Curated AP apps, reviews, region filters, install links | Xero‑vetted ecosystem for compatible AP tools | ★★★☆☆ app-dependent | 💰 Free to browse; app pricing varies | 👥 Xero users exploring AP integrations |

| Microsoft AppSource – AP automation | App listings for Business Central, trials, docs | Direct compatibility with Microsoft ERPs | ★★★☆☆ app-dependent | 💰 Pricing varies by app (often quote) | 👥 Microsoft Dynamics / Business Central users |

| G2 – AP Automation category | Category rankings, user reviews, feature filters, buyer guides | Crowd-sourced reviews & market snapshots for shortlisting | ★★★☆☆ broad market insights | 💰 Free to browse; vendor links | 👥 Buyers researching AP vendors |

| Capterra – AP Software (2025 Shortlist) | Shortlist, vendor profiles, pros/cons, filters | SMB-friendly shortlist with direct vendor links | ★★★☆☆ curated research tool | 💰 Free to browse; routes to vendor sites | 👥 SMB buyers comparing AP options |

Choosing the Right AP Software to Scale Your Business

Navigating the landscape of AP automation can feel overwhelming, but making an informed choice is a pivotal step toward reclaiming your time and streamlining your financial operations. We've explored a range of solutions, from comprehensive platforms like BILL and Tipalti to seamlessly integrated tools like QuickBooks Bill Pay and Ramp. Each offers a unique approach to solving the accounts payable puzzle.

Your journey to find the best AP automation software for your small business isn't about finding a single "perfect" tool; it's about identifying the one that aligns with your specific operational reality. A freelance bookkeeper might find Melio's free bank transfer options ideal, while a growing e-commerce retailer may need the more robust, multi-entity support offered by platforms like Plooto or Quadient AP.

Key Takeaways and Your Next Steps

Before you make a final decision, distill your needs down to the essentials. Revisit your core pain points and match them against the strengths of the software we’ve reviewed.

- For Deep Accounting Integration: If your business lives inside the QuickBooks or Xero ecosystem, starting with their native or tightly integrated solutions (QuickBooks Bill Pay, Xero App Marketplace) is often the path of least resistance.

- For All-in-One Spend Management: Businesses looking to consolidate corporate cards, expenses, and bill payments into one platform will find compelling value in solutions like Ramp, which leverages its financial products to offer powerful, free AP features.

- For High-Volume or Complex Approvals: As your invoice volume and approval workflows grow, dedicated platforms like BILL, Tipalti, or Plooto provide the scalability and control necessary to manage complexity without chaos.

- For Specialized Data Extraction: If your biggest challenge is getting accurate data into your system from varied and messy documents like invoices, receipts, or bank statements, a specialized tool is non-negotiable. This is where tools like DocParseMagic shine, focusing on the critical first step of data capture to ensure everything that follows is built on a foundation of accuracy.

Making a Strategic Choice

The most critical action you can take now is to test drive your top contenders. Almost every provider offers a free trial or a personalized demo. Use this opportunity to process a handful of your real-world invoices. Does the interface feel intuitive? How quickly can you set up an approval workflow? How accurate is the data capture?

Answering these questions with hands-on experience will provide more clarity than any feature list ever could. Remember, implementing AP automation is not just a software purchase; it's an investment in your business's efficiency, financial clarity, and future scalability. By choosing wisely, you empower your team to shift its focus from tedious administrative work to strategic initiatives that drive growth.

Ready to fix the most critical, error-prone part of your accounts payable process? If your primary bottleneck is manually entering data from invoices, receipts, or other documents, start with a tool built for accuracy. Try DocParseMagic to see how intelligent document processing can eliminate data entry and ensure your accounting system gets clean, reliable data every single time.